7 undervalued stocks (and 1 IPO) for the near term

A once-in-two-decades opportunity has been created by small- and micro-cap speculators, say portfolio managers from Longwave Capital Partners and Spheria Asset Management.

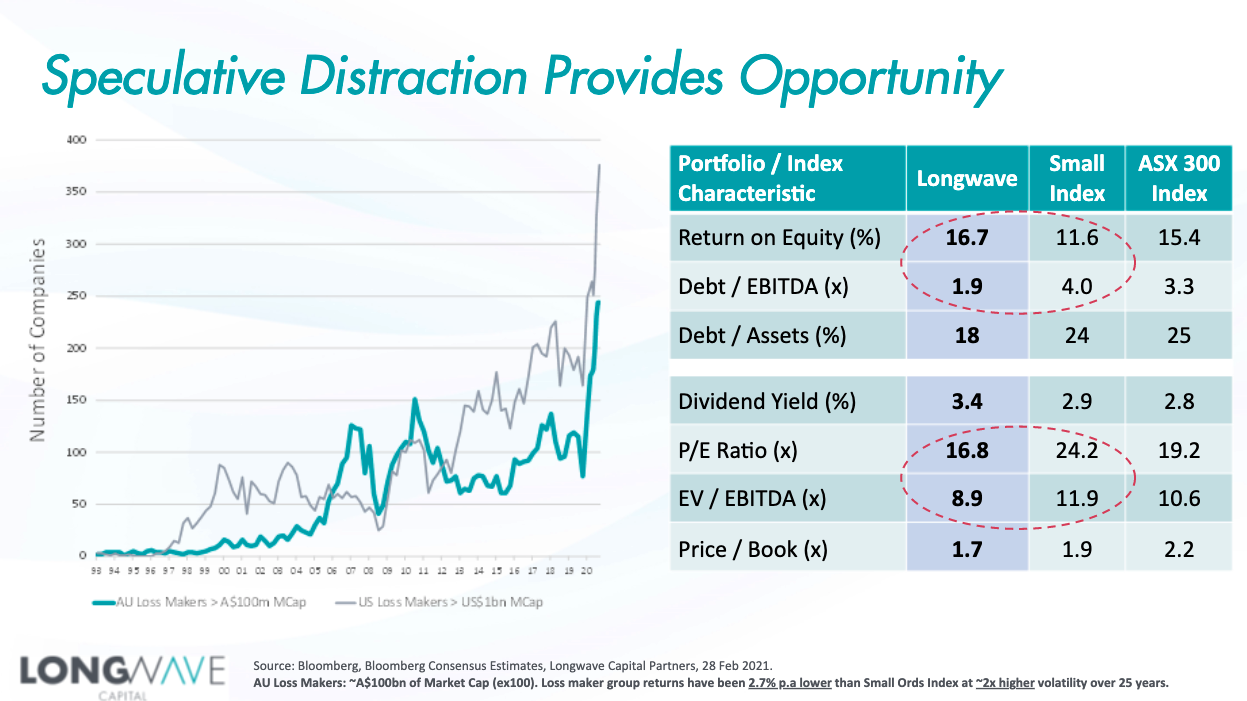

The number of unprofitable Australian companies with market caps beyond $100 million has risen more than three-fold in the last year, explained David Wanis, CIO and portfolio manager, Longwave Capital Partners at a recent webinar hosted by Pinnacle Investment.

“The past year has just been a rocket ship to the moon for unproven and unprofitable businesses, that to us is a speculative distraction,” said Wanis.

But he believes this obsession among large pockets of the market increases the opportunity for investors who rely on fundamentals-based research.

Wanis referred to the right-hand side of Figure 1 to explain that forward PE ratios for small-caps is higher than we’ve seen in almost 20 years. “But we don’t think you need to pay for that level of quality, we can get there with much lower relative prices.”

