AI, Bitcoin, Electric Vehicles, and more: ARK Invest's 10 charts for investing's biggest megatrends

Let's face it. Every investor is a dreamer. Lots of us hope that our micro-caps will become nationally revered stocks one day. Some of us hope that the stocks we buy are in companies that will end up changing the world for the better. Others hope that the assets we invest in will help reform an ageing or out-of-date concept.

All of these aspirations require innovation, or if you prefer the marketing equivalent, disruption.

When the COVID-19 pandemic upended all of our lives, many asset prices befitting these qualities took off. Vaccine makers, micro-cap health plays and most significantly of all, Bitcoin and Buy Now Pay Later all saw their share or asset prices skyrocket.

And it's in these companies that ARK Invest plays in. The company, founded by Catherine Wood, is now world-famous for its thematic approach to investing (as well as several bold calls).

In this wire, we're going to summarise the big ideas ARK Invest is watching throughout 2023 through ten charts that will cover most of the major themes in the report.

Artificial Intelligence (AI)

Few things have captured the imagination of the everyday investor quite like artificial intelligence. From artwork fed by word prompts to Microsoft's financial backing of ChatGPT, AI has the power to make work more cost- and time-efficient.

ARK's own forecasts suggest artificial intelligence could increase skilled work productivity by more than 4-fold by 2030. At 100% adoption, they believe AI could increase global labour productivity by US$200 trillion.

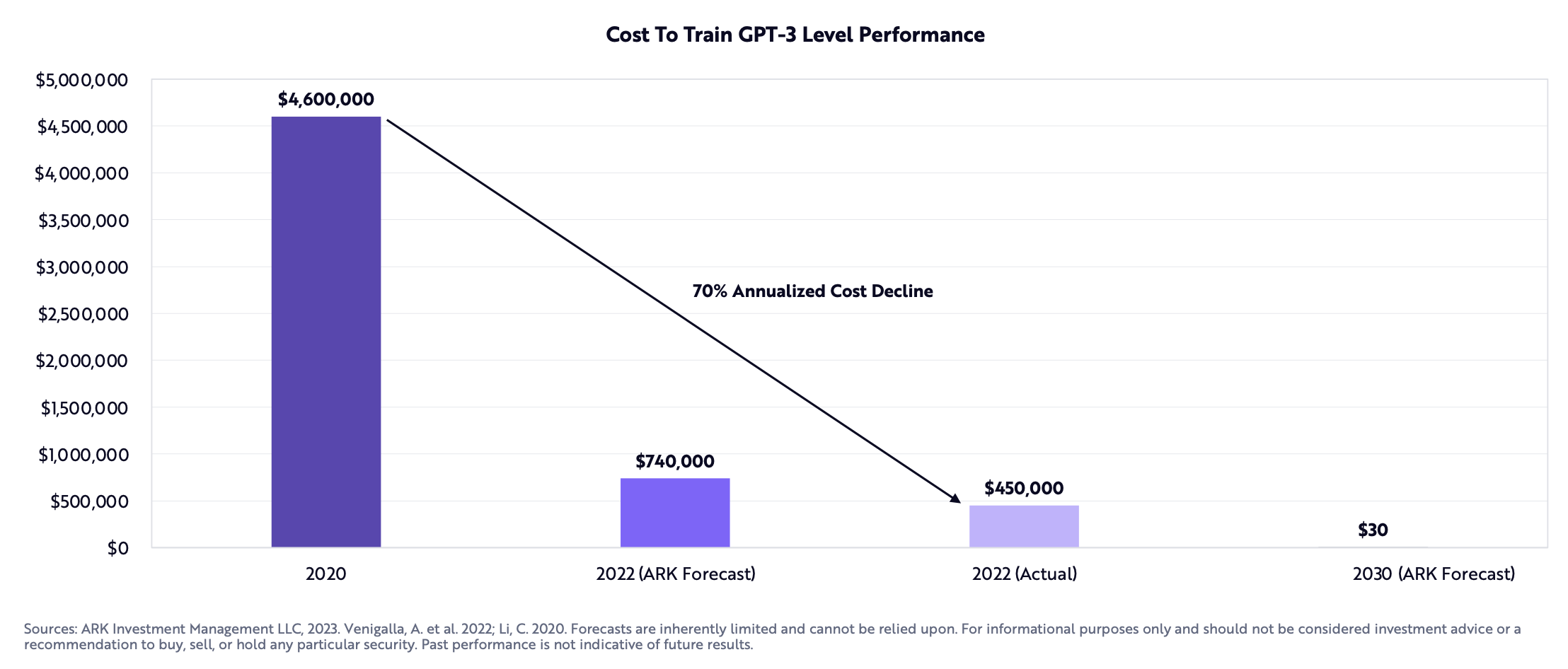

The first chart illustrates this cost saving in a nutshell. ARK's research team suggests AI training costs are coming down at a rate of 70% a year.

