8 reasons lithium markets will stay tight

Conrad Capital Group

To meet the stated requirements of electric vehicle manufacturers, lithium production must grow from current levels of 300,000 tonnes to two million tonnes by 2030. Our analysis, supported by interviews with independent industry specialists, concludes the lithium price needs to stay in the $US10,000 to $US12,000 per tonne price range to incentivise this growth.

We provide eight arguments supporting our view that not only is an oversupply situation unlikely, but lithium prices will have to remain at levels that would incentivise the large supply requirements:

1. Supply growth will be slower than expected

Creating fresh lithium supply is technically challenging. It is highly probable that supply growth will disappoint and there will be disruptions to existing operations.

To give you an example, in 2012, the market expected global lithium supply to more than double from 175,000 tonnes to 400,000 tonnes by 2016. By the time we got to 2016 it had only grown to 200,000 tonnes, a paltry 15% increase in four years.

2. Forecasts for supply costs are inaccurate

In a growth commodity industry like lithium, the cost of new production is highly influential in setting price.

The cost forecasts from some investment banks are inaccurate. They have not considered:

- sales commission,

- regional development contributions,

- impurity removal,

- correct royalty levels,

- contributions to local communities,

- research and development costs,

- freight charges,

- working capital costs, and a

- proper return on the capital that needs to be spent to generate new supply, which in our opinion, was the major analytical error in their work.

3. Industry structure suggests a rational market

Because the industry is in its infancy, projects are only receiving debt and equity financing if they have offtake agreements with buyers. This naturally keeps new supply in check. Further the major existing lithium producers are stating they will be disciplined about supply growth:

“We will only build capacity to meet long term commitments from our customers, we’re not in the business of speculating that demand will materialise” ~ Leading lithium producer, Albemarle, March 2018

4. Concerns about “oversupply“ help prevent it

The negative investment bank report has caused significant uncertainty in an emerging industry in the process of organising finance for high risk mining and processing projects. This report in of itself has probably delayed some lithium supply by 6-12 months.

5. Buyers of lithium are locking up supply as they scale up ahead of demand

Because of the significant growth expected within the electric vehicle industries, battery manufacturers are building capacity well ahead of market forecasts for demand.

To ensure these plants run optimally these companies require specific lithium chemistry as well as secure, long-term supply. Reflecting this need they are locking up most of the available new supply by entering into sizeable long-term contracts from reliable lithium producers

6. Inventory levels need to be built along the supply chain

There is a significant time lag between lithium production at the mine to an electric vehicle being purchased by a consumer in a dealership. We estimate 10-15% of lithium supply to be ‘tied up’ along the supply chain as working capital. This industry feature was a material omission by those arguing for an undisciplined lithium oversupply scenario.

7. The forecast period used by analysts is flawed

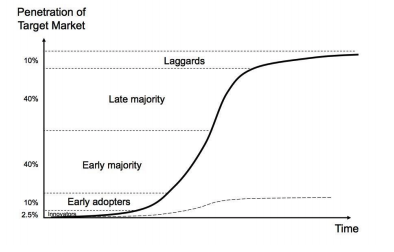

For no good reason, the market is fixated on the electric vehicle penetration rate in 2025 and the resulting lithium demand and supply balance in that year. This is the wrong way to think about it because based on the plans of the major car manufacturers, the penetration rate in 2025 will be 10-15%, but just five years later in 2030 is likely to be 50-75%.

This growth trajectory reflects how new technology adoption rates follow a typical “S-curve”, pictured below.

To meet this demand lithium supply will need to double over this five-year period.

For this enormous supply growth to occur post-2025, the lithium price must remain at incentive levels to keep encouraging new supply. These incentive levels are $US10,000- $US12,000.

8: There are new sources of demand for lithium

In our base case analysis for lithium demand growth we have only considered the demand stemming from electric vehicles. We have ignored the prospects for demand from battery energy storage. Demand for lithium from battery energy storage could be at least as great as that from electric vehicles

Conclusion

The market sentiment towards lithium stocks has been poor on the back of misplaced oversupply concerns and worry that lithium prices will fall further than expected. We remain long Orocobre (ORE) and will be looking for opportunities elsewhere in the lithium sector to capitalise on our work.

1 topic

1 stock mentioned

Tim has 25 years’ experience in the investment and securities markets. Tim was a partner of Goldman Sachs and during his 16-year tenure at the firm had senior experience across all areas of equities investing.

Expertise

Tim has 25 years’ experience in the investment and securities markets. Tim was a partner of Goldman Sachs and during his 16-year tenure at the firm had senior experience across all areas of equities investing.