Victoria hits it out of the park with the biggest ever book-build and bond deal, topping $8bn

After some criticism following a poorly received post-budget debt funding update, Victoria's debt management arm, Treasury Corporation of Victoria (TCV), has hit the ball out of the park with the largest State government bond book-build in history (>$8bn) that was consummated with the largest State government bond deal ever ($4.4bn). In one month, Victoria has slashed its FY23 debt issuance requirement by some 31%. This transaction also shed light on the unprecedented demand from Aussie banks for state government bonds (aka "semis"), which has been a subject of some debate. And it was capped off with news that Victoria is finalising the sale of VicRoads’ motor vehicle registration, licensing and custom plates arm for north of $4bn in order to be able to pay-back COVID-19 debt via a newly established "future fund" that replicates NSW's extraordinarily successful Debt Retirement Fund.

In more detail, TCV launched dual-tranche 2028 and 2030 floating-rate notes (FRNs) targeting bank investors that prefer this type of bond format over fixed-rate alternatives that slug banks with much higher capital charges. A positive result would have been demand north of $4bn. Instead, TCV attracted over $8.1bn of bids based on the original price guidance. They were then able to tighten the pricing and issue a record $4.4bn across the two FRNs (we bought both FRNs). Combined with the $2bn of debt Victoria issued in May, it has now completed $6.4bn (or a remarkable 31%) of its $21.3bn funding task for FY23, leaving it with only $14.9bn to issue for the entirety of FY23.

FRNs are likely to become much more attractive to the states because they are so much cheaper than a fixed-rate bond. On these two FRNs, Victoria is paying just 1.2% to 1.3% in annual interest repayments. Yet on a 10-year fixed-rate bond, Victoria would pay more than 4.1% pa. There are therefore huge interest repayment savings for the states by issuing FRNs. This is also the product that their major investors -- Aussie banks -- want to buy (banks prefer FRNs over fixed-rate bonds because FRNs attract much lower capital charges).

The semis market is probably the only bond market globally where issuers seem to be reluctant to issue in the format investors actually want. Bank and corporate bond issuers always issue in the fixed or floating format, and target maturities, that investors are actually seeking. And yet for some reason the supposedly sophisticated states have been historically resistant even though they can -- like any bank or corporate issuer -- simply execute a swap to switch the format into the structure desired by their own government agencies (eg, they can issue an FRN and then swap it into a fixed-rate bond if that is what the state desires). You often hear the counter that "the swap costs the state money". So what: every bond issuer on the planet executes swaps to align the funding provided by the bond issue with their own borrowing requirements. And if the swap costs money, price that into the (lower) spread you pay investors.

We certainly know what state taxpayers want: almost all Australian households have switched to floating-rate mortgages in recent months, which represent 90-100% of new home loan approval flow, precisely because a variable-rate loan costs 2.25% compared to a 3-year fixed-rate loan pricing at 4.5%. And fixed-rate pricing currently reflects arguably unrealistic expectations for the RBA to lift its cash rate to 3.7%.

Victoria's FY23 budget should have been a positive event for debt markets, with Treasurer Tim Pallis unveiling a much better than markets (or we) expected $4.5 billion improvement in the total public sector cash deficit, which includes capex, over both FY22 and FY23 relative to the mid-year update released in December 2021 (there was a circa $4bn reduction in the deficit in FY22 and another $0.5bn reduction in FY23 relative to the December forecasts).

The arguably better news for markets was that Victoria announced that it was slashing its required debt funding in FY23 by 17% from the original estimate 12 months ago of $25.8bn to $21.3bn (this was also a nontrivial reduction from the $23.6bn funding requirement estimated in December 2021).

A final positive development was the announcement that Victoria was establishing a "future fund" to pay-back the huge amount of COVID-19 related debt it had racked up, which saw its credit rating downgraded from AAA to AA in December 2021. Importantly, this new fund was going to be supported via asset sales and cash budget surpluses (only once net debt stabilised). Today the AFR reports that Victoria is finalising the first $4 billion of asset sales via the divestiture of VicRoad's registration business.

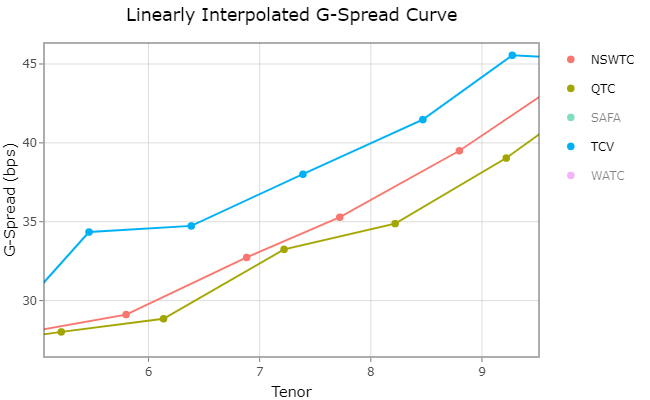

Yet TCV's post-budget funding updates were very poorly received by the market, which sent the state's cost of capital relative to other states like NSW soaring higher. Whereas Victoria used to pay a similar interest rate to NSW, it now pays more than any other major state in Australia (and some 5-6 basis points more than NSW).

