5 killer ETFs for your income portfolio

Considering Australian investors' thirst for yield and the growing popularity of exchange-traded funds, it may surprise some to learn that around 20% of ETFs listed on the ASX are focused on income.

In fact, while there are 31 fixed-income ETFs listed on the ASX, only around half that number are focused on yield and dividends within equities (15, to be exact). That's of the 226 ETFs listed on the ASX (if that doesn't scream opportunity for ETF providers and fund managers, I don't know what does).

Despite there not being as many options as an income investor may have liked, ETF researcher Mark Monfort of ETFtracker believes these exchange-traded products are still highly attractive, helping investors to harvest yield from equities in a diversified fashion and access parts of the fixed income market with greater ease, transparency and often best of all, lower fees.

As part of Livewire's Income Series, Monfort shares some of his recent research into ETFs, as well as his thoughts on some of the new income-focused ETFs that have launched to market, including Magellan's FPAY and a new hybrid offering from Daintree.

Plus, he also outlines five killer income ETFs that he believes should have a place in any income portfolio.

Note: This interview took place on the 27th of September, 2021. You can watch the video below or read a written summary.

Dissecting the income ETF universe

While Monfort notes that the definition of an "income ETF" can be quite broad as there are many that offer dividends (which are dubbed distributions in the ETF world) without smacking income or yield on their labels.

However, if we were to focus on those that do advertise to be income ETFs, there are 55 products in total that are available to investors across the ASX and Chi-X (39 fixed income, and 16 equity-focused), as outlined below:

Of the 39 fixed income ETFs:

- 26 are Aussie focused (21 are listed on the ASX, five are listed on Chi-X)

- 13 are global fixed income (10 are listed on the ASX, three are listed on Chi-X)

Of the 16 equity ETFs:

- 11 are Aussie focused (all 11 are listed on the ASX)

- Five are globally focused (four are listed on the ASX and one is listed on Chi-X)

Of these 55 income-focused ETFs, 46 are index-tracking products. Nine of Australia's income ETFs are actively managed (two Aussie fixed income ETFs, three global fixed income ETFs, and four Aussie dividend yield ETFs).

Risks and rewards of passive and active management for income investors

While active ETFs are built to outperform their benchmark, they often don't, Monfort says. This is the primary risk that investors should be aware of when investing in active ETFs, he adds.

"It just shows how hard it is for even the professionals who look at this stuff every day to outperform the market," he says.

However, passive funds don't get off easy either.

"If something happens in that fund, for example overseas, we have GameStop and AMC type stocks that rocket to the moon with retail investors pumping them up," Monfort says.

"And there was a clear example with AMC, which was in a cheap ETF index, it stayed in that cheap ETF index because the ETF could not rebalance until the next quarter or the next six months.

"So, even passive comes with its pitfalls."

That said, Monfort believes that every portfolio should include both passive and actively managed ETFs, particularly in the current uncertain environment.

"If you're in passive ETFs, it's going to be harder to navigate that future, whereas active can move around a little bit more," he says.

"But if you are (invested only in actively managed ETFs), I do think that there are some passive and cheaper options out there when you look at the management expense ratio and other factors. There's definitely room for both."

If rates do rise, fixed income investors should look to actively managed ETFs such as the ActiveX Ardea Real Outcome Bond Fund (ASX: XARO) or eInvest's Core Income Fund (Chi-X: ECOR), both of which can actively manage risk and duration within fixed income, Monfort says.

"We track the monthly data from the ASX and Chi-X, but there's also league tables that come out each week... from ETF Securities who run a really nice report," Monfort says.

"XARO was always up there in terms of the flows going into it, with investors and institutions being cautious."

Meantime, Monfort likes ECOR as it has "a great Sharpe Ratio", and invests actively in short-dated bonds.

The new Magellan FuturePay Fund (Chi-X: FPAY) has also caught his attention, as it has had "some positive returns and some positive metrics coming out of it when we look at inflows over the first couple of months that it's been in existence."

