Why manufacturing is set to drive India's economy

India's growth story over the last decade has been driven by rising consumption rather than investment. This was partly caused by the global financial crisis, when excesses were built into the system and overhangs occurred from 2008-2012 in capex-related industries. It also meant excessive corporate leverage funded by the banking system.

In response, we've seen a rise in bad loans and weaker balance sheets. This has meant consumption and, to some extent government spending, "carried the can" for growth during the 2010s.

Personal consumption was largely fuelled by banking services and credit funding from privately owned banks and non-bank financial companies. This led to a fantastic period for companies in these sectors. Stocks like HDFC Bank, Kotak Bank, Bajaj Finance, Hindustan Unilever, Asian Paints, Maruti Suzuki and Nestle rose in prominence and market cap over the decade. However, industries that are related, infrastructure or manufacturing-focused all suffered from stagnant demand and lack of private investment. As a result, India's GDP growth fell from over 8% to 3% in 2020 (pre-pandemic).

In the 2020s, the focus has shifted incrementally towards manufacturing and exports. Given the supply chain issues faced by the world due to the dominance of China, India and other countries like Indonesia, the Philippines and Vietnam are trying to seize the moment and integrate into global supply chains through either a structural advantage in labour costs or an edge in manufacturing, R&D or technology in value-added exports.

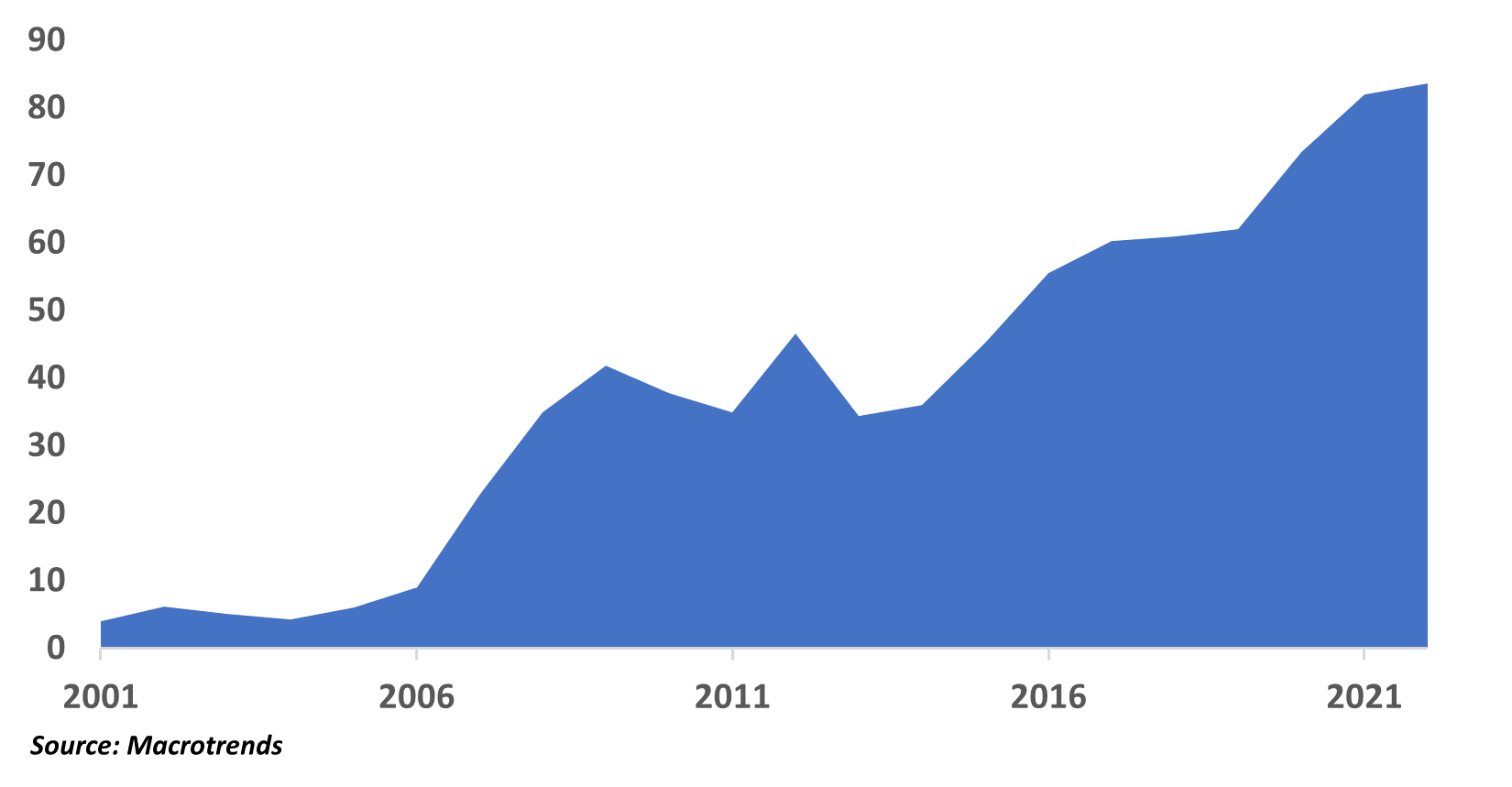

The Government of India has pivoted towards this post-COVID-19 by announcing its "Atmanirbhar" self-reliant philosophy, which focuses on manufacturing locally, reducing imports and seeking to increase exports to US$1 trillion per annum by 2030 (from the current US$350-400 billion pa today). When it came to power in 2014, the Narendra Modi-led BJP Government set up an initiative called "Make-in-India" which was focused on leveraging on India's strengths to manufacture more locally. This initiative has had mixed success in its initial years. However, cutting corporate taxes and taxes on new manufacturing projects in 2019 and introducing a Production Linked Incentive (PLI) scheme in 2021 to increase foreign interest in manufacturing locally in India in a JV with a local partner, are two areas that have the potential to increase India's integration into the global supply chain. Additionally, lowering the cost of doing business by cutting red tape and improving transparency and audit trail have led to rising levels of foreign direct investment than ever before.

