2016 Macro predictions: Readers Vs Experts

[Screen Shot 2016-10-27 at 12.46.13 PM.png]

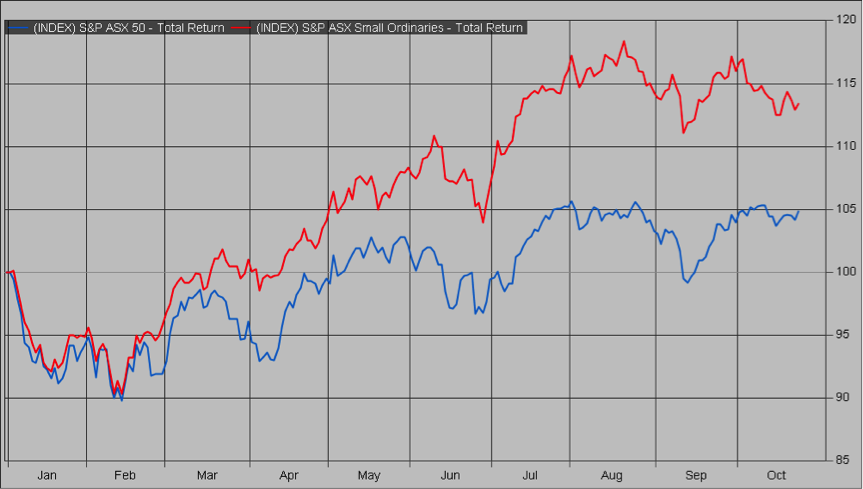

Will small caps keep out-performing large caps in 2016?

After four years of small cap underperformance, small caps started to twitch in the second half of 2015. When we conducted the survey in mid-December 2015, 78% of Livewire readers predicted that this would be the start of a trend that would last through 2016.

This highly insightful prediction foresaw one of the most profitable trends in the market this year. Small caps, as determined using the Small Ordinaries index (total return), has led all year, and is up by 13%, well ahead of large caps, measured using the ASX50 (total return), which is up just 5%.

Source: Factset

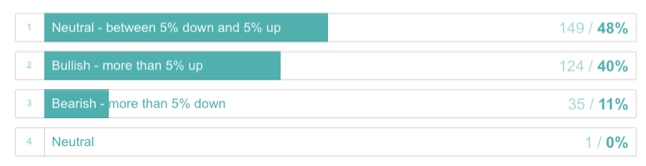

The outlook for the ASX200 for 2016

A 48% majority of respondents have so far correctly predicted that the ASX200 would be neutral (less than 5% move in either direction). As of 27 Oct, the ASX200 accumulation index is within the ‘neutral’ range with 4.4% YTD. This could change quickly given how close we are to the boundary of the range, but for now the majority of Livewire readers have called this one correctly too.

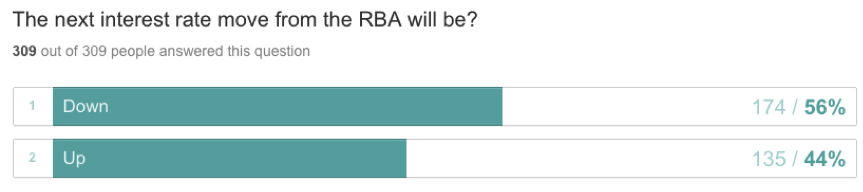

The next rate decision from the RBA

A majority of 56% of contributors correctly predicted that the RBA’s next move would be down, though they had to wait until May to see it happen. On 3rd May, the Board decided to lower the cash rate by 25 basis points to 1.75 per cent, citing lower inflationary pressures than expected.

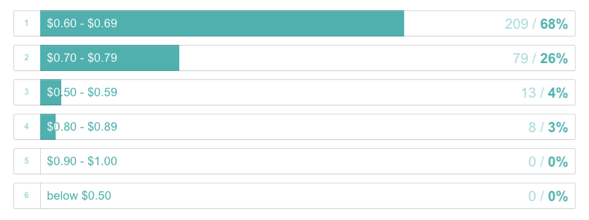

Where does the Australian dollar finish next year?

We were a bit bearish on this one, with as many as 68% of respondents calling it down to the $0.60 to $0.69 range. This compares to its current value of $0.76, with just 26% predicting it to be in the 70’s by year-end.

The bearishness on the AUD in late 2015 is understandable given that the currency had just put in its third consecutive year of ~10% declines. Indeed, by January 2016, the currency had fallen further, and briefly touched the 60’s, before then spiking into the 70’s during the March quarter, where it has stayed ever since, with the currency currently up by more than 4% YTD.

Here’s what the experts said…

Last December we also asked some of our contributors for their predictions on where interest rates and the dollar would head in 2016. We then asked them ‘what is the one thing the market has priced as certain that you think will NOT Happen in 2016?' Watch this video featuring Matthew Kidman, Chris Stott, Roger Montgomery, Steve Johnson, Romano Sala Tenna and Ben Clark to see how they did on their macro calls, and to see who correctly foresaw the recoveries in oil, resource stocks and bond yields.

In case you missed it…

Livewire recently looked at the best and worst of Livewire readers’ 2016 stock picks, which you can see here: (VIEW LINK). We will check in again on both your macro calls and stock picks again in November, before closing the books in December. Until then, think about a stock pick for 2017!

2 topics