Where to hunt for value when the big beasts have fallen

A household-name Korean company delivering 150 million doses of COVID vaccine and a Russian bank rank among the most appealing opportunities for 2021, says RWC Partners' John Malloy, Jr.

Head of RWC Partner’s emerging markets strategy – which is distributed in Australia by Channel Capital – Malloy believes equities from markets including Brazil, India, Russia and China will blow developed markets out of the water next year and beyond.

“From the end of September to today, value stocks in emerging markets have outperformed growth by about 200bps – about 15% growth – and we continue to see a broad recovery in emerging markets,” Malloy says.

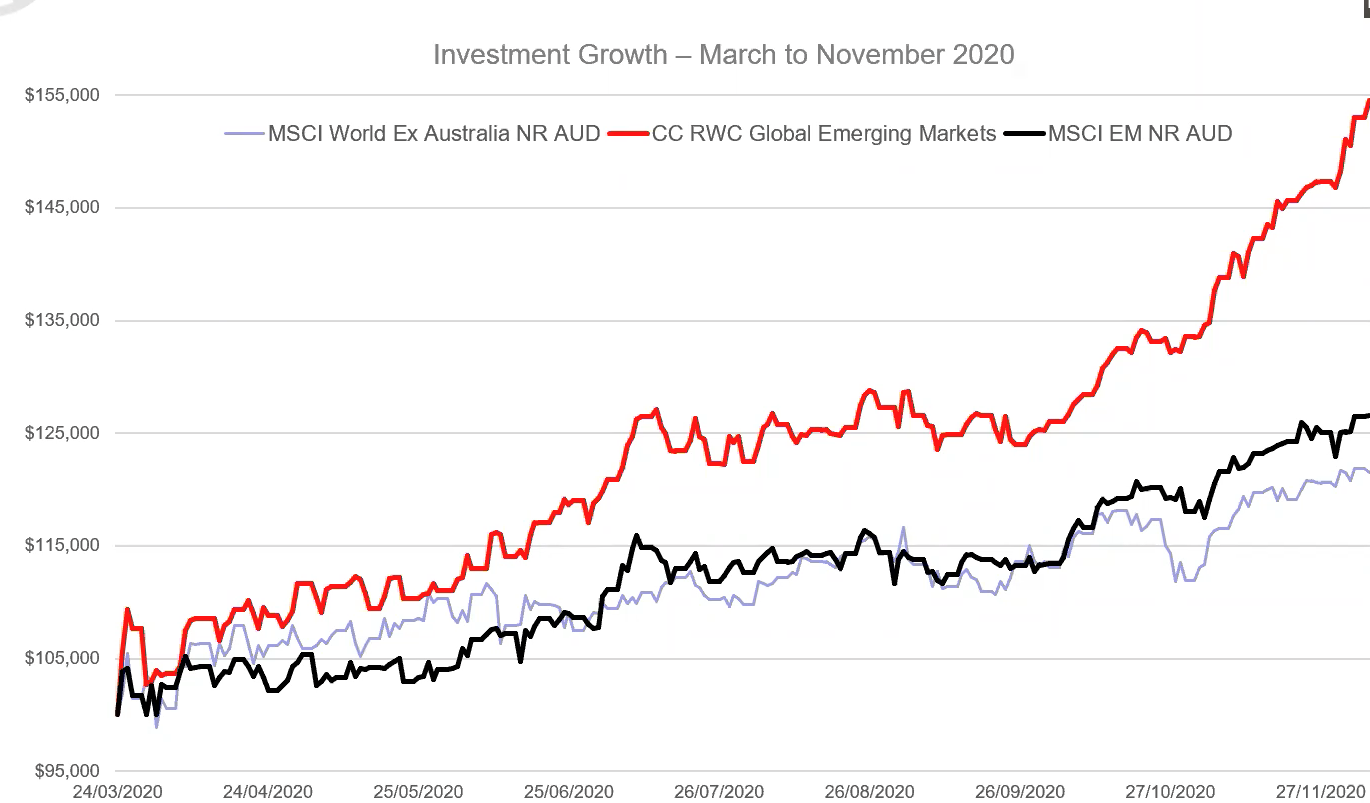

The MSCI Emerging Markets Index NR – in Australian-dollar terms – rose 4.12% in November, while the CC RWC Global Emerging Fund was up 9.93%.