He also likes eInvest's Better Future Fund (ASX: IMPQ), which actively engages with company management.

What to expect with management fees and spreads

While Monfort says the industry average management expense ratio is 0.52% as of August 2021, fees can vary significantly depending on the active or passive style of an income-focused ETF.

"Whether it's fixed income or these dividend yield focus equity (ETFs), they range from as high as 1% for Magellan's new FPAY, to as low as 0.12% for an Ishares Yield Plus ETF (ASX: IYLD).

Meantime, the league average for spread is 0.21% across the ASX and Chi-X income ETFs.

"But that can get up as high as 0.62% for one from Switzer and also Magellan's FPAY and even as low as 0.04% for spread for the iShares Core Composite Bond ETF (ASX: IAF)," Monfort explains.

"You want your spread to be low and your liquidity... to be high."

Total return versus yield

Monfort believes it's important for investors to assess "total return data" rather than just looking for ETFs with strong price returns or yield.

"The ASX and Chi-X (both) published the total return figure on a one month, one year, three years, and five-year basis. And that takes into account the dividends. It's the package of all of the above," he says.

However, he notes that even if you select a product with a great total return, it may not necessarily mean that it will deliver regular dividend income over time.

"We find that some historical yields have been trending downwards, (while) some have been trending upwards or just maintaining their high levels," Monfort says.

"It's important to look under a hood with the data there."

Interestingly, Monfort does believe size matters when it comes to income-focused ETFs.

"It's not a one to one correlation, but on average, the larger ones do appear to have a little bit more in terms of the yield that they offer to investors," he says.

Monfort argues that hybrids are a great asset class for income investors - one that sits on the risk-return spectrum between fixed income and equities.

"There are a few hybrids, but one that's interesting that's caught our eye recently and we're going to look into this more, is something from eInvest again," he said.

"It's managed by Daintree. It's called DHOF, that's the Daintree Hybrid Opportunities Fund. And as something that is offering investors just something a little bit different, I think that the hybrids are definitely one to keep an eye out for."

