Why Citi believes we are nearing the end of the cycle

Equity markets are nearing the end of the cycle, according to Citigroup USA's managing director and global head of exchange-traded funds (ETF) research, Scott Chronert.

Speaking at the Inside ETFs Australia conference in Sydney on Tuesday, Chronert argued that both equity ETFs and fixed income ETFs are pointing to worrisome "later stage behaviour", while the global economic recovery lags behind at an early- to mid-cycle phase.

It comes as investment leaders clash on where we are in the equity market cycle, with greats like Jeremy Grantham warning of an impending end to this great bull market run, while the country's top-rated fund managers argue there is still fuel left to stoke the market's fire.

But, humour me here, in the case that we are nearing the latter end of a bubble, what exactly should investors do?

In this wire, Chronert points to a variety of signs that suggest we are, indeed, nearing the end of the cycle. Plus he also shares how investors should position their portfolios with this in mind, as well as the overall implications for the ETF industry.

Global evidence of later stage behaviour

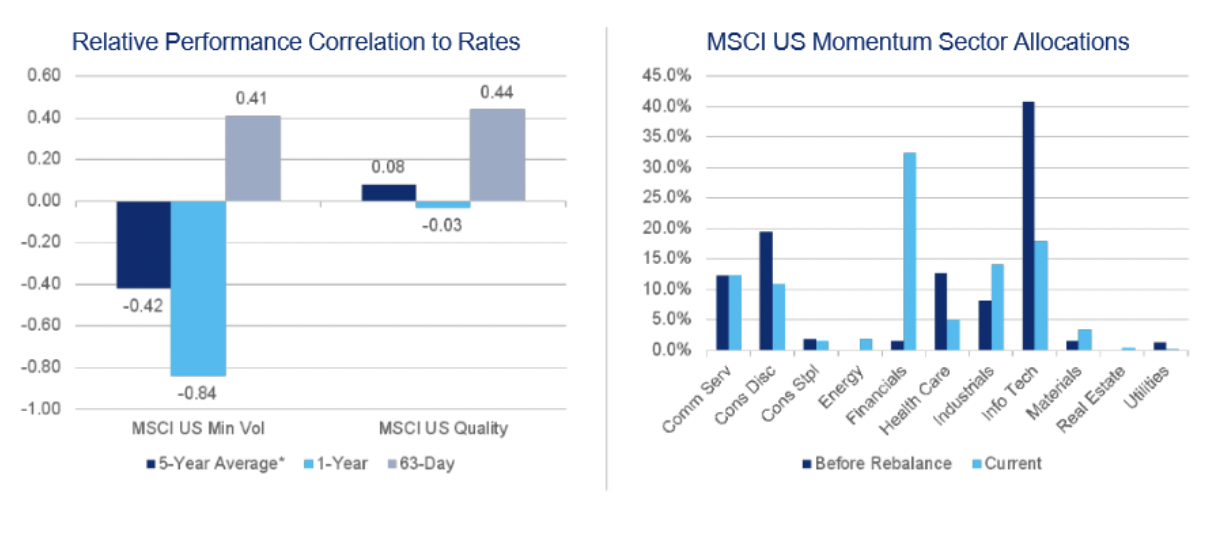

Chronert argues that the underlying behaviour and composition of single factors is shifting, with both Minimum Volatility and Quality-focused MSCI ETFs recently becoming more correlated to rates - something that we haven't seen over the past five years.

Even more recently, the Momentum ETF (the MSCI underlying index) recently rebalanced at the end of May, he says, with the weight towards tech falling dramatically, while financials rose in a similarly dramatic fashion (as seen in the MSCI US Momentum Sector Allocations chart).

"Even momentum is beginning to get a more economic sensitive, value bias," Chronert says.

"Essentially, what this means is that the broader market - through a single factor lens - is increasingly now positively correlated to rates. We're interpreting this as a sign of, what we call, later cycle behaviour."

