Where to find higher yields for less risk

Australian investors love their bank hybrids. They sit between shares and bonds in a bank’s capital structure. This means that if the bank becomes insolvent, hybrid owners are paid after bond holders, but before shareholders. It also means, because of this risk, investors expect a higher return than bonds, but a lower expected return than shares.

Bank hybrids, are known as Tier 1 capital. Higher than them on the capital structure, but still lower than bonds are Tier 2 capital. Tier 2 capital is known as subordinated debt, because of its place in the capital structure you would expect Tier 2 to provide a lower yield than Tier 1, but it’s worth checking if the “1” is always higher than the “2”.

What is Tier 2 (subordinated debt)?

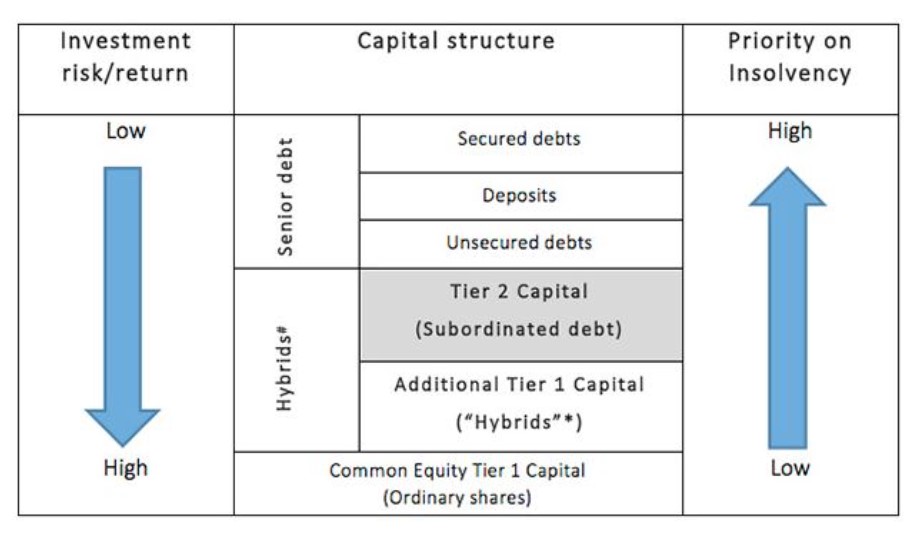

It is called ‘subordinated’ because it sits below ‘senior debt’ or traditional bonds in the capital structure, but it also sits above and takes priority over ordinary shares and Tier 1 (hybrids), in the event of insolvency. See the shaded area in Chart 1 below which provides a simplified example of the capital structure in a financial institution to illustrate how different securities issued by financial institutions rank in priority of payment in the event of collapse.

Chart 1. Simplified capital structure of a financial institution

You can see from the above chart that in the event of insolvency, priority is given to deposits and other senior debt. Shareholders get paid last, if at all.

Subordinated debt securities (also known as ‘subordinated bonds’) rank above ordinary shares and hybrids (additional Tier 1) but below senior debt, including traditional bonds, deposits and unsecured debt obligations. For this reason, subordinated bonds carry more risk than deposits and traditional bonds but are considered less risky than shares and other hybrids.

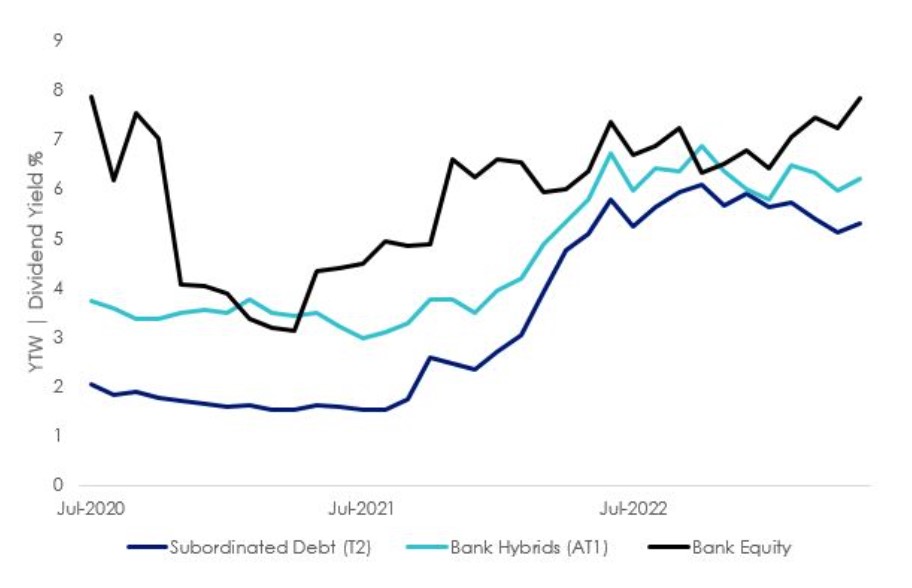

Two isn’t always higher than one, but it is now

Right now, yields on subordinated debt are comparable to hybrids, despite its higher ranking in the capital structure. In other words, investors are potentially being rewarded (with higher yields) for less risk (higher in the order of insolvency).

Chart 2: Yield comparison

Subordinated bonds can now be accessed on ASX via the VanEck Australian Subordinated Debt ETF (ASX code: SUBD) and can be used to potentially enhance the return on the fixed income portion of an investor’s portfolio or as an alternative to Additional Tier 1 Capital securities.

1 stock mentioned

1 fund mentioned