Where ARK is looking next: 3 themes from the Big Ideas 2024 report

From the realms of science fiction into the real world: robots and drones are among the disruptive innovations and developing technologies that Cathie Wood’s ARK Invest highlights in its latest annual Big Ideas research report.

“With a belief that innovation is key not only to growth but also to resilience, ARK emphasises the necessity of a strategic allocation to innovation in every investor's portfolio,” notes the report’s preamble.

“This approach aims to tap into the exponential growth opportunities often overlooked in broad-based indices, while simultaneously providing a hedge against the risks posed by incumbents facing disruption.”

The report suggests the global equity market value associated with "disruptive innovation" could increase from 16% of the total currently, to more than 60% by 2030.

"As a result, the annualised equity return associated with disruptive innovation could exceed 40% during the next seven years, increasing its market capitalisation from around US$19 trillion today to roughly $220 trillion by 2030," it notes.

The full report is more than 160 pages long, but in this wire, we’ve picked out a few areas from the report.

Electric vehicles

Most of us have by now heard about Tesla (NASDAQ: TSLA) and its colourful CEO Elon Musk. It may be the most recognised brand in the electric vehicle space but it’s by no means the only one.

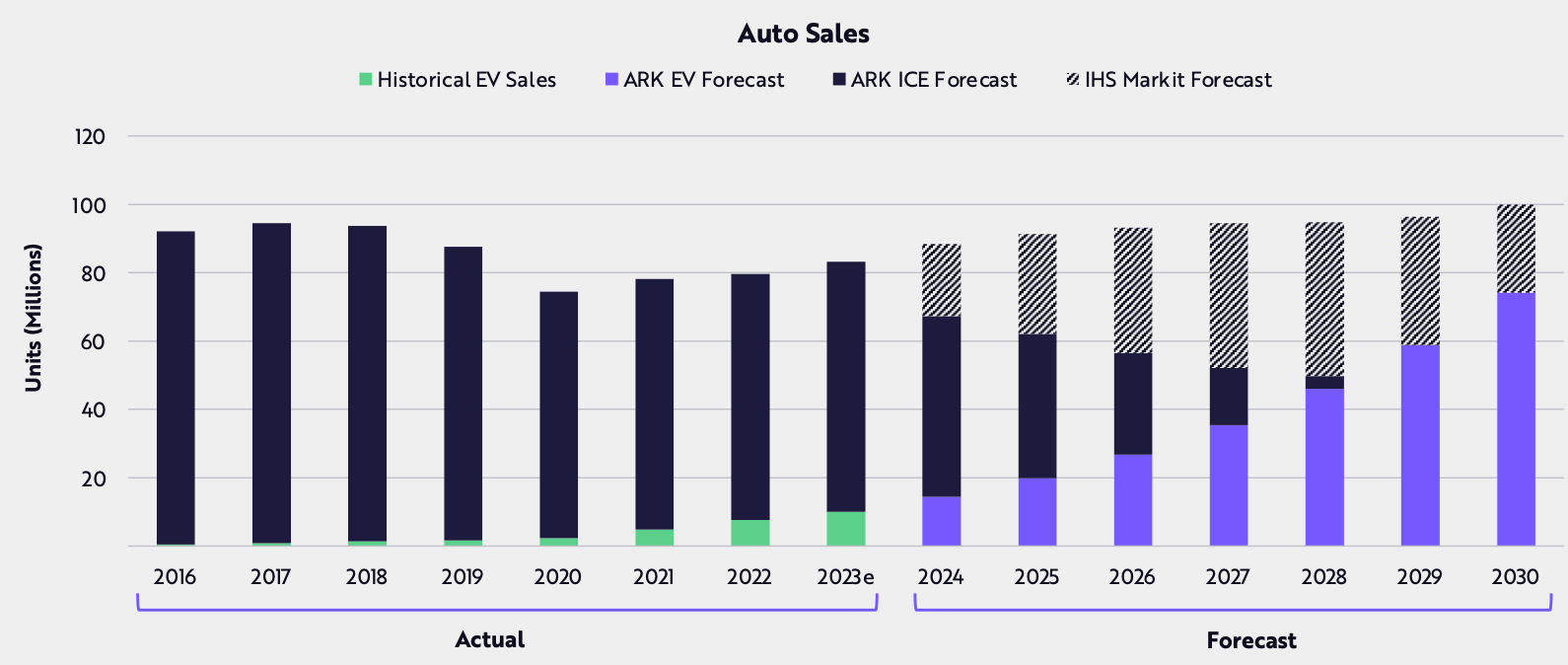

The ARK report references Wright’s Law multiple times – technologies that follow Wright's Law, observed by Theodore Wright in 1938, get cheaper at a consistent rate, as the cumulative production of that technology increases. In the context of EVs, the cost of batteries is falling, which is pushing down the price of the vehicles. This is a large part of the reason why ARK anticipates EV sales will rise 33% – from around 10 million in 2023 to 74 million worldwide in 2030.

