US recession risks rapidly rising

Firetrail Investments

Financial conditions are central to the US outlook. Fed Chair Jerome Powell stated earlier this year that "Policy works through financial conditions. That's how it reaches the real economy".

In contrast to Australia, the US economy doesn't respond directly to increases in short-term interest rates. Most home owners aren't affected, as they have long-term, fixed-rate mortgages. Some of these mortgages may not reset for decades to come.

Of greater importance to the confidence of American households is the portion of their wealth invested in the equity market. They are sensitive to financial conditions, with a falling equity market often resulting in declining consumer confidence and spending.

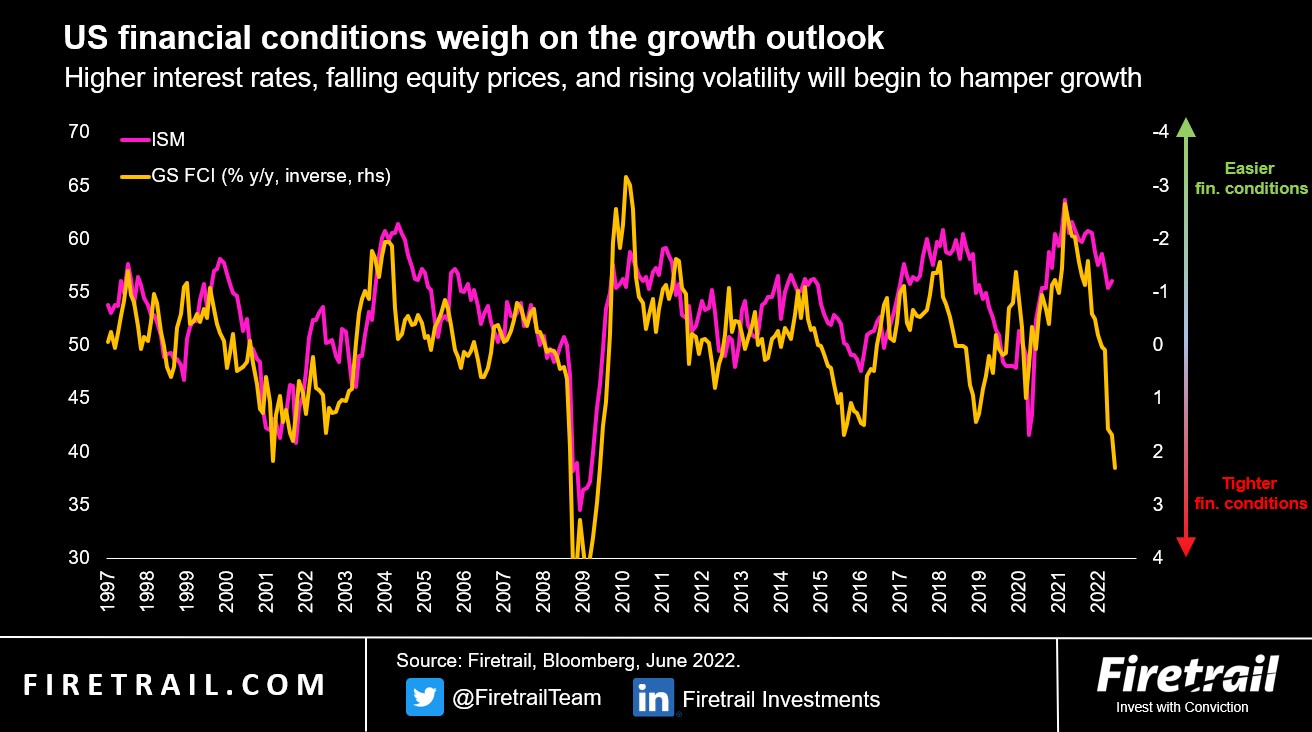

Higher interest rates, rising credit spreads, and a falling and volatile equity market have all contributed to the rapid tightening in US financial conditions this year. This suggests downside risk for the US ISM, a key monthly indicator of US economic activity.

An ISM level above 50 indicates an expansion of the manufacturing segment of the economy compared to the previous month. A reading of 50 means no change. A reading below 50 suggests a contraction. US financial conditions, which have shown a good relationship with the ISM through the business cycle, now indicate a deterioration in US activity in the months ahead.

The Fed has an inflation problem. Higher bond yields and lower share prices are now beginning to have the desired slowdown effect on the US economy.

3 topics

Expertise