EM performance against index coming out of COVID-19 crisis

Source: Channel Capital; Morningstar Direct

“Because EM have been oversold and under-held, we’re seeing money coming into the asset class but not just into value, we see it coming across the board. And that’s really the difference between these and developed markets," Malloy says.

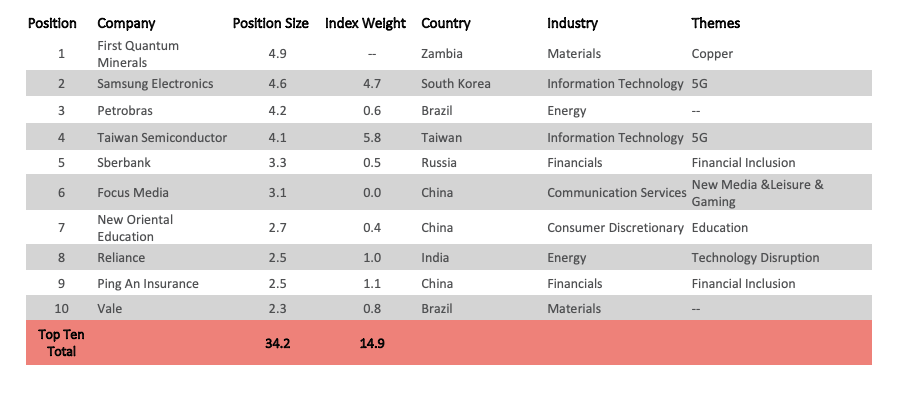

Top picks in emerging markets

Putting its money where its mouth is, RWC Partners has boosted its exposure to a few key sectors in a big way since the sell-off and subsequent rebound. These include the “technology disrupters” of e-commerce, cloud computing, gaming and digital payments, that Malloy says have done “phenomenally well”.

The capital for increasing its allocation to these sub-sectors has come from taking profits from a few positions that they felt had seen their best days for a while. These included the likes of Chinese e-commerce giant Alibaba and Chinese technology multinational Tencent.

“Frankly after Ant Financial, we were very concerned,” says Malloy. A US$35 billion IPO by Alibaba founder Jack Ma was halted by the Chinese government in August after the country’s second-richest man criticised the Chinese Communist Party's handling of the economy.

“We could look back on that and see it as a very important period for Alibaba. And there are other reasons to be concerned,” he says, citing stiff competition from the likes of JD.com and Pinduoduo.

But the fund isn’t entirely bearish on China, with Ping An – China’s largest insurance company that also has a bank and medical business – tipped to outperform as part of a rotation among large-cap emerging market stocks.

After the third-quarter and into October, Malloy and his team pulled back on some of the tech disrupters which in some cases were up 200%. “Some we still hold, but the sizing has been brought down materially,” he says.

It has since shifted further into companies likely to benefit from the post-COVID recovery, in countries that include Brazil, South Africa and India – where its weightings sit at 11% versus 5% for the index.

Korea is an overweight market for the manager, where it holds names like semiconductor manufacturer SK Hynix and multinational conglomerate Samsung. He singles out the latter – known globally for its consumer technology products including flat-screen televisions, but which is also “likely to produce between 50 million and 100 million doses of the vaccines every few months.”

More broadly, Malloy believes Korea is the canary in the coalmine of the post-COVID bounce.

“When you start to see Korea doing well, that means the world is doing well and that we’re seeing a global recovery.”

He says the Kospi – a series of indexes tracking the overall Korean Stock Exchange – has broken out to a new 10-year to 12-year high.

Within South America, RWC likes Brazilian railroad operator Rumo Logistica, a logistics company that moves a lot of produce and iron ore from the nation’s interior out to the ports.

In Europe, the manager holds a 3.3% exposure to Russian bank Sberbank – a considerable overweight versus the index holding of 0.5%.

Back in Asia, Vietnam is another country benefiting from growing industrialisation, urbanisation and increased capital markets activity. RWC's holdings here include the largest steel-maker in the country, Hoa Phat, which is currently trading at a PE of 6-times earnings. This forms part of RWC’s frontier markets exposure that comprises around 11% of the portfolio.

Top 10 positions in Global Emerging Markets fund

Source: RWC Partners, Bloomberg as at 8 December 2020

Not already a Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

You can follow my profile to stay up to date with other wires as they're published – and don't forget to give them a like.

5 topics

1 contributor mentioned