A2 Milk delivers yet again

Never before has the Australian small and mid-cap equity market experienced such a broad variety of Australian and NZ-based businesses achieving stellar success in overseas markets. Where offshore expansions have long been an investment graveyard for larger-cap Australian businesses desperately looking for growth avenues to supplement mature domestic market positions (see National Australia Bank, QBE, AMP, Wesfarmers/Bunnings amongst others), a new cohort of globally-focused emerging Australian companies have thrived in entering new territories.

Specialist dairy and infant milk formula producer The A2 Milk Company (A2M) has been one such notable performer, a business that only six years ago was a A$210m market cap NZ-based fresh milk producer generating $48.6m in revenues from the sale of bottled A2-only milk into supermarket chains in Australia and New Zealand.

Today, the same humble Kiwi milk producer now commands a market capitalisation of over A$9.7bn, selling fresh milk and infant milk formula (IMF) products into Australia, New Zealand, China, the US and UK and will deliver an expected ~A$1.25bn in revenue for the 2019 financial year.

The business commands the number one market position for infant milk formula sales in Australia, already speaks for 5.7% of the $20bn Chinese infant milk formula market and recently announced A2-branded bottled milk now being sold in over 12,000 stores in the United States. It now holds more cash on its balance sheet that its entire market capitalisation in 2012.

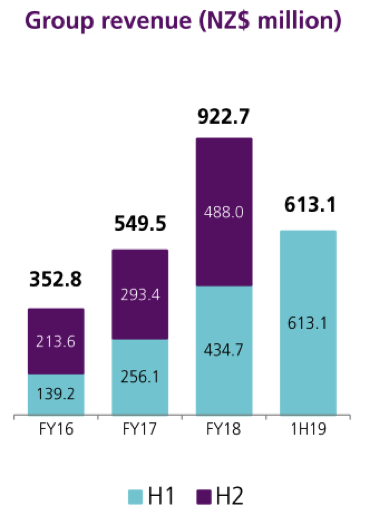

Source: A2 Milk Company Half Year Interim Results FY19 Presentation

Key takeouts from today's result

The recently announced first half result from the company again highlights how far the business has come in recent years and the momentum it continues to see across all geographies and product lines.

Group revenues grew +41% on the previous corresponding period, while earnings before interest, tax, depreciation and amortization (EBITDA) grew +53%. The result was a 8-10% ‘beat’ to underlying market expectations, with the stock subsequently rising +8% on the day.

Strong performance at the margin line was particularly noteworthy at this result, with gross margins across the business coming in at a healthy 55.5% as the company benefits from increasing scale, price increases and a continued shift in sales mix towards the more profitable infant milk formula products. The margin performance provides an excellent example of the strength of the business given a material increase in recent months toward investments in marketing and brand.

Growing footprint in China and US markets

Infant milk formula sales into China continue to be a key driver, with the business now benefiting from landing product into China via a variety of channels. Where initially the company saw enormous growth via the cross-border e-commerce channel (where individuals would purchase tins of A2 formula in Australia, take offshore and sell to Chinese parents via online market places such as Tmall or Taobao), the company now has an in-country presence in over 12,250 Mother and Baby stores, resulting in +83% growth in China-label tins from the same period last year.

While still only a small market by current revenue contribution, the growth the business has experienced this half in the United States is worthy of mention. Fresh milk sales in the US doubled over the period, with management noting they are seeing similar parallels to the brand building experience of their initial Australian roll-out – a pleasing anecdote considering the US milk market is worth in excess of US$13 billion per year with an underlying consumer already sympathetic to the alternative dairy market. With further distribution agreements recently signed with national US supermarket chain Krogers and additional regions with Costco, Walmart and Safeway stores we expect the growth to continue to compound from here. Importantly, it was the success of the fresh milk product in the Australian market that ultimately provided the company with the credibility required to underpin the success of its now immensely popular infant milk formula business – a market opportunity within the US that isn’t yet garnering any attention.

Significant growth opportunities still lay ahead

With a significant amount of runway left for the business in the two largest economies in the world, we continue to maintain confidence that the company will be a significantly larger one in years to come. Pleasingly, we entered February with the stock as the second largest held position across the Ophir Funds and we very much look forward to continuing to monitor and enjoy the business’ growth from here.

1 topic