A small cap performer with mid cap potential

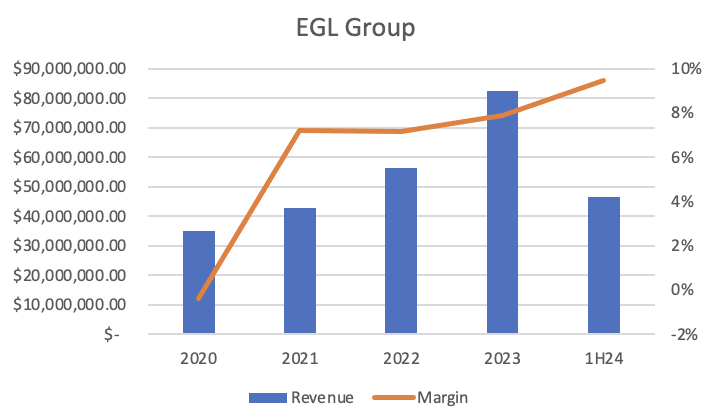

The Environmental Group (ASX: EGL) continues to exceed expectations, beating consensus earnings for 1H24 and upgrading full-year earnings guidance again to +45% growth on last year. As the business now looks likely to generate c.$10m of EBITDA and is close to surpassing the $100m market cap, we think it will start to attract capital from a new group of investors.

In this wire, we’ll provide a brief update on the result and the outlook from here.

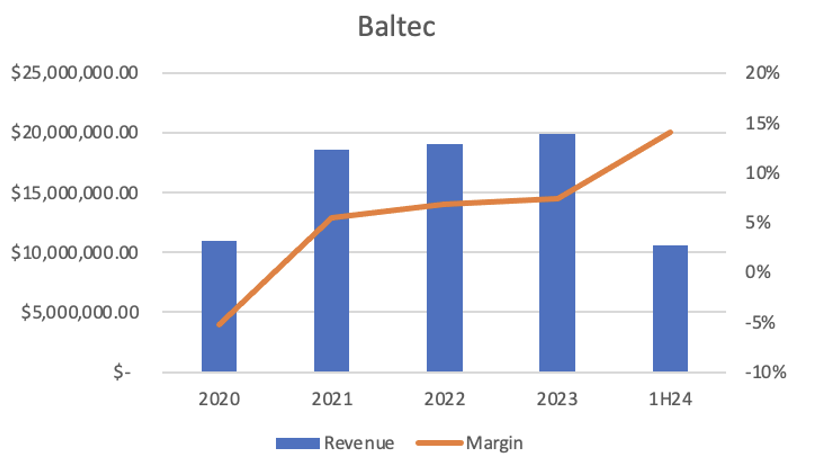

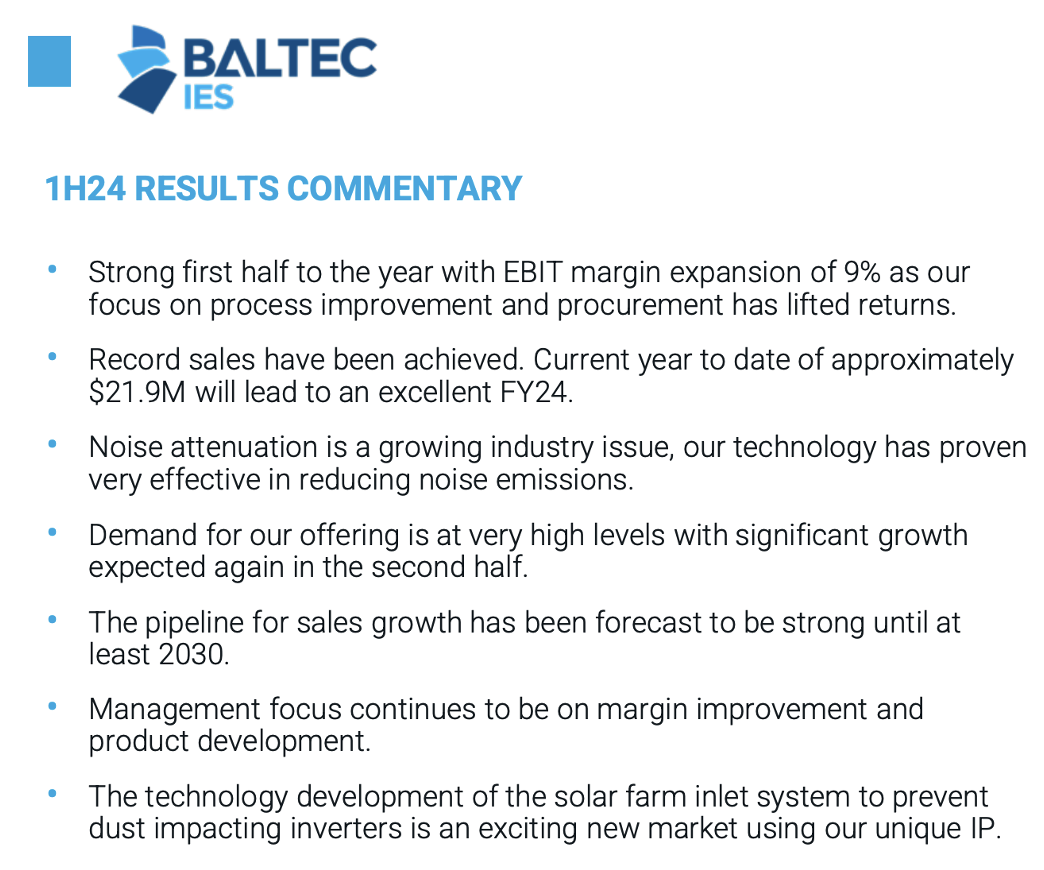

Baltec

Baltec was the star performer with EBIT margins doubling in 1H24 vs FY23. But the most positive sign was the strength of the outlook for this business and the expected revenue growth in the second half and into FY25.

To take a step back and explain what’s driving Baltec’s growth – Baltec provides solutions to the gas turbine industry. What was once a steady business is now seeing a multi-year growth spurt driven by the increased demand for gas turbines as the industry deals with the transition to renewables.

This is driving the transition from base to peak load energy generation, which currently requires a gas turbine to provide the enormous levels of power required at the peaks. Previously, these turbines might be turned off once every three years. Now they might be turned off twice a day.

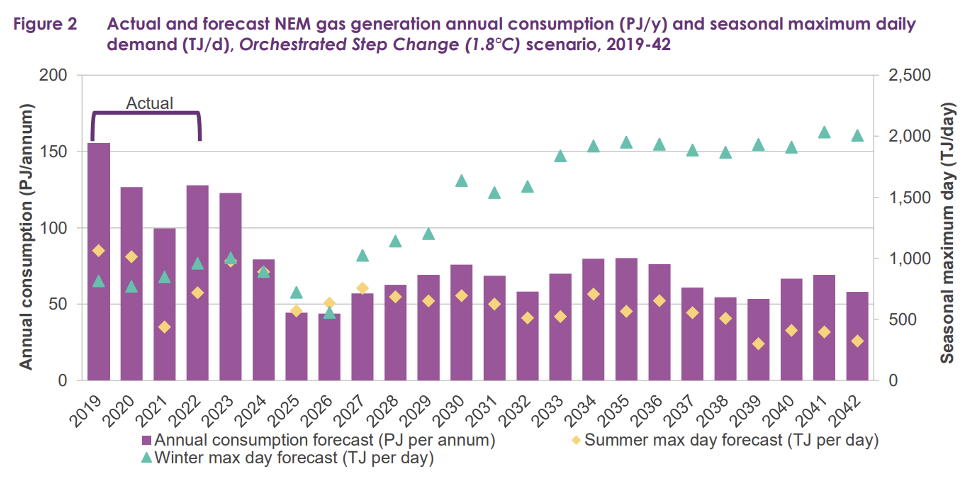

Most solutions in the market currently are not equipped to handle this, on top of the fact that we simply need a whole lot more gas turbines in the power grid if the renewables transition is to be achieved. The image below from AEMO provides an overview of how gas generation is expected to decline, but the peaks are expected to be materially higher.

Baltec provides a technology called a silencer that sits above the turbine and provides a noise abatement solution. EGL claims that Baltec has the only silencer in the market that can handle peak load without degradation of equipment and is therefore being inundated by demand as the power industry prepares to make this transition. The company is seeing strong demand out to 2030.

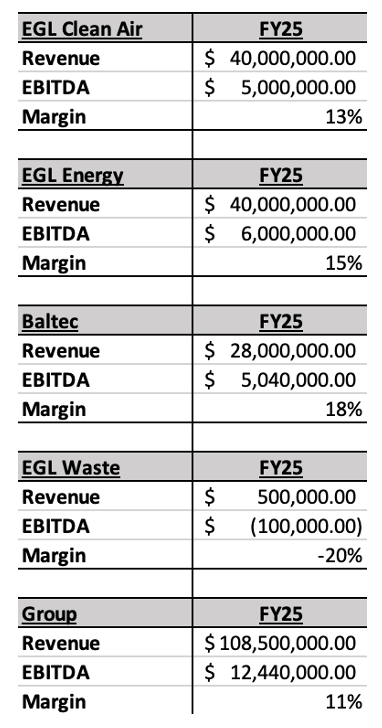

Baltec is a fixed cost business with plenty of operating leverage. In 1H24, EGL invested in Baltec’s capacity by adding to the team, and we now expect them to be able to generate c.$28m of revenue per annum, with capacity booked out for the rest of the year.

At that level of demand and the current gross margins being achieved, Baltec could exit 2H24 run-rating at $5m of EBITDA per annum. We think the market is underestimating the earnings potential of what was once a steady little business but now has tailwinds for growth out to 2030 and a clear technological edge over competitors.

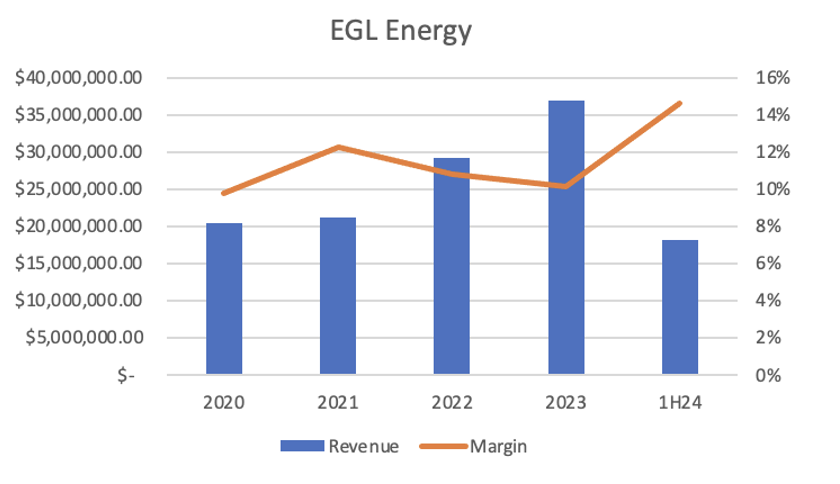

EGL Energy

EGL Energy is a great little business that sells, maintains and services boilers with primarily recurring revenue (75% of earnings are derived from service and maintenance work) and a unique national site presence that creates cost advantages and barriers to entry.

The addition of Ignite, acquired two years ago, has been a success with earnings doubling over that period.

Margins were the driver of earnings in the half, with the one-off impacts in the pcp (high steel prices, shipping costs) all normalising. Margins are now running near 15% and should remain strong.

EGL Energy will continue to be a steady earner as recurring revenues grow off the back of the expanding installed base of equipment, which will be driven by work won in EGL Waste and a recent large contract win for boilers at a WA refinery. We love steady growers with large recurring revenue bases and well-defined competitive advantages, as in time, the market tends to put them on high earnings multiples. EGL Energy fits that bill.

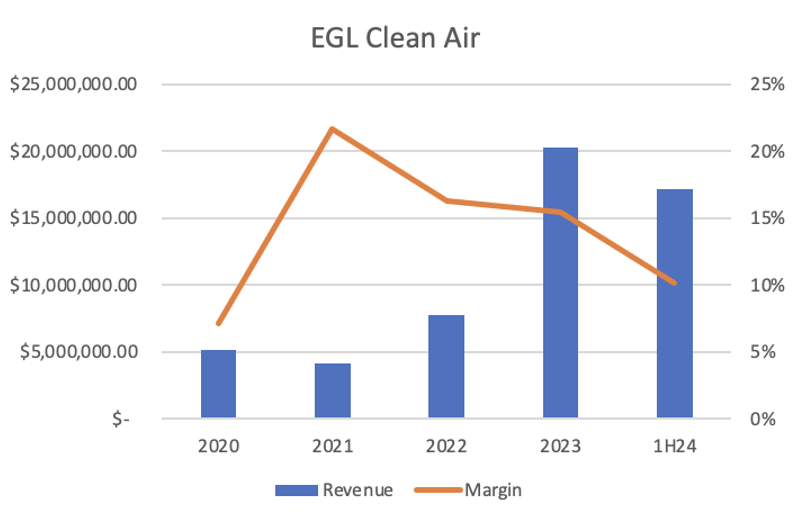

EGL Clean Air

Through FY23, EGL management had been vocal about their intention to improve margins and processes. Through all the business units in 1H24 (and at the group level) there was a clear margin expansion story because of this focus. Except, for EGL Clean Air.

Revenue was up substantially (+78%) but EBITDA margins fell from 16.2% to 10% (earnings up +12%).

The reason for the above was the timing of the acquisition of AirTight in May 2023, a business similar to TAPC that provides air pollution control systems, but to SME clients rather than the larger enterprises TAPC typically services.

As a result of the slightly different business model of AirTight vs TAPC (larger number of smaller clients requiring a larger sales team), the margins are always going to be slightly lower in AirTight than in TAPC. Where TAPC has consistently achieved >15%, AirTight should be closer to 10%.

If you break out TAPC’s revenue and EBIT contribution in 1H24 from EGL Clean Air, you’ll note AirTight contributed $8.4m revenue and EBIT of $340k. This includes about $200k of one-off costs associated with the integration, which many management teams would have pulled out in the underlying figure, but wasn’t done here (arguably too conservative, but the benefit will show up next half).

That would suggest Airtight was running at about a 6% normalised margin in 1H. We understand margins are improving in 2H and medium term (18 months) should approach 10%. That’s a material lift in earnings for the EGL Clean Air segment just from improved purchasing, systems and processes.

EGL management now has a track record of successfully acquiring, growing and improving businesses, so this is high odds of being reflected in the full-year results, and more so in FY25.

There is some lumpy project work in TAPC selling to large enterprises, but it’s the higher margin recurring revenue that we track as the key indicator. This was up 64% in the half to $3.6m. Recurring revenue from servicing and spare parts is now greater on an annual basis than TAPC’s entire revenue when Jason first joined and implementing this same focus in AirTight is a significant opportunity. This too will support both top-line growth and margin expansion for EGL Clean Air.

One of the negative takeaways in the 1H24 result for the segment was the way the price routs for commodities like lithium, nickel and rare earths have impacted the pipeline of new works for TAPC in the mining sector. What the market has missed is that this has almost entirely been replaced by work in the pipeline for EGL Waste, where AirTight already has $6m of tenders out.

EGL Waste

Despite the strong 1H24 result, there was a negative earnings contribution from the Waste segment, compared to $800k of EBITDA in FY23. It’s possible the market interpreted this as a negative, when in our view the fact the group result was so strong without Waste firing was impressive, and the outlook is increasingly positive.

The reason the 1H24 Waste result was subdued was the delays to approvals and contract signings for the construction of large-scale recycling plants as the Government extended the deadline for new regulations to be implemented from 2028 to 2030. Over the last 12 months, EGL had flagged that client decisions were being put off in response.

A key takeaway from the investor call was that this has now changed. Approvals have been issued and investment decisions are being made. If this proves true it is a substantial net positive to EGL, and provides earnings upside not reflected in the current share price.

As a reminder of the EGL Waste business model, as a representative of Turmec, EGL earns commission revenue (typically 2%) based on the total value of the contract. This is effectively 100% margin to the bottom line.

The value of the near-term pipeline is currently >$120m and industry estimates $5-$8b of required CAPEX spending on new recycling and energy-to-waste plants between now and 2030.

But the real value in this business unit is in how its pulls through demand for the rest of EGL’s business units. The waste plants require dust extraction systems (EGL Clean Air), the medical waste sector uses boilers (EGL Energy). In time there may be demand for PFAS treatment plants from EGL Water.

For some context, we understand that for two of the most prospective deals in EGL Waste’s pipeline there’s more than $12m of work to be generated in the other business units, followed by potential servicing and spares work that is recurring in nature.

Waste did not feature strongly in 1H24, but it is a big part of EGL’s future, and if the market can be shown this is the case we think it’s a potential catalyst for a re-rate.

EGL Water

The optionality in EGL Water is so substantial that it would be remiss not to talk about it, but it is also true that the time taken to commercialise the technology has been longer than both management and the market initially estimated.

Since our last update, EGL sold their first commercial PFAS separation plant to a client, but we have been waiting for news regarding the EPA approvals allowing the operation of the plant on site. This process was handled by the site operator, not EGL, but at the results the company told the market all submissions had been made and approvals were expected this quarter.

It is our understanding that while the delays to final approvals have meant material revenue generation was pushed back, the work done on building the sales pipeline has continued. The opportunity is still as real as it was when first communicated to the market.

If EGL can start to show traction in EGL Water and generate material revenues from this business unit, then we will write an update dedicated just to that subject, as it is worth understanding. In the meantime, view it as optionality.

Outlook

At the result EGL upgraded FY24 EBITDA guidance to +45% over last year, which implies $9.7m, or an EV multiple of 8.8x. Since Jason Dixon (CEO) and his team joined, all key financial metrics for the group have moved in the right direction and the company has built a reputation for upgrading earnings multiple times throughout the year, something that tends to get priced into the stock positively over time.

But what we think the market is missing is the level of visibility for earnings growth into FY25. It’s our view that EGL’s focus on margin and process improvement is only halfway reflected in the numbers, while the key themes they’re exposed to will drive revenue growth for several years.

On this basis the company looks capable of generating $12m+ of EBITDA in FY25 which if achieved would put the stock on 7x EV/EBITDA and is too cheap for a business like this. It could command double and still look very reasonable vs peers.

Our assumptions to get to $12m+ aren’t heroic either. We have assumed EGL Clean Air benefits from AirTight’s expanding margins, EGL Energy generates 10% revenue growth and stable margins and that Baltec executes on its record order book.

We have not assumed any material impact from EGL Waste or EGL Water in our numbers, which is arguably too conservative, particular for Waste, which is likely to be a material contributor, while EGL Water is more difficult to forecast. This doesn’t mean we don’t expect these business units to perform, only that we wish to be conservative in our valuations – we’d be happy to be surprised on the upside.

On this basis, EGL continues to be our largest holding in Inception Fund. We’ve been impressed with management’s execution and believe the current price reflects a very attractive entry to what should be a multi-year growth story.

5 topics

1 stock mentioned