“If EVs continue to gain share, as we believe they will, then used cars and new EVs will make more economic sense than new internal combustion engine (ICE) vehicles, perhaps causing a death spiral for incumbent auto manufacturers,” writes ARK.

Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources.

Robotics

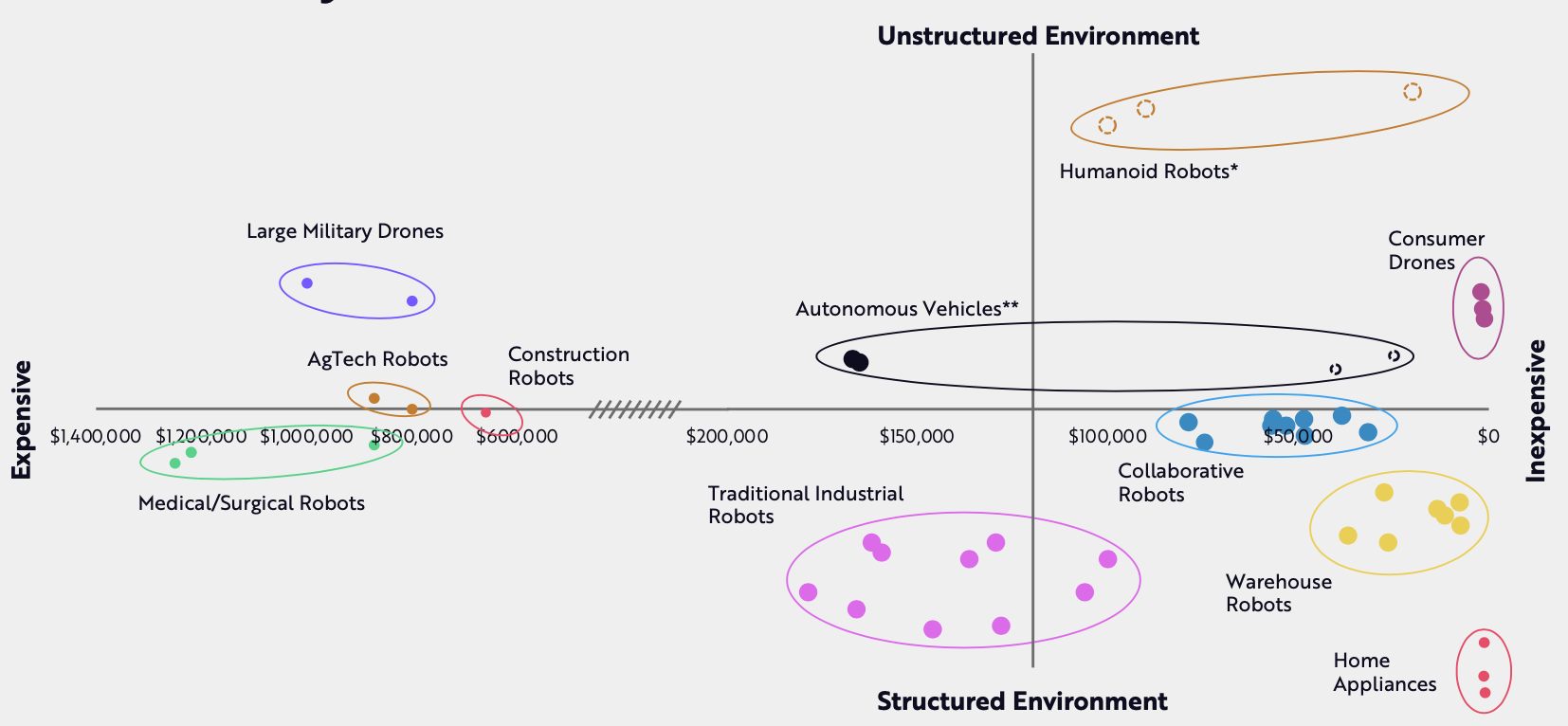

The ARK report also invokes Wright’s Law in its discussion of robotics, noting that artificial intelligence, combined with declining hardware and software costs, is improving productivity. In turn, this is driving demand and creating new market opportunities for what it terms “generalisable robotics”, which could generate annual revenue of more than US$24 trillion.

These robots are already being deployed across multiple parts of the global economic environment, including:

- Military,

- Agriculture,

- Construction, and

- Medical.

They’re also being used increasingly in consumer settings, warehouses and households.

Robots set to operate cost-effectively in unstructured environments

Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon.

The report notes that the cost of industrial robots has been dropping by 50% for every cumulative doubling of production.

“Collaborative robots and humans are likely to operate together, whether on the road, in factories, or at home. Historically, S-curves reach tipping points when the adoption of new technologies approaches 10-20% market share.”

The “S-Curve” refers to the typical technology adoption curve, which looks like an "S" when plotted over time.

Increasingly, robots are being deployed by companies, particularly in “freeing humans from tedious physical tasks,” the ARK report says. It points to Amazon (NASDAQ: AMZN) as a prominent example in the following graph.

Within manufacturing industries, it notes that robotics could add around US$28.5 trillion to global manufacturing GDP by 2030.

