Why we still hold New Century Resources

New Century Resources is up significantly since we first acquired it and is trading approximately in line with our original share price target. Clearly, the company has been through a period of price discovery with strong promotional support. Hence, we felt a need to justify our purchase but also outline how our valuation has changed and why we continue to hold the company.

By way of background the key asset held by NCZ is the Century Zinc mine, and supporting infrastructure, located in far north Queensland. The infrastructure has >AUD1bn replacement cost and includes:

- A 7Mtpa+ processing plant,

- 700-man accommodation camp,

- Private airport,

- Warehouses and lab facilities,

- 304km slurry pipeline to Karumba,

- Karumba Port Facilities (80kt storage and bulk load out and 5kt transshipment vessel),

- A 49% interest in >7,000km2 of cattle station land and 38k head of cattle.

The resources themselves include a tailings dam at circa 3% Zinc (Zn) head grade for ~2Mt of Zinc and >40 in-situ deposits, the second largest of which (Silver King) exceeds the size of the second largest pureplay Zinc company on the ASX (Red River Resources with an AUD140m market cap).

The Century Zinc mine was first opened in 2000 and operated for 16 years until the end of 2015 changing hands several times (Pasminco, Zinifex/ OZ Minerals, MMG) before MMG put it into care and maintenance when the main pit was largely depleted and the zinc price was USD0.70/lb.

The asset was eventually divested/ given away by MMG to Raging bull who backdoor listed it into Attila Resources (Reinstated on the ASX July 2017). In return, Raging Bull took over liability for the rehabilitation through the AUD193m financial assurance bond (to be paid out of 40% of operating EBITDA upon restart). They were also given a further AUD46.6m cash receivable by MMG to assist with the rehab.

In July we completed detailed work on the company and met with Management prior to acquiring it. We further met with MMG’s corporate division to corroborate this unbelievable wealth transfer. MMG management confirmed ours and NCZ’s Managements’ beliefs about large corporate cultures and the stigma of tailings (as well as the strong rise in the Zn price since 2015).

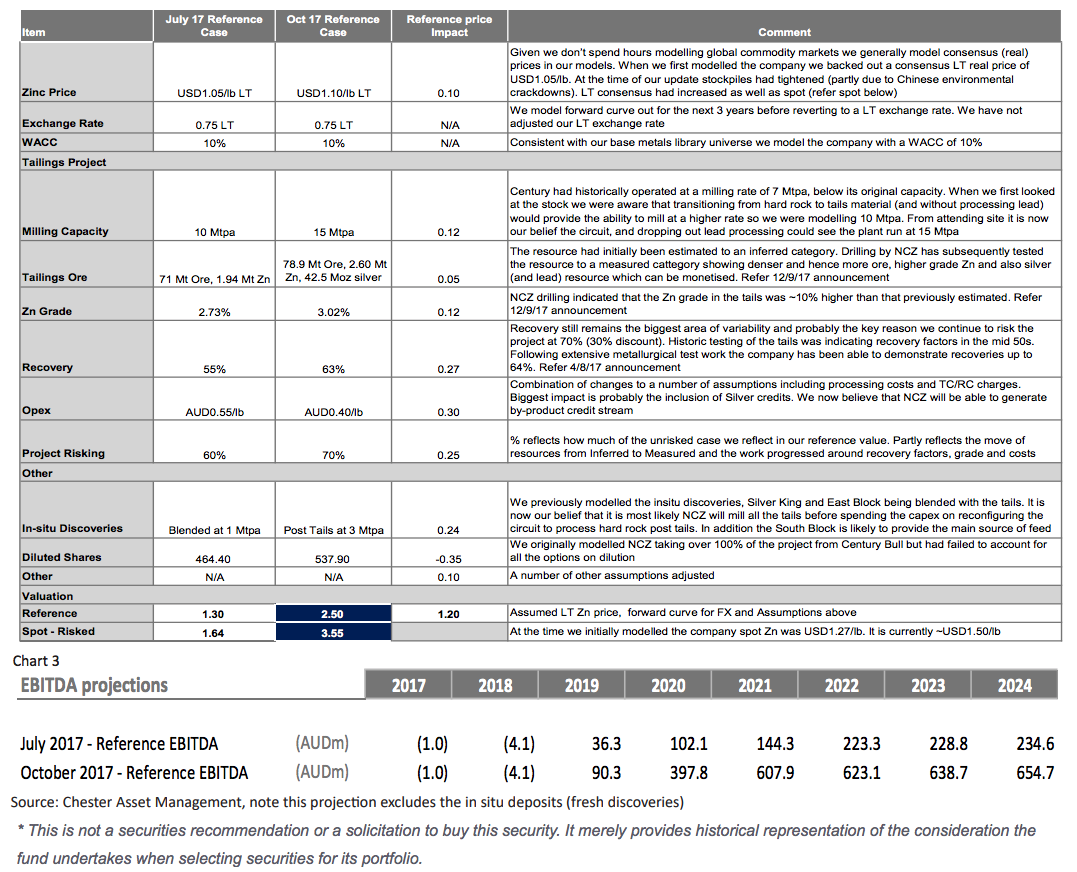

Our assumptions and how they have been refined as the work progressed and post our September site visit are tabled below (see link). We were very much attracted to the scale of the assets and the margin of safety in the valuation on the potential EBITDA/cash NCZ could generate (see link below).

In our view, we were effectively buying >AUD1bn of infrastructure and AUD4bn of Zn for AUD200m market cap.

Our reference valuation now stands at AUD2.50 per share using the assumptions as outlined in the table below.

1 stock mentioned