Why 2021 won't see a repeat of this year

Short-term rates are determined by policymakers (central banks). Long-term rates are a function of the forward path of short-term rates and a term premium – essentially the additional compensation investors demand for the risks of lending longer term versus short term – which is mostly tied to economic growth, inflation expectations and supply/demand effects. Short-term policy rates are near zero in most developed countries and are unlikely to go anywhere, making it almost impossible in 2021 to see a repeat of the capital gains that government bonds provided in 2020. The key here is the term premium.

More credit-sensitive areas of fixed income in 2020 were largely spared catastrophe by the rapid and massive monetary and fiscal support put in place to counter the economic crisis. Amid the strong recovery of credit markets since April it is easy to overlook the losses towards the start of the year. Credit spreads in late 2020 are still wider than where they were pre-COVID and it is our belief that we are likely to see a reversal of the return rankings in 2021 with more credit-sensitive parts of the market – such as high yield bonds and securitised credit (securities that merge various financial assets together to create new securities) – outperforming interest rate-sensitive government bonds, where investors are likely to have to content themselves with the coupon.

Striking a balance

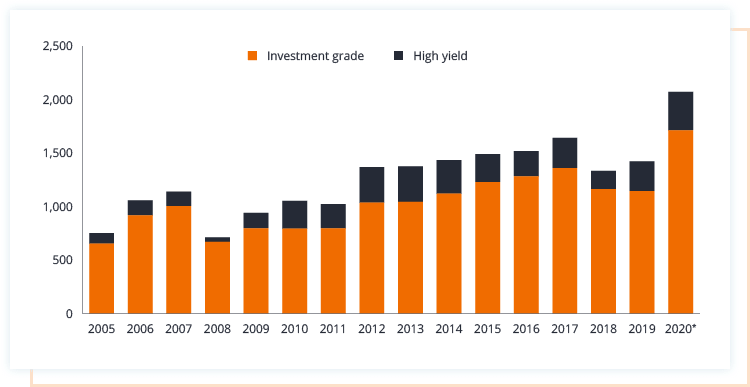

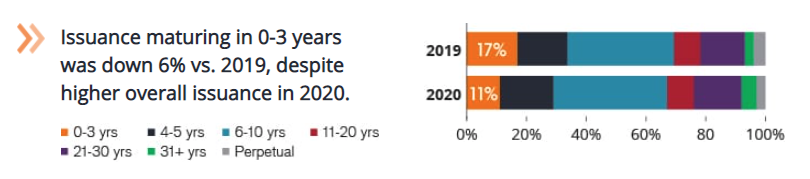

Commentators seemed surprised there was appetite for record supply of fixed income but if a company or government is able to issue bonds, by definition someone must be on the other end buying them. Driving demand was the ongoing need for income. In the US, investment grade and high yield bond corporate issuance reached US$2,073 billion by end October alone, already exceeding the record year of 2017 as shown in Exhibit 1.

Exhibit 1: US gross corporate bond issuance per calendar year (US$ billion)

Source: SIFMA, full year issuance, *2020 year-to-date figure reflects to 31 October 2020.

Corporations have front-loaded their borrowing, following the maxim of equity fund raisers – “go big and go early”. It is always easier – and cheaper – to borrow when you appear less desperate. With interest rates and bond yields at such low levels the carrying cost of excess cash reserves in an uncertain environment is low. For some companies this cash is simply sitting on their balance sheets, such that net debt has increased only marginally. Our sense is that leverage (debt) levels will diminish in 2021 as earnings improve.

Bridge or viaduct

The speed of deleveraging will be dictated by COVID-19 and potential vaccines. In the first half of 2020 many countries went into lockdown in the hope it was a one-off. The authorities would help companies bridge the revenue gap caused by lockdown with ample liquidity and fiscal support. Further lockdowns mean that bridge may require several arches and is turning into a viaduct as liquidity has to extend further. Yet companies have always been concerned about multiple waves and have sought to protect against this by borrowing for longer periods to avoid having to return for additional near-term funding.

We would argue that the coronavirus crisis truncated the usual credit cycle, bringing forward the downturn recession phase into 2020 and hastening a repair phase in 2021.

Historically, this phase of the credit cycle has been associated with credit markets outperforming as revenues improve at companies and balance sheets are repaired, often leading to tighter credit spreads.

