2023 Outlook

No recession, a mild recession, or a deep recession; these are the three economic scenarios that will influence market activity in 2023. In the US, we view that the combination of government spending, high levels of consumer savings and low levels of unemployment will help to counter the fall in economic demand attributable to rising interest rates. A mild US recession is our most probable scenario, which will add pressure to the Federal Reserve to start to look at cutting rates later in 2023. A potential policy shift to lower interest rates will be the catalyst for the US market to start rebounding after a soft first half.

Closer to home, our most probable scenario is for the Australian economy to avoid a recession. In our base case, we believe that a rebound in economic growth in China after loosening Covid restrictions, combined with their government policy to support the construction industry as well as general economic stimulus will deliver ongoing demand for Australian commodities. High levels of home ownership in Australia will ensure that the Reserve Bank of Australia will be close to the top of its rate-raising cycle as inflation continues to moderate from recent highs.

The pandemic and the conflict in Ukraine perhaps teach us a lesson that as we look at the crystal ball and make assumptions about what the key themes will be next year, we will likely be discussing new themes at the end of next year which none of us had seen or predicted of today. However, the following key themes are ones that we have identified which could be pivotal in determining market returns in 2023.

China’s pivot in Covid-19 policy will support Australia’s economy by boosting commodity exports

After enduring lockdowns for years, mass protests broke out in China towards the end of 2022 as authorities gave no signal as to when they would end. They finally got their answer, with authorities responding by easing restrictions across the country and signaling a pivot away from Covid-zero policies.

This began with a policy shift of reducing the length of lockdowns and ending it in some areas, a large-scale vaccination campaign and softening rhetoric on Covid-19. This policy shift will give a boost to its struggling economy, which has been weighed down by heavy Covid-19 restrictions. Currently, its yearly GDP growth is below 4%, which is well below the growth levels the country saw before the pandemic at around 6-7%.1

This is in addition to China’s step-up in policy regarding its ailing property sector. Whilst earlier in 2022 there were concerns that the government was rather apathetic towards bailing out the property sector, the government has clarified its intentions. In November 2022, authorities unveiled a set of directives to save the property sector, which includes credit support for debt-ridden developers, assistance for homebuyers, and orders for development banks to issue offshore loans to assist property developers in repaying overseas debt.2 This is crucial as the property sector is a key driver of growth for the Chinese economy, accounting for around a quarter of the economy. Whilst we don’t expect the property sector to grow in 2023, at the very least, we are pleased to see policies which will help stifle larger downturns.

This is important as approximately 80% of Australia’s iron ore exports are to China.3 With iron ore exports making up 6.7% of Australia’s GDP in 2021, China’s demand for Australia’s iron ore is a large factor in Australia’s economy.4 Although it is not a given, many economists forecast Australia to narrowly avoid a recession in 2023. With its demand for iron ore and other commodities, a resurgent Chinese economy will further support the Australian economy and boost its prospects of avoiding a recession. Fiscal stimulus to complement China’s reopening would further drive demand for iron ore, with the commodity being a key input in big spending items such as infrastructure and in the property market. This is because iron ore is a major component of steel.

Inflation to ease, but remain embedded above historical levels of 2-3%

With inflation reaching 7.3% in Australia, 9.1% in the US, and double digits in the UK and Europe, we believe inflation is past its peak. Although we expect inflation to continue to ease, this will be gradual, and we predict that it will reduce to a level that is still above the preferred inflationary band of 2-3%.5 6 7 8

Due to a lag in impact from contractionary monetary policy, the full effects of elevated interest rates won’t be felt until we are well into 2023. This is because many mortgages that have been fixed at low rates for two years will start to roll off into the current higher rates. When this happens, every Australian who has a mortgage will realise the full effect of these higher rates. Given that Australia is one of the most mortgaged countries in the world, the RBA knows that it will not need to raise interest rates as high as central banks in other countries do. Consumers will then restrict their discretionary spending as more of their savings will be used to pay off the higher interest repayments required. This will help ease inflationary pressures from the demand side.

On the other hand, higher interest rates will keep rent payments high, as homeowners seek more rent to cover their higher interest repayments. This is particularly because leases will continue to be rolled over, and renters will be forced to go to the market at prices much higher than they were a few years ago. Rent has been a key contributor to elevated inflation levels in Australia. Vacancy rates will need to increase before the price of rent decreases. It may ultimately get to a point where renting becomes too expensive, resulting in people moving back in with their families, which would increase vacancy rates.