AI Training Costs Continue To Plummet (Source: ARK Invest)

And those cost declines appear to be already showing up in places like generative Artificial Intelligence (e.g. ChatGPT). The OpenAI product is designed to generate text through user prompts. But it's turned out to be a lot more than just a cheeky writing tool, doing everything from TV script writing to penning entire university essays.

Semafor now values the bot at US$29 billion, buoyed in large part by a US$10 billion investment from Microsoft. The investment comes off the heels of Google releasing its own AI chatbot called Bard.

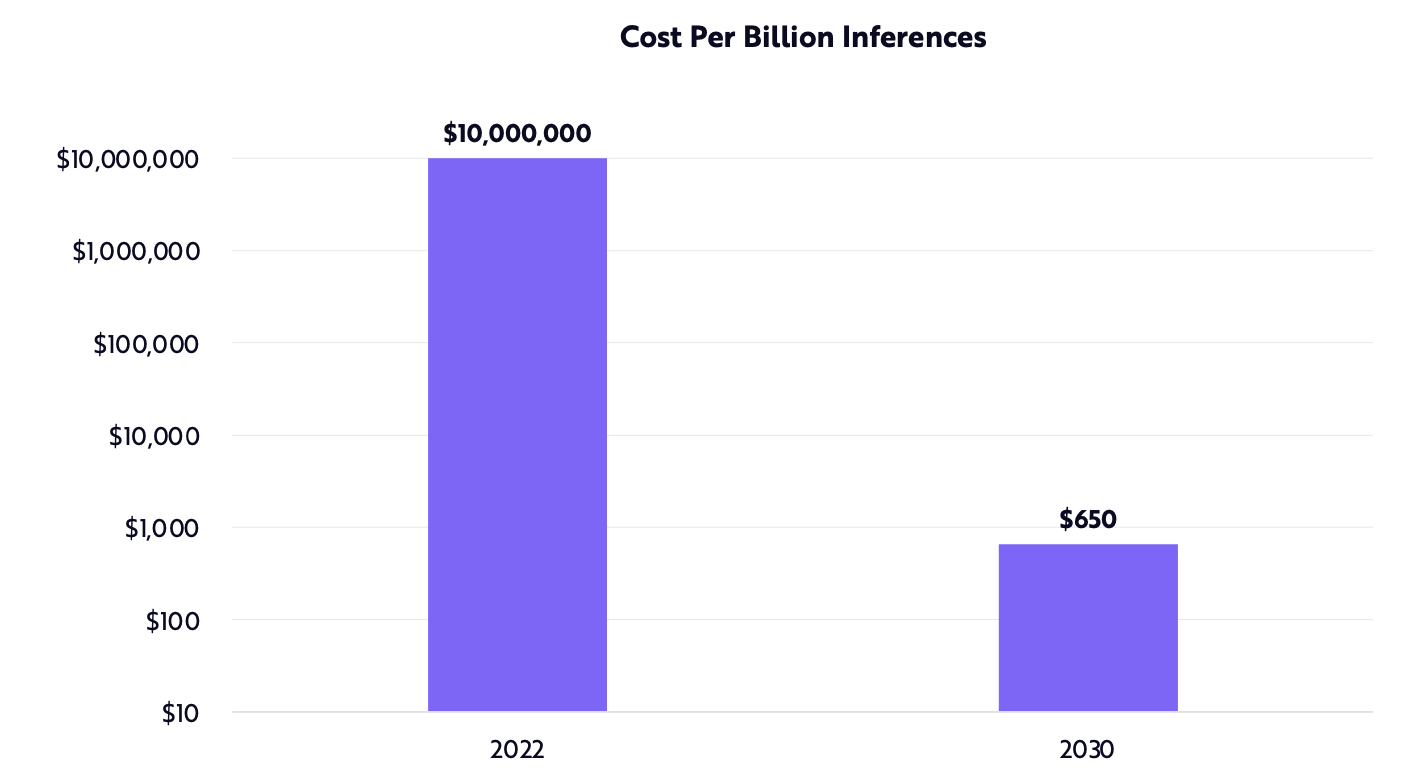

But the biggest opportunity might be in its operating cost. In the future, every ChatGPT query could cost as little as one cent to run and that's great news for the companies that can run it and then scale it.

