Why the Fed is shifting focus from inflation to unemployment

The September FOMC meeting underscored a subtle but important shift in the Federal Reserve’s stance. While inflation and growth remain central to the discussion, I believe the focus, both in markets and at the Fed, is now tilting more heavily toward employment.

As I wrote in our latest Flash Macro note:

“The market’s focus, along with the Fed’s, is now more on employment than inflation.”

This is a significant turning point, one that will shape the policy path, the market’s reaction function, and ultimately where investors should position their portfolios.

Key Data: Why labor market weakness matters

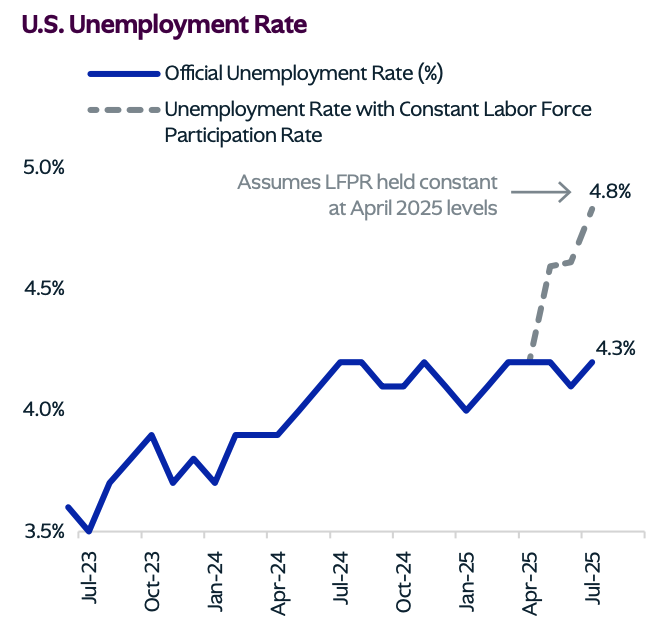

Much of my assessment hinges on what is happening in the labor market. Headline unemployment looks reasonable at 4.3%, but when you strip back the distortions caused by collapsing participation, the true picture is more fragile.

Unemployment would be closer to five percent if it were not for lower labor market participation, we think, which helps explain why the FOMC’s unemployment forecast moved down despite the Chair’s more cautious tone.

Exhibit 3: If Not for Collapsing Labor Force Participation (Lower Immigration and Labor Supply), the Unemployment Rate Would Have Climbed to Nearly 5% in August Instead of 4.3%

In Exhibit 3 of our report, we show how the unemployment rate would look if participation had held constant.

The message is clear: the labor market is weaker than the headline suggests, and this is exactly what the Fed is beginning to acknowledge.

At the same time, “sticky” inflation components are finally starting to soften. Housing is cooling, and I expect the Fed to look through tariff-related inflation when it comes time to cut rates.

That combination, weaker labor and softer inflation, is why I believe the Fed will need to move more aggressively than its own dot plot implies.

What do we think this means for markets?

- We think the Fed will ultimately need to ease rates a bit faster than its dot plot suggests. Indeed, with job growth likely to linger near zero in 2025, this would typically call for a zero percent real rate.

- This cutting cycle does not mark a reversal in our Regime Change thesis. If anything, Fed cuts amid what remains above-target inflation underscores the importance of understanding deficits, demographics, geopolitics, and the energy transition. Each of these factors is helping to reset the floor for inflation higher, we believe.

- Accordingly, we think that inflation settles in the mid-two percent range long run, with fed funds settling in the low three percent range. Importantly, this also means that the amount of rate cutting this cycle is limited, in our view.

- Six months from now, equity markets are likely headed higher, the dollar is likely to be headed lower, and the demand for collateral-based cash flows and other forms of inflation protection will remain robust.

- We would stay overweight the U.S. with a focus on large-cap stocks. Outside of the U.S., we like Japan, China, India, Germany and Spain. We also think that there are growing strains in the bank loan market of smaller companies that lack scale and/or a technological advantage.

- We remain bullish on our Capital Heavy to Capital Light thesis. We also like non-correlated collateral based cash flows, we see ongoing opportunity in opportunistic credit, and we remain bullish on all things linked to productivity. Productivity is the ‘secret sauce,’ in our view, to extending this cycle despite deficits and a shrinking labor force.

For the full analysis, including charts and scenario detail, please see the complete note here.

1 topic