A messy oeuvre

Prior to 2020, low inflation, moderate deficits and easy monetary policy drove investment returns for an extended period. From 2021, the dominoes progressively fell; deficits were turbo charged, and whilst abating somewhat through the past year, still remain well above what they were before COVID entered the social and economic vernacular; knocking into inflationary pressures, which in turn have seen monetary policy revert to something approaching more sustainable levels. On each of these three fronts, we moved from what we saw as an extreme towards a more neutral position. In the process, for the ASX, they have disturbed some long held truisms which are starting to appear as less true than some may have wished.

The AI dream

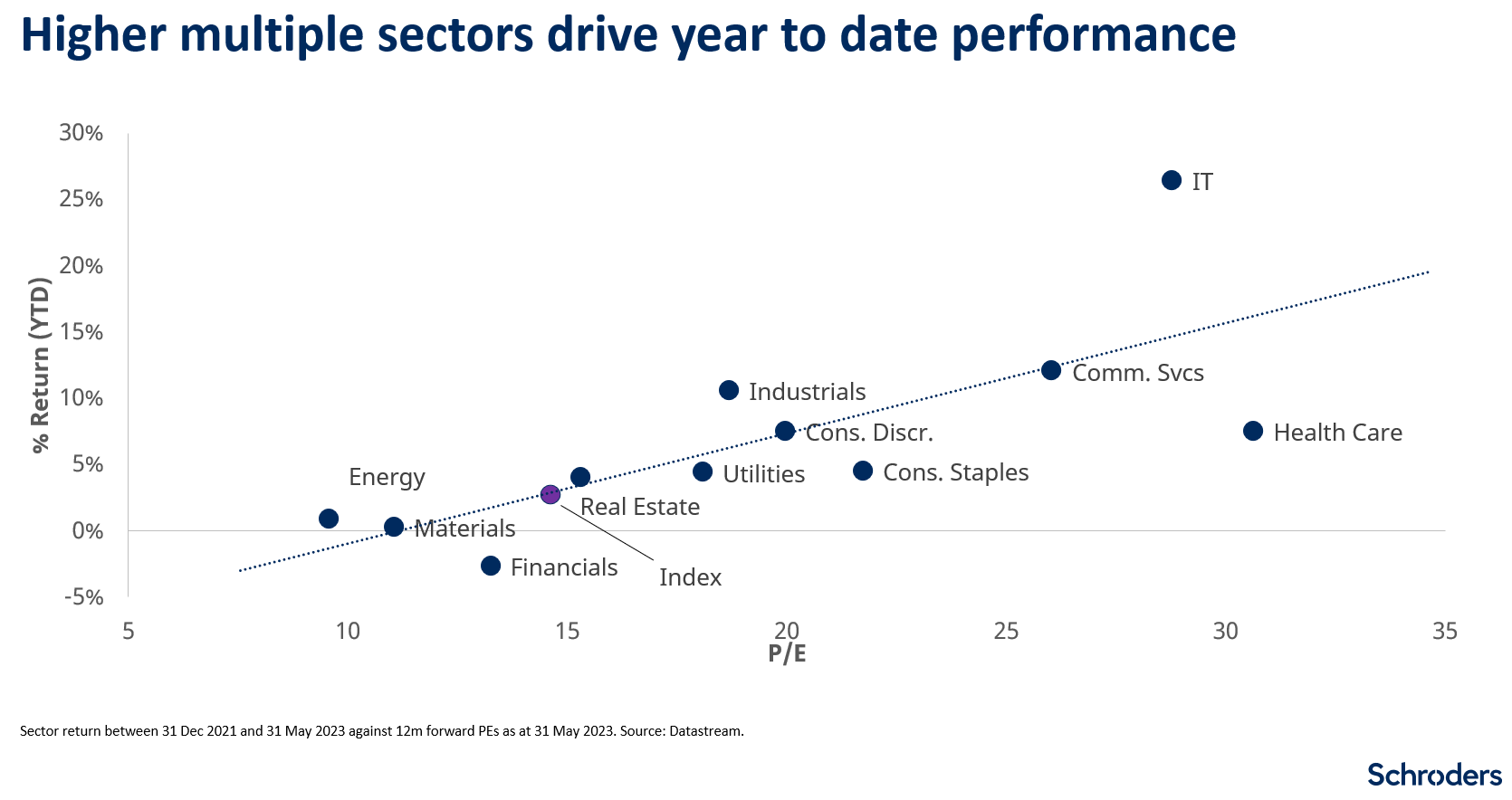

This year to date, the market has changed tack again. The AI dream has captured imaginations and driven market prices, albeit quite narrowly. Much has been written of the narrowness in return year to date for the S&P 500; the ‘Magnificent Seven’ technology stocks are 88% of the 10% market return, with the net of the other 493 stocks being effectively flat year to date. The ‘Magnificent Seven’ also have a multiple (30x price to earnings ratio) which is effectively double that of the 493 ‘rump’ stocks. The same phenomenon is apparent in Australia, with the highest returns year to date accruing to the highest multiple sectors. This isn’t reflecting earnings growth; it is reflecting multiple expansion in those sectors that have done best, in anticipation of the myriad AI benefits yet to come.