Cost Declines Should Enable Mass Adoption Of Sophisticated AI Chatbots (Source: ARK Invest)

Digital Consumers

As of the end of 2019, cash payments still made up more than 30% of the Reserve Bank's Consumer Payments Survey here in Australia. But the pandemic has turbocharged the shift from physical payment to digital payment. The consumer is more digital than ever and now, you can commit to whole lives on the internet. This section of the ARK Big Ideas paper focuses on what people want to do with all those digital payments: digital leisure.

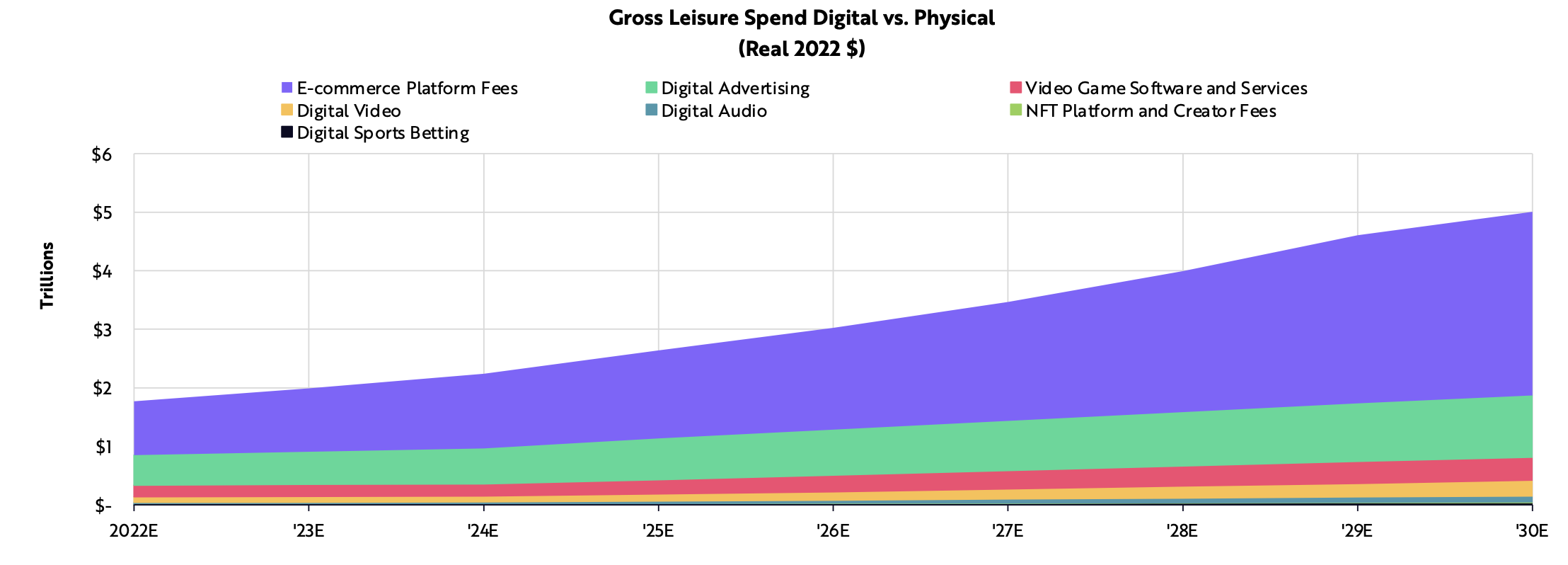

The increase in gross leisure spend, including ARK's forecast is the subject of this next chart. They predict the bulk of the surge in spending will go into eCommerce (online shopping).

Digital Leisure Revenue Could Reach $5 Trillion Globally In 2030 (Source: ARK Invest)

The ARK team believe we'll see an acceleration in online-centric leisure activities in four ways:

- Connected TV (known in Australia as the Smart TV)

- New social platforms

- Sports betting (long legal in Australia, only just gaining legalisation in parts of the US and Canada)

- Video games

The growth in all these thematics is varied. Connected TV is likely to earn its increased value from the decline in linear TV. New, content-centric social platforms such as TikTok will likely earn their revenues at the expense of incumbents Facebook and Twitter. Roku (NASDAQ: ROKU) is the top individual holding in the ARK Next Generation ETF as well as a major holding in the company's flagship ARK Innovation ETF (the one run by Cathie Wood.)

But the real growth is in sports betting and video games. Sports betting has only just been legalised in some US states as well as Canada.