It appears the updates ignored the 17% issuance downgrade for FY23 and the other constructive developments outlined above, and bizarrely focussed on the superficially large funding task in distant years. This is especially odd given funding requirements in FY24 and FY25 are almost impossible to forecast accurately. These numbers are basically meaningless.

In almost all debt markets globally, investors understandably focus on issuance over the 12 months ahead because numbers beyond a one-year horizon have no real statistical meaning. This is underscored by the fact that the forecast funding requirements for states like NSW and Victoria have been massively reduced in recent years as the actual budget data has trumped the state's overly pessimistic forecasts.

It would be like CBA telling debt markets that they don't have that much funding to do in the next year, but guiding investors to ignore that fact and focus on a hypothetically large increase in CBA's debt funding needs in 2-3 years' time that is based on some useless projections.

Some argue that one possible explanation for these mis-steps is that without any obvious profit motive, and any direct economic incentive to reduce their own cost of capital, the states tend to do a poor job of marketing their own debt securities (and are effectively taken to the cleaners by the banks advising them and the banks' balance-sheets, which are their biggest investors). This is certainly the view of most real money investors we speak to.

While there are meant to be Chinese walls between banks advising the states and the same banks' balance-sheets that are in turn the states' biggest investors, it often appears like bank sales and trading teams do a much better job for their own bank balance-sheet investors than they do for the states. Everyone is always jawboning the states' cost of capital higher...

One rejoinder to the positive news that Victoria has completed 31% of its FY23 debt funding in just one month is the argument that they will have substantial pre-funding for FY24 to do on top of this. There is, however, some evidence to suggest that a change in liquidity policies, whereby Victoria is now actively pre-funding all debt maturities 12 months ahead, means that pre-funding is already baked into the FY23 funding task of $21.3bn.

In the FY23 budget there is an extra $6bn of borrowing that cannot be explained by reference to the change in the deficit, which looks like it is borrowing to fund maturities over the next year. This line of reasoning is also rationalised by the fact that in the last two financial years Victoria has announced massively completed pre-funding of $11bn in FY21 and $8.6bn in FY22 that bore no resemblance at all to their actual debt issuance, which broadly tracked their official funding task. For example, in FY22 Victoria's funding task was about $26bn, and that is what they issued. So there was no pre-funding. The budget in FY22 and FY23 was $4.5bn better than Victoria forecast in December, which provided $4.5bn of pre-funding. And yet TCV announced they had actually completed $8.6bn of pre-funding for FY23. So it appears the $26bn task for FY22 already had about $4bn of pre-funding baked into it. Similarly at the end of FY21, TCV shocked the market by announcing that they had done $11bn of pre-funding for FY22. And yet if you look at the budget improvement and issuance versus the funding task, you are hard pressed to explain any of this pre-funding.

Finally, there has been some debate about whether banks will have a need to buy a lot of state government issued debt as a result of their APRA-regulated liquidity requirements. Since last year we have presented research estimating that bank demand for government bonds over the next 2-3 years will be somewhere between circa ~$350bn and ~$550bn (see our latest numbers here).

For a long time there were no sell-side estimates of this demand. Yet recently we have seen UBS, ANZ, and others publish estimates. UBS calculates that the banks will need to buy $275bn to $375bn of government bonds assuming APRA allows them to lower their Liquidity Coverage Ratios (LCRs) from current system levels north of 130% down to 125%. While there is no chance of APRA allowing banks to run more liquidity risk, especially after APRA has recently fined Macquarie (twice), Westpac and Bendigo for overstating their LCRs, UBS's numbers are broadly similar to ours (albeit lower because of the reduced LCR assumption).

Over the next 2.5 years, the states will probably issue about $155bn of debt while the Commonwealth will issue another $250bn. Of course, there is more than $1.2 trillion of existing government debt outstanding. So while bank demand for state debt will very likely exceed total supply over the next 2.5 years (banks understandably prefer owning higher-yielding state bonds to lower-yielding Commonwealth securities), there is more than enough government debt available for banks to meet APRA's liquidity targets.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $7 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 14 analysts and 5 portfolio managers. Click the ‘CONTACT’ button below to get in touch.

2 topics