While it may well be that AI ultimately is harnessed to increase revenues, shift market shares or decrease costs for those companies currently being rerated on such potential, there is certainly nothing currently in the reported profits of ASX200 companies to reflect these benefits. And of course it is early in AI’s adoption, and that may well come, albeit it is worth recalling that it took well more than a decade for the benefits from the adoption of ecommerce to meaningfully shift profits, and notwithstanding the intuitive seduction, it is difficult to find any company which has been able to structurally reduce unit costs on the back of using it.

Within that broad framework, though, of course there shall be some winners and losers.

The most tangible benefits of AI we have heard of to date for listed companies is in rerouting applications for waste and heavy material companies running fleets of vehicles through dense traffic; and given that these systems, while currently beneficial, are not proprietary it is unclear whether they will ultimately accrue significant additional return. Indeed, even practitioners are expressing some scepticism of economic reality mapping to media hype; Sergei Burkov, the CEO of Colibri.ai, a generative AI-driven co-pilot for salespeople, celebrated the 6-month anniversary of the release of ChatGPT last week by highlighting eight early impacts it has had, the last of which highlighted “… 100% of VC firms claiming to have “always been big believers in AI” …”.

Disturbing home loan trends

Most of the good denizens of Australia would currently celebrate should AI assume responsibility for setting the cash rate. Unless, of course, it reached the same conclusion as the reviled RBA board, which has continued increasing the cash rates to the current level of 4.1%. The oeuvre of Governor Lowe’s tenure, unfortunately, shall not be lamented. In the long sweep of history, and certainly in any year previously where inflation – even declining – was 6% or above and the economy was experiencing full employment, the cash rate was above current levels, and yet public opprobrium was well less than current levels. This simply reflects growth in lending against incomes – from a multiple of less than three times some decades ago, in Australia this grew to the point where more than 25% of flow was written at a multiple of more than six times income in recent years.

This is a level which is well above that seen in many peer countries, and in some cases (such as the UK) it is at a level which is illegal.

Which is not to say that those systems do not themselves have frailties – for example, notwithstanding its other virtues, mortgages with a longer duration than 30 years in the UK represented 38% of flow last year, and the proportion of mortgages with a duration of 35 years or more doubled to 17%. This disturbing trend is starting to emerge in Australia – Ubank, a NAB subsidiary, for the first time offered those refinancing a 35 year mortgage option in February. We think APRA should stymie this trend before it takes hold. It matters for investors – the UK banks generate a higher return on tangible equity than their Australian peers, hold greater capital levels and yet are priced at half of the multiple. Australian banks, even with a challenged growth outlook, are as a sector priced relatively moderately against other sectors in the ASX200, and yet any further degradation in lending standards may well undermine their investment case. Given pressured operating earnings arising from both challenged revenues and increased compliance and systems costs, this appears unavoidable.