During the 2021/2022 NFL season, total sports betting in the US and Canada increased an estimated 83% year-over-year, to $117 billion. Online volumes also quintupled that year. DraftKings (NASDAQ: DKNG) is another core holding in the ARK Next Generation ETF.

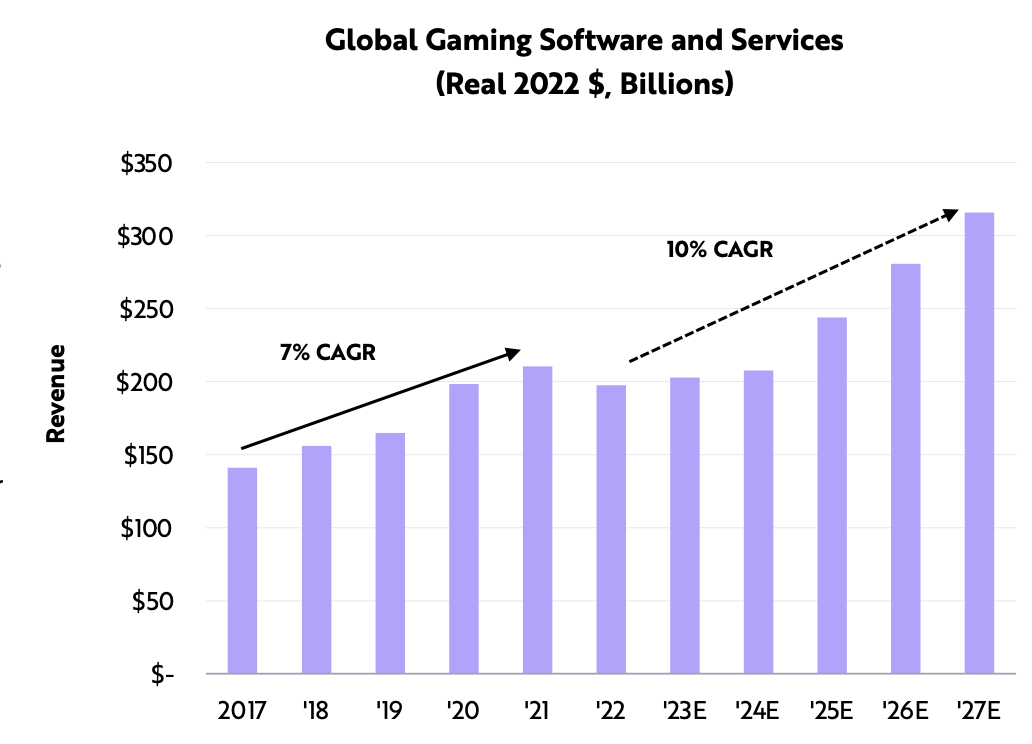

In gaming, it's all about the intersection between software revenues and social media integration. ARK says that trade could compound at a rate of 10% a year through 2027.

Immersive Virtual Experiences Should Galvanise The Next Wave Of Gaming (Source: ARK Invest)

Electric Vehicles

Just as you cannot talk about Warren Buffett without mentioning Apple, you cannot mention Cathie Wood without mentioning Tesla (NASDAQ: TSLA). The Elon Musk-run company is 10% of Wood's flagship ETF and 15% of the ARK Autonomous Technology and Robotics ETF.

In fact, she's so bullish on Tesla that she thinks it's an alternative way to get in on the ChatGPT trade.

"Tesla is one of the most profound AI companies out there ... Autonomous taxi platforms, we believe, are the biggest opportunity in the next five to 10 years out there around artificial intelligence." (Wood on Bloomberg Television, February 10 2023)