With global demand slowing due to a downturn in the global economy, there will be lower demand for oil, gas and coal. These are key inputs to manufacture goods, so as these goods see less demand, lower production will result in lower demand for these energy inputs. This will help ease inflationary pressures. Despite this, prices may not decrease as much as they did in the past. This is because these commodities will still remain in demand as a transition fuel whilst the world is waiting for renewable energy to take over. With a level of demand set to remain in the medium-term, supply isn’t increasing as much as it used to. This is due to a lack of private investment as a result of ESG policies, creating a higher hurdle rate to generate a return on investment on projects. Constrained supply will result in prices being relatively higher than before at the same level of demand, which will likely contribute to higher structural inflation in the medium term.

Other than constraining the supply of transition fuels, ESG policies have other inflationary impacts, which is referred to as ‘greenflation.’ This includes the massive investment needed in decarbonisation technologies and renewable energy sources to make it more economically viable and available on a global scale in the future. Furthermore, taxes to disincentivise the use of carbon-emitting energy have also contributed to structural inflation. For example, if you apply the EU’s carbon tariff to cement, the price of cement would rise by approximately 70%.9 With cement being used as a main material for all types of construction including housing, furniture, dams, and ports, taxes such as these will result in higher structural inflation. In another example, a carbon tax on heating and transportation contributed to 0.6% of Germany’s CPI in 2021.10 Although prices will reduce in the long term as renewable energy becomes more reliable, it will increase prices in the short to medium-term.

An ageing population is another factor that contributes to higher structural inflation, and the world is ageing considerably. In fact, according to the United Nation’s ‘World Population Prospects 2022’ report, the percentage of the population aged 65 and over will increase from 9.7% in 2022 to 16.4% in 2050. An ageing population is inflationary in nature because retired individuals tend to be net spenders, in which they spend much more than they produce or save. On the other hand, a younger working population tend to be net producers, producing more than they spend, which is deflationary in nature. However, a shrinking working population pool due to an ageing population can lead to labour shortages, which puts upwards pressure on wages.

Deglobalisation is another trend that is occurring which adds to structural inflation. There is rising protectionist sentiment around the world, which results in more tariffs, which adds to the price of goods and services. Furthermore, less outsourcing results in rising costs of labour. A key trend in particular has been energy and technology independence. Countries and companies have become more weary of relying on other countries for crucial goods such as energy and technology, particularly with countries that do not share the same values and have the risk of trade tensions to the point of withholding supply. For instance, the US has moved to invest in processing plants of rare minerals, which are crucial inputs for a range of goods including electric vehicles and military equipment.

Companies are also looking to shift manufacturing of semiconductors to the US, even though labour is cheaper in China and Taiwan. This leads into the broader theme of shifting supply chains, or a ‘Supply Chain 2.0.’ Countries have been more willing to shift their supply chains onshore to reduce the supply chain risk, even if costs are higher. This is an additional factor adding to structural inflation.

Green metals are the place to be in the long-term

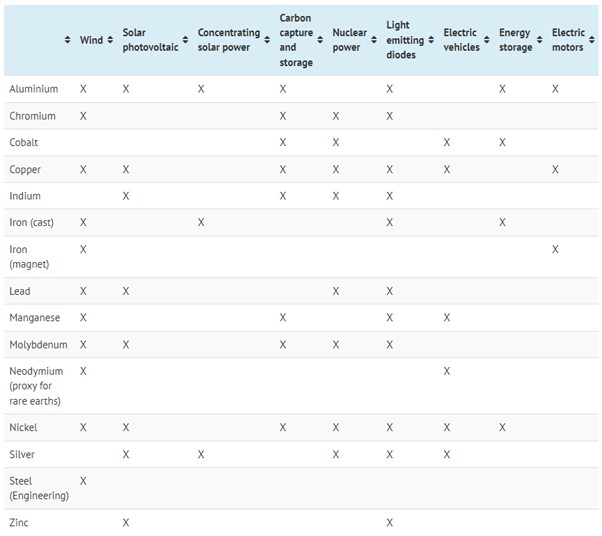

Green metals are poised to have a strong run in the next few decades as the world shifts towards decarbonisation technologies. Clean energy technologies and energy sources rely on key metals as inputs. These include copper, lithium, nickel, rare earths and cobalt, among others. There are many essential themes in the move to a net zero world, including the eventual replacement of the global car fleet with electric vehicles (EVs) and the use of renewable energy as the world’s primary source of energy. The table below from the World Bank shows the uses of some of the green metals in low-carbon technologies.