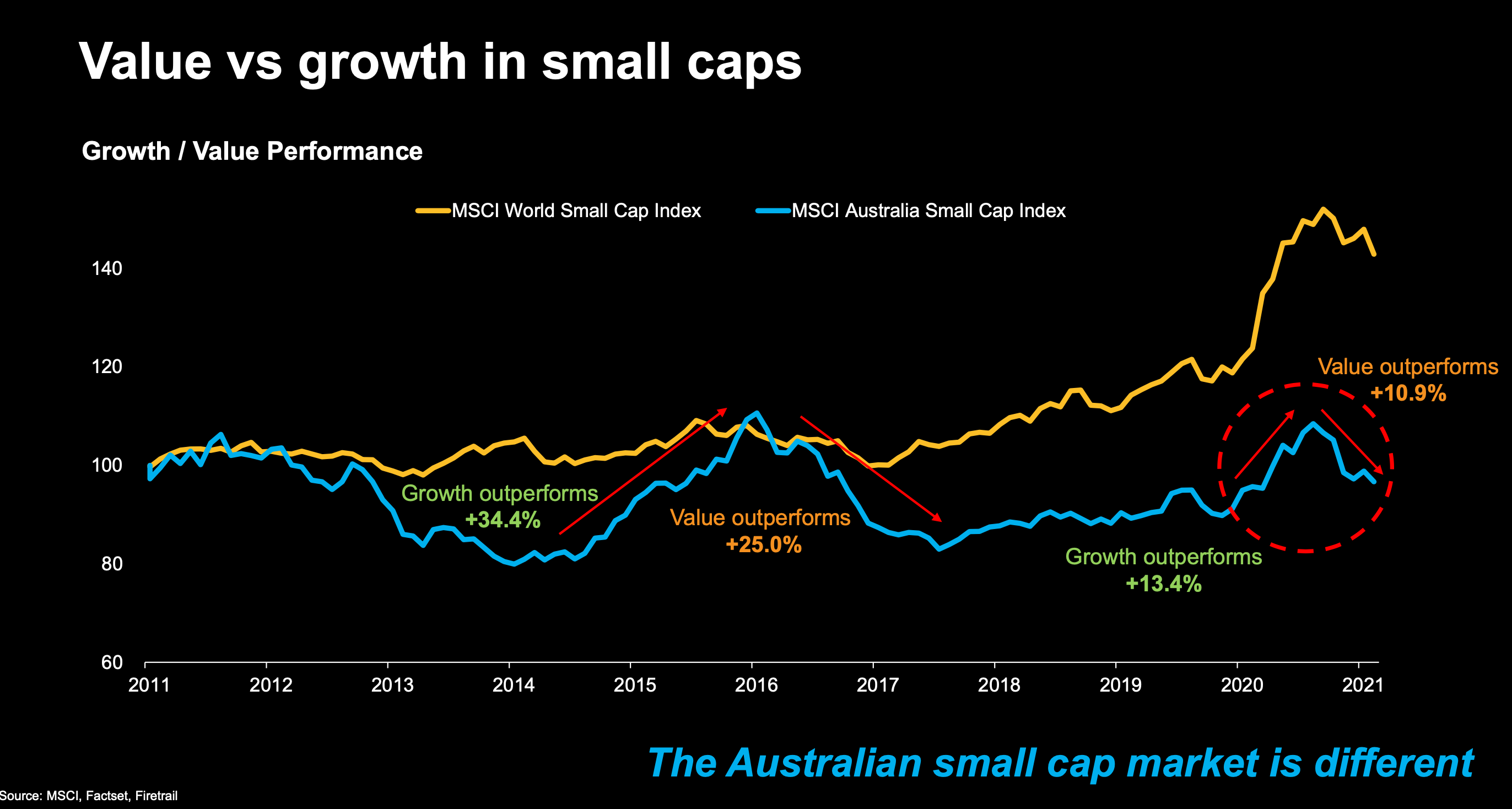

A similar view was voiced by Marcus Burns, co-founder and portfolio manager, Spheria Asset Management. He countered the prevailing speculators' view that valuation is almost irrelevant when you’re investing in small- and micro-caps.

A macroeconomic environment pumped up by unprecedented levels of monetary stimulus has driven the market, said Burns. He also pointed to the huge rise in retail share trading over the last year, referring to social platform Reddit’s role in spruiking GameStop in the US as an example, along with the mass appeal of cheap or free share trading platforms Robinhood and Superhero in the US and Australia.

“The second trend has been the rise of passive investing with stocks that are invested based solely on their size, and with no quality or valuation overlay, simply buying the marketplace – what could possibly go wrong?” said Burns.