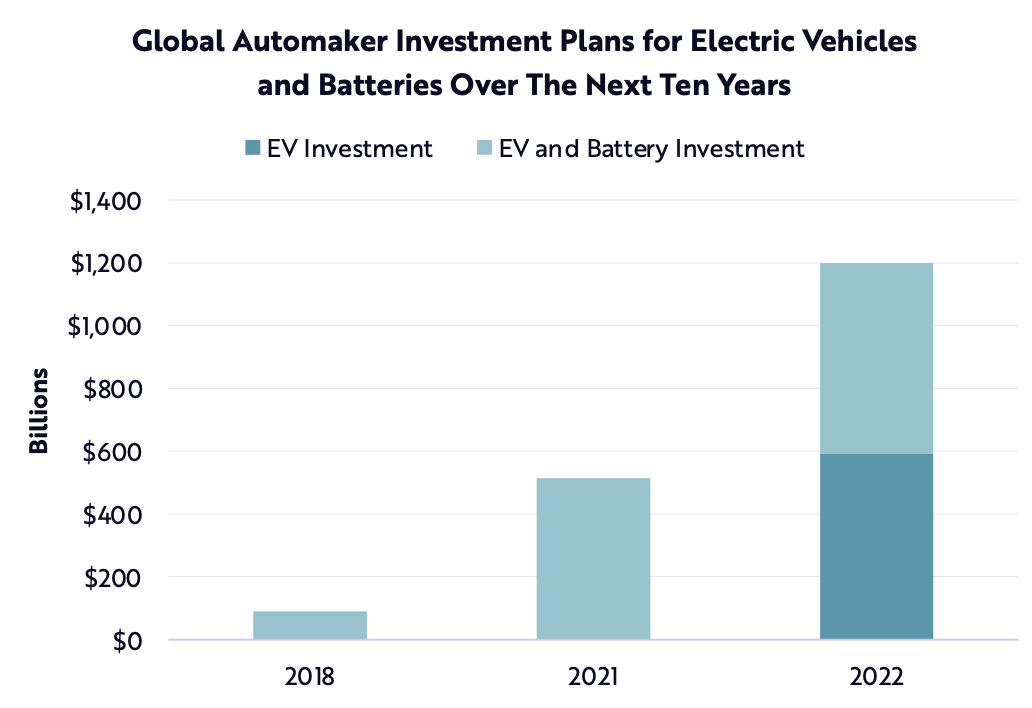

Whether you back Musk (and Wood's vision) or not, you cannot deny Tesla's first-mover advantage into the EV space. And many other brands continue to follow since. This chart is a small illustration of what Tesla started.

Global Automakers Have Increased Investment Plans For EVs And Batteries More Than 10-Fold Over The Past Four Years. (Source: ARK Invest)

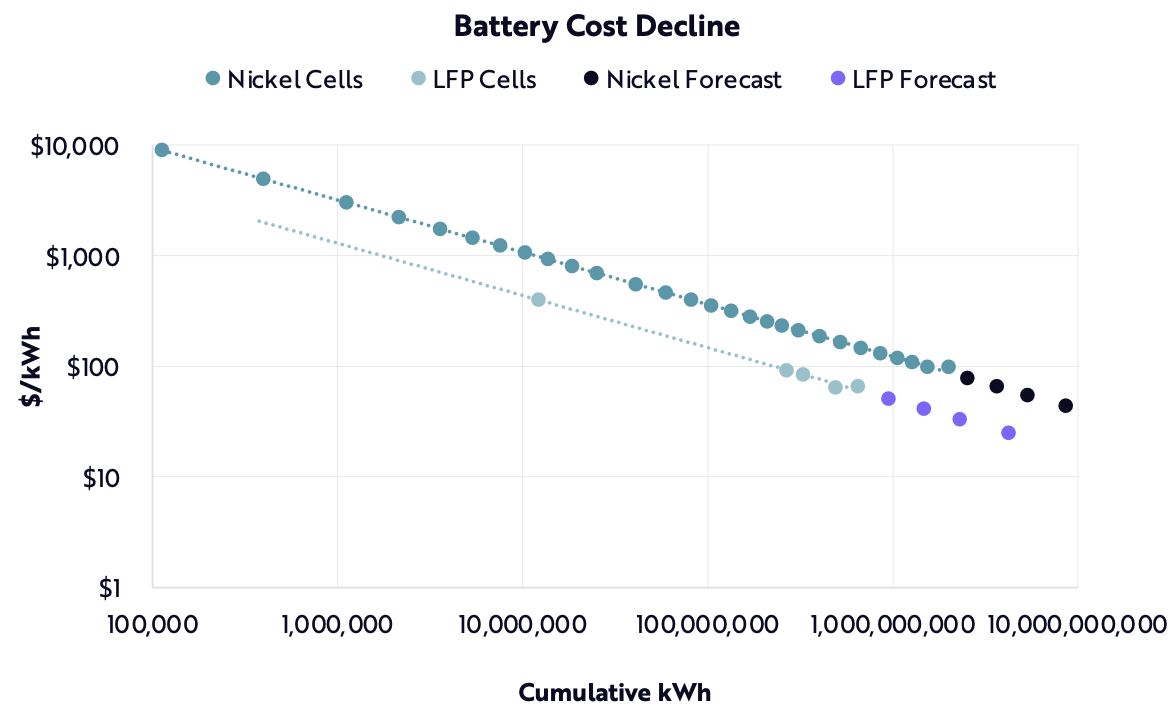

