Where these professionals would invest $1 million in 2023

This year will go down in the history books as extraordinary, not necessarily for the best reasons. Many records were tested and broken. Inflation soared to levels not seen since the 1970s. Interest rates worldwide surged in a way they hadn't since the early 1990s. And bond portfolios suffered losses that they hadn't since, well.... forever.

With things settling down in the December quarter amid early signs of inflation cooling, it's conceivable that investors a generation or two from now will be saying similar things about 2022 that I have just said about the 70s and 90s. Then again, with worries about inflation potentially turning into worries about global growth, we could easily see heightened volatility well into next year.

So, how on earth does one invest and allocate capital when there is so much uncertainty? That is one of the many questions I put to my guests as part of the 2023 Outlook Series - Asset Allocation Roundtable.

Given 46% of Livewire readers have $1 million or more to invest, we went out and spoke to three of Australia's leading wealth managers about how they see things presently and, more importantly, what they are doing to protect and grow wealth into 2023 and beyond.

Our guests for this discussion are:

- Alexandre Ventelon, Head of Research and Investment Strategy at Morgan Stanley Wealth Management

- Andrew McAuley, Chief Investment Officer at Credit Suisse, and

- David Cassidy, Head of Investment Strategy at WILSONS

The recorded interview took place on Thursday, 1 December 2022.

Please note that the comments below, whilst direct quotes, are heavily edited from the original transcript. The aim is to highlight the best snippets from each guest.

The comments also only focus on the conversation around the asset classes. The video above includes an introduction and discussion about key market themes, which have not been included in the notes below. For the full experience, please be sure to watch the video.

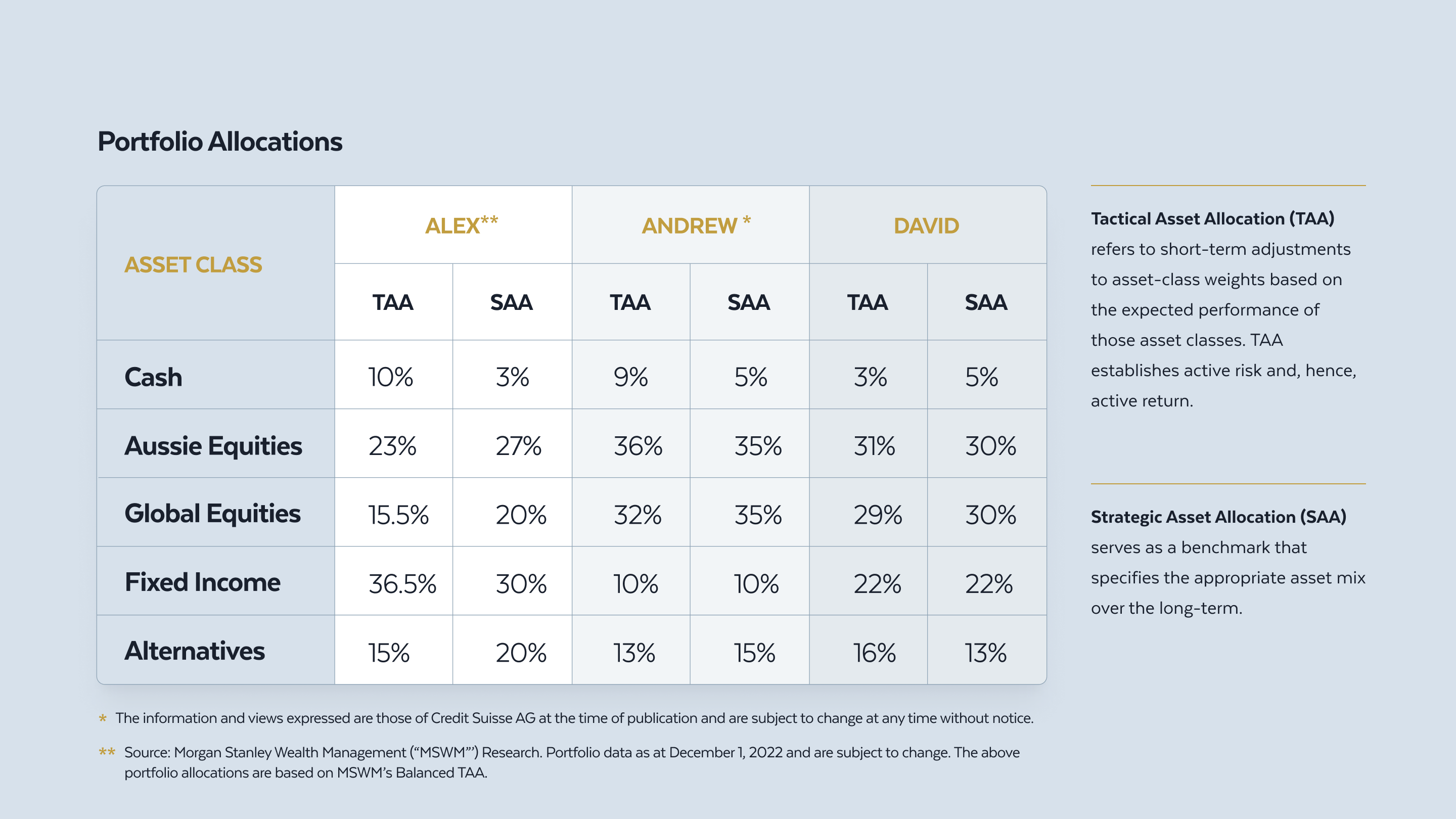

For the information provided by Morgan Stanley (Alex), the source is Morgan Stanley Wealth Management (“MSWM”’) Research. Portfolio data as of December 1, 2022, are subject to change. The above portfolio allocations are based on MSWM’s Balanced TAA.

