What is an Active ETF and what are the benefits for investors?

Actively managed (active) exchange traded funds (ETFs) = Active ETFs. We have written before about active ETFs being like Vegemite, something uniquely Australian, as well as how the industry is set to BOOM. This piece helps explain what they are.

Active ETFs are a relatively new innovation so we’re all still learning about them. Investors should consider active ETFs when building their portfolios. They’re easy to invest in and sit well in a client’s portfolio alongside passive ETFs and direct shares for those investors who like to invest via the stock exchange.

To help investors with their consideration of active ETFs, this piece covers the status of the active ETF industry, what the benefits are to investors, how to make sense of the naming jargon, how the price you buy and sell them at is determined on any given trading day, how to invest in them including the “one house two doors” attractive new feature, and where to find information about your favorite active ETF.

The active ETF industry

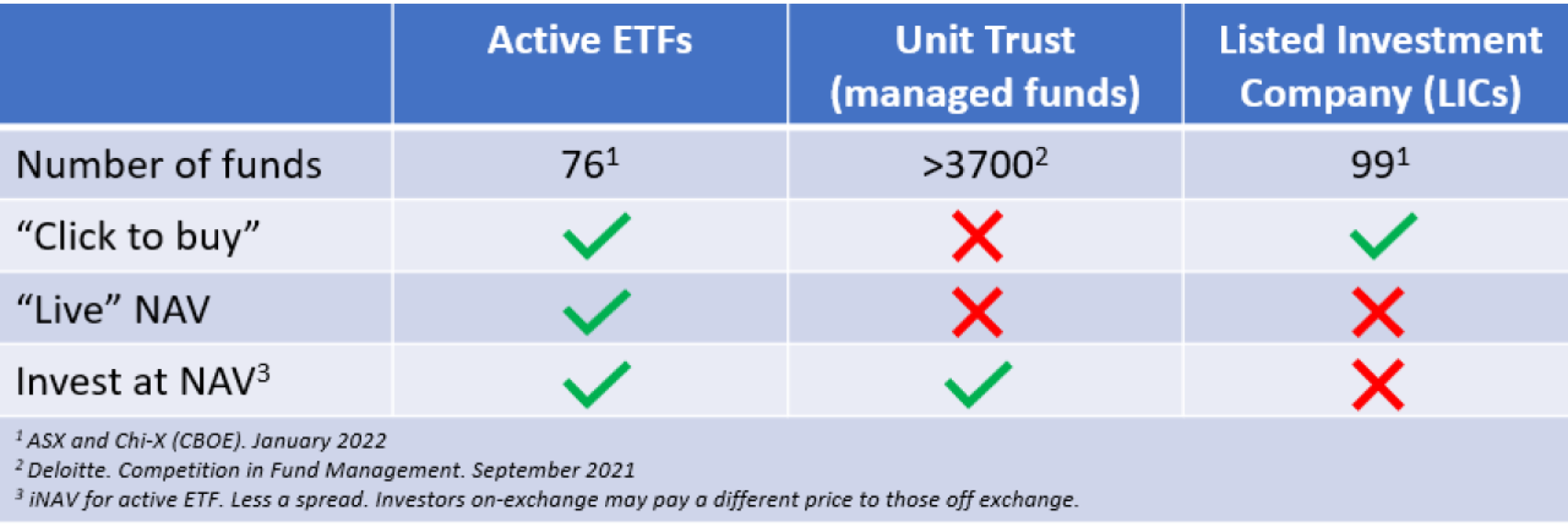

As at 28 February 2022, there were 60 active ETFs on the ASX and 16 on Chi-X (now CBOE) with assets of about $27.5bn. Removing the double counting of off-exchange assets in the dual-access active ETFs (more on this later), we arrive at industry assets of about $12bn. That’s decent for a young industry that was only born in 2014 (in Australia at least). Active ETF investors now have access to underlying asset class choices ranging from Australian and Global equities to Australian fixed income and more recently, ESG and listed real estate.

This compares to >200 passive ETFs (that track an index) in Australia with >$100bn of assets. Active ETFs thus make up 10%-15% of overall ETF industry assets. ETFs are still a drop in the ocean compared to unlisted unit trusts (so called managed funds), by some measures making up only 4% of the assets across the thousands of funds in that industry. More than 85% of the assets in the managed fund industry are still actively managed according to Morningstar (i.e. the opposite of the ETF industry).

The benefits of ETFs (active and passive) to investors are enduring which will ensure their continued growth. In Canada, the global leader in active ETFs, they are >25% of ETF assets. The U.S. is just getting started. There’s a bright future for active ETFs in Australia.

The benefits of active ETFs for investors

Active ETFs don’t have the same low-cost benefits of passive ETFs, but there are times when paying an active manager to add some human common sense amidst the noise of choppy markets is valuable. The real enduring benefit of the ETF vehicle (active and passive) to investors, however, is their ease of use. Simply buy and sell them like a share by punching in the ticker into your broking account.

This click-to-buy has been made a consumer ‘must have’ by the likes of Amazon Prime. Investors will increasingly come to love that feature of ETFs.

So too is the ability to invest in an active ETF at the price level when you make your investment decision. Investing in something on-exchange is an immediate implementation of your investment decision. In an unlisted fund, if you’re organized enough to make the 12pm cut-off for your application forms on the day you make your decision to invest, and if your forms are correctly filled out, you will only get the end of day NAV as your price. If you’re investing in a global equity fund, it could only be the closing price of the US market at 8am Australia time the following morning, a full 20 hours after you made your investment decision.

