4 Bitcoin metrics at all-time highs

Bitcoin is currently down ~70 % since peaking at US$68,789 in November 2021. In the current macro environment where tightening by the Fed continues to try to tame inflation, the price remains under pressure and may fall further.

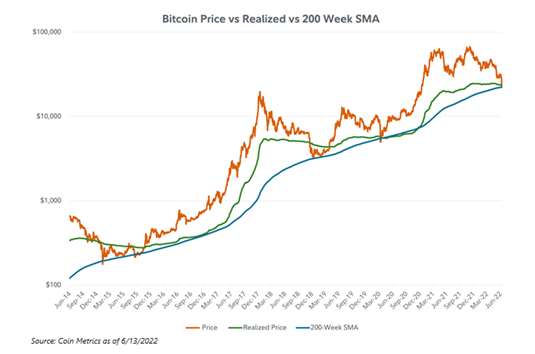

There is some consolation in that the bitcoin price has fallen to its 200-week simple moving average (‘SMA’) and is now trading close to its ‘realized price’ (a kind of total “cost basis” for all coins on the network). Historically, both have been near ultimate lows or support for bitcoin.

Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Four on-chain metrics that have continued to hit higher highs and demonstrate the health of the Bitcoin network are:

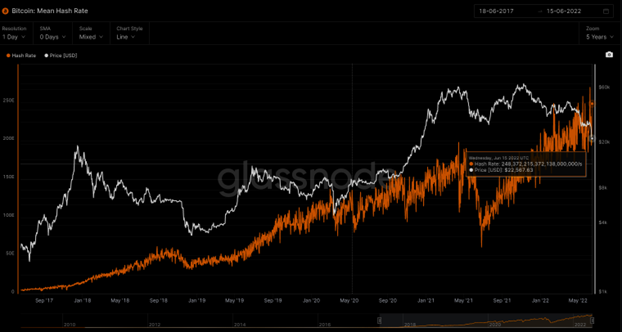

Bitcoin: Mean Hash Rate

While industry players like centralised borrowing and lending platforms have experienced risk issues, the Bitcoin network has continued to operate normally without any kind of hiccup, downtime, or “pause.” With the hash rate continuing to climb to a new all-time high, on this metric the Bitcoin network appears more secure today than at any time prior.

Source: Glassnode

Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Bitcoin wallet addresses with at least or greater than .01, .1 or 1 BTC

Number of addresses with at least or greater than .01, .1 or 1 BTC shows the number of unique addresses holding at least or greater than the amount specified. This metric gives us a big picture view into whether the network is growing.

Source: Glassnode.

Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Percent of Supply Last Active 1+ Years Ago

Percent of supply last active 1+ years ago shows the percent of circulating supply that has not moved in at least a year. Bitcoin that has not moved in 1+ years could be considered ‘illiquid’ even though it would still be considered as part of the circulating supply. The higher the illiquid supply, the less selling pressure there can be on the network, which is considered positive in the long-term.

Long-term holders have continued to sit tight. Investors holding BTC for at least 1 year has continued to grow and sits at an all-time high of 65.47%.

Source: Glassnode

Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Lightning Network Capacity

Lightning Network Capacity shows the total amount of BTC locked in the Lightning Network. Lightning Network payment nodes open payment channels with each other. As transactions are made across channels, the channel balance is reflected without the need to broadcast a transaction on-chain, effectively creating a second layer on top of the Bitcoin network.

Source: Glassnode

Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Learn more

BetaShares offers the broadest range of technology-focused ETFs in Australia providing access to global tech giants, cybersecurity, Australian technology and more. To stay up to date with my latest insights into the digital assets market click FOLLOW below, find out more about investing in crypto with BetaShares here.

3 topics

1 stock mentioned

1 fund mentioned