The canary in the coal mine

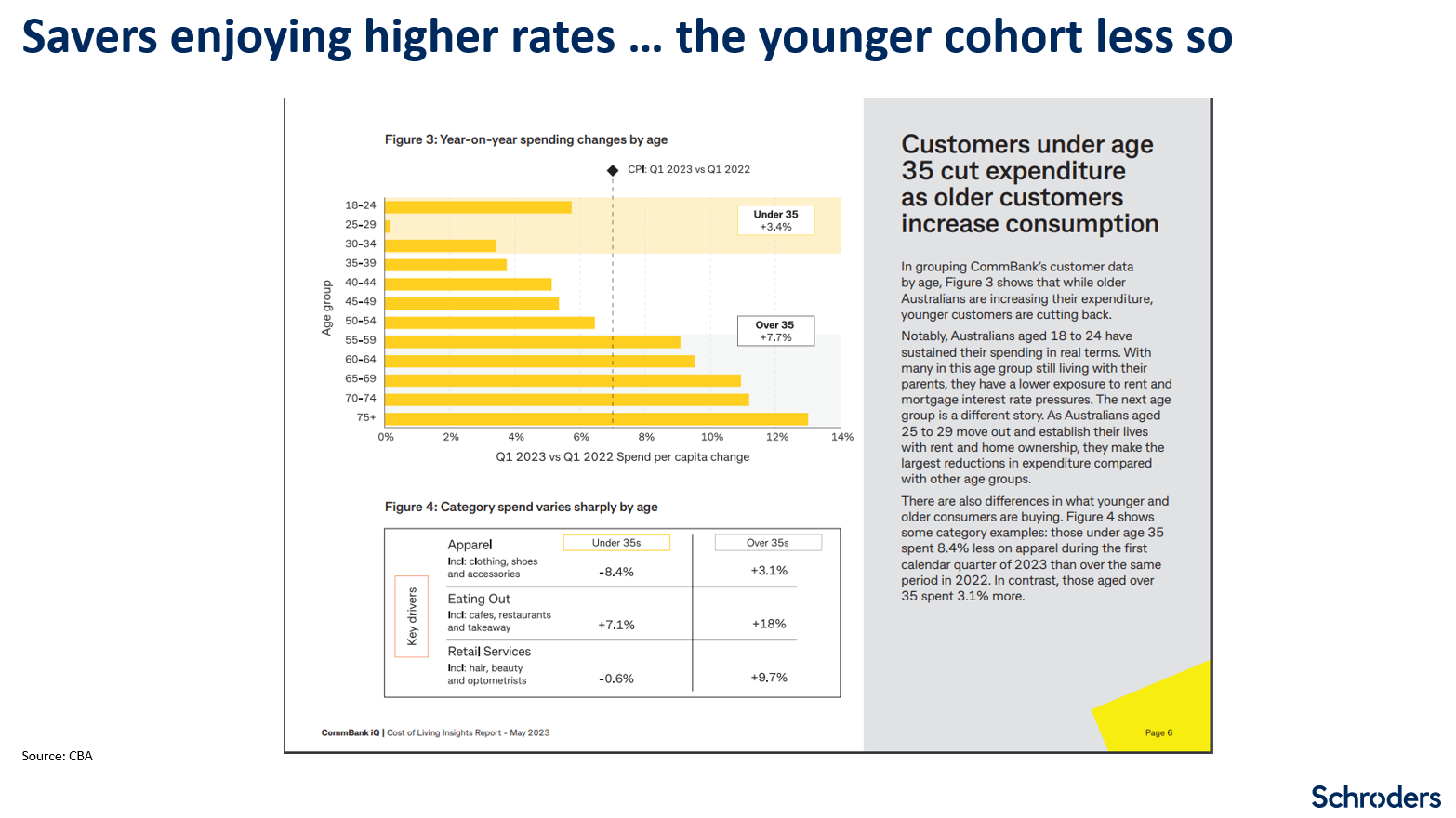

Consumer stocks have started to report the weakening in sales, and even greater weakening in profits, arising as a result of tightening conditions. Universal Store Holdings was the canary in the coal mine “… trading conditions observed throughout April and May have further tightened … The Group expects this subdued environment to continue for the balance of F23 and into FY24 …”. Subsequently, Accent Group (ASX: AX1) and Adairs (ASX: ADH) downgraded, citing similar conditions. Weakness in discretionary retail, we believe, may still be nascent and hence together with an underweight to the banking sector, this remains one of the Fund’s key positions. The interplay between mortgage stress and retail spending is heavily skewed by demographics, as would be expected, but is highlighted by CBA data.

In the face of this outlook, investor days and corporate strategies have assumed renewed importance. Qantas (ASX: QAN) hosted what amounted to a victory lap by PowerPoint for the outgoing CEO, who having painted a scenario of how the airline can prospectively avoid the cyclicality which has beset it through its history, and hence warrant a higher multiple, proceeded to sell shares. In contrast, the incoming CEO for the ASX didn’t sugar coat the investment requirement confronting the organisation, and the market reacted accordingly. Two companies in different, mature industries but both with overwhelmingly large market shares and confronting significant capital needs draining free cashflows through coming years, presenting the same factors in a different light; and getting a very different market reaction.