Source: The World Bank, The Growing Role of Minerals and Metals for A low Carbon Future, June 2017

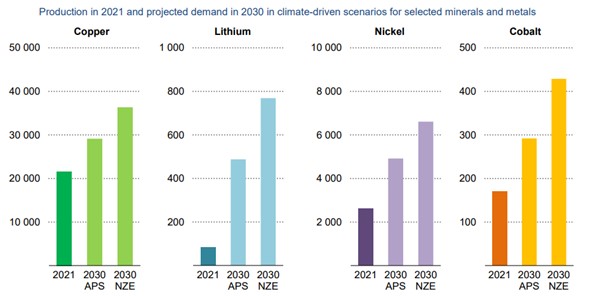

The transition is already occurring, and growth has been ramping up in recent years. According to statistics from the International Energy Agency (IEA), EV market share of new car sales increased from just 0.9% to 8.6% from 2016 to 2021. Deloitte expects that EVs will account for 32% of annual new car sales by 2030, and that EV sales will increase from 2.5 million a year in 2020 to 31.1 million by 2030.11 The IEA has estimated that investment in renewable energy will need to hit US$1.3 trillion a year by 2030 for the world to stay on track to limit global temperature rises to adhere to the Paris Agreement. This means a lot of demand for green metals, with forecasts from the IEA shown in the graph below.

Source: International Energy Agency, World Energy Investment 2022, June 2022

The significant opportunity is best illustrated with an example comparing two situations. If the world were to fully replace its current energy infrastructure and global car fleet with traditional technologies in the next few decades, this would still require largescale demand for key inputs such as copper. However, renewable energy infrastructure and EVs have a much higher concentration of metals such as copper. This means the demand for metals such as copper would actually be multiplied. In fact, renewable energy technologies use approximately 5 times more copper than traditional power generation systems.12 Furthermore, EVs use anywhere from 2.5 to 5 times more copper than internal combustion vehicles.13 14

Looking at some specific metals, lithium is one of the most watched green metal commodities. With investors increasingly aware of the importance of lithium, as it is a key component of lithium-ion batteries, there has been a lot of money flowing into lithium companies. This is because there are growing concerns of a global supply shortage as demand outpaces supply. Lithium companies are something we keep a close eye on, waiting for the right price, as we won’t invest in a company which we believe its market price has overrun its fundamental value. Investment attention in this theme has also been focused on rare earth companies, as there is a limited supply of rare earths outside of China, so a company currently producing significant amounts of rare earths is sure to gain some traction. Rare earths are key inputs in permanent magnets, which are used in electric vehicles and renewable energy technologies such as wind power. This is also an area which we would like to be invested in for capital gains purposes.

Copper is quite an interesting one. For now, it is still treated as ‘Doctor Copper,’ in which copper prices reflect the current or predicted state of the economy. Other than the low-carbon technologies already discussed, copper is used in everything from electric generators, internal combustion vehicles, wires, computers, and TVs. Due to its widescale use, demand for copper is linked to global economic output, so copper prices tend to be cyclical, in line with the global economy. Whilst this is still the case, we believe the cyclicality of copper prices will flatten out in the long term and form an upward trajectory. This is because of the massive demand for copper needed for this decarbonisation transition, which will occur throughout economic cycles. Thus, we view any weakness in copper prices arising from near-term headwinds of a slowing global economy as an opportunity to buy in at an attractive valuation. Inevitably, prices will recover and fall again, but if copper companies are held throughout the cycles, we believe the long-term value proposition is there.

Other sectors to be invested in

We have identified a few key areas to be invested in 2023, which are those that we believe will be able to withstand uncertain economic conditions. That’s not to say investors should stay on the sidelines and hold cash, as inflation would chip away at its value. On the other hand, as of 20 December 2022, ASR Wealth Advisers’ Income Portfolio has a forward dividend yield of 5.96%.

Our preferred strategy in 2023 would be to invest in companies that are able to defend their earnings, whilst paying out steady dividends. We look for companies with strong and stable earnings and cash flow, a dominant position in their market, high barriers to entry, pricing power, and the ability to pass through higher costs. Think about what sectors and types of companies can withstand an economic downturn. This ranges from infrastructure assets to the owners of your local pub. Toll roads will still be driven on, and tighter hip pockets aren’t stopping Australians from going to the pub after years of lockdowns. This is particularly the case as pub meals are much more economical than a fancy restaurant. Names in these areas include Hotel Property Investments (ASX: HPI) and Atlas Arteria (ASX: ALX).

Many of these companies are also found in the Consumer Staples, Health Care, and Utilities sectors. With consumers having tighter hip pockets due to elevated interest rates and inflation, consumers will focus their spending on essentials, which is why we like Consumer Staples. Many of these companies have strong market positions and the ability to pass on costs. Health Care companies are counter-cyclical and usually have a defensive earnings profile. Take CSL (ASX: CSL) for example. Their plasma collections business usually benefits from an economic downturn as individuals will look to alternative income sources such as donating plasma for a payment. Utilities have extremely high barriers to entry as they are often government regulated, and regulations also determine inflation-linked price increases which allow them to defend their earnings.

As mentioned, we also like parts of the Materials sector, particularly companies which mine ‘green metals.’ However, we also see an opportunity in other commodities related to the reopening of China, which will benefit commodities such as iron ore.

5 topics

3 stocks mentioned