“We’ve observed this massive rise in what we call ‘concept’ stocks…we’d typically say that stocks with an EV-to-sales of more than 5-times is high, but 10-times is truly off the charts.”

In this context, he believes the massive surge in stocks indicates rising risk ahead.

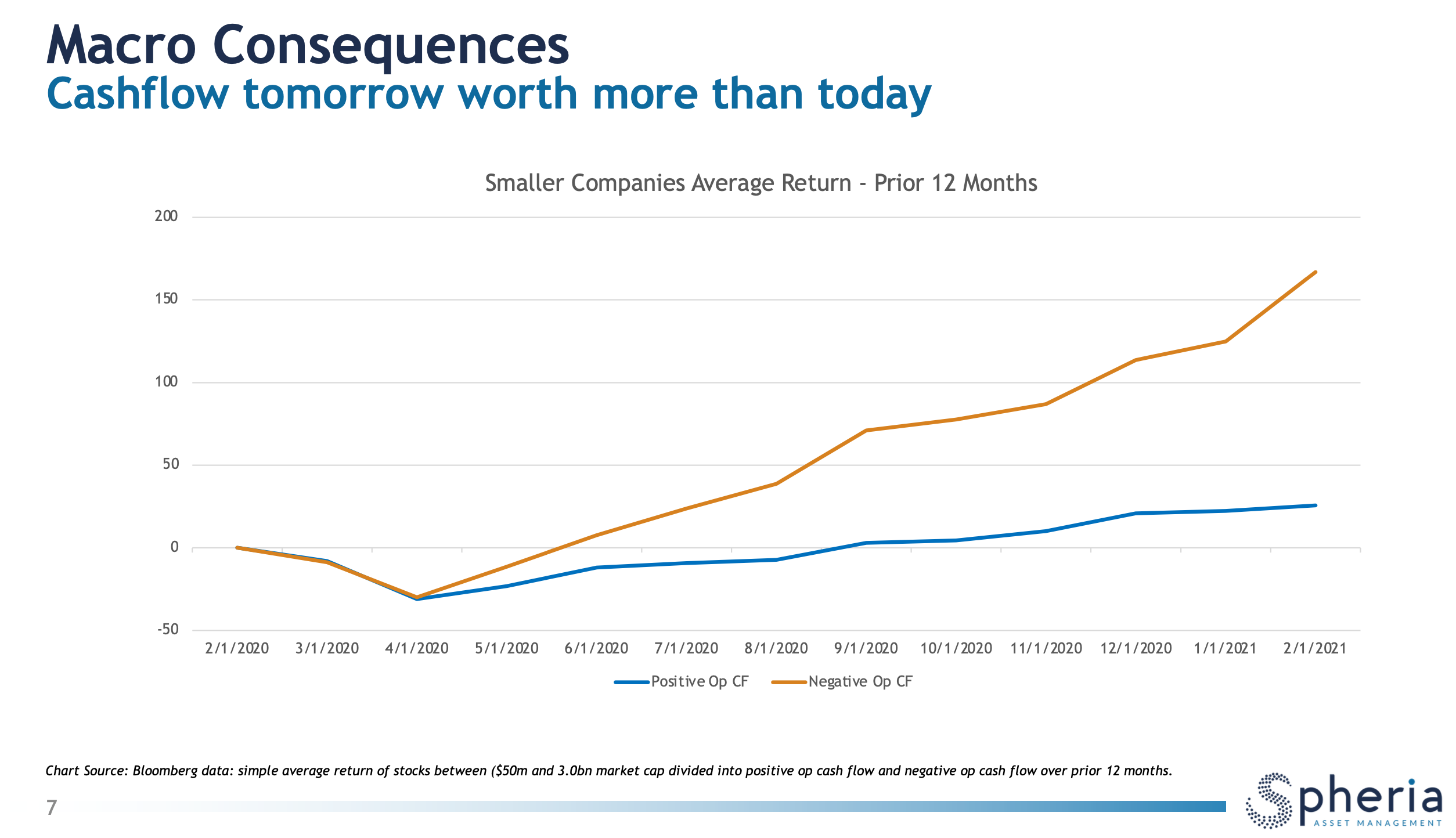

Also alluding to global bond markets, where record lows for long-duration yields mean cash tomorrow is worth more than it is today, he said: “stock markets are following suit.”

