The tech selloff has been brutal – but it's not yet time to buy

Technology stocks have been crushed. In the US, the Nasdaq 100 is off around 16% since 1 January. And it’s worse in Australia, where the ASX All Tech index is down 24% this year. From the low point of 2022 so far, when it hit 2394 points on 27 January – it rallied only briefly at the start of February but has since fallen below 2,300.

And in the US, around 70% of tech stocks have fallen so far (more than 20%) they’re now officially in “bear” territory. One-third of the US sector has wiped out around half of their individual share prices, Bloomberg reports.

For a local perspective on the situation, I spoke with two portfolio managers, QVG Capital’s Chris Prunty and James Delaney from Sage Capital. Both firms run long-short funds and own Australian tech stocks.

- What’s happening in tech and why

- Is it time to sift the bargain bin?

- The risk/reward of a bifurcated sector

- How to find quality Aussie tech firms.

The sell-off since November – and it’s still going - has already drawn comparisons with the 2000 tech wreck. Tech stock valuations have been, arguably, bloated by record low cash rates and the (necessary) loose monetary policy that’s pulled world markets through COVID.

But as inflation ticks up, the spigots are turning off as central banks ratchet up rates. The equity capital many tech companies have used to keep growing their top lines – in some cases, far surpassing the fundamentals of their business models – is drying up.

