A case for India...

From an investor’s perspective, a strong case can be made for an allocation to Indian equities as part of an investment portfolio. We have put together a white paper on “A case for Indian Equities in a Global portfolio” and summarise our key findings below:

Structural Reasons – A strategic allocation to front-run the MSCI ACWI

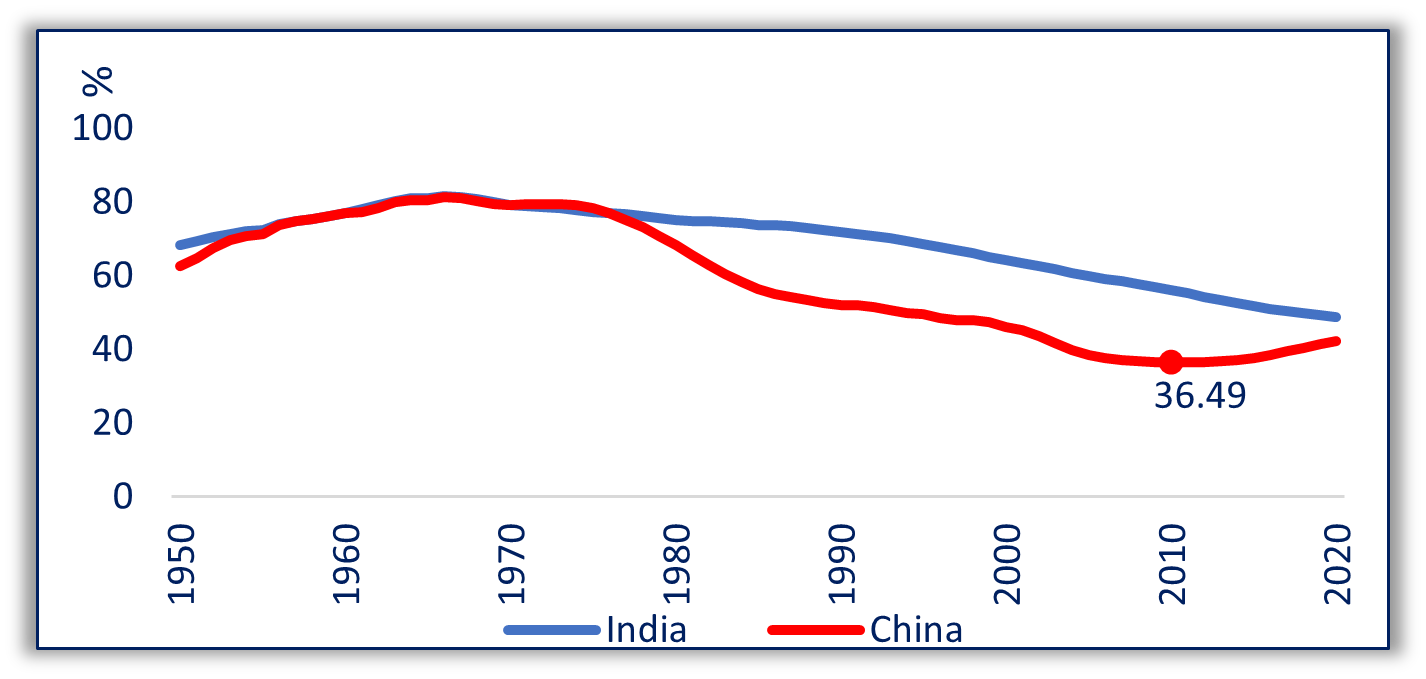

- India’s underlying fundamental tailwinds can be illustrated by its falling dependency ratio (the number of dependents / the number of working age people). As China’s dependency ratio fell (troughing in 2010), it coincided with the strongest phase in its economic growth. India is now making its journey towards its trough.

Source: Statista

- India’s trend of urbanisation will lead to increasing wealth gains and present opportunity for companies to profit for changing trends. A significant shift towards organised business is underway, which is ideal for India's listed corporates.

- India’s exports will benefit from an increased focus on manufacturing, global partnerships and the China + 1 strategy adopted by those seeking to diversify their global supply chains.

- India’s equity markets exhibit low correlation to AUD based assets, making it an attractive inclusion in a global equity portfolio, particularly given the sustainability of its growth.

- The digitisation and financialisation of India, initiated by demonetisation is leading to a significant shift towards digital transactions, improving governance and audit trail as well as wealth shifting from physical assets towards financial assets.

- Local investors are now over 15% and rising of market cap, which is reducing the volatility of equity markets previously at the whims of foreign investors as the incremental traders.

Cyclical Reasons – Why now is a great time to begin

- The cost of capital has fallen (10-year bonds are 6.22%, cash rates 4%), and this is a lead indicator of the next business cycle commencing in India. During the last cycle (2003-2008), earnings growth was above 20% p.a.

