US private credit's 'cockroaches' signal superior value down under

Global equity markets have continued to hit record highs across 2025, with AI and technology continuing to be a dominant driving theme. In all the equity market exuberance, there has been unexpected consequences for credit markets, in particular US private and public credit markets.

There has been a marked shift in spreads and valuations, with the result that the US market is looking less attractive when compared to peers like Australia.

The impaired health of US credit markets

Markets are increasingly expensive. Alongside an easing cycle, investors have been forced to consider alternative options to boost their yield and driven capital influx into non-traditional spaces.

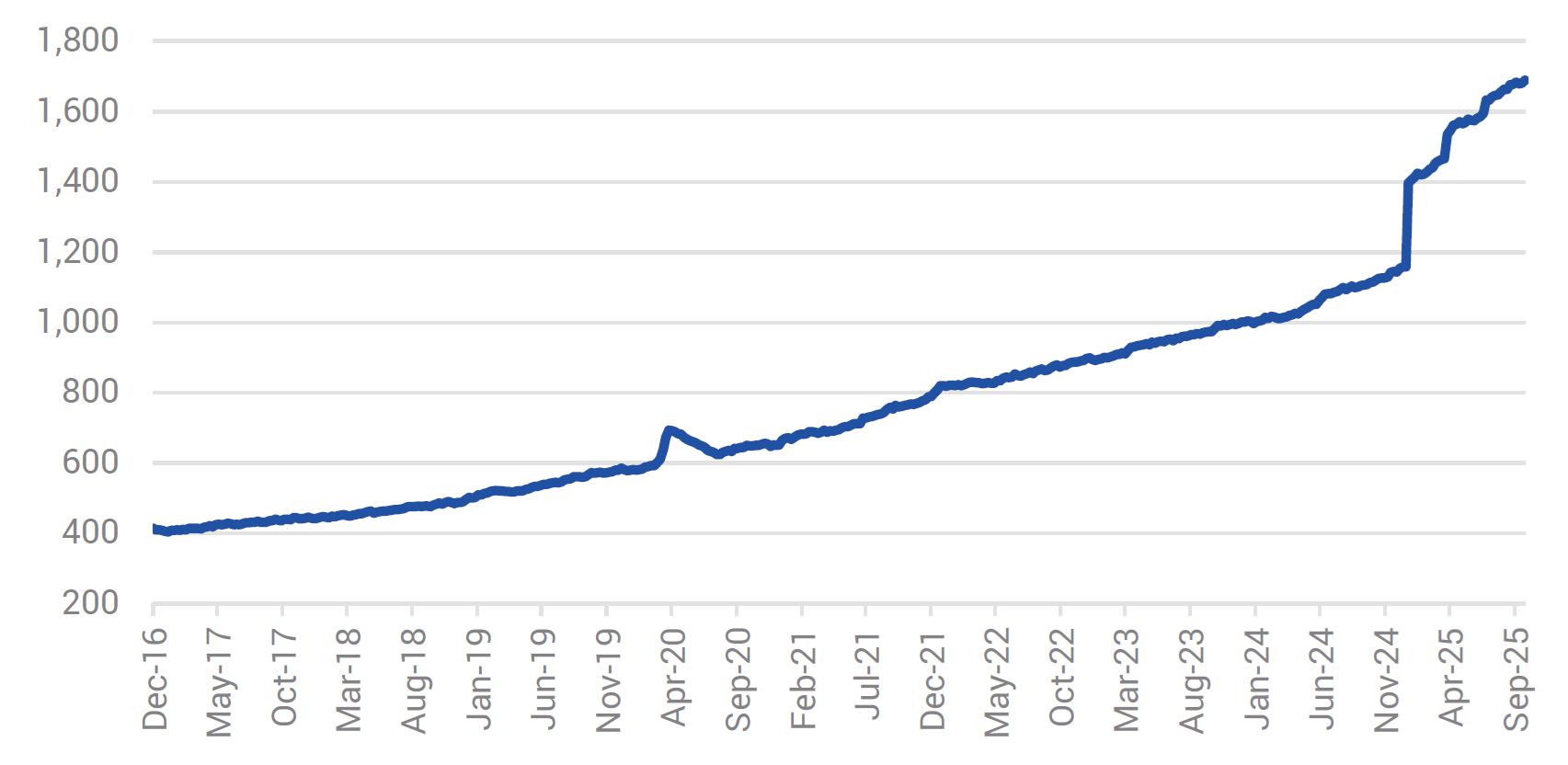

For example, US banks appear to be rapidly increasing exposure to leveraged credit through the back door with US bank loans to Non-Bank Financial Institutions (NBFIs) doubling over the last three years, surging to an estimated $US1.68 trillion as at September 2025 (refer Chart 1).