In common with the credit rating agencies we see defaults peaking in the first half of 2021 but falling back quickly. A well-capitalised banking sector is a difference between this crisis and the last one. Those sectors that have been most hit by COVID-19 such as energy, retail and hospitality will bear the brunt of the pain, albeit creating selective opportunities for investors prepared to study credit fundamentals. Dispersion will be a key feature of 2021 as returns are mixed across sectors and issuers; geopolitics and vaccine-led news are likely to create pockets of volatility. There are likely to be more fallen angels but high yield proved capable of absorbing large downgrades from investment grade in 2020.

Other sectors, such as asset-backed securities (ABS) and mortgage-backed securities (MBS) – which are ‘backed’ or collateralised by a pool of assets such as loans, credit card debts, leases or mortgages – are in a different position. These sectors have not seen leverage rise materially over the last ten years and were better positioned going into the pandemic. As an alternative source of income, we expect demand to increase materially for these segments in 2021. Although less liquid than many corporate bonds, these instruments offer diversification within their structures and additional credit enhancement. Again, security selection will be important, as some segments – such as residential mortgages and loans – may be well protected against disruption. Others, such as mortgages backed by offices or retail, may be more at risk from a prolonged pandemic.

The recovery should help more cyclical sectors but it will be important to recognise those that have been permanently impaired by the crisis. We envisage the structural shifts towards technology have been accelerated and the interest in environmental, social and governance factors will deepen in 2021. With more banks globally refusing to extend credit to businesses failing certain ESG factors, the pressure on broader debt capital markets to integrate ESG considerations will intensify, particularly if the US begins to promote a ‘green’ agenda. We believe a self-reinforcing feedback loop is beginning to form in which companies with stronger ESG credentials will be able to finance at relatively cheaper levels.

The shape of water

The type of stimulus we have in 2021 will be important. Fiscal policy will remain critical. Until household and business demand steps up, governments will be forced to plug the gap or risk seeing a large economic contraction. Weening the economy off fiscal stimulus will take time and the lines between debt monetisation and fiscal spending may become even more blurred as central banks continue to act as buyer of last resort. Modern Monetary Theory to some extent may already be with us. We expect European countries to continue with furlough schemes for as long as is warranted and even the US Congress to approve a further package once the election dust has settled.

Nothing is so permanent as a temporary government programme.” -Milton Friedman, economist

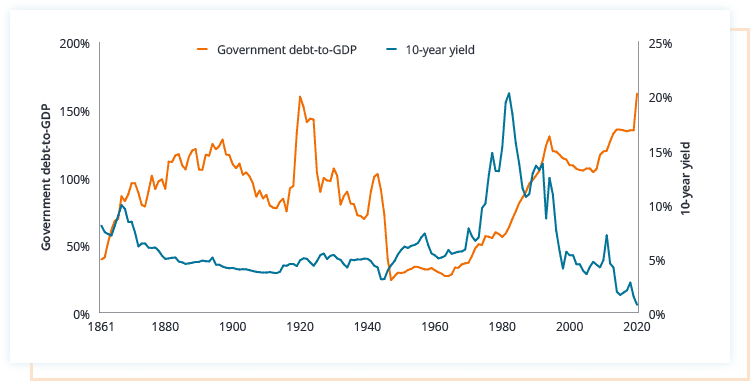

Vast spending is typical when countries are at war – and governments have waged an economic and medical war against COVID-19. There will no doubt be ongoing murmurings that government debt levels are getting out of control, but such noise has been around for decades and rarely influences markets so long as there is faith the debt servicing will be honoured. Italy is a case in point: as Exhibit 2 demonstrates, the relationship between debt levels and borrowing costs is tenuous and for much of history higher debt levels have tended to coincide with low and falling government bond yields.

Exhibit 2: Italian Government debt-to-GDP ratio and 10-year yield since 1861

Source: IMF, Bloomberg, Banca D’Italia, Janus Henderson Investors, 1861 to 2020. 2020 to 2021 incorporates IMF forecasts. Forecasts are estimates and are not guaranteed. Past performance is not a guide to future performance.

The ongoing recovery is likely to be felt in currency markets. The US dollar often acts as an inverse barometer of global growth, strengthening when global growth is relatively weak – given investors often seek the dollar as a ‘safe haven’ – and weakening when the rest of the world is doing well. A recovering rest of world should see a weaker dollar. In such an environment we would expect additional flows into emerging market bonds in 2021, repairing some of the outflows in 2020 depicted in Exhibit 3. A thawing of US-China relations should also help.