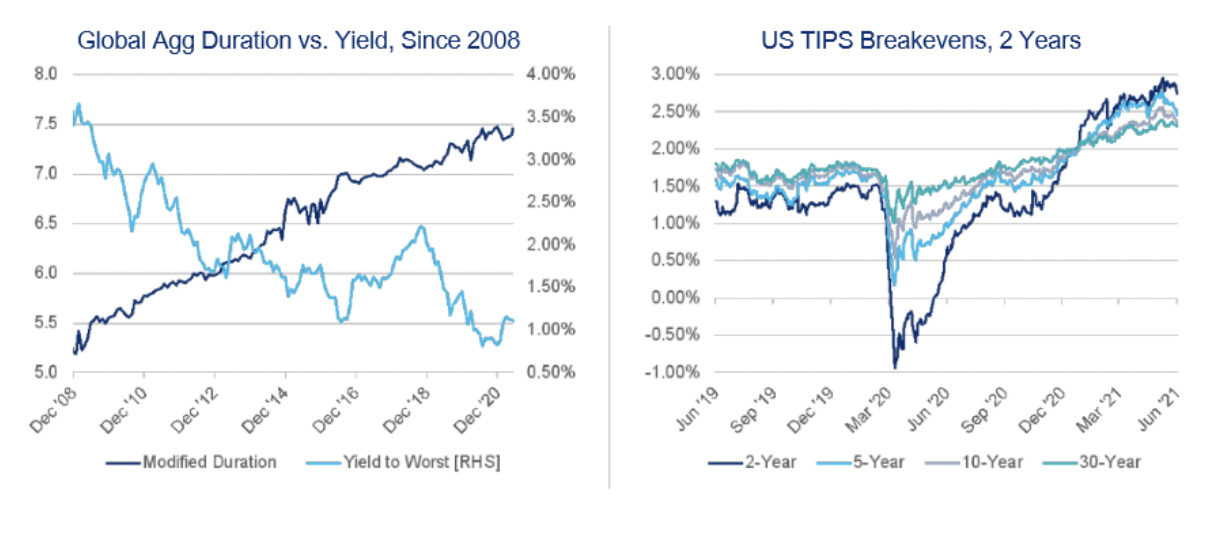

The fixed income market is also increasingly sensitive to interest rate conditions, Chronert says.

"We've seen the duration on the Global Agg (the Global Aggregate Bond Index) do nothing but move higher as rates have come down. You're now looking at a duration on the Global Agg of roughly 7.5," he says.

"If you compare that to US investment grade, it's up closer to 10."

He argues that the cyclical action that we have witnessed in the market, as well as the all-encompassing conversation around where inflation could be headed, has forced fixed-income ETF investors up the risk curve in their quest for yield - making fixed-income core exposures all the more sensitive to interest rate conditions from this point forward.

How to position your portfolio

From an equity perspective, Citigroup's research into equity flows suggests that investing outside of the US is a relatively better position for the ongoing reopening trade, Chronert says, while a value bias will also be key as inflationary and positive economic revision sentiment continues over the short term.

"We will continue with a value overweight, but increasingly we want to barbell it with a quality exposure," he says.

"We find that quality tends to match pretty well with rising inflation i.e. cost pressure circumstances, and we actually think that from a relative valuation perspective, this provides a pretty good risk-reward as we go down this later cycle discussion path."

An investor's mantra for the remainder of 2021, as well as looking forward into 2022, should be visible earnings growth, he says. Chronert also believes there to be value in "tactical positioning" from a sector-specific perspective, pointing to oil and gas ETFs as an inflationary hedge in the energy sector.

On the fixed-income side, Citigroup is less interested in inflation-protected securities, with Chronert arguing real rates do not justify any major investments from here on in.

Instead, the investment giant is focused on getting more credit exposure; high yield and emerging market debt - and also prefers globally positioned multi-factor fixed income ETFs as well.

"So the bottom line is that, from a fixed income perspective, while equities may be further down the path of positioning for a later cycle, we think there's still comfort in early cycle economic conditions to support going up the credit curve if you will," he says.

The case for a "core + satellite" portfolio construction approach

Perhaps unsurprisingly, Chronert is bullish on the opportunity for ETF asset growth going forward and is particularly supportive of their growing use in investors' portfolios. He argues that a "core + satellite" focus is the way forward for asset allocation and model portfolio construction.

"What we're suggesting here is a traditional, core market cap weighted ETF, at low cost, provides a very valid means for basic positioning," Chronert says.

"But around that, we want to begin to use the full breadth of the ETF ecosystem to be able to tactically position according to thematics and other forces at work."

He also believes we are likely to see the demise of the "size and style" investing approach, and instead believes that investors will exploit stock-specific opportunities through ETFs.

"Essentially we think large, mid, small, core, growth, value is out of the spotlight, and instead, investors via ETFs are going to be able to find lots of stock-specific opportunities. Viewing, for example, small and mid-cap as an opportunity set as opposed to an index," he says.

Chronert also argues the case for using passive exchange-traded products for active investment.

"This is another way of saying, the traditional discussion about flows out of active into passive we argue is somewhat misplaced. What is essentially happening here is that the global ETF toolkit gives investors many different options in terms of how to actively manage a portfolio - but using passive products," he says.

Why active ETFs are the next big thing

Chronert says that active ETFs are the natural evolution and development of the investment landscape, arguing that over the next five to 10 years, much of the mutual fund landscape in the US could migrate to an ETF structure.

"We see active as the next big thing in ETFs," he says.

"I know Australia has been way ahead of the curve on this, and I think the stage is set for the US to play catch up. And again, we think that most of the broader mutual fund complexes need to give serious thought to how they develop their own complex by complex ETF strategies."

In addition, generational wealth transfer issues - as well as the tax advantages that come with an ETF structure - should continue to drive more mutual or managed funds to migrate over to active ETFs, he says.

More on ETFs:

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

Livewire’s 100 Top-Rated Funds Series is live. Check it out now.

3 topics