Paradigm: A company with massive near-term potential

In my time at University (which seems like a lifetime ago) I recall two types of lecturers: Those that guided the students towards what to expect at exam time, and those that didn’t.

Unsurprisingly, there was a strong correlation between the type of lecturer, the student attendance late in the term, and the pass rate. Once students knew what to expect in an exam and where to find the answers, it would take a special kind of person to fail.

Management at Paradigm Biopharmaceuticals are the type of people that, had they been lecturers at University, would have had near 100% attendance in the final weeks of class, and a near 100% pass rate.

We already know the exam questions, and their solutions.

Paradigm (ASX:PAR) is a company repurposing a blood clot drug (pentosan polysulfate sodium (PPS) to treat inflammation, with its current focus being the treatment of Osteoarthritis of the knee.

Unlike the arduous, costly, and time-consuming process of qualifying a new drug for use in humans, PPS is a compound that has been used for 65 years to remove blood clots. Essentially this has meant that PAR has been able to skip directly to human testing, comfortable in the knowledge that the drug is safe.

And test they have. As at the writing of this article, Paradigm’s formula (iPPS) has been used to treat some 500 patients with arthritis through the Australian Therapeutic Goods Administration Special Access Scheme (SAS). Patients include all sorts, from the elderly seeking to avoid life altering surgery, to AFL footballers looking to extend their careers.

Anecdotally the feedback has been very positive. Having spoken to a number of recipients of iPPS, we have been impressed by the consistency of results. In fact, PAR announced on December 7 that data from 183 patients who have taken part in the SAS trials have returned consistently positive outcomes.

Results from the SAS trials have shown that 88.5% of participants reported a reduction in joint pain, with 91.2% reporting improved knee function. Those same patients reported pain scores that were reduced by over 51% after treatment of iPPS, which is a significantly superior outcome compared to the 15% reduction in pain reported from opioid treatment. This is of note especially in a world currently struggling with opioid addiction

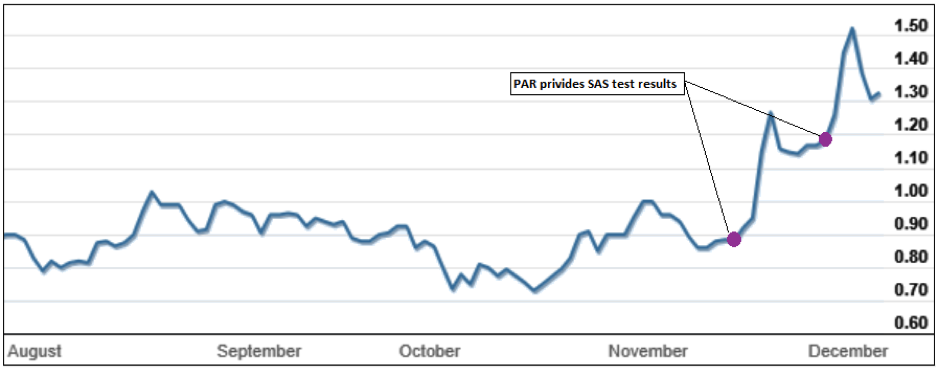

As the following chart shows, PAR has already seen its share price improve over the last 6 months.

Paradigm Biopharmaceutical share price chart

Nevertheless, it is the Phase 2b trial due to report in mid to late December that will be the catalyst that determines if iPPS is brought to market, and will likely be the driver that sees a company with a current market cap of just $180 million grow beyond $300 million.

The differences between SAS treatment and Phase 2b trial:

The core difference between SAS and Phase 2b is that the SAS seeks to treat, while the Phase 2b seeks to test. Practically speaking this means that the Phase 2b trial will include patients being tested with placebos, the results from which will be measured against the results from patients actually receiving iPPS.

However, this will not be the first time iPPS has been tested against a placebo. In 2005 Dr Peter Ghosh found that under clinical trial conditions iPPS showed statistically significant results when measured against a placebo.

What’s it worth?

Based on our understanding of the size of the Osteoarthritis market and the likely cost per treatment, we estimate that PAR could generate revenues of between $50 million and $100 million per year if they achieve a 10% penetration into the treatment market. However, if PAR are able to satisfactorily show superior results from iPPS and become a leader in osteoarthritis, a 50% penetration rate would see revenues as nearer to $350 million per annum.

Entry into global markets would see the companies potential increase significantly. As a point of reference, if PAR were to reach 10% of US Osteoarthritis patients, they could generate another $1 billion per year.

Paradigm’s agreement with the NFL (American National Football League), and its stated intention to engage with FDA (US Federal Drug Administration) suggest that such a move is certainly intended.

Our View:

We’ve never before seen a company provide access to its test data before a phase 2b trial. Having done just that, PAR’s release is akin to a teacher providing a test to their students weeks in advance of the test being due.

Having access to so much information has meant that unlike like other biopharmaceutical investments, Paradigm is right down the risk curve. Additionally, management have an exceptional pedigree, having come from from industry leaders like CSL and Mesoblast, and have a significant personal investment in the company.

When taken in context, we believe that the share price of PAR is too low.

1 stock mentioned