10 paradigm shifts and how they could impact your portfolio

Future Fund chair Peter Costello has announced Australia's sovereign wealth fund has evolved its strategy to respond to the changing investment environment, pointing to heightening tensions between global powers, extreme forms of monetary policy, and expansive fiscal stimulus as the cause for the pivot.

"Over coming years these forces are likely to have fundamental implications

for the economic and investment environment and accentuate regional and sectoral divergences," he said.

"Many of these long-run changes will also impact the cost base of economies, adding to concerns that higher inflation may take hold and that this may also lead to higher real interest rates."

Uncertainty surrounding the unwinding of these stimulative measures, as well as how governments will respond to the changes to "global order", create a challenging environment for investors, Costello said.

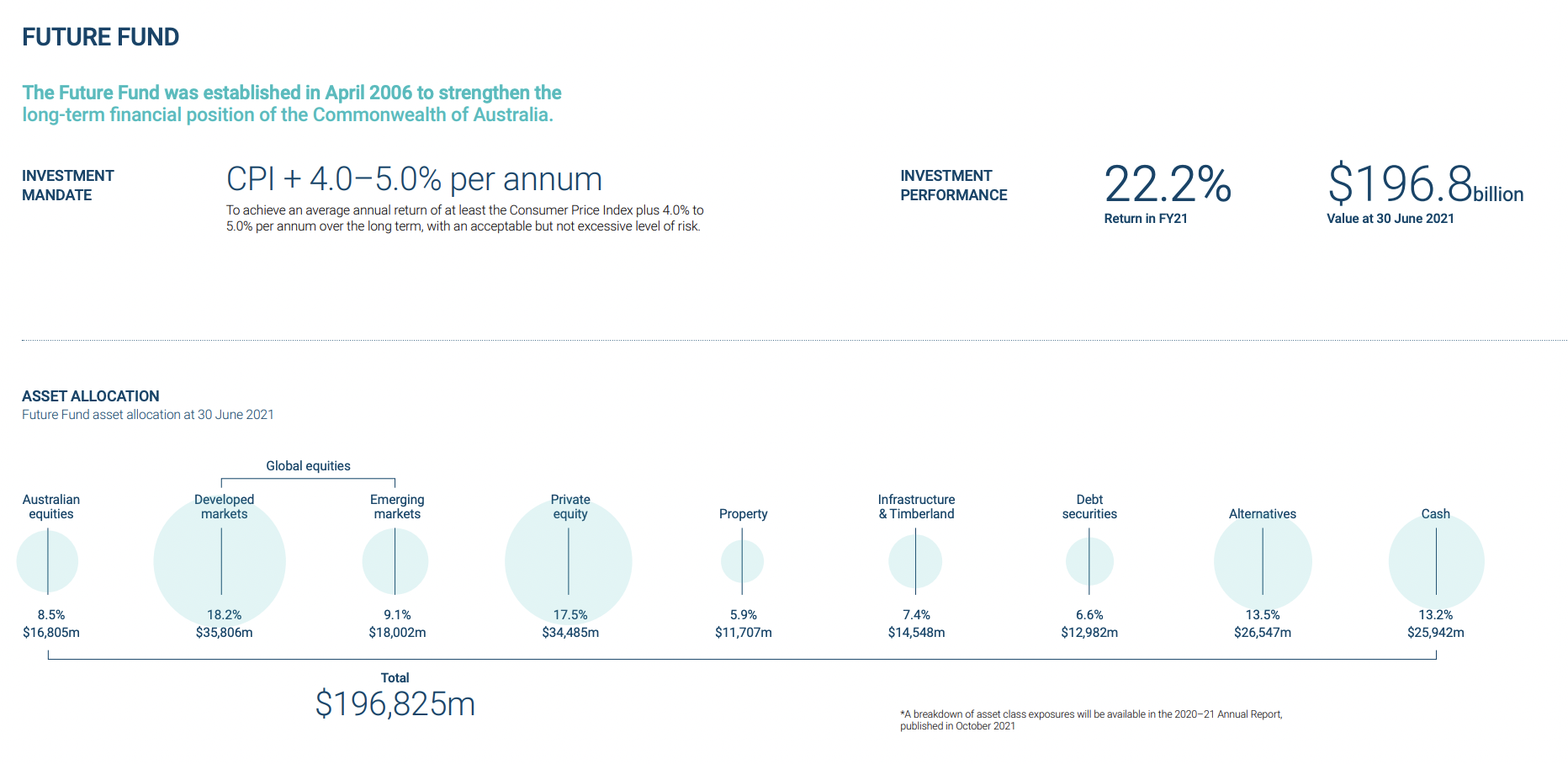

The Future Fund's refreshed asset allocation

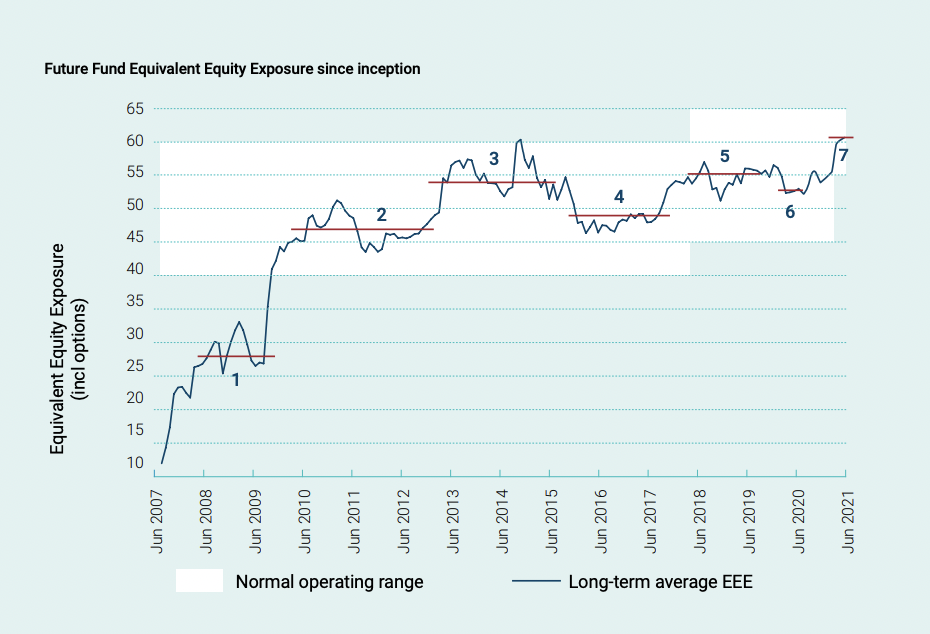

Future Fund's chief executive officer, Dr Raphael Arndt, said the wealth fund will increase structural risk levels across the portfolio to ensure it can achieve its long-term investment mandates.

"Our view is the world is fundamentally changing and financial markets are changing with them, and to continue to be successful and achieve our long-term investment mandate in the context of this new regime we knew we needed to refresh our investment model and evolve our business strategy," he said.

