Using ESG factors to create a diversified investment style

Given the wide range of fixed income managers and products, differentiating credit capabilities can become increasingly complicated once environmental, social and governance (ESG) considerations are thrown into the mix. The issue, as always, becomes one of implementing a framework whereby an investor can consistently rank different active investment styles in terms of processes and capabilities. The following sets out a simplified framework which may be of use in providing a level of consistency in grouping and communicating investment styles in terms of credit and ESG capabilities.

Credit processes are part of a spectrum

The increased significance of ESG risk factors as inputs to credit processes has added further nuances to differentiating between investment styles. To assist in accommodating these nuances, it is increasingly important for investors to utilise a framework not only for ranking the capabilities associated with individual investment styles, but also as a means of differentiating and communicating differences in the investment styles themselves.

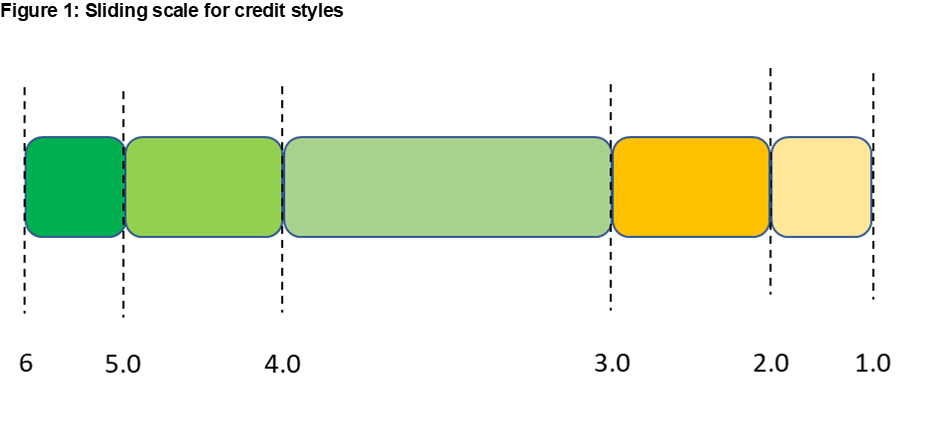

The investment styles associated with credit management can be considered as a spectrum where each successive band builds upon the previous one from simplest to most complex.

Figure 1 above sets out one potential framework for establishing a sliding scale for differentiating not only ability but also investment style. Investment strategies would be categorised by the band, based on investment style and then scaled against the similarly classified peers within each band based on the idiosyncratic strengths and weaknesses of the individual investment processes adopted.

The following sets out the relevant attributes applicable to different investment styles within each proposed band. A key point to note is that the approach to banding outlined below aims to provide a more consistent approach to grouping investment styles based on the additional nuances associated with credit management.

Whether or not one style is preferred by/suitable for an investor will come down to a range of factors such as the investment universe utilised, investor preferences, fees, etc. Accordingly, the scaling framework is not meant to be used as a means of passing judgement per se on which investment style is preferred over others.

Band 1.0: Credit process reliant on official credit ratings

The simplest approach to credit analysis is to not undertake any internal analysis regarding creditworthiness but rather rely completely on official third-party credit ratings. Such an approach is based on the premise that, despite the limitations associated with official ratings, the ability to add value over official ratings in a consistent manner is limited. This approach will tend to make the most sense when investing in large, publicly-listed issuers at the higher-quality end of the credit rating spectrum.

With such an investment style, the focus is on assessing relative value rather than overall issuer creditworthiness. The lack of any internal analysis regarding creditworthiness results in this style being set as the starting, or base, band, i.e. the bare minimum in terms of a credit investment style.

Band 2.0: ESG factors not separately identified

The next level of investment style is where in-house credit analysis is undertaken to generate an internal credit rating; the purpose of which is to either compliment or act as a check on official ratings. These internally generated credit ratings facilitate the more proactive alteration of the inputs driving credit ratings to reflect those impacts deemed of greater significance in a more timely manner.

In essence, the use of internal credit ratings aims to enhance returns by being one step ahead of the official credit ratings, i.e. correct for any potential limitations in official credit ratings.

In terms of ESG risk factors, the 2.0 band groups investment styles which do not identify ESG considerations as discrete risk factors. Put another way, investment styles within this band view credit analysis as simply focusing on the determination of the creditworthiness of an issuer.

