2020 US Election

With that in mind, this article outlines the economic plans of each candidate and how they may impact financial markets.

Candidate: Biden/Harris

- On COVID-19 policy, Biden has suggested emergency paid leave for sick or short-term contract workers, covering 100% of weekly salaries up to $1400 a week. He has also pushed for relief or forbearance of federal student loans and federally backed mortgages. Interest free loans to COVID-19 affected small businesses is also on his agenda.

- On taxes, Biden has said he would increase taxes on those earning $400,000 or more while keeping the Trump tax cuts for everyone else. He suggests restoring the top tax bracket to 39.6% from 36% (for individuals earning more than $518,400). The corporate tax rate would also be raised from 21% to 28% under a Biden Presidency, compared to the 14% cut Trump delivered in 2017.

- On housing, Biden has touted $640 billion over the next 10 years for housing, including a $100 billion affordable housing fund. Biden also wants to offer rental assistance to those earning less than 50% of the median income in the area. His plan would cap their rental spending at 30% of income.

- On minorities, Biden is looking to spend money in minority communities, pledging $50 billion to start-up businesses run by entrepreneurs of colour, as well as $100 billion in low interest loans to minority communities.

- On climate change, Biden has stated this as a massive area of investment if elected. He has promised $2 trillion over the next decade, which will include investment in clean energy, construction of sustainable housing and updating existing housing to improve energy efficiency. A large part of his climate change expenditure is focused on the transition to electric transportation, both public and private.

Candidate: Trump/Pence

- On COVID-19 policy, Trump has expressed support for a $1.5 trillion plan that would continue COVID-19 relief. It includes more aid to small businesses and a continuation of additional unemployment benefits.

- On taxes, Trump has proposed further tax cuts. While an exact policy is yet to be laid out, it has been suggested that middle income earners will see a tax cut or a restructuring of tax brackets. At present, it is still unclear whether tax cuts made in 2017 will be made permanent or will be phased out in 2025 as currently planned. President Trump has also talked about reducing taxes on capital gains.

So, what does this mean for the economy, particularly US equity markets?

Trump’s policies, although lacking detail at this stage are expected to be much of the same as last term. This means that its good news for corporations with further company tax cuts on the cards, possible middle-income tax cuts and possible capital gain tax cuts. Trump’s plans should also provide a positive impact on financial markets.

Similarities

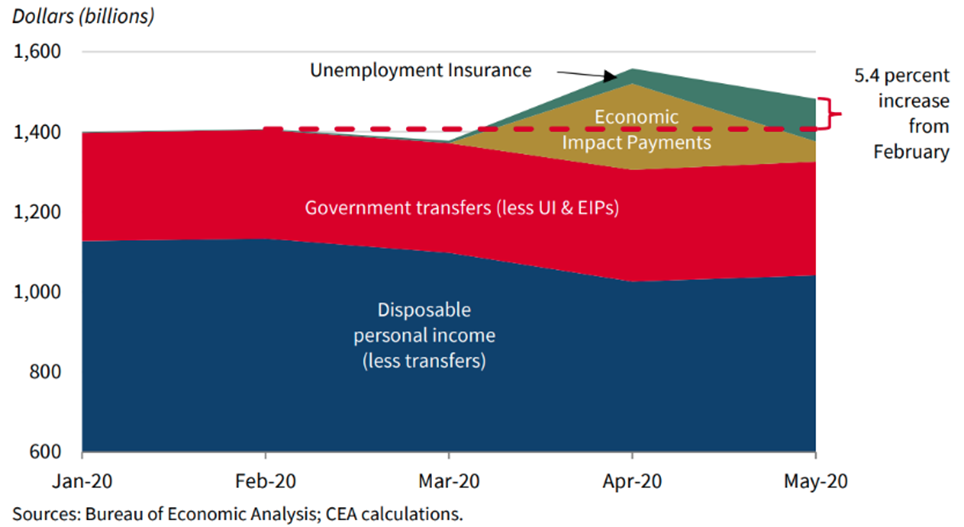

Both candidates seem to be in favour of another round of stimulus and an extension of benefit payments to soften the economic impact of COVID-19. If Congress passes further stimulus, we should expect to see investor confidence continue to return and equity markets benefit. We may also see another wave of retail money enter the share market as household disposable income rises (the Council of Economic Advisors (CEA) August report noted disposable income has increased 5.4 per cent since February).

Conclusion

*As at 1st October 2020.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics