A stock for all terrains

ARB manufactures and sells a wide range of 4WD accessories, with a dominant footprint in the Australian market and a growing presence offshore.

After a stellar 2020-21 result, and recent confirmation of further growth in first quarter 2021-22, we believe ARB (ASX:ARB) is well placed to sustain attractive earnings growth for many years to come.

In this wire, we explore the outlook for domestic growth and explain why ARB is now well positioned to roll out a store network in the USA.

Domestic growth

Despite the significant growth in ARB’s export sales over the past decade, the domestic business remains the engine room, generating about 65% of group sales. Our expectation of sustained sales growth in ARB’s domestic business is based on:

1. The ongoing structural shift towards SUVs and 4WDs, which reflects the attractive versatility of use and the significant effort of vehicle manufacturers to improve vehicle comfort and performance. New vehicles represent an important source of demand for accessories, such as those sold by ARB.

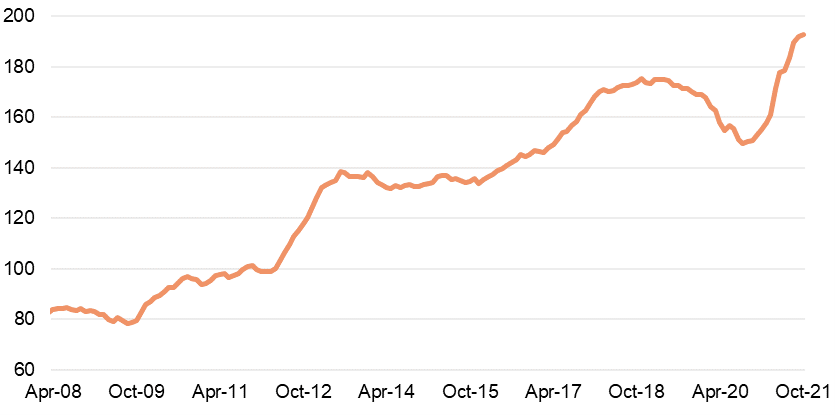

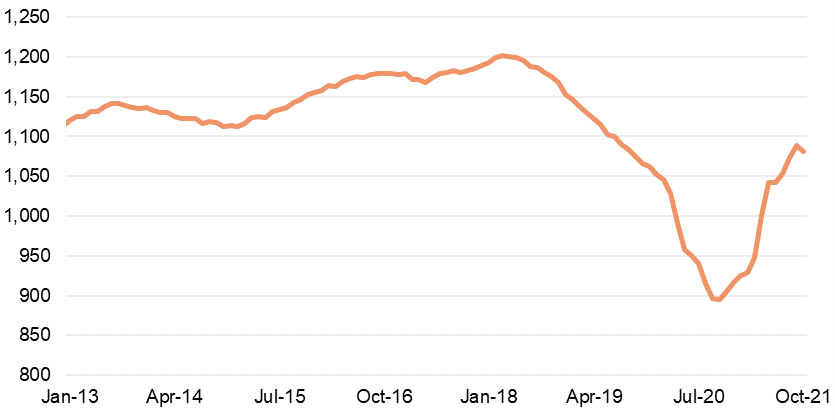

Rolling 12-month new vehicle unit sales for the 4X4 segment (eg, Toyota Hilux, Ford Ranger) are at record highs, while the total new vehicle market is still about 10% below its highs.

4X4 segment new vehicle sales, rolling 12m units

Source: FCAI

Total market new vehicle sales, rolling 12m units

Source: FCAI

2. Benefits from the Federal Government’s instant asset write-off scheme, which allows eligible businesses to claim an immediate deduction on the cost of an asset, such as a new vehicle. The 2021 Federal Government Budget extended the scheme through to 30 June 2023.

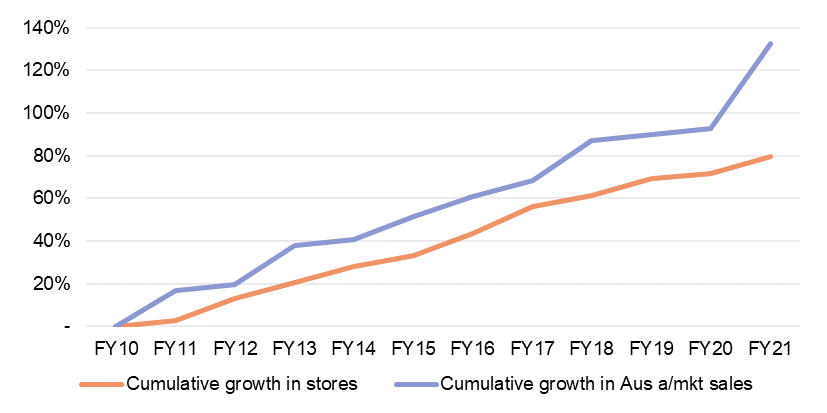

3. Expansion of ARB’s store network, which has enabled ARB to capture the growing demand for 4WDs and associated accessories. Since 2010, ARB’s Australian store network has increased by 80% and sales in ARB’s Australian aftermarket segment have increased by 133%.

Cumulative growth in ARB’s domestic store network vs Australian aftermarket segment sales since 2010

Source: ARB

Store network rollout in the USA

ARB has been selling product into North America for over 30 years and currently wholesales product to more than 1,300 dealers, primarily serviced from two warehouses in Seattle and Jacksonville.

In our view, the company is now well positioned to rollout a store network in North America, based on:

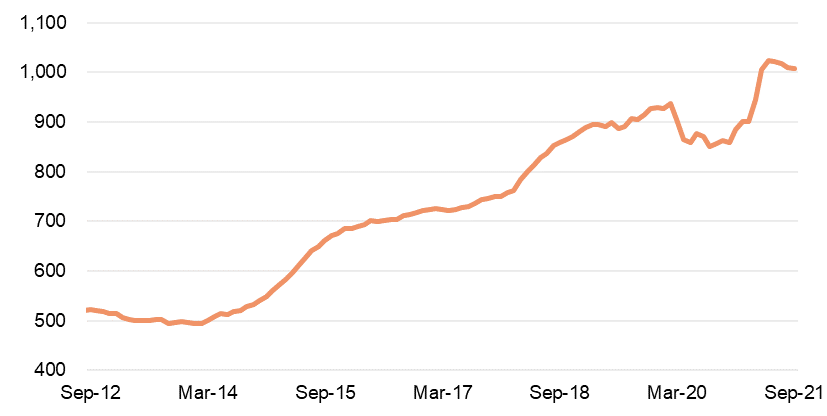

1. Attractive market scale and growth. The USA aftermarket truck accessory market was estimated at US$10B in 2016 and is likely to have increased since then. The mid-size truck market alone (eg, Jeep Wrangler, Ford Ranger) accounts for about 0.9m new units sold pa, which is more than 3.5 times the size of the equivalent Australian market and about 13% above the previous peak in 2007. This highlights the attractive scale and underlying structural growth profile of the market.

USA mid-size truck new vehicle unit sales, rolling 12m units

Source: GoodCarBadCar.

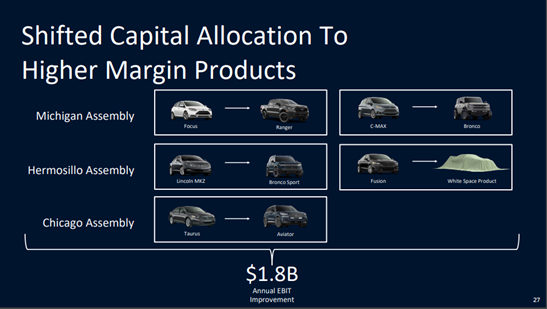

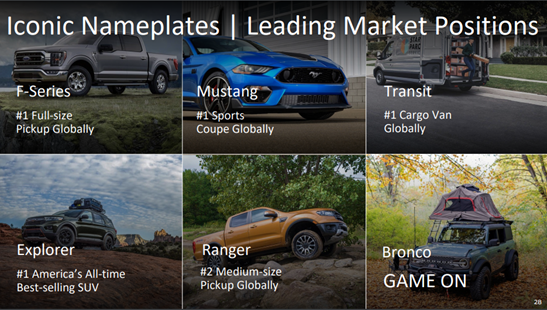

2. Increased focus on the mid-size truck market. Ford Motor Co is increasing its capital allocation to production of mid-size trucks (eg, Ranger and Bronco), which are considered a more relevant vehicle type to the ‘overlanding’ market and associated demand for accessories.

Ford shifting capital allocation to higher margin products

Source: Ford Capital Markets Day Presentation (2021)

3. Enhanced brand awareness. ARB is supplying branded product to Ford for factory / dealer-fitted accessory packages, with first sales expected in second quarter calendar 2021. At its recent AGM, ARB alluded to the potential for further partnerships with vehicle manufacturers.

4. Broader product range. On the back of the collaboration with Ford, ARB has expanded its range of products designed specifically for North American vehicle models.

We assess a realistic target for ARB will be a network of 90 stores in North America and, with sustained complementary sales growth in the wholesale channel, we believe ARB could generate USA segment revenue of more than $700 million by 2034-35, compared to the $88 million reported in 2020-21.

A combination of structural growth in demand for 4WDs and associated accessories, and an opportunity to accelerate growth in North America through a store rollout, sees ARB well positioned to sustain attractive earnings growth for many years to come.

Realise your ambition

At Wilsons, we think differently and delve deeper to uncover a broad range of interesting investment opportunities for our clients. Stay up to date with all my Australian Equity insights by hitting the follow button below.

2 topics

1 stock mentioned