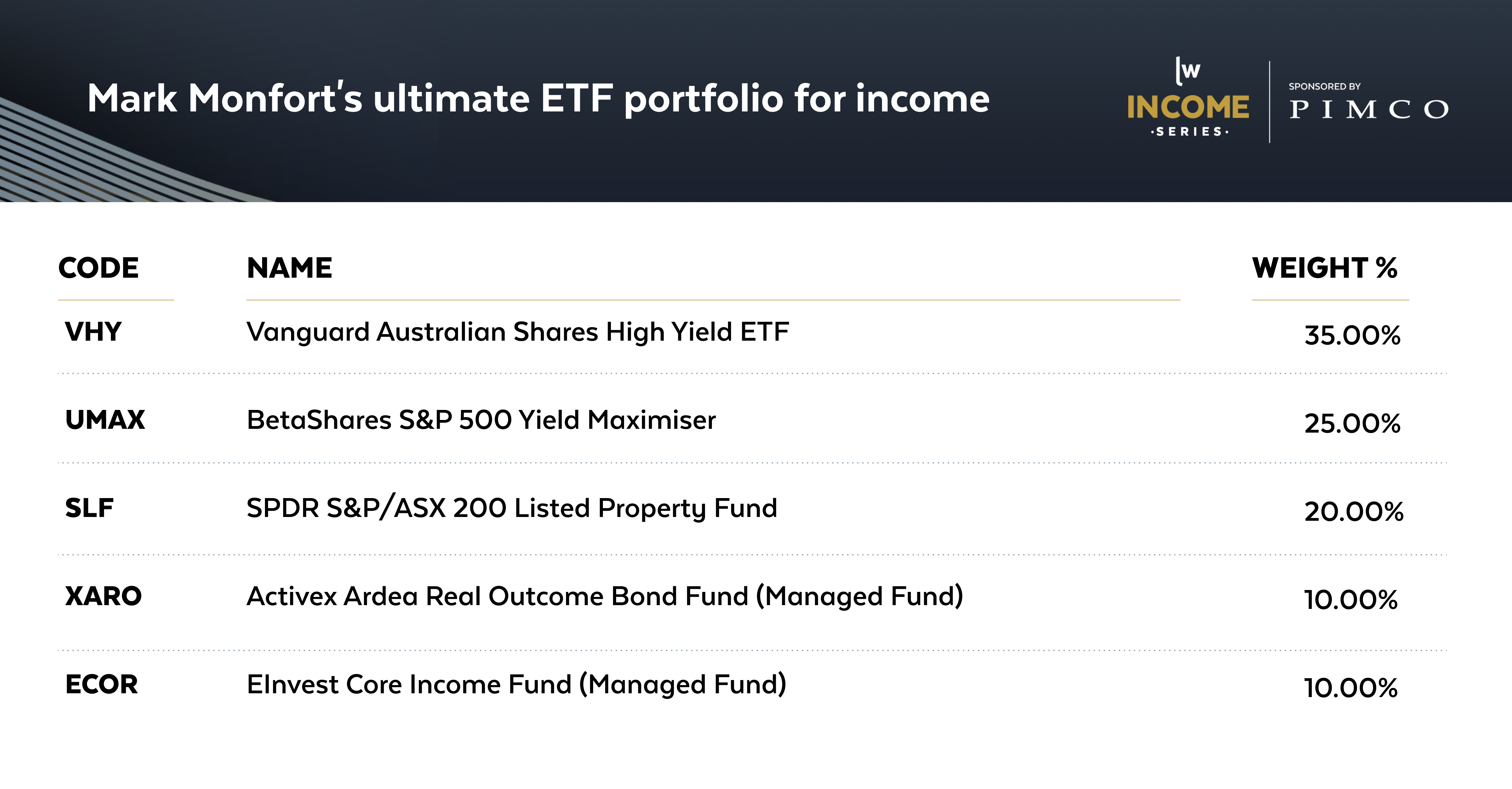

Monfort has selected five ETFs that he believes will provide a regular source of income, while all being great ETFs in and of themselves.

First up, the Vanguard Australian Shares High Yield ETF (ASX: VHY) which is big, boasts a strong track record and also has low fees, he says.

"The other thing is that yield has been quite strong for it. It has been decreasing a little bit over time, but it is made up for with its total returns," he says.

"And even though this has been established for some time, we're still seeing an uptick in terms of trades... It's still seeing that hockey stick curve up."

For global exposure, Monfort points to the BetaShares S&P 500 Yield Maximiser (ASX: UMAX) as his pick of the bunch.

"It's had strong returns and it gives you exposure to the S&P 500 and the dividend yield coming from that," he says.

He also points to the SPDR S&P/ASX 200 Listed Property Fund as another winner.

"That one's quite interesting because it's had very strong performance this year and it's actually got a decent dividend yield," Monfort says.

"Not as high as the income-focused equity ETFs or fixed income plays, but as a normal ETF that people might be looking at for various other reasons and not yield, it actually offers an attractive yield."

Due to the uncertainty in the market, Monfort said he would round off his portfolio with two active fixed income ETFs, XARO and ECOR.

"They've got that ability to move into short-dated exposure if rates do rise," he says.

Want to read other content like this? Check out some of the wires below:

.jpg)

Why you can’t miss the Livewire Income Series

Livewire’s 2021 Income Series gives investors best in class education and premium content to build a bulletproof income portfolio.

Click here to view the dedicated website, which includes:

- A list of income-focused ETFs, LICs and funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with leading fund managers.

- Videos and articles to help you perfect your income strategy.

Want more content like this?

Give this wire a like if you've enjoyed the discussion and hit follow to be notified when new episodes are released.

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

3 topics

7 stocks mentioned

1 fund mentioned

1 contributor mentioned