Exhibit 3: Net flows in emerging market funds (US$ billion)

Source: International Monetary Fund World Economic Outlook, October 2020, January 2017 to September 2020.

It is difficult for monetary policy to be additive at these levels. We are not convinced that the US Federal Reserve (Fed) and the Bank of England are keen to take rates into negative territory given the questionable results seen in Europe and Japan.

We doubt that short-term policy rates will rise in any major developed country in 2021. Central banks have indicated they will remain accommodative, a bias which should help depress volatility in markets. We take our cue from two factors. First, today’s central bankers are schooled against the stalling effect of tightening policy too soon, which held back recoveries and contributed to Japan’s lost decade in the 1990s. Remember the Fed took seven years to raise rates after the 2007-2008 Global Financial Crisis and was shaken by the ‘taper tantrum’ in 2013 when it suggested winding down asset purchases. Second, the Fed actively signposted its inclination to hold rates by moving to flexible average inflation targeting (FAIT) back in August. It is willing to allow inflation (rising prices) to overshoot 2% in the short term.

Much ado about nothing

Monetary policy can be supportive by doing nothing. Holding rates steady at ultra-low levels while inflation rises pushes real rates (rates adjusted for inflation) down. This means that the real cost of financing is falling, which can encourage businesses to invest and households to take out credit. It is no accident that housing markets as far apart as the US, Sweden, and Australia have remained buoyant throughout the crisis as real rates have remained low or fallen. We do, however, need to be mindful that easy monetary policy can be an incentive for excessive risk-taking.

The Fed has also been extremely effective at using signalling to achieve desired results. For example, despite announcing corporate bond purchase programmes the actual purchases it has made have been derisory – merely knowing the Fed was providing an implicit backstop was sufficient for private demand to absorb bond issues. By early November 2020 the Fed’s Primary Market Corporate Credit Facility had not even been tapped and the Secondary Market Corporate Credit Facility held just US$13.5 billion of corporate bonds and corporate bond exchange traded funds (ETFs) – just 0.2% of the eligible US$8.7 trillion market.

Europe is somewhat more addicted to technical support and given the divergent economies within the eurozone it is perhaps here more than any other region where monetary policy will have the most direct impact on returns."

Contrast this with Europe where the European Central Bank (ECB) has been a massive purchaser of corporate bonds and owns €243 billion. Europe is somewhat more addicted to technical support and we would expect the asset purchase programmes to continue through 2021. Announcements from the ECB will be critical and given the divergent economies within the eurozone it is perhaps here more than any other region where monetary policy will have the most direct impact on returns.

Let it flow

There is a lot of money still sitting on the sidelines – some US$4.0 trillion in US money market funds at 31 October 2020, a third more than at the end of 2009 when we emerged from the last global crisis. 2021 brings certainty to the political dimension in the US, removing a key variable. We also expect further progress on the medical front in the fight against COVID-19 – whether that it is improved treatments or a vaccination programme. A vaccine is more economically powerful than a fiscal package.

With cash interest rates pitiful, we believe investors will want to put some of that money to work and it will flow into bonds and equities. With central banks continuing to absorb government debt we believe many investors will continue to treat higher quality investment grade corporate bonds as “new sovereigns”, offering higher yields for an acceptable level of additional capital risk.

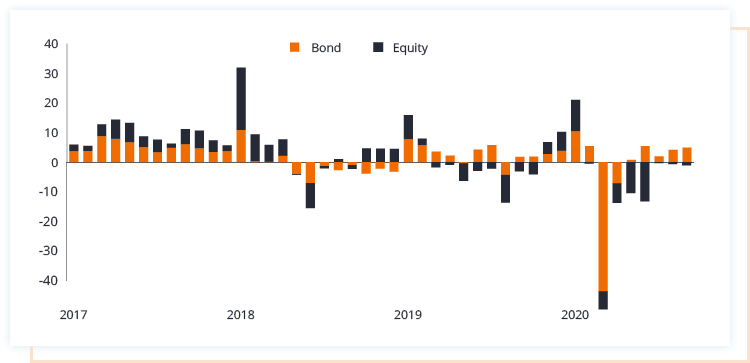

Questions are rightly being asked about the effectiveness of government bonds as a hedge for equity risk. This has become more valid as the prospect for an offsetting rise in bond prices diminishes when yields have little room to fall further. Bonds still offer relative capital stability, however, and at lower maturities where duration risk (sensitivity to changes in interest rates) is smaller should continue to offer income without excessive capital volatility.

