Why now is the time to take another look at this investment region

Fun fact: the first stock markets were established in Europe. In 1531, in the Belgian city of Antwerp, the bourse opened as a place where traders could exchange commodities and promissory notes.

In 1602, the Dutch East India Company (VOC) became the first company to offer its shares for sale on the Amsterdam Stock Exchange.

According to the National Museum of Australia, “shareholders were amply rewarded for their investment, with the company paying an average dividend of 16% a year for almost 40 years after its formation”.

To think it has been almost 500 years since the first trades were made.

Today the Euronext exchange is the fourth largest exchange on the planet, behind the NYSE, NASDAQ, and the Shanghai Stock Exchange, with a market cap of US$6.1 trillion.

And whilst a lot of that money is ‘old’ money, investors shouldn’t sleep on the opportunities that Europe presents – particularly right now.

According to a recent article from Goldman Sachs,

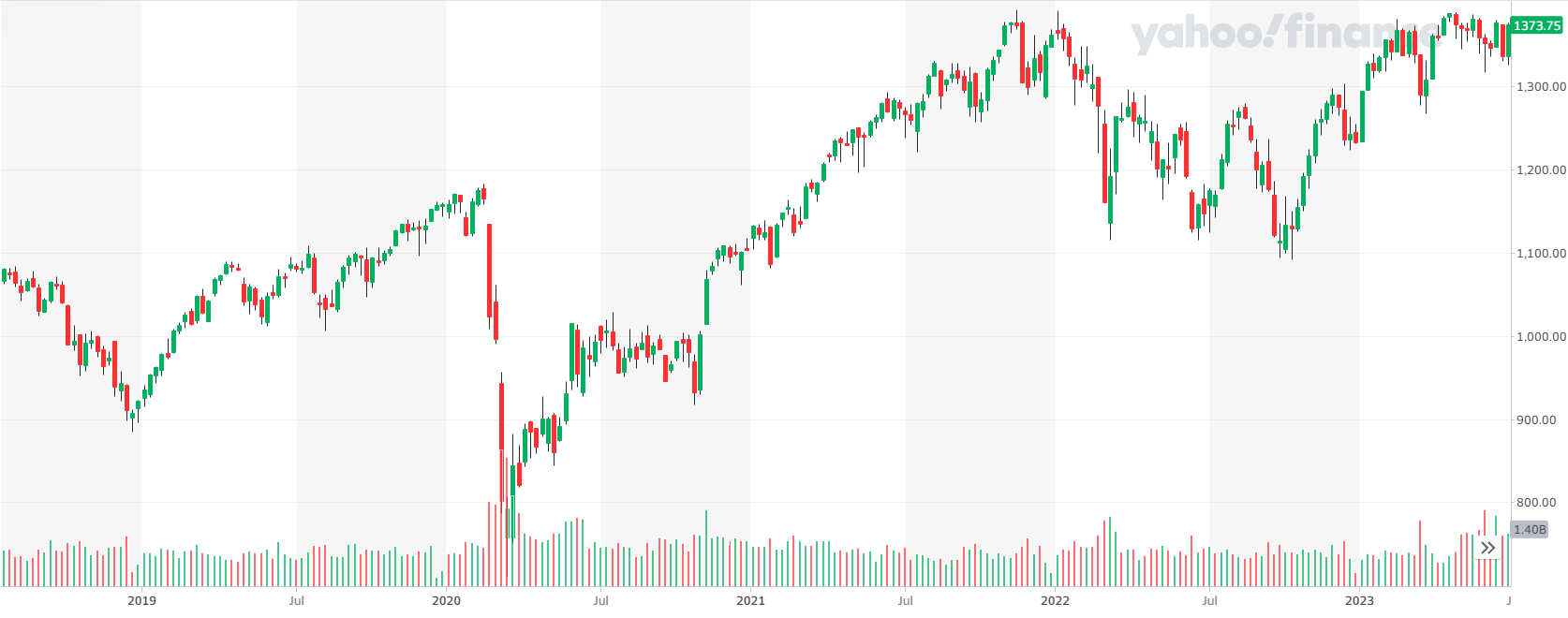

"European stocks continue to trade at a larger-than-normal discount to those in the U.S., and European equities are changing hands at about 13-times forward consensus earnings, versus about 19 times in for their U.S. counterparts.

That discount is the largest it’s been in more than a decade, and well below the 20% median over the past 20 years.

In this wire, with help from Alison Savas from Antipodes, we unpack why Europe remains one of the most appealing and dynamic investment regions on the planet.

You can view the previous wires in the series via the following links:

- Where in the world should you invest? This region represents 55% of globally listed companies

- Where in the world should you invest? Commodities, tech, and fast growth define this region

- Why the US is still the dominant investment region (and how Aussies can access the opportunity)

- Is this the most attractive investment destination of the next decade?