He pointed to the below chart comparing the share price returns of small companies with negative operating cashflows against those with positive operating cashflows.

“Perversely, the stocks that lost operating cash flow over the last 12 months have materially outperformed those that make cashflow – the average return is 150% plus, whereas those that are making money have delivered returns of 25-30% - still very respectable returns under most conditions”

What are the investment opportunities?

A few surprisingly “old world” companies rank among the fundies’ current favourites, Longwave’s Wanis discussing a well-known media brand, a retailer, and building materials company.

Media conglomerate worth twice the price

News Corporation (ASX: NWS) is best-known for its global media brand headed by Rupert Murdoch, but Wanis emphasised newspapers and broadcast media account for less than 1% of the company’s overall revenue. Around 85% of the company’s current share price valuation comes from online real estate firm REA Group (ASX: REA).

Wanis believes the true value of News Corp is around twice its current share price, stocks trading at $30.74 as of 11 am Wednesday.

“In a market where people are focused on trying to get to the current share price, putting in bullish assumptions to even achieve some of the market caps that are being applied, you have a situation where with a bit of digging, you can find a pretty attractive situation,” he said.

Only quality matters

Small retail is another sector he believes is ripe for opportunity, especially given the market’s ongoing obsession with companies that can scale up. But Wanis cited a few reasons for his view that some small retailers have driven business improvements since the onset of the pandemic, despite not necessarily growing. These are:

- Investment in “omnichannel” online and in-store retailing

- Increased bargaining power with landlord tenants

- Closer direct relationships with consumers.

Taking a forward P/E view of around two years, Wanis and his team believe the market doesn’t appreciate the discount at which some companies in the sector are currently trading. Adairs (ASX: ADH), a more than 100-year-old Melbourne-based homewares retailer, is one of these companies held by Longwave.

Building bounce ahead

In building materials, despite the “pretty rough cyclical period” more recently, Wanis singled out CSR Limited (ASX: CSR). “Even at cyclical low points, CSR has earned more than 50% return on invested capital

He also likes the company’s recent share buyback, “so capital management has been in shareholders’ favour.”

“And it’s currently trading on a EBIT multiple of 12-times, so it has quality, value and now the earlier signs of growth as home builder stimulus rolls into housing starts,” Wanis said.

Strategic shift prompts a re-think

The stocks nominated by Spheria’s Burns are also drawn from some of the more under-appreciated parts of the small-cap market. Personal care and hygiene company Asaleo Care (ASX: AHY) isn’t a flashy brand, but ticks Burns’s boxes as a business with both attractive cash flow and a recent change in strategy.

After selling off its underperforming tissue business in 2018, Asaleo’s management embarked on a debt reduction strategy, prompting Spheria to reassess its view of the company.

“We found it was trading at very attractive levels and given the de-risking, we took a position in that company,” said Burns.

Due to its defensive characteristics, the company traded very well through COVID before dropping off slightly in more recent months as the recovery has unfolded. But its share price again picked up after management in mid-February accepted a $1.45 per share bid from a Swedish company and major shareholder Essity. This represents a more than 44% premium to Asaleo’s share price at the time.

A resilient travel stock

And for the same reasons, Spheria also boosted its position in Corporate Travel Management (ASX: CTD) in recent months. Citing the company’s good cash flow, growth and cost-cutting after the March market sell-off, Burns is impressed management didn’t tap shareholders for capital, as many of its competitors did during the downturn.

Corporate Travel only finalised a capital-raise to fund a $274 million acquisition of a large North American company, Travel and Transport Inc from Omaha, Nebraska in late September last year.

“We’ve topped up our position and think the stock is very well positioned to trade out of COVID, with the reopening coming through from vaccines.”

Eleanor Swanson, small companies lead analyst at Firetrail Investments - a Pinnacle stable-mate of Spheria and Longwave - also presented her view on the space during the webinar. She highlighted two companies, luxury automotive dealer Autosports Group (ASX: ASG) and online marketplace outsourcing platform Airtasker - due to IPO on the ASX later this month - as holdings of interest. Swanson discussed these in greater detail with Livewire earlier this week, as part of our International Women’s Day coverage.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

7 stocks mentioned

4 contributors mentioned