Uncertainty, fear, toilet paper and investing

Most of us have seen photos of empty toilet paper shelves in the super markets. What was your emotional response? Did you think about buying toilet paper too? Despite assurances from the government and suppliers that we have no shortages, fear can take hold of our decision making especially when there is uncertainty. As humans we are deeply influenced by the crowd. Faced with uncertainty our decisions tend to be more emotional. In this monthly note we take a look at the recent market correction in the context of human behaviour.

Uncertainty and emotional decisions are part of everyday life in financial markets. Investors can be both overly optimistic as well as overly pessimistic. In recent monthly notes we have written often about pockets of exuberance – investors overpaying for growth and re-rating some companies higher despite deteriorating fundamentals. Recently we have seen the opposite. The coronavirus has created significant uncertainty and many investors are selling first. As prices go down fear is exacerbated (just like the emotional response to seeing empty shelves in the super market).

Has the baby been thrown out with the bath water?

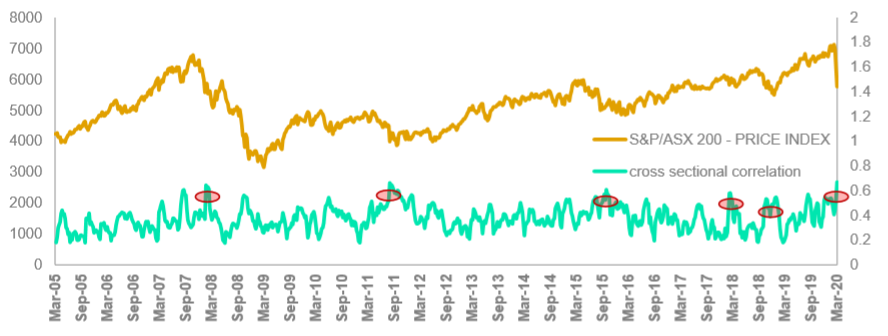

Do we see significant evidence of the “the baby being thrown out with the bath water”? One way to measure how much a single event is driving all stocks is to look at the cross sectional correlation of stock returns. The higher the correlation the more company returns are moving together. When all companies are tending to move to the same beat we say they are highly correlated. This often occurs when larger macro-economic factors are driving company prices rather than company specific news. High levels of correlation can be a sign that investors are not differentiating between good and bad companies and are indeed throwing the baby out with the bath water. Figure 1 illustrates that current stock correlations are at extremes, near levels seen in other market shocks.

Figure 1: High levels of cross sectional correlation

Source: Thomson Reuters, State Street Global Advisors as at 9 March 2020. Past performance is not a reliable indicator of future performance. Index returns are unmanaged and do not reflect the deduction of any fees or expenses.

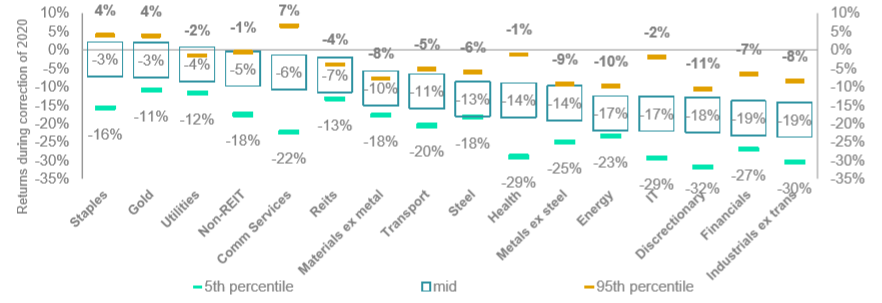

Recent correction largely typical

Whilst the degree of correlation is high we do still see many companies responding to the information as we would typically expect. Figure 2 below shows the median returns for different sectors within the S&P/ASX 300 index from the market peak on the 19th of February to market close on the 9th of March. Over this period the S&P/ASX 300 index declined -18.7%. Figure 2 illustrates both the median return (in the blue outlined box) and the variability of returns within each sector. As you would expect the more defensive sectors, Consumer Staples, Gold, Utilities, Communication Services and REITs faired significantly better than the more economically sensitive sectors. While the median return for Consumer Staples stocks was down only -3% some companies actually had positive returns while some were down -16%. The wide range of return outcomes across every sector is supportive of investors differentiating between companies based on fundamentals.

Figure 2: Performance differences amongst stocks within sectors during market correction (19 February 2020 – 9 March 2020)

Source: Thomson Reuters, State Street Global Advisors as at 9 March 2020. Past performance is not a reliable indicator of future performance. This information should not be a recommendation to buy or sell any security or sector shown. It is not known whether the sectors shown will be profitable in the future

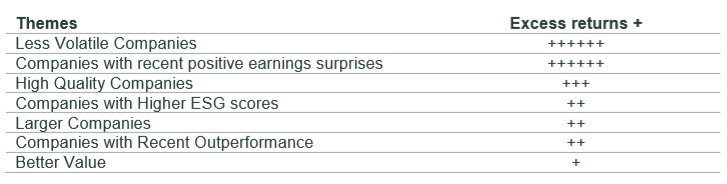

Looking at the types of companies that outperformed in the correction we do not find too many surprises. Figure 3 highlights the types of companies that outperformed in the correction. Companies that have lower volatility outperformed as investors gravitated towards greater certainty. Companies with better financial strength and better operating metrics outperformed as well as did those with higher environmental, social and governance scores. With earnings season fresh in investors’ minds the companies that produced the largest surprises continued to do better than those that disappointed. Larger companies outperformed smaller, past winners outperformed past losers and higher yield marginally outperformed lower yield

Figure 3: Themes that outperformed in correction (19 February 2019 to 9 March 2020)

Source: Thomson Reuters, State Street Global Advisors as at 9 March 2020. The + signs represent large and small outperformance of each theme of the underlying S&P/ASX 300 index. The more + signs the greater the outperformance. The above information is for illustrative purposes only, it should not be considered a recommendation to buy or sell any security types shown. It is not known whether the securities will be profitable in the future.

How we are positioning

With uncertainty still high we will continue to see fear play a larger role in company valuations. Our process will continue to remain unemotional and search for quality companies that exhibit sound fundamentals that will be better placed to weather the volatility. In the correction of 2020 many of our portfolio construction principles were tested and pleasingly our approach was able to help mitigate some of the losses associated with the recent market correction. The State Street Australian Equity Fund outperformed its benchmark during February. From a sector perspective, good stock picking within Real Estate and Metals & Mining ex Gold were key contributors. On the other hand, having a lower exposure to Financials (not holding the big four) and not holding CSL detracted.

Learn more

Stay up to date with our latest thoughts by clicking follow below and you'll be notified every time we post content on Livewire.

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.