Imagine if you placed an order with your broker and the order was only executed 20 hours later. You’d fire your broker!

Active ETFs are also more accessible to investors, with no minimum investment amounts, making them more inclusive to a whole cohort of younger savers.

Many names for the same thing

As an industry, we’ve done a bit of a hash job on providing a clear name for active ETFs. Good thing is it seems that ASIC is onto this and hopefully will shortly introduce “active ETF” into the fund name. For now, the best way to determine if an ETF is an active ETF is that it will have the term “(Managed Fund)” in the fund name. Not very helpful I know. Other descriptors you may see, although not in the fund name, only in things like the PDS or fund factsheet, are Exchange Traded Managed Funds (ETMFs) or Exchange Quoted Managed Funds (EQMFs). It’s all much ado about nothing. Different terms for essentially the same thing. They’re all active ETFs.

How the price you buy and sell an active ETF is determined

ETFs trade at their “live” NAV. They are open-ended vehicles which means the fund can allow investors in and out of the fund at NAV by creating and redeeming units in much the same way that an unlisted managed fund does. There are a few caveats for this such as fixed income ETFs during stressed markets but that’s more a reflection of stale NAVs when liquidity dries up in fixed income markets than any flaw of the ETF vehicle. This is beyond the scope of this piece.

The point is that unlike closed-end funds such as LICs, that can trade at premiums or discounts to their NTA, active ETFs trade at their “live” NAV (less a spread).

The key then in pricing an active ETF is to have a “live” NAV during the ASX trading day from 10am to 4pm. To do this, active ETF issuers send the portfolio holdings of the active ETF to an independent third party at the start of every day who then calculates what is called an indicative NAV or iNAV. This is essentially a “live” NAV, as opposed to an end of day NAV.

For an active ETF with holdings in Australian stocks or bonds in it, calculating an iNAV is straightforward as those holdings have a live price on the local exchange. For an active ETF with global stocks or bonds, it’s not so simple.

Imagine an ASX listed ETF that owns Apple shares. Apple trades on the Nasdaq. The Nasdaq closes at 4pm New York time. That’s 8am Sydney time. What price does the ETF use for those Apple shares between 10am and 4pm the following day when the ASX is open and the US market is closed ?

If the ETF uses the closing price of Apple and something happens in the world after the U.S. market closes (like an escalation in the Russia/Ukraine conflict) that causes markets to fall in a heap, a buyer of the ETF during the ASX trading day that has Apple shares in it would be overpaying for those Apple shares (and most of the other shares in the portfolio). Passive ETFs face the same challenge.

How to solve this challenge. Most active ETFs use what is called a “proxy” to calculate the value of Apple shares during the ASX trading day. The proxy normally takes the form of an index future that trades during our time zone. In the case of Apple, this could be the S&P500 or Nasdaq future. If the markets are down say 2% as indicated by a fall in the futures “proxy”, this move is then applied to the closing price of Apple shares to give an estimate of the “live” price of Apple even though Apple shares are no longer trading in the U.S. Sum up all these proxy moves at the individual stock level for all the holdings in the active ETF portfolio and you get the overall iNAV of the active ETF. For most active ETFs, these iNAVs are updated every 1 second. That’s pretty “live”.

Not a perfect science but a pretty good way to provide investors with a “live” price they can transact at when they make their investment decision. It’s much more transparent than an unlisted managed fund where you make an investment decision and have to wait 20 hours (or more) before you know the price you paid. It's more transparent than LICs where the only requirement is to publish an NTA (value of their portfolio) once a month within 14 days of month-end.

One house two doors

A pioneering idea by former Magellan CEO, Brett Cairns, is the dual-access ETF.

Essentially this is where an investor can choose whether to invest in (access) the exact same unit of the exact same fund (same house) either on-exchange say via your online broker (door one) or off-exchange say directly with the fund by filling out the application forms (door two).

This means investors get the same fees, same portfolio, same everything no matter which door is their preference to enter and exit through. Of course, the price paid to enter through door one is the live intraday price as reflected by the iNAV (less a spread) and the price paid to enter through door two is the end of day NAV of the fund (less a spread). These can be different.

This innovation is just shy of two years old but is catching fire. It has benefits to investors and issuers alike so we’re convinced it will be a game changer to grow the active ETF industry. Most ETFs (especially passive ones) are still standalone funds. Many of these ETFs have equivalent unlisted managed funds, but they are separate houses with separate doors.

Finding information about active ETFs

Active ETFs have taken disclosure a step further than their unlisted managed fund cousins. The full portfolio holdings of an active ETF are disclosed quarterly. It’s not as transparent as the daily holdings disclosure of passive ETFs but it’s a step further than the typical top-10-only holdings disclosure provided by unlisted managed funds in their monthly factsheets.

If you’re interested in active ETFs, there’s a list of them on the ASX and CBOE - remember to look for “(Managed Fund)” in the fund name !

Once you’ve chosen your favorite active ETF, head off to the fund’s website (a Google search of the fund name or ticker should get you there) where you will find:

- the iNAV - to guide you on what the live portfolio value is and thus the price you can buy or sell the active ETF at

- the ASX announcements for the active ETF including the quarterly holdings disclosure and the fund’s monthly factsheet to guide you on what is in the active ETF’s portfolio

- a bunch of other information the issuer deems relevant to help you make your decision about whether or not to invest in the active ETF

2 topics