What's in the carry on luggage for Qantas CEO Alan Joyce following his hasty departure

Today’s announcement of the hastening of CEO succession plans at Qantas (ASX: QAN) - Alan Joyce’s time in the role finishes on 6 September 2023 - comes with the final interest notice lodged on the ASX, which shows him leaving the Board as at 5 September.

As always, these make for an interesting read.

Directly, Joyce holds Qantas shares valued at $11,288,938 based on the $5.65 closing price on 4 September 2023 x 1,999,989 shares. Indirectly, he holds Qantas shares worth $1,293,421 based on same valuation (228,924 shares).

A matter of interest in contracts and performance rights

Qantas rewards employees for achieving shareholder value through long-term incentive plans (LITPs) which offer interests in contracts based on grants of performance rights.

There are a total of 3,108,000 rights under these three plans which Joyce would be entitled to:

2021-2023 LTIP: 1,349,000 performance rights.

2022-2024 LTIP: 861,000 performance rights.

2023-2025 LTIP: 898,000 performance rights.

Unlike a traditional option with an exercise price, performance rights are like a zero exercise price option. They always have value on vesting

LTIP plans always state the date on which performance is assessed. It is 30 June for each plan noted above. Aside from the first plan noted where the performance test date of 30 June 2023 has passed, Joyce will no longer be employed at the testing date.

So how have these been retained?

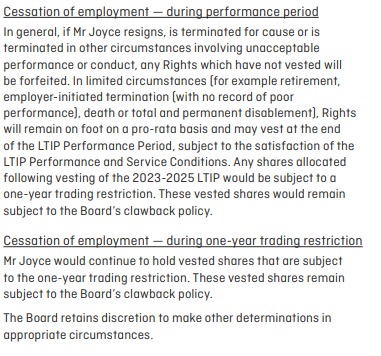

From the 2022 AGM notice of meeting in relation to item 3.2, the LTIP grant of 898,000 performance rights for 2023-2025, the stated policy treatment on termination addresses the issues of Joyce ceasing employment during the performance period (1 July 2022 to 30 June 2025) or during the one year trading restriction (1 July 2025 to 30 June 2026).

It may be such that the pro-rata vesting will happen at a later date. That might be revealed as late as the remuneration report of 2025.

But it could also be that this is one of those times where the Board has decided it is in appropriate circumstances and made some other determinations.

Qantas 2023 AGM is scheduled for Friday 3 November 2023.