Chart 1. US Bank Loans to NBFIs ($USbn)

Source: ASR/Yarra, Oct 2025.

This increase has been driven by:

- The desire by private credit managers to use leverage to boost returns in an increasingly expensive market.

- Banks taking advantage of more favourable capital requirements in lending to higher-rated funds compared to lending directly to sub-investment grade issuers.

It isn’t universal behaviour though.

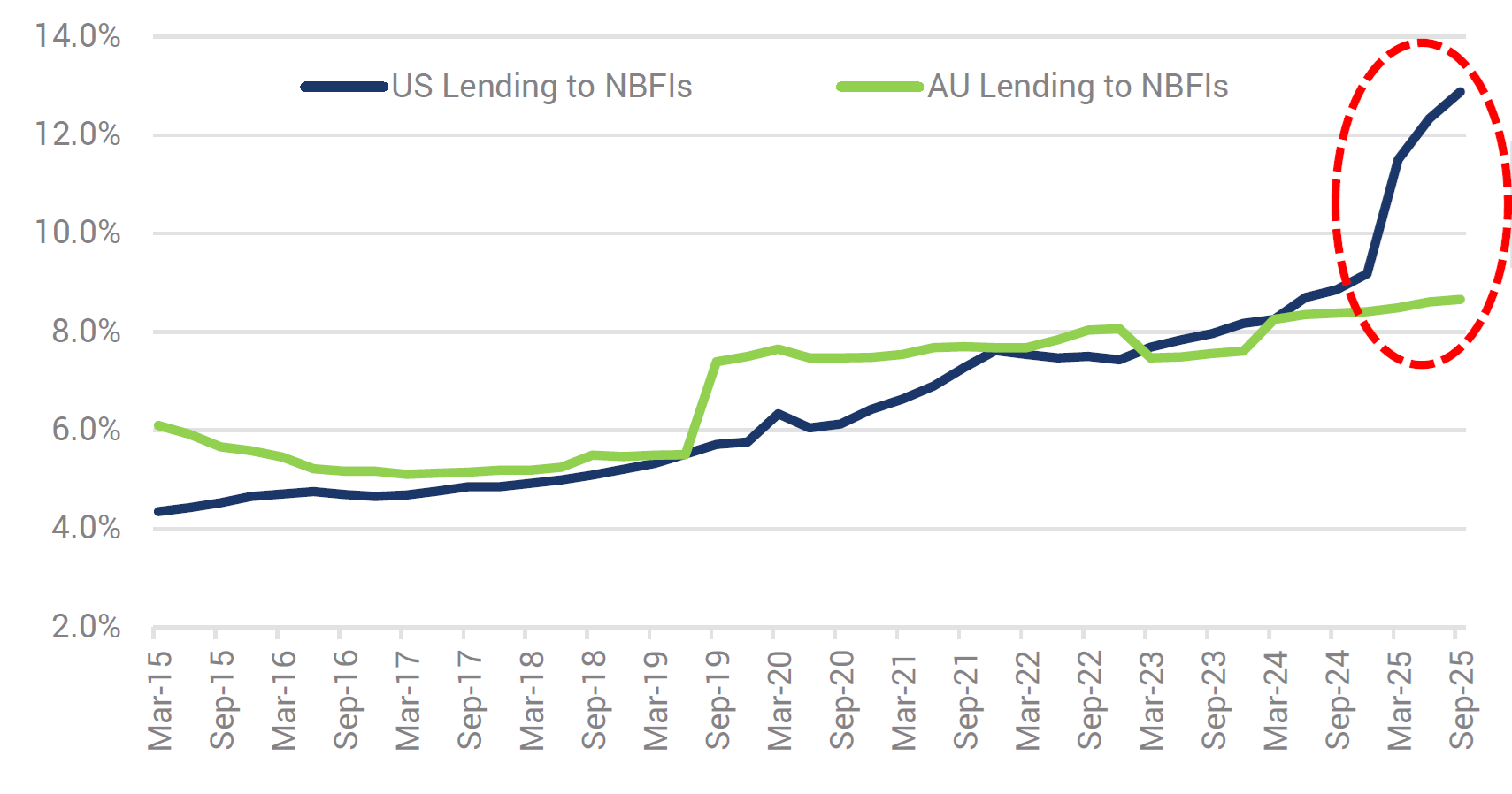

To put this in perspective, US bank loans to NBFIs as a proportion of total commercial loans have increased from ~9% to 13% in the 9 months to September 2025. Similar lending in Australia has remained relatively static, as you can see in the following chart.

Chart 2. Share of US and AU bank loans to NBFIs

Source: ASR/RBA/Yarra, Oct 2025.

This influx of capital into US credit markets has not been without consequence though, with the recent collapses of auto-parts company First Brands and sub-prime auto-lender Tricolor a sharp reminder of growing risks in different parts of the credit market.

First Brands had a private equity style structure and a lack of transparency. It collapsed due to aggressive leveraging and a complex financial structure which it couldn’t fund.

Tricolor targeted borrowers who were undocumented and lower-income and therefore at higher risk of defaults. Its funding was based on securitising these loans and there are allegations that Tricolor pitched the same collateral to different lenders.

These examples should give investors cause to ponder the end result of increased liquidity and increased risk: compressed spreads and poorer valuations encouraging US credit investors to take greater risk.

Australia is looking attractive for credit investors

In contrast to the US, the Australian market is currently offering a superior alternative. Far from the AI-boom and liquidity influx seen in the US, Australian credit generally offers a more attractive relative value proposition for investors seeking sustainable, risk-adjusted returns in most segments of its credit market.

There has been a significant and persistent divergence in credit valuations in the US market as a result of the capital influx, particularly compared to Australia. This pricing disparity highlights the case for focusing on the superior relative value of Australian credit.