Of course, this does not mean that ESG factors are not considered at all. Rather, they are considered indirectly. Unlike equities, credit analysis is all about ensuring an investor gets their money back within a finite time period, i.e. repaid at the maturity of the loan. It follows then that anything which may adversely impact the ability of an investor to be repaid, including ESG-related risk factors, will be factored in. Therefore, not specifically taking ESG risk factors into account will not necessarily impact the quality of the underlying credit analysis.

But there are reasons to believe that by not specifically identifying ESG risk factors the resulting analysis has the potential to miss relevant dynamics within markets beyond the pure creditworthiness of an issuer.

Band 3.0: ESG risk factors as separate risks

Where the separate identification of ESG risk factors becomes more important is in recognising the potential for these factors to impact investor flows and access to capital. Separate identification of ESG risk factors explicitly recognises that realised returns can be impacted by risk factors beyond simple creditworthiness. Most significantly, with ESG risk factors becoming more important in determining capital flows within bond markets, they also have the potential to impact the availability of capital to bond issuers.

Evolving ESG risk factors opens a new source of value for the clients of active managers, beyond assessing the creditworthiness of an issuer. It follows then that active managers should be able to earn higher returns if they can identify changes in ESG risks not necessarily captured by official ratings. This arises as bonds will either outperform or underperform as the market more accurately assesses the ESG risks associated with the issuer. This highlights why viewing ESG risk factors as standalone factors within the credit assessment process is becomingly increasingly important for active bond managers.

The key point to highlight with this style is that the ESG factors are simply utilised as an extension of the traditional credit process. Though the ESG risk factors may be separately identified, they are nonetheless additional risk factors for assessing the relative value of issues/issuers within the credit process. The objective of the investment style is still to maximise returns based on the level of risk assumed. It is only after we move beyond Band 3.0 investment styles that the transition into what is referred to as ESG investing starts to occur. This is where ESG risk factors are not just utilised to assess ‘fair value’ but increasingly become an explicit part of the overall investment objectives.

Band 4.0: Application of negative filters

The initial phase of ESG investing is the application of negative filters within the investment style. Negative filters aim to exclude those issuers deriving a material level of revenue from business activities that are legal but deemed to be ‘unethical’, for example, armaments producers, tobacco and pornography.

Investment styles applying negative filters may also have outright exclusions for issuers involved in specific activities, such as cluster munitions, irrespective of the significance of revenues. Though negative filters aim to improve the ESG bias associated with a strategy, the potential issue is that the relevance of such a generic approach will vary from market to market. Specifically, whilst excluding unethical business activities may be ethically appropriate, such negative filters may have limited relevance in practice within a credit market where such issuers do not already exist.

Band 5.0: Proactive, positive ESG objectives

One way to overcome some of the limitations of negative filters is to include positive ESG outcomes as an explicit objective within an investment strategy. Strategies within this investment style initially apply negative filters but go further in specifically aiming to incorporate positive biases into the portfolio. Incorporating such biases goes beyond exclusion to actively support those issuers making a positive contribution to ESG outcomes. Such strategies may be considered very broadly as proactively supporting ‘best in breed’ issuers and/or activities.

The benefit of such investment styles is that they not only proactively support positive ESG outcomes but can also be applied and adapted to reflect different market characteristics. In doing so, such investment styles facilitate the incorporation of relatively superior ESG outcomes irrespective of the underlying characteristics of a particular market.

Though analysing investment styles is very nuanced, adopting a suitable classification system for credit processes can assist in differentiating and communicating investment styles. The ability to differentiate becomes particularly relevant as the increased focus on ESG risk factors creates additional nuances to credit processes and investment styles. These additional nuances mean it’s becoming more and more important for investors to compare ‘like with like’ when assessing strategies.

An appropriate ranking process also assists with respect to communication, as the whole integral applied to the numerical rank can now be utilised to clearly denote a particular style or capability within the broader spectrum of credit management approaches. The result can be greater clarity and consistency when appraising credit capabilities within an increasingly varied spectrum of investment styles.

Note that while Russell Investments adopts a numerical ranking system for managers, the process outlined above is not that applied by Russell Investments.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

2 topics

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...

Expertise

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...