Chart 1: Foreign Direct Investments into India US$bn

Companies like Apple NASDAQ: AAPL, Toyota, Samsung, Pfizer NASDAQ: PFE, Walmart NASDAQ: WMT and Amazon NASDAQ: AMZN are all making investments in India to build locally, which is likely to create additional employment opportunities and help boost India's GDP-per-capita from being 15 years behind where China is. Given India's huge market opportunities, these multinationals are seeking to lower their cost of production and enjoy lower taxes and fewer barriers to entry into India's lucrative long-term opportunity.

If India can address its manufacturing woes (which currently contributes less than 15% of GDP) and integrate more into global supply chains and use its skilled and unskilled labour to manufacture for the rest of the world, then its GDP-per-capita is set to experience a rise like China's in a more sustainable way, over the next two decades.

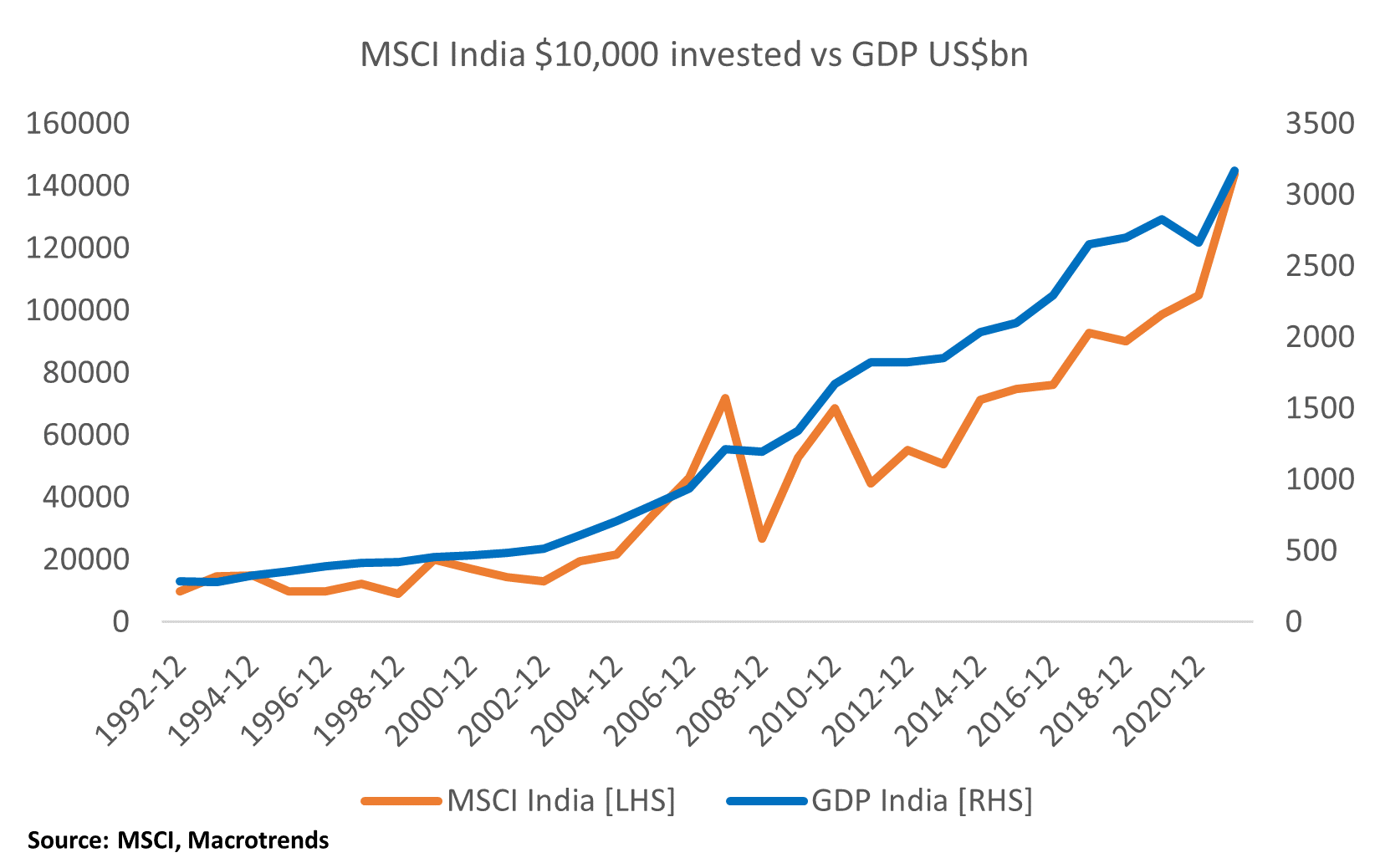

The chart below indicates that a corporate earnings recovery is underway after lagging GDP through the last decade. India has been one of those economies/markets where GDP and markets have tracked side-by-side over the longer term. This augurs well for investors looking to take advantage of India's increasing economic prominence on a global scale.

Most actively managed funds will seek to invest in companies that are not just the Index heavyweights which tend to significantly represent the winners of the last decade. Whilst those companies may continue to be good investments due to the moat they have built, they may not necessarily capture the same share of incremental growth in the future.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

4 topics

4 stocks mentioned