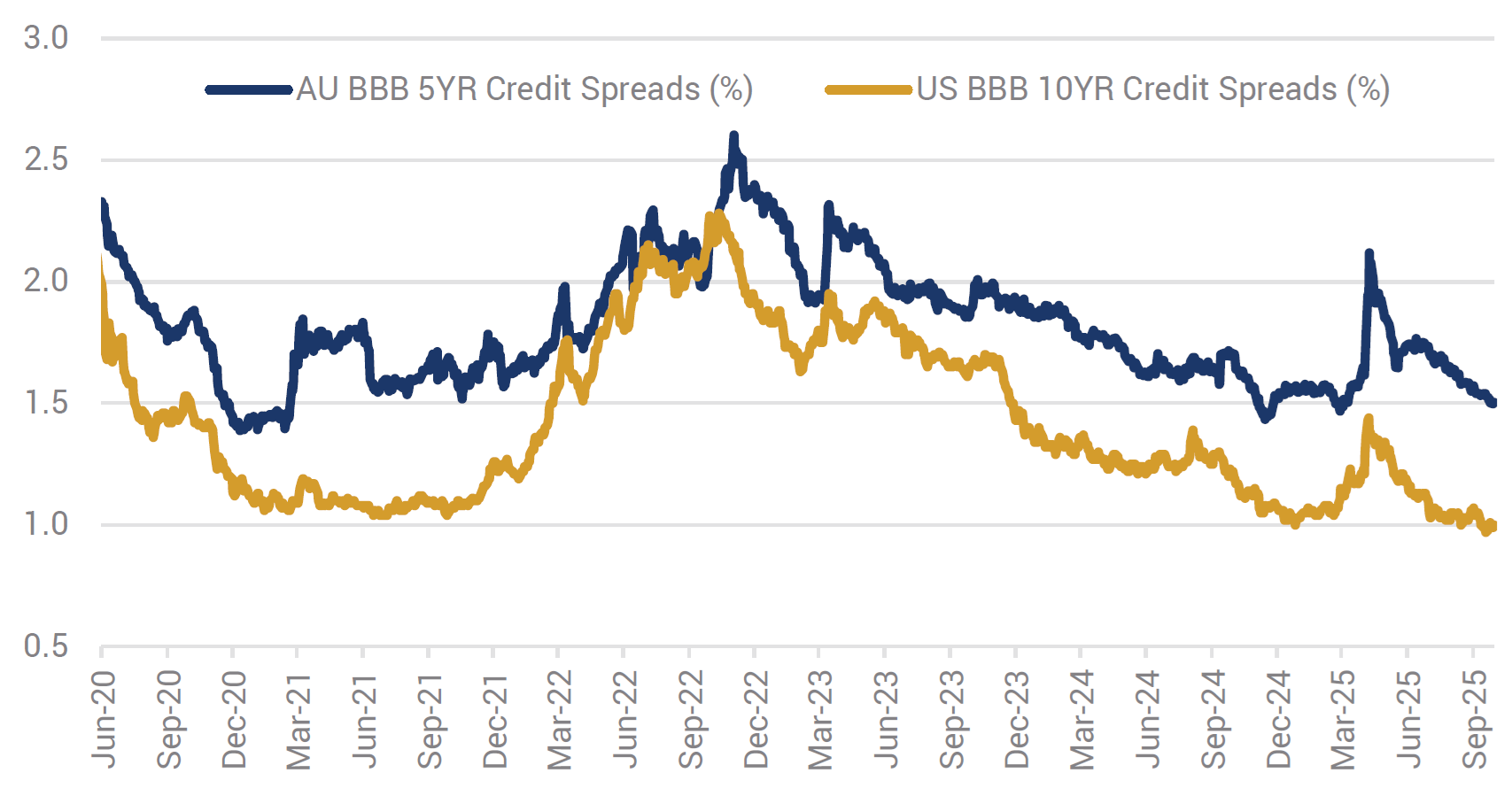

This is starkly visible in the public investment grade space.

US credit spreads are currently trading well below their long-term averages, while Australian spreads remain near their historical averages, resulting in an attractive pricing gap. Specifically, Australian 5-year BBB credit spreads continue to trade comfortably above US 10-year BBBs, maintaining a differential of approximately 50 basis points (bps) for ostensibly half the spread risk as you can see in Chart 3.

Chart 3. AU/US BBB Credit Spreads (bps)

Source: NAB/Yarra/Bloomberg, Sept 2025.

The pricing disparity can be even more pronounced in some parts of the private credit and leveraged (sub-investment grade) loan markets, which is more directly influenced by the US private credit boom and its use of additional layers of leverage.

In the US leveraged loan market, the influx of capital has tightened pricing to levels inconsistent with optimal risk-adjusted returns. In general terms, US loan spreads on equivalent BB and B-rated credits are pricing 50-100bps tighter than Australia, with the recently completed Arnott’s Group $US and $A TLB refinancing providing a directly comparable data point. While we elected not to participate in the B rated Arnott’s Group refinancing, the $US TLB 7-year (+300bps) priced 50bps below the $A tranche (+350bps). The credit spread differential between markets is generally more pronounced still for less comparable/smaller deals.

The Australian spread premium

While Australian mortgage holders may be less thrilled by the interest rate outlook off the back of a higher-than-expected inflation print, the news adds another positive element to Australian credit over US.

The difference in outright yield factored in current rate cut expectations over the next 12 months in both markets adds an extra ~~60bps in favour of Australian dollar securities compared to the US.

While there are times to bemoan Australia’s geography and distance, now is certainly not one of them for credit markets. Our relative distance from US liquidity drivers has resulted in a persistent 50-100bps spread premium in the Australian market. This confirms the superior relative value of Australian credit in both public and private parts of the market and is an opportunity we have focused on to maximise risk-adjusted returns in the Yarra Enhanced Income Fund and Yarra Higher Income Fund.

Both the Yarra Enhanced Income Fund and Yarra Higher Income Fund are maintaining running yields between 5.5-6.5%. They continue to perform strongly while proactively promoting their all-weather credentials through the use of strategic interest rate duration and – in the case of the Higher Income Fund – also through credit default protection.

2 funds mentioned