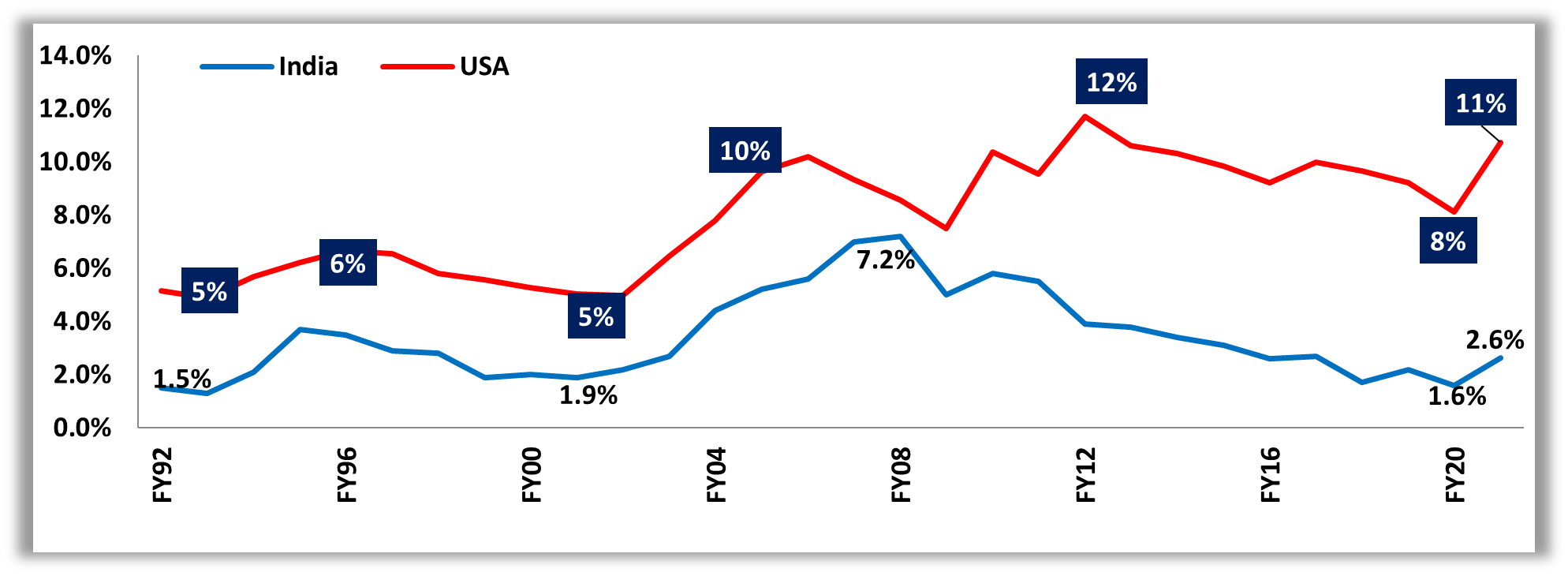

- India is close to the bottom of its earnings cycle, relative to other regions. Corporates have significant operating leverage to an economic recovery, which is now underway given the country's strong vaccination drive.

Source: Spark Capital

The chart above indicates that India’s profitability is bottom of the cycle at present. Corporate profits are likely to experience a cyclical upswing and be driven by greater contribution from rising private investment, manufacturing and exports in this decade.

However, implementation is mismatched to needs

While investors may acknowledge all of the above, they tend to seek "easy ways" to implement this by looking at low-cost passive or benchmark hugging exposure offered by large investment firms with an Indian equity product as part of a suite of investment products to balance out their stable. However, the Indian equity market has been a rich source of alpha over time. The benefits of this can only be provided by an actively managed exposure, willing to dig more deeply than allocating significantly to heavyweight index consituents.

Local fund managers in India, as you would expect, are naturally far better at understanding and knowing the local ecosystem as witnessed by their alpha generation relative to global investors investing in India.

“Perceived Safe and Liquid”

On average most multi-product, asset management firms offering an Indian equity product have between 45-55% allocated to the top-10 stocks of India, akin to an Index. Whilst the top-10 companies may make a strong case for inclusion, they aren’t necessarily demanding of half your exposure given that there are over 6,000 listed companies in India. Some of the remaining 5,990 companies are equally dominant in emerging and fast growing addressable markets and are likely to experience far higher level of earnings growth if discovered earlier than when they become significant index constituents.

That is the true opportunity to an investor seeking capital growth from investing in Indian equities, rather than seeking to not to underperform an irrelevant benchmark.

Why you can’t miss the Livewire Income Series

Livewire’s 2021 Income Series gives investors best in class education and premium content to build a bulletproof income portfolio.

Click here to view the dedicated website, which includes:

- A list of income-focused ETFs, LICs and funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with leading fund managers.

- Videos and articles to help you perfect your income strategy.

4 topics