"We increased the allocation to listed equities in regions that are offering more attractive long-term return prospects, including Australia and emerging markets."

Meantime, the size of its allocation to private equity has also increased over the past financial year, "driven by higher valuations and new investments, and

despite large cash inflows supported by a strong IPO market," Arndt said.

The sovereign wealth fund has also increased its investments in both listed and unlisted property and infrastructure. Meantime, its exposures to debt continue to drop as credit spreads remain tight.

"Following our total portfolio approach in searching for the best use of capital across asset classes and along the capital stack, we invested into credit opportunities in property and alternatives," Arndt said.

It also continues to add to its alternative exposures, including high-return relative value strategies and inflation-related tail hedging strategies.

For its defensive positioning, Ardnt believes that a meaningful level of foreign currency exposure can provide the fund with valuable diversification.

Two new investments

The Future Fund recently announced an agreement to acquire 49% of InfraCo Towers from Telstra (ASX:TLS) - the largest network of mobile towers in Australia.

The consortium comprises Sunsuper, the Commonwealth Superannuation Corporation and the Future Fund, with the deal expected to complete this month.

"Our investment in this asset further increases our exposure to digital infrastructure and the long-term thematic of data growth, and sees us playing an important role in strengthening Australia’s 5G infrastructure," Future Fund said.