Australian Equities

Andrew – 36%: We're a little bit overweight Aussie equities in a portfolio context. Aussie equities have outperformed strongly this year. We think that will continue for at least the next three, four, or five months.

David – 31%: From a very high-level macroeconomic perspective, we think the Australian economy is looking relatively resilient. Recession risk, we think, over the next year is relatively low. So that keeps us in Australia to a degree.

Alex – 23%: We are underweight both Australia and the US, because we still have more Australian than international equities in the models. It's just that we wanted to be underweight equities as a whole in this environment.

Global Equities

David – 29%: We don't really take huge geographic bets. We invest more on the basis of styles. So, to that extent, we often let our managers make that geographic allocation for us. So we sort of think about global equities in terms of the major factors, quality, value, and growth. We've been prioritising quality slightly ahead of value, having growth at the bottom of the pile. In terms of our allocations this year, I think it's an interesting junction now.

Andrew – 32%: We're a little bit more focused on geographies. Our least preferred geography is Europe. Some clear issues around the Ukraine war, the energy transition or lack thereof, energy security, and the economy there is weak. We expect a recession, it's probably already in a recession. What it has going for it, the European stock market is that it's cheap and it's cheaper than the US. This is the debate internally, we're underweight Europe and we're neutral to the US.

Alex – 15.5%: Our view to be a bit light on international equities is really predicated on our US equities view. We actually think a number of ex-US markets already trading at very attractive multiples and even if they can still be challenged next year with the more sluggish macro environment, a lot of the bad news is priced in. Whereas in the US it's the opposite.

Cash

Andrew – 9%: We're overweight cash, because we're underweight equities and neutral bonds. I see that cash weight, without giving too much away, I see that cash weight being put to work in bonds fairly soon. We're just waiting for some confirmation on a peak in yields, which I think we have seen.

Alex – 10%: This is very tactical, it's an asset class that we generally don't like too much, but this year it served us very well to be overweight cash versus equities and clearly we've been holding that cash bucket looking for opportunities to deploy the money. We found a lot of them in alternatives and fixed income in the past couple of months and we will continue to look for opportunities and to deploy that cash.

David – 3%: We've been reducing our cash levels at the margin in recent months as both equity valuations have improved. We were reluctant to capitulate and reduce equity allocations and we also wanted to increase our fixed interest allocation, which was suddenly underweight at the start of the year. We had to find the money somewhere and so we decided to use cash in part as a funding source for that.

Fixed Income

Alex – 36.5%: We've had quite a lot of bonds throughout the year, but the bulk of it was in floating rate, which has served us extremely well and in the last few months we've really increased the fixed income portion of the bond portfolio to the fact that now we are overweight on duration. So we're more sensitive to interest rates, especially when we had Aussie government bonds with 10-year yields of around 4.5% and the US equivalent of around 4%. We thought this was extremely good value.

Andrew – 10%: That's 10% in our growth portfolio, which is a higher-risk portfolio. Two places we see opportunities, as I mentioned earlier, are investment grade, Aussie bonds and some US investment grade as well. The other area that we are looking at is emerging market hard currency.

Alternatives

David – 16%: We've got a pretty broad definition of alternatives. So in that space, we have some allocation to private equity still. We have some allocation also to private credit. Private debt is a compliment to our fixed-interest exposures, mostly domestic credit.

We have some market-neutral hedge funds in there to give us some diversification benefits, and some unlisted infrastructure, which should be a good inflation hedge and potentially a beneficiary if we do see some declines in bond yields, at least cyclically over the next 12 months or so. And we've also got a little bit of gold just on the notion of potentially the Fed pausing or pivoting.

Andrew – 13%: We're looking at low-beta hedge funds. Examples of that would be long/short managers, managers that are investing in special situations where there's a takeover and they might buy the company being taken over and sell the one that's doing the taking over. Those sorts of examples where the hedge fund isn't relying on the direction of the markets. The other area, it's probably not particularly new news, would be private equity.

Alex – 15%: A number of our private client portfolios have a very decent allocation to the private debt field. It's been working extremely well. The spreads have behaved quite well, especially in the higher-quality segment of the market. You're getting a boost also from the rising cash rate. So in terms of related value versus fixed income this year, it's clearly been a major source of interest.

What is your one piece of advice for investors next year?

David: Stick to your long-term strategy, diversified with the growth focus if that's your mandate, would be my core advice.

Andrew: Maintain the faith in a multi-asset strategy. It's not unusual for a multi-asset class portfolio, 60/40, or whatever you want to call it, to have a negative year. If you look at a portfolio that was 60% S&P500 and 40% 10-year US treasuries over the last hundred years, there's been 21 years where it's had a negative return. 82% of the time, the following year is positive. And if there are two negative years, 100% of the time, the 3rd year in the cycle will be positive.

Alex: Investors need to think about the long term, the next 10 years. That's how you generate value. If you're all in cash right now and unprepared, you might miss out on the bounce. You just want to be disciplined and use the volatility to average in. And I think the last bit of advice as well is very often the opportunities that are arising are the areas [of the market] that have very little appeal at first. They are the areas where you probably don't want to go because you feel that's where the market was moving away from. And right now, to us, it's the bond and emerging markets.

Check out more of the great content coming through from the series - including interviews with Australia’s top fundies, a new series of Success and More Interesting Stuff, and an asset allocation roundtable featuring three of Australia's top money managers.

3 contributors mentioned