K.I.S.S

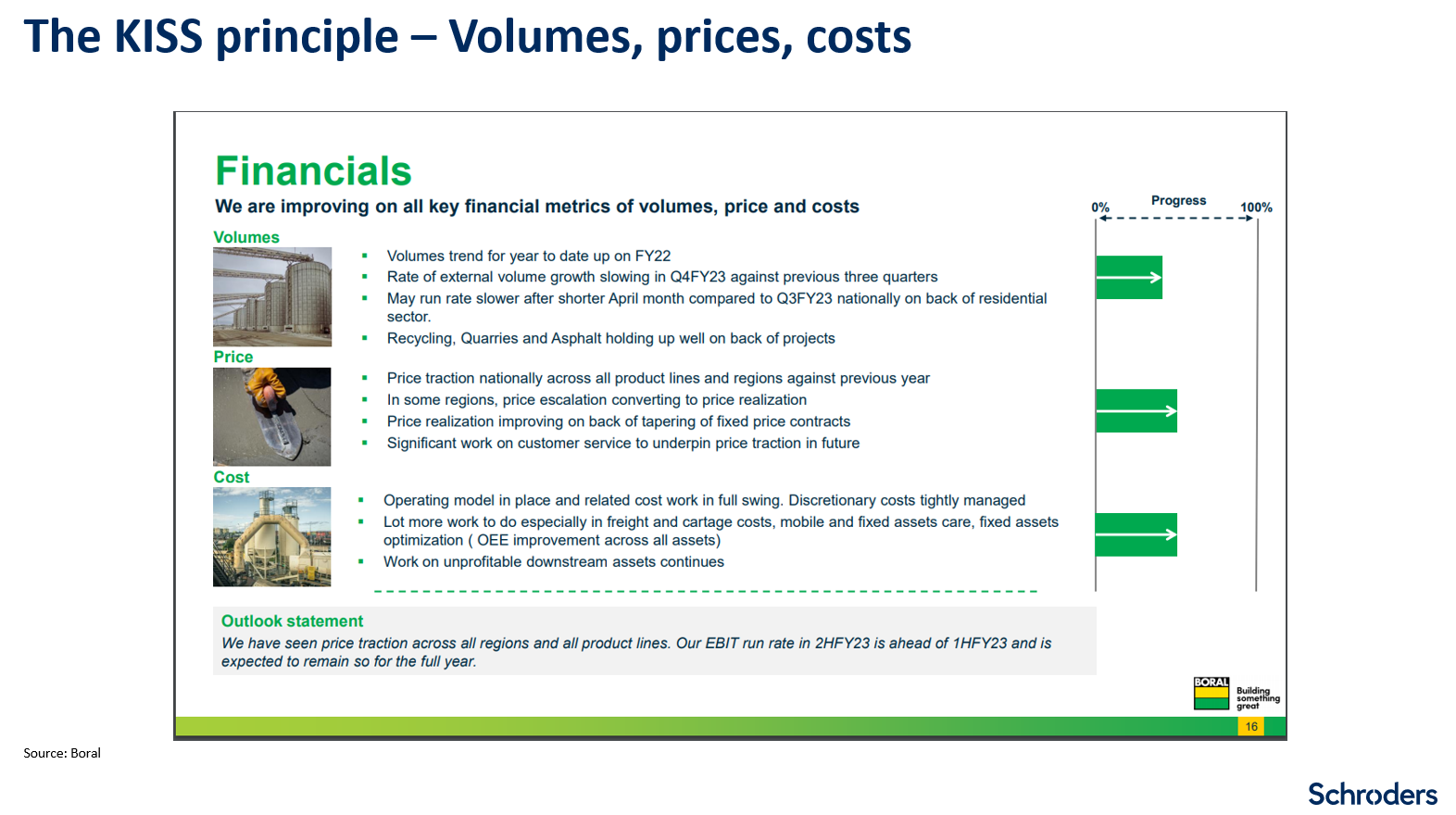

The best performing stock year to date in our portfolio is Boral (ASX: BLD), and their investor day presentation took a different tack again. Keep it simple, concrete truck driver. Their presentation material outlined their business by reference to five key pillars – PEMAF (people, environment, markets, assets and financials). Each distilling objective targets and an honest appraisal of what is being done well and where opportunity still sits. The ‘financials’ slide, as shown below, keeps it simple but gives an investor all that is needed to understand the context of all of the other PEMAF factors, by detailing impacts upon volumes, prices, costs and cash. These are simple factors; yet execution is hard, and the ability to generate meaningful free cashflow, especially in a downturn, is even harder. As we are about to see.

Market outlook

As the year progresses, hegemony may return. It may well be that sectoral and stock performance resumes a choppy path and recent winners and losers toggle as interest rates and interest rate projections change. To date, however, it has been a homogenous market through 2023 – the higher the starting multiple, the better the performance, with few exceptions. At some point, however, the first principles – cashflows and multiples – always transcend the ephemeral driver, in this case the AI driven lunge for growth stocks again. As our view continues to be that multiples for industrial stocks on the ASX are higher than they have been for most of the past several decades, and yet the cashflow growth they are producing is no better, the investment case is not low risk, should inflation (and hence interest rates) remain higher than forecast. Inflation reverting but settling at closer to 3% and liquidity continuing to be withdrawn, is a different environment for equity markets than a 2% and less inflation number with abundant liquidity. Our portfolio continues to be positioned accordingly, with major underweights to the banking and consumer discretionary sectors, and overweights to telcos and material stocks that operate in industrial markets.

Learn more about investing in Australian Equities with Schroders by visiting our website.

4 stocks mentioned