BHP

BHP Group Ltd

ASX:BHP

Followed by 2281 people

BOE

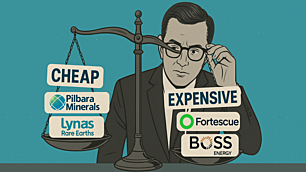

Boss Energy Ltd

ASX:BOE

Followed by 223 people

CXO

Core Lithium Ltd

ASX:CXO

Followed by 380 people

Livewire Markets

CBA

Commonwealth Bank of Australia

ASX:CBA

Followed by 1644 people

Livewire Markets

Advertisement

Fat Tail Investment Research

BHP

BHP Group Ltd

ASX:BHP

Followed by 2281 people

DEG

De Grey Mining Ltd

ASX:DEG

Followed by 154 people

NEM

Newmont Corporation

ASX:NEM

Followed by 40 people

Livewire Markets

AMD

Arrow Minerals Ltd

ASX:AMD

Followed by 80 people

CZR

CZR Resources Ltd

ASX:CZR

Followed by 19 people

FEX

FENIX Resources Ltd

ASX:FEX

Followed by 72 people

Independent Journalist

BHP

BHP Group Ltd

ASX:BHP

Followed by 2281 people

FMG

Fortescue Ltd

ASX:FMG

Followed by 1269 people

MIN

Mineral Resources Ltd

ASX:MIN

Followed by 568 people

Livewire Markets

GMG

Goodman Group

ASX:GMG

Followed by 384 people

MIN

Mineral Resources Ltd

ASX:MIN

Followed by 568 people

PME

Pro Medicus Ltd

ASX:PME

Followed by 334 people

Livewire Markets

29M

29METALS Ltd

ASX:29M

Followed by 244 people

BHP

BHP Group Ltd

ASX:BHP

Followed by 2281 people

CIA

Champion Iron Ltd

ASX:CIA

Followed by 50 people

Livewire Markets

BHP

BHP Group Ltd

ASX:BHP

Followed by 2281 people

FMG

Fortescue Ltd

ASX:FMG

Followed by 1269 people

MIN

Mineral Resources Ltd

ASX:MIN

Followed by 568 people

Livewire Markets

29M

29METALS Ltd

ASX:29M

Followed by 244 people

BHP

BHP Group Ltd

ASX:BHP

Followed by 2281 people

MIN

Mineral Resources Ltd

ASX:MIN

Followed by 568 people

Livewire Markets

BHP

BHP Group Ltd

ASX:BHP

Followed by 2281 people

CIA

Champion Iron Ltd

ASX:CIA

Followed by 50 people

FEX

FENIX Resources Ltd

ASX:FEX

Followed by 72 people

Livewire Markets

ANZ

ANZ Group Holdings Ltd

ASX:ANZ

Followed by 6982 people

BHP

BHP Group Ltd

ASX:BHP

Followed by 2281 people

CBA

Commonwealth Bank of Australia

ASX:CBA

Followed by 1644 people

Livewire Markets

FMG

Fortescue Ltd

ASX:FMG

Followed by 1269 people

Tyndall AM

29M

29METALS Ltd

ASX:29M

Followed by 244 people

BHP

BHP Group Ltd

ASX:BHP

Followed by 2281 people

FMG

Fortescue Ltd

ASX:FMG

Followed by 1269 people

Livewire Markets

BHP

BHP Group Ltd

ASX:BHP

Followed by 2281 people

CIA

Champion Iron Ltd

ASX:CIA

Followed by 50 people

FEX

FENIX Resources Ltd

ASX:FEX

Followed by 72 people

Jevons Global

1-20 of 334

.jpg)

.jpg)