EUROPE

Key stats and food for thought

- Europe is home to 9.3% of the world's population

- The European Union (EU) operates as a single market made up of 27 countries

- The EU27 accounts for around 14% of the world’s trade in goods

- The EU, China and the United States are the three largest global players in international trade

- Europe is the 3rd largest continental economy, accounting for 25% of global GDP in nominal terms

- The services sector is by far the most important sector in the EU, making up 64.7% of GDP, compared to the manufacturing industry with 23.8% of GDP and agriculture with only 1.5% of GDP

.png)

What are the main characteristics of the investment region?

Europe is home to many leading industrial, tech and pharma franchises that generate revenue and profits globally, yet fly under the retail investors’ radar, relative to the more popular US large and mega caps. Siemens, SAP, STMicroelectronics and Sanofi are great examples of this.

Whilst we don’t think investors should be completely avoiding US equities, instead remaining selective in the current environment, there is a strong argument for a European overweight in global equities portfolios, with European stocks trading at a very attractive valuation discount relative to the US. This discount is evident even for similar companies and industries.

Currently the average starting multiple for European equities is around 12x earnings, on earnings that are further into the downgrade cycle on account of the challenges faced by Europe in 2022 (for example, the energy crisis and ongoing conflict in Ukraine).

This is an attractive valuation relative to history.

Compare this to around 20x for US equities, where consensus forecasts at the headline level have FY23 earnings flat on a year-on-year basis despite the tightening already in place.

Why do you like the region as an investment destination?

We are seeing a shift in rhetoric to a “tangible” led investment cycle as policymakers around the world address climate change and security. For example, developed markets will be required to make incremental investments of at least 3% of GDP p.a. for the next several decades to meet climate goals (with even greater investment required by emerging markets). Europe’s ambitious decarbonisation goals also present unique opportunities.

The region has some of the most aggressive decarbonisation targets globally and as a net energy importer, it stands to be a major beneficiary of the global energy transition.

Europe can offer investors exposure to best-of-breed multinationals that are exposed to global investment trends like energy transition and supply chain security but are priced at a discount relative to similar businesses elsewhere in the world. Some of these businesses will be tomorrow’s secular winners, many of which are not efficiently priced because we are still in the early stage of this secular shift. Companies like Siemens (global leader in factory automation and rail, with a Smart Infrastructure/electrification business) and ST Microelectronics (European semiconductor champion with Western-world manufacturing capacity).

What are the major risks to the region?

Whilst fears around Europe’s energy woes have subsided uncertainty will remain, largely due to the vagaries of the weather, until such a point where new and long-term energy supplies are fully in place which replace Russian gas. We are also cognisant that the ongoing war in Ukraine can lead to unpredictable outcomes.

Europe is also facing its own tightening cycle and is arguably behind the US.

While we don’t see Europe’s banking system suffering from the same issues as the US (Europe has a more consolidated banking market, better asset-liability match and regulation has been stricter post-2008 financial crisis), we do see stresses in other parts of the European economy, namely the real estate sector in Northern Europe and parts of Scandinavia in particular, such as Sweden. The challenges in the listed and unlisted real estate sector, however, are not limited to Europe, rather this is a broader issue for a sector that carries a substantial amount of leverage and relies on short-term variable funding. Higher short-term rates will see meaningful pressure build.

Finally, the European Union can be a slow decision-maker as the EU’s treaties require unanimous agreement amongst member states for many policy changes.

What is the one thing that potential investors need to know before investing?

Recent market moves have resulted in high multiple dispersion.

European equities are cheap relative to history and are priced at one of the largest discounts relative to US equities over the last 30 years. Europe is home to many global leaders, and this unusually large discount offers a good hunting ground for resilient businesses at attractive valuations.

What is one stock in your portfolio that best represents the region?

Sanofi (EPA: SAN) is a French pharmaceutical company with a resilient growth profile.

The company has a diversified earnings stream that sees around one-third of revenue from long-duration, sticky businesses including vaccines, where they are one of the three major manufacturers of the flu vaccine globally, and its leading consumer health business which includes well-known over-the-counter remedies and health supplements.

Unlike other big pharma firms, Sanofi does not face meaningful patent cliff risk and has lower drug price risk relative to peers. The company’s pharma business is growing via increasing penetration of existing drugs, opportunities in rare diseases where competition is typically lower, as well as via an under-appreciated pipeline.

It is priced at just 12x earnings, and we see the company growing earnings in the high single digits.

How to invest in Europe (some options)

- Antipodes Global Fund

- iShares Europe ETF (AU)

- BetaShares Europe ETF - Currency Hedged

- Vanguard FTSE Europe Shares ETF

3 topics

4 stocks mentioned

5 funds mentioned

1 contributor mentioned