U.S. midterm elections – potential implications for policy and markets

With less than a week to midterm elections in the United States, voters and investors will be focused on the political and economic implications. Midterm elections have historically led to market uncertainty and, with opinion polls divided amidst a volatile political environment, this year is likely to be no different.

In this webinar, Capital Group political economist, Matt Miller, considers the different potential outcomes of the vote along with the implications for political policy and for markets.

There are three possible outcomes to watch for in the national races:

• Congress splits: Democrats take the House of Representatives, but Republicans maintain a Senate majority.

• Republicans hold on: The status quo is preserved, as the same party maintains control in Washington.

• Democrats sweep: Although Republicans maintain control of the White House, Democrats would control both chambers of Congress.

Let’s consider what each of these outcomes could mean for policy and, ultimately, markets.

1. Congress splits: Will markets shrug?

Because it’s the most widely expected outcome, Democrats taking the House – but only the House – could have only a modest impact on asset prices.

The Senate seats in play this year strongly favour Republicans, but voters will consider all 435 House seats. Of those, Democrats need to flip just 23 seats to gain the majority. Polling as of this date suggests about a dozen current Republican seats are likely to flip. That leaves Democrats needing about 11 of the 30 or so Republican-held seats considered toss-ups. That outcome is certainly possible, especially if Democratic turnout is strong.

Gridlock is all but certain. Will there be any chance for cooperation? There may be the occasional appearance of such efforts, but they’ll be largely for show and to avoid being blamed for the impression that the parties can’t govern together. One possibility is infrastructure – an issue on which Donald Trump campaigned about doing big things. However, the larger goal of winning the 2020 presidential election makes it hard to imagine Democrats giving President Trump anything he can claim as a victory.

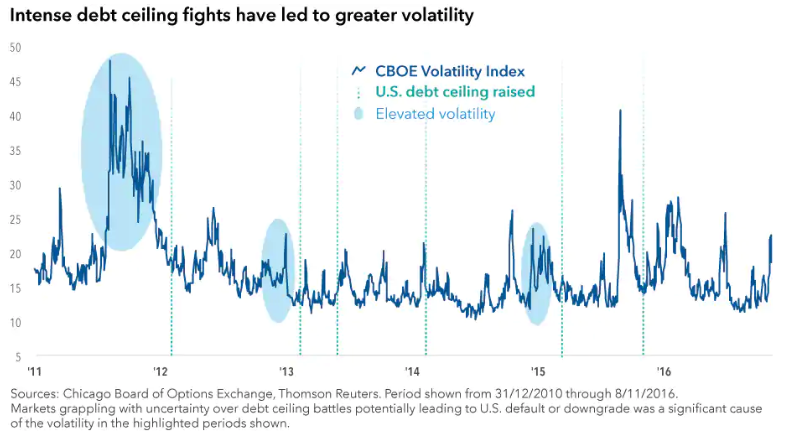

The debt ceiling may come back into focus. One of the most important things to watch for in this scenario is an inevitable showdown over the U.S. debt ceiling in the summer or fall of 2019. Given the must-pass nature of the legislation, this has potential to generate some bipartisan action. However, it also could cause market volatility if Democrats look to wield their newfound power as a tool – much as Republicans did with President Obama after they took over Congress in 2011.

Presidential power still matters: Overall, with divided government, we can expect President Trump to focus more on areas where he has freedom of action – namely trade and foreign policy. So in this scenario, expect trade to remain a front-and-centre risk to markets. Sectors that are more exposed to trade, such as transportation, could face resulting headwinds.

With only one chamber under their control, Democrats won’t be able to make any legislation stick without Republican cooperation. That means that we should expect some symbolic legislative proposals from a Democratic House with an eye towards the 2020 presidential election — useful for messaging purposes and headlines even as they stand almost no chance of becoming law. Those might include measures such as a minimum wage hike, “Medicare-for-all,” or extending antitrust reach. In this scenario, also expect the House Democrats to launch investigations galore, from the 2016 election to Trump’s business practices and taxes.