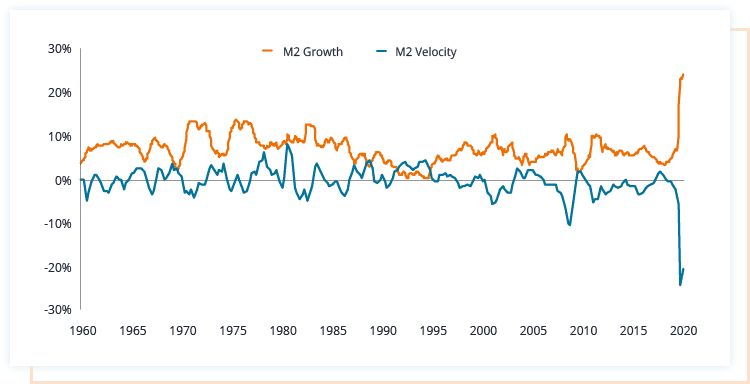

The other pressing question is whether the increase in money supply will lead to inflation. It is expected to rise in 2021 in response to base effects: inflation is measured as a year-on-year percentage change so an exaggerated effect will be created when comparing with the abnormally low prices in 2020 when demand collapsed and oil prices plummeted. We see any spike as short-lived and not a regime change towards permanently higher inflation. Disinflationary technological forces, plus the overhang of higher unemployment and an output gap from the COVID-19 crisis, should prevent inflation from gathering steam, although we will keep a watchful eye on commodity prices or changes in the velocity of money (the rate at which it circulates around the economy) that might challenge this view. In 2020, the velocity of money fell back sharply, as illustrated in Exhibit 4, diluting the impact of the growth in money supply and restraining inflationary pressures; it would be worrying if both were to rise in lock-step.

Exhibit 4: Year-on-year change in money supply and velocity of money

Source: Bloomberg, Janus Henderson Investors, 30 September 1960 to 30 September 2020.

Inflation offers a possible source of volatility, as happened with the 2013 taper tantrum, where markets panic that monetary policy is set to be tightened. Government bond yields are likely to creep higher in 2021, but we expect these to be modest rises measured in tens of basis points rather than percentage points. Floating rate exposure or instruments like Treasury Inflation‑Protected Securities (TIPS) could help hedge interest rate risk.

Volatility and the performance of risky assets are closely linked, as is the desire of investors to hold less liquid assets. In a low yield world, the search for income will persist. Along with that, the demand for diversification in income will rise. Whether emerging market debt, asset-backed securities, or corporate bonds, we are likely to see appetite evolve for a broader cross-section of assets. The cycles behind these different asset classes are typically not fully synchronised, allowing them to be combined in a manner to provide more sustainable returns. The ABS and MBS sectors look particularly well-suited to deliver on this in 2021; although most investors hold corporate bonds, a smaller number hold securitised debt instruments. The expectation that these structures can also de-lever into a global recovery, we believe, should underpin the segment in the coming year.

Upward pressure on rates will likely increase as the recovery unfolds, but increases should be held in check by aggressive central banks and well-behaved inflation. We anticipate the economic recovery, slightly higher inflation, and the insatiable appetite for yield will be a powerful elixir for higher yielding segments of the bond markets, propelling the demand for corporate bonds and MBS. Current valuations do reflect much of the expected improvement, however, and fundamental improvement will be needed to drive returns materially higher in 2021. Central banks will do their best to suppress volatility, something they are now quite proficient at, but investors should be prepared for the occasional and potentially sharp interruptions to this trend. The year will kick off under a cloud of COVID cases set against a vaccine-driven recovery, reflecting the type of competing forces we will see throughout the year. Investors should stay nimble, react to the signposts that foretell the prospects for growth and liquidity provision, and take advantage of these market disruptions. The low level of rates, the acceleration of secular trends and policymaker interference have altered the landscape permanently, and a new framework is needed.

Never miss an update

Click the follow button to stay up to date with the latest insights from our fixed income team as we look to help clients navigate the markets and opportunities ahead.

For all references and sources please visit the original version of the above wire here

1 topic