"The long-term growth potential and

defensive cash flow profile of the investment is a

valuable fit with our focus on diversification across

the portfolio."

Earlier in the year, the Future Fund, the Queensland Investment Corporation (QIC) and AGL Energy (ASX:AGL) entered into an agreement to acquire 100% of Tilt Renewables' (no longer listed) Australian portfolio.

"The transaction will add to the Future Fund’s existing

Australian renewable energy assets and increase our

exposure to around $1 billion," it said.

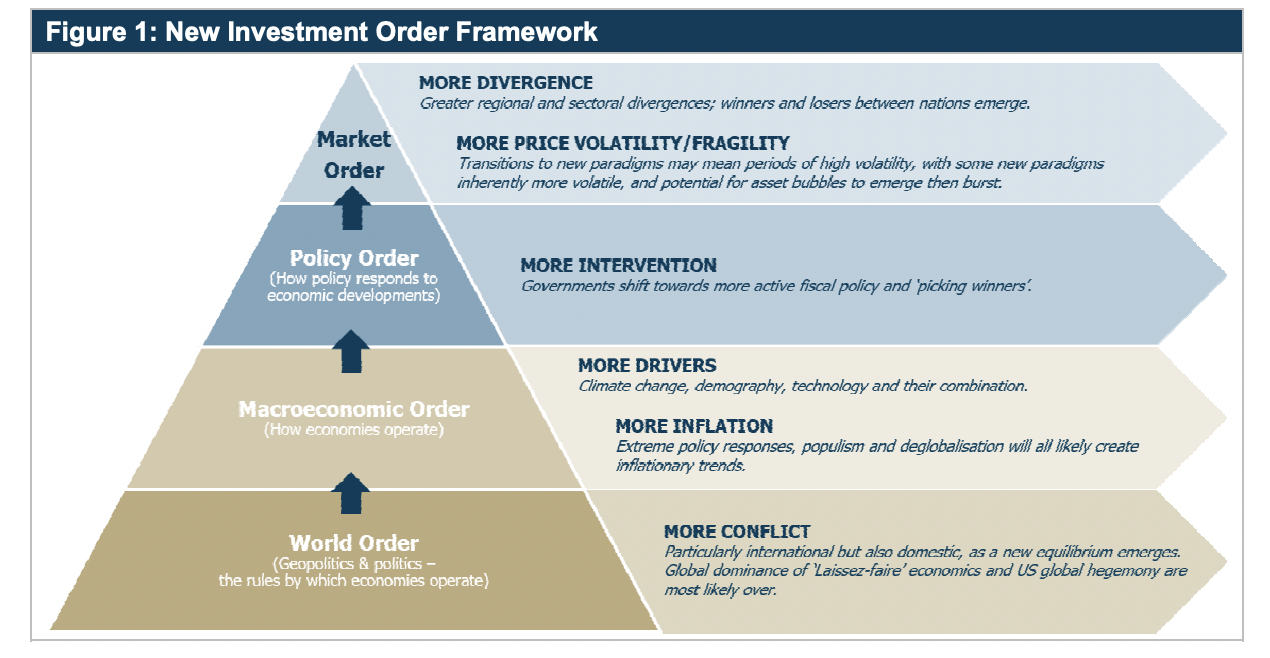

10 paradigm shifts that should change the way investors look at their portfolios

There are 10 paradigm shifts that are shaping the investment order, according to the Future Fund, which could have ramifications for both markets and investor's portfolios. These include:

1. Deglobalisation:

The momentum behind the free movement of goods and services, as well as investment and people, has slowed and in some cases reversed. The Future Fund also notes that tensions between the world's largest economies - being China and the US - have increasingly worsened, while technological developments are now more closely guarded rather than shared on a global scale.

2. Populism:Instead of an open international system, many countries around the globe have a new domestic focus, with a preference of the national interest, greater state intervention, and controls.

3. Technological disruption:Innovations in technology have allowed companies to develop business models based on intangible assets - like data and software platforms (e.g. Facebook), leading to the rise of "digital conglomerates". These breakthroughs in technology have led to disruption within many of the world's industries.

