3 structural shifts driving REITs and how to play them

There are REITs one can access around the globe, particularly in North America, offering exposure to sectors that are simply unavailable in Australia. Not only are many of the listed REITs invested in these property types attractively priced right now, but the opportunity set is also deep and diverse.

They say that in the midst of every crisis lies great opportunity. This has certainly proved true of the global pandemic. Whilst REIT markets have begun to recover now that a vaccine is imminent, one key fact remains; despite recent share price increases, relative to other financial investments REITs offer attractive income streams and inflation protection.

This is evident in most REIT markets around the world, including Australia. What separates North America from elsewhere are the deeper trends within the continent that are more powerful, more enduring and therefore more laden with opportunity.

APN’s investment focus has always been in favour of durable, high-quality yield and our strategy in North America changes that not one bit. The difference is in the magnitude of the structural shifts underway in North America that enrich the opportunity set.

There are three primary structural shifts from which we aim to benefit, helping us to deliver an enhanced yield and higher capital growth prospects.

Structural Shift #1: Online retail

Before the pandemic, the North American transition to online retailing was more advanced than elsewhere. The US Department of Commerce estimates that in the first quarter of 2020, e-commerce sales as a percentage of total quarterly sales hit 11.5%.

From the first to the second quarter of this calendar year, US retail e-commerce sales jumped from US$160bn to US$212bn, an increase of 32%. The conclusion? The pandemic has not only pulled forward future demand but also bought a new audience of shoppers online.

The same effect is evident in Australia, but the market is far smaller and pre-pandemic online penetration rate was lower. According to Statista, the Australian e-commerce market was worth just AU$28.6bn in 2019 and accounted for 9% of total retail sales.

In both countries, the demand for additional industrial real estate by traditional and non-traditional retailers is creating a 'long tail’ of future demand. But as a far bigger, more advanced market, the US has more opportunities on which it can capitalise, especially as the pandemic is still raging here.

This acceleration of recent trends is resulting in increased demand for space that we believe will be long-dated, creating higher rental rates and new development opportunities for Industrial REITs. As a result, we expect Industrial REITs to have close to the highest levels of earnings and dividend growth across the various property sectors. This impact is likely to be more pronounced here in the US and Canada than in Australia.

Industrial Logistics Properties Trust (NASDAQ:ILPT) is an example of the kind of opportunity we have uncovered. The company, which has Amazon as a major tenant and is growing rapidly, remains about 20% below its pre-pandemic high and currently offers a high and well-covered 5.8% distribution yield.

Structural Shift #2: Digital transformation

More than 4.5 billion people use the internet and 5 billion own mobile phones. The result is that 60% of the world’s population is already online, a remarkable number that will only accelerate. The move from 3G to 4G, for example, resulted in a 100-fold increase in mobile data in the decade since 2010. The advent of 5G will likely enhance this trend.

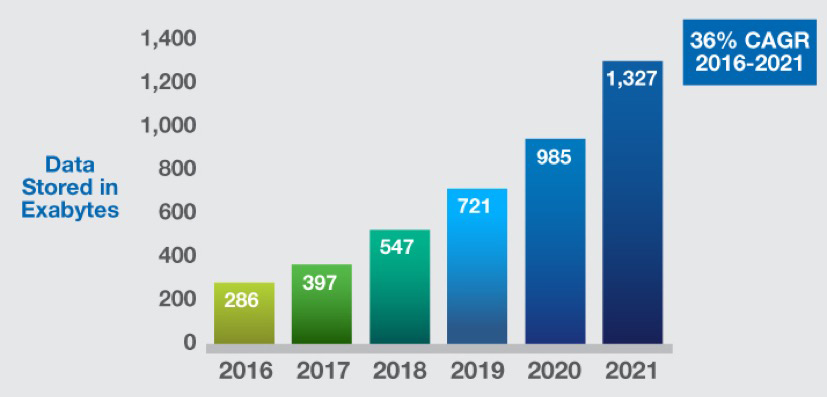

Just as the spread of electricity networks needed pipes and wires, the digital economy needs more real estate infrastructure. This is one of the most important global secular trends income investors should understand. The big data that digital transformation is delivering is driving a huge increase in demand for technology-orientated real estate.

Global Internet user growth

Source: Cisco Annual Internet Report (2018 – 2023) White Paper

Mobile phone towers are central to all things digital. Demand for more space and development of new towers will accelerate growth in rents and dividends from Mobile Tower REITs, an asset class that does not exist in Australia.

Crown Castle (NYSE:CCI), which occupies a place in the APN Global REIT Income Fund, is the largest provider of communications infrastructure – including cell towers, small cells and fibre – in the United States. In the last decade, its share price has risen almost three-fold and nearly five times more than than the US REIT Index.

We expect further increases, too. The roll-out of 5G through the small cell network is only in its infancy, e-commerce is continuing to grow and artificial intelligence, autonomous vehicles, virtual/augmented reality and the Internet of Things will massively increase demand for data. Crown Castle is exceptionally well-positioned to capitalise on that trend.

Of course, data also needs to be stored and technology ecosystems require high levels of interconnectivity. Data centres house the majority of tenants’ cloud computing technology equipment in secure, mission-critical real estate. Although NextDC and Megaport are listed in Australia, neither operate under a REIT structure. In the US, we are spoilt for choice. US REITs will also likely be bigger beneficiaries of the secular growth in data.

In addition to private sector demand, large government users focused on mission-critical intelligence are further boosting demand for data centres. Together, these factors should deliver growing rents and dividends from North American Data Center REITs for many years to come.

This is why we have invested in Digital Realty Trust (NYSE:DLR), one of the largest REITs in this space with large platforms in Europe and Latin America as well as North America.

Structural Shift #3: Healthcare and wellness

The need for essential healthcare, vaccinations, new medicines and advanced surgical procedures has created a multi-trillion-dollar industry. The pandemic is likely to accelerate the future growth of this sector. Also, wellness is garnering a bigger slice of disposable income and, as populations age, demand for healthcare increases.

Hospitals and doctors, therefore, require well-located modern facilities to perform their essential services while biotech and pharmaceutical companies need high tech lab spaces to innovate. The 15 Healthcare REITs listed in North America provide this specialised real estate.

This is another sector rich and deep in North America but quite small in Australia. Currently, the APN Global REIT Income Fund owns four companies in the US, including Alexandria Real Estate (NYSE:ARE) and one in Canada – Northwest Healthcare (TSX:NWH) which has a global hospital investment footprint.

As with digital transformation and the growth in online retailing, we expect rents and dividends in the healthcare REITs we own to grow at rates well above inflation.

This emphasis on growth, on picking sectors that offer attractive yields but also benefit from the secular trends that are transforming the global economy, leads to a materially different portfolio compared with the Global REIT Index.

Along with preferred securities – a story for another day – these three structural shifts are the basis of our well-designed strategy to achieve enhanced yield and higher growth prospects to investors in the APN Global REIT Income Fund.

Broaden your income horizons

Access a stream of income through an underlying diversified portfolio of thousands of quality commercial real estate assets located across the globe. Find out more.

1 topic

2 stocks mentioned