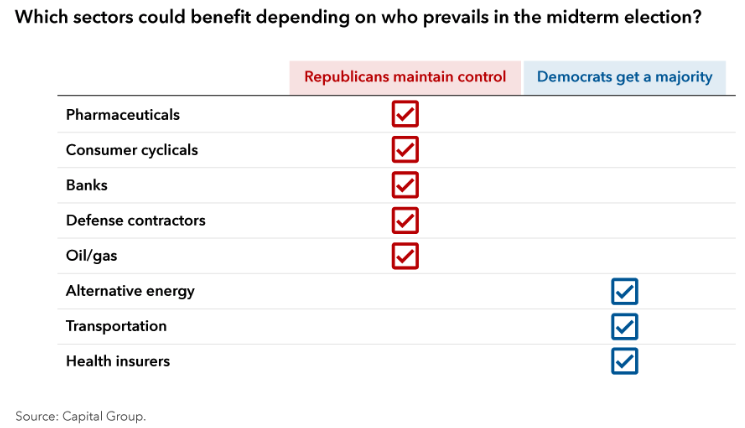

Several sectors could be affected. Winning the House would put Democrats in control of key committees. How these committees treat policy can affect certain industries through new rulemaking or even headline risk. Among the key committees are Financial Services, Energy and Commerce, Armed Services and Ways and Means, which contains the subcommittee that handles health-care policy.

With the Republican deregulatory agenda facing a new roadblock, uncertainty could rise for some key sectors such as pharmaceuticals, which face criticism on prices from Democrats and some Republicans. Businesses that would feel a negative shock from Democrats’ efforts to raise the minimum wage, such as retailers and restaurants, would also feel some pressure if a symbolic House bill is passed.

2. Republicans hold on: Will markets rejoice?

You might think that extending the status quo wouldn’t evoke a particularly sharp reaction when it comes to stocks and bonds. But in reality, markets price political uncertainty into asset valuations. The consensus currently expects Republicans to lose the House, which would imperil their legislative agenda. For many investors, who have welcomed policies such as deregulation and tax cuts over the past two years, an end to such business-friendly governing is a downside risk.

Republican policies could have additional impacts. The market may underestimate the likelihood that Republicans maintain control. Republicans likely would pursue a second round of tax cuts, including making the individual cuts permanent and indexing capital gains for inflation. The administration would continue its pursuit of the deregulatory agenda already underway. This could provide another boost to equities.

We potentially also could see the Republicans begin to chip away at rising deficits through measures to slow the growth of some programs, such as capping the Medicaid growth rate. In conjunction with renewed efforts to repeal the Affordable Care Act, these actions could have a negative impact on hospitals and insurers active in related markets.

3. Democrats sweep: Will markets sag?

The most surprising outcome, both from a current expectations perspective and the potential impact to short-term markets, would be if Democrats take both chambers of Congress. This could foreshadow a sea change coming to Washington after the 2020 election, and markets might begin to take policy proposals from the left more seriously. That would happen even if Trump vetoes any legislation he doesn’t like for the next two years – and even though it’s premature to assume a midterm sweep means a Democratic presidential win 24 months later.

Could Republicans slip in a big “goodbye” bill? A final possibility not currently on investor radars is that Republicans could try to squeeze in swansong legislation if the election results in a loss of control over one or more chambers. For example, they could pass a reconciliation bill with just a 51-vote majority that could include market-moving measures, such as tax cuts and a Medicaid growth cap. These measures could be structured to endure at least through 2021, when a change in White House control would be needed to reverse them.

How much will this matter in the long run?

It’s important to remember that although policies can have significant short- and even medium-term macroeconomic effects, fundamentals are often only modestly affected. Moreover, in time, strong companies can adjust to shifting legal and regulatory frameworks.

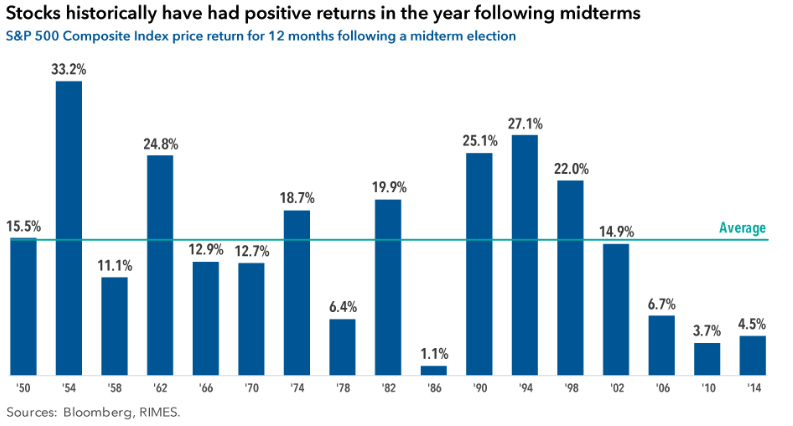

At Capital Group, we take a long-term approach to investing, which means midterm elections like this one only have a limited impact on our approach to companies and fundamental analysis. One final note for investors: Although past results are no guarantee of future outcomes, after every midterm race since 1950, markets were higher a year later.

Want to learn more?

Gain insight into our history, philosophy, people, and unique approach to investment management - The Capital System - by exploring Capital Group in more detail.

1 contributor mentioned