Autonomous logistics

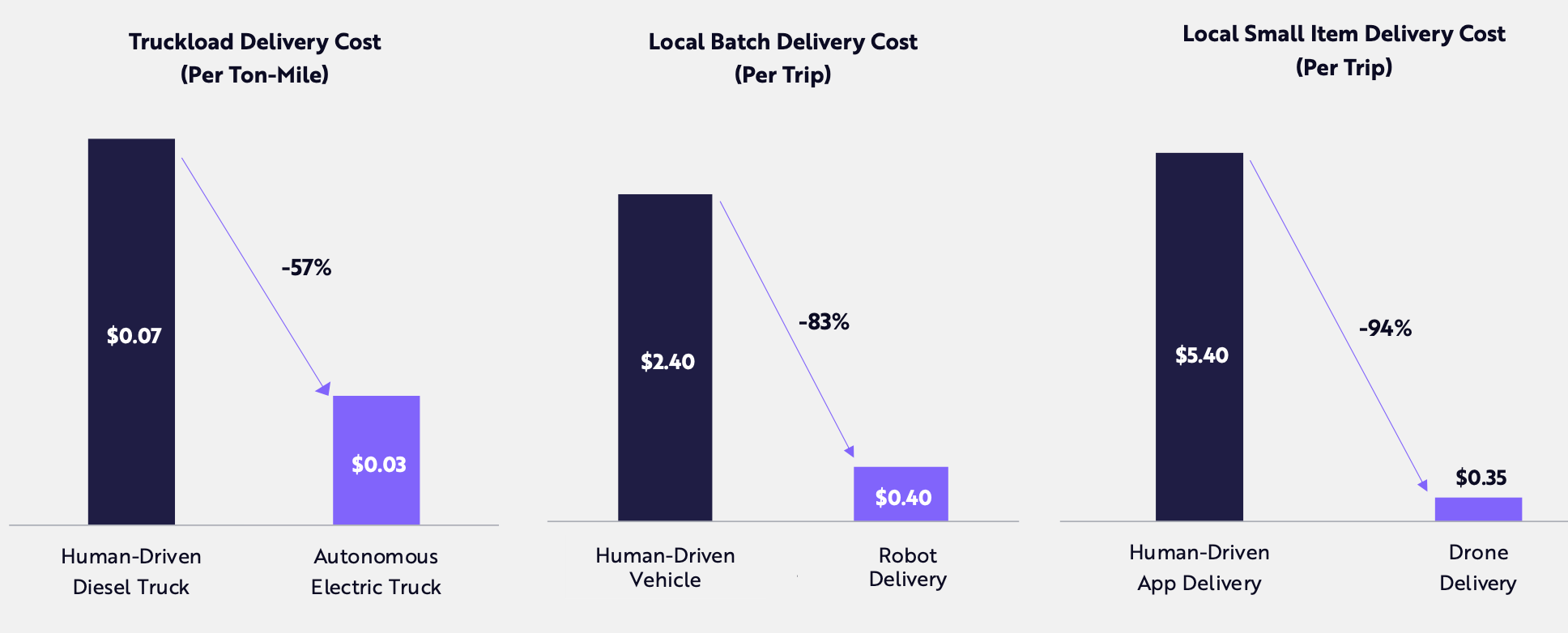

Another area where ARK believes automation holds huge potential is in the way it can reduce costs and alter supply chains.

“Autonomous logistics should reduce the cost of moving goods by 15-fold during the next five to 10 years,” says the report.

“Autonomous drones and robots have made millions of deliveries, while autonomous trucking companies have logged tens of millions of miles and are beginning to remove safety drivers.”

These shifts also flow into other areas, the report noting that autonomous operations are changing shopping behaviour and impacting healthcare by accelerating the delivery of life-saving supplies, especially in emerging markets.

“According to ARK’s research, autonomous delivery revenues could scale from essentially nil today to $900 billion in 2030.”

Autonomous vehicles that roll and fly could lower supply chain costs

Source: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources as of December 7, 2023. Forecasts are inherently limited and cannot be relied upon.

The report also notes that companies with the greatest volumes of real-world data are likely to have a competitive advantage in leveraging autonomous logistics.

ARK estimates revenues from autonomous delivery could reach US$900 billion by 2030. Broken down, this reflects the potential US$450 billion revenue uplift within robot and drone food and parcel deliveries and US$450 from autonomous trucking revenues.

Precision agriculture

Another part of the broader automated logistics theme, the report cites continued automation and yield improvements in breeding, transgenics and agricultural biologics (which are products derived from naturally occurring micro-organisms).

What does this mean? For agricultural companies, this could add up to cost savings and fee generation that are comparable to the margins currently achieved by software firms.

“As a result, their collective enterprise value could roughly double to around US$600 billion at scale.”

For more information

The full report spans 160 pages, with chapter titles including Technological Convergence, Artificial Intelligence, Bitcoin in 2023, Digital Wallets, Precision Therapies, Reusable Rockets and 3D Printing. You can access the full report on disruptive innovation by clicking this link: Ark Invest – Big Ideas 2024.

3 topics

2 stocks mentioned