4. Demography:

It's no secret that many of the world's developed nations face ageing populations. Instead, governments have been reliant on migration to counter the contraction of the workforce. Meantime, asset inflation has exacerbated wealth inequality between generations. Particularly in developed nations, the Future Fund believes that "younger people may experience disadvantage in security of employment, house prices, higher education debt and record levels of national debt."

5. Climate change:

The Future Fund said insured losses from natural disasters have increased from around US$10 billion per annum in the 1980s to US$45 billion over the last decade (inflation-adjusted). Direct losses have been four times the size of this insured loss, increasing threefold over the last 30 years. The Future Fund believes that "companies with carbon-intensive operations and value chains are potentially vulnerable to market repricing." Meantime, renewable energy is increasingly becoming competitive on a cost basis.

6. Challenges to corporate earnings:

If the trends aiding the ability of the world's corporates to capture a rising share of total economic income come to an end, or worse, reverse, as a result of deglobalisation and populism, the Future Fund expects downward pressure on earnings and equity returns in the decades ahead. These trends include the use of technology to drive productivity improvements such as intangible assets, and capital friendly tax arrangements allowing forum shopping, restructuring, offshoring and automation - all of which have helped reduce costs over the past few decades.

7. Inflation:

Although developed economies have experienced disinflation over the past four decades, the forces that have kept inflation under control are now in reverse. Both accommodative monetary policy since the GFC as well renewed fiscal stimulus "can only be met by pro-inflationary policy," the Future Fund said.

8. Fiscal-monetary coordination:

Largely independent monetary policy was introduced legislatively in the 20th Century, the Future Fund said. However, in the aftermath of the GFC, this independence has been eroded through unconventional monetary policy like Quantitative Easing and yield curve control in an effort to support fiscal spending. This shift has been further accelerated during the COVID-19 crisis, the Future Fund said.

9. Change in fair values:

The traditional economic cycle is under threat, while traditional metrics for assessing fair value are being challenged, the Future Fund said. Meantime, declining trend growth, the weight of savings relative to investable assets, and high debt have pushed real interest rates to all-time lows. Combined with this decline in the economic cycle, the Future Fund believes that the base rate and risk premium component of discount rates should be structurally lower, while valuations are higher than they have been throughout modern financial history.

10. Decline of sovereign bond duration in portfolio construction:

Once the defensive anchor of investment portfolios, government bonds provided the opportunity to add returns with downside protection to equity risk. "The world now looks different," the Future Fund said, with the scope for bonds to pay off significantly reduced. Investors have ended up paying to benefit from bond rallies rather than being paid, it said. And if inflation does indeed begin to rise, the correlation between bonds and equities may prove much less beneficial going forward.

These paradigm shifts come together to form a "new investment order" according to the Future Fund (as seen in the image above).

"We cannot know how these themes will play out or quite how they will interact with each other," it said.

"Rather than trying to form a prediction, we consider a variety of plausible scenarios and consider how we can evolve and position the portfolio to be as robust as possible in those scenarios."

It is prioritising the modest increase in the fund's structural risk profile. The Future fund also maintains its focus on the long-term, while identifying the scope to increase its tolerance for illiquidity to access value from skill-based investments. Returns from these managers are more attractive in this environment, and are worth the higher fees required to access them, it said.

Private market opportunities can also create value in this environment, it said, and can also provide protection against inflation and play a role in the defensive segment of a portfolio. Meantime, it can also manage the use and costs of illiquidity by adding value in public markets, it said.

Additionally, the Future Fund said it would be applying further resources to identify focused strategies for high conviction exposures, particularly within private markets and debt.

Conclusion

The Future Fund believes the investment thinking that has delivered strong returns over the past few decades needs to be revisited, encouraging investors to test and challenge their long-held assumptions about investing.

But perhaps, this is easier said than done.

Ultimately, we cannot know how the 10 paradigm shifts outlined above will play out over the coming decade.

"However, we believe that preparation and monitoring the investment environment, and testing our thinking and the assumptions on which it is built, are the best ways we can position our investment program to generate strong returns, with acceptable risk, over the long-term," the Future Fund said.

As American economist Richard Thaler said, quoting Mark Twain: "It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so."

Want more content like this?

Give this wire a like if you've enjoyed the discussion and hit follow to be notified when new episodes are released.

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

4 topics