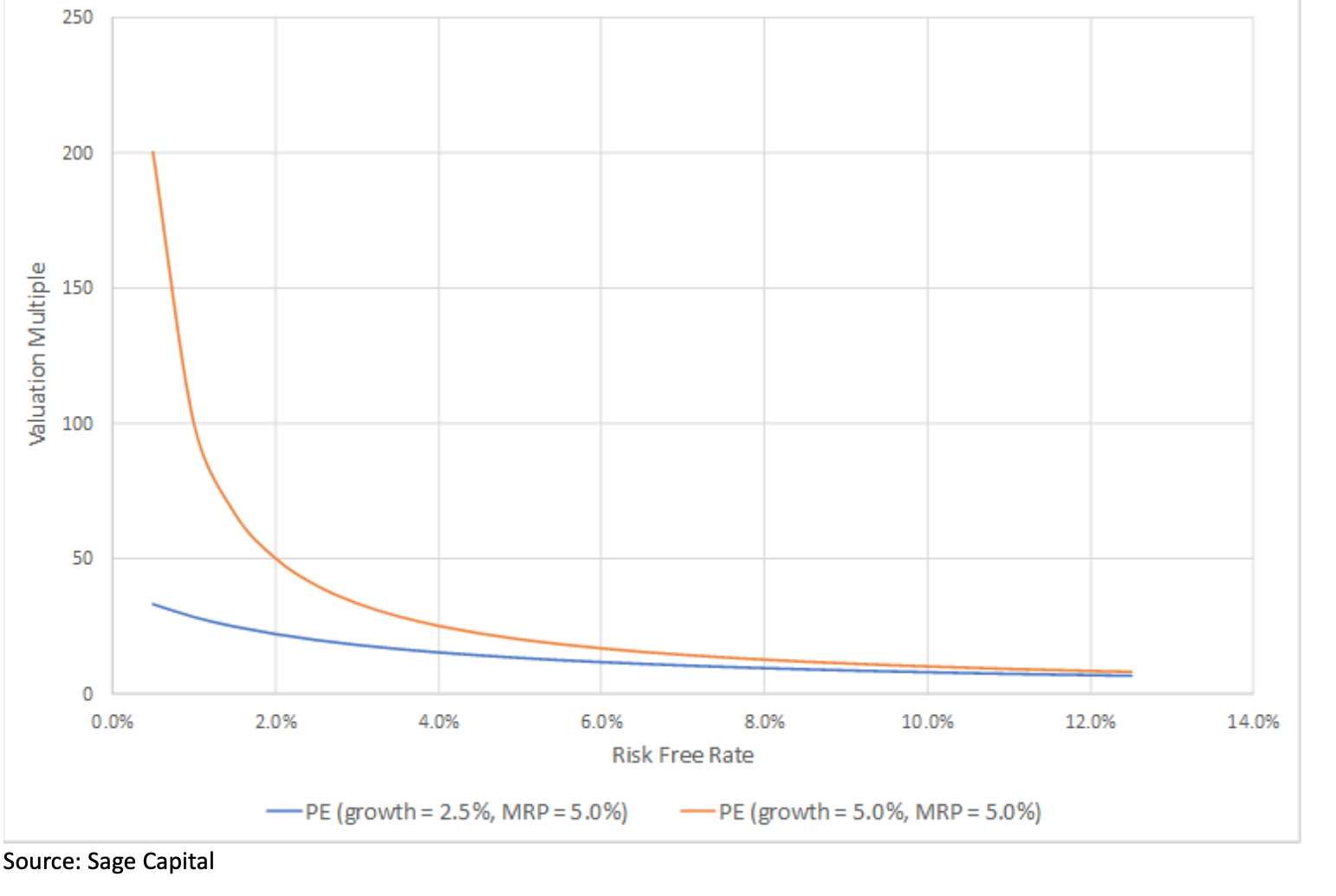

The growth versus valuation trade-off

Throwing out the baby with the bathwater

In a rush to reposition away from technology, institutional and retail shareholders alike are also dumping some of the quality names alongside the speculative “land-grab” tech stocks. (This is a term used by Sage Capital’s James Delaney as quoted below).

I asked Delaney and Prunty what sets a merely decent technology company – or even a dodgy speccy stock – apart from a great one. Finding top tech firms is much the same as identifying quality businesses from other sectors. As a starting point, quality firms need a strong – and growing – base of loyal customers and at least one good reason why a sharp competitor can’t disrupt their business.

But while quality firms may have plenty in common – whether you’re talking about industrials, consumer durables, retail – the technology sector probably attracts more than its fair share of duds.

Delaney believes a two-tier way of thinking about tech stocks in the current market has some merit. It may help in separating quality businesses from those that may simply have ridden their valuations up on the easy money of recent years.

“Investing isn’t just about the top-line…it’s about barriers to new entrants, which is where you find the market leaders,” he says.

“Business multiples aside, they’re the companies that are going to survive an equity market or macrocycle, those that don’t need the equity market for funding. They have pricing power in various markets."

Stuck in a “death spiral”

On the other side of the coin are what Delaney refers to as “land-grab stocks” that pursue a growth-at-any-price approach, continually tapping shareholders for more equity to keep growing.

“We saw this in Australia last year, many tech companies using CAPEX simply to fund their marketing to grow the top line instead of deploying it to make the business better. At the same time, when you’re not building barriers to stop other players coming in, you’re just drawing in more competition,” says Delaney.

He says many local technology firms are stuck in a “death spiral,” having to burn ever more cash to pursue slowing top-line growth.

With the US Fed expected to start hiking interest rates as early as August – combined with monetary policy tightening by the Bank of England and the European Central Bank, “it’s not a favourable backdrop for speculative growth companies or for asset prices generally.”

“Some of the quality tech names have seen share price falls too, but in the ASX 200 there are some companies with business models that will not survive a cycle and that’s where some of our best short ideas come from,” Delaney says.

“With the market’s risk appetite shrinking and increasing signs we’re at the tail-end of the cycle, it’s been a very good six months (for our short book)."

This is fine if you’re a long-short fund manager or a high-net-worth individual investor with a keen grasp of derivatives trading. But it’s not so great for the rest of us. So, what distinguishes quality tech stocks from those that are more speculative?

Mostly common across various sectors, Delaney and his team look for companies that:

- Lead the industry in their category

- Have a growing base of loyal customers

- Are led by excellent management teams.

But for tech, you should also zoom in on companies with the “stickiest” customer relationships and businesses that build barriers to keep other players from replicating their success. This is particularly important for earlier-stage and often unprofitable technology firms, given the long-dated nature of their offering, says Delaney.

There’s also the issue of leverage, and not just in the form of balance sheet debt. Many of the more speculative local names sold off in recent months were highly leveraged to the risk-tolerance of the equity market and to their own overall share price.

“There’s a compound effect that means when one falls, the ability to reinvest in the business falls as well. You’re seeing that today with Zip Co (ASX: Z1P) and Pointsbet (ASX: PBH).”

It’s also worth highlighting that in technology, unprofitable stocks aren’t necessarily “uninvestable”. Though some funds set strict exclusions, avoiding companies that haven’t yet booked any profits is like using a sledgehammer on tech stocks when it’s tweezers you need.

When looking at non-profitable companies, analysts commonly project forward to determine when they might achieve their first profit and how high this might be. This obviously introduces a higher-than-average level of risk.

The Goldman Sachs "non-profitable" technology index

Source: Sage Capital; Bloomberg

“Some funds are as underweight technology as they’ve been in five years, some taking that cash and reinvesting it in banks and resources instead,” Prunty says.

And the more cautious approach of many firms is fair enough, he explains, because sticking to companies that don’t need to tap equity markets for growth capital is far easier. Having profits is also self-perpetuating in another way, opening up the cohort of potential investors in the company.

At a stock level, Kiwi accounting software firm Xero (ASX: XRO) is an example that defies these distinctions, to some extent.

“They deliberately run it at a $20 million to $30 million free cash flow positive business and reinvest everything above that level,” Prunty says.

“Management believes its best spend of every incremental dollar above that is best used by further developing the business.”

Smaller companies also in the software-as-a-service space Smaller, such as SiteMinder (ASX: SDR) and Nearmap (ASX: NEA) – remain unprofitable. But in their cases, it’s not a deliberate strategy.

“They’re still building to scale. They will get there because customer churn is low and customer loyalty is high,” says Prunty.

Tech is only a mid-cycle play

Sage Capital’s Delaney is quite clear when asked whether now is the time to buy tech stocks.

“We’ve had a decent drop off in valuations but we’re not in a normal environment yet given we’re at the late end of an equity cycle,” Delaney says.

“Technology stocks are the things you want to buy in the mid-cycle, late-cycle is not the time to get into these ultra-high valuation tech stocks because of the multiple expansion they’ve benefited from over the last few years.”

It again emphasises Delaney’s earlier point about why short-sellers are now spoilt for choice.

“Many businesses got a massive free kick from that monetary policy environment and it’s not likely to be repeated, certainly not until we’ve been through a full cycle.”

Some of the more speculative parts of local tech that were trading on valuation-to-sales multiples of 12 times have now fallen to around four times.

“Investors are excited and looking for opportunities to buy but if you look at the non-profitable tech stock index over a longer period, even four is quite a high multiple.”

Are there signposts?

There are a few signs to watch for, which might suggest when it’s time to push some money into tech stocks. M&A pick up is usually a good signal, particularly from private equity funds hunting for opportunities: “That will show there’s good corporate interest,” Prunty says.

A drop off in IPO activity may also be an indication the market has hit the bottom. And after a record level of IPOs last year, tighter central bank monetary policy and more recent geopolitical events such as the Russia-Ukraine conflict suggest this year is likely to be much softer. A global IPO report from EY released in September says as much.

A dead cat bounce

There’s also the fear that any nearby reversal in technology valuations mentioned at the start of this article could be short-lived. We recently saw a mini-rally in the space, stocks including Block (formerly Square), Xero, WiseTech, PointsBet, EML Payments and Appen seeing gains of between 4.5% and 7.7% last week.

When the dot-com boom of the late 90s ended, after the initial falls in tech and telecom stocks, the sector recovered. But only briefly, proving to be what Dan Suzuki of US investment manager Richard Bernstein Advisors termed “the mother of all dead cat bounces,” in a Bloomberg article.

How should investors respond?

Adapting Prunty’s remarks from an earlier Livewire article, published last September, when he discussed unprofitable stocks more broadly, three tips include:

- Be aware there are technical factors such as index inclusions that can drive share prices well above fair value.

- Don’t get caught up in thematic mania – or if you can’t help yourself, keep your bets small. (His recommendation to avoid getting caught up in “thematic mania” seems particularly apt).

- If you buy an index product, be aware you’re buying the good, the bad and the ugly. As we’ve discussed, both fundamentally “quality” tech stocks and the more speculative “growth at any price” variety end up in indexes.

In the second part of this series, which will be published later this week, Prunty and Delaney each discuss a couple of tech stocks on which they’re most bullish.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

.jpeg)

4 topics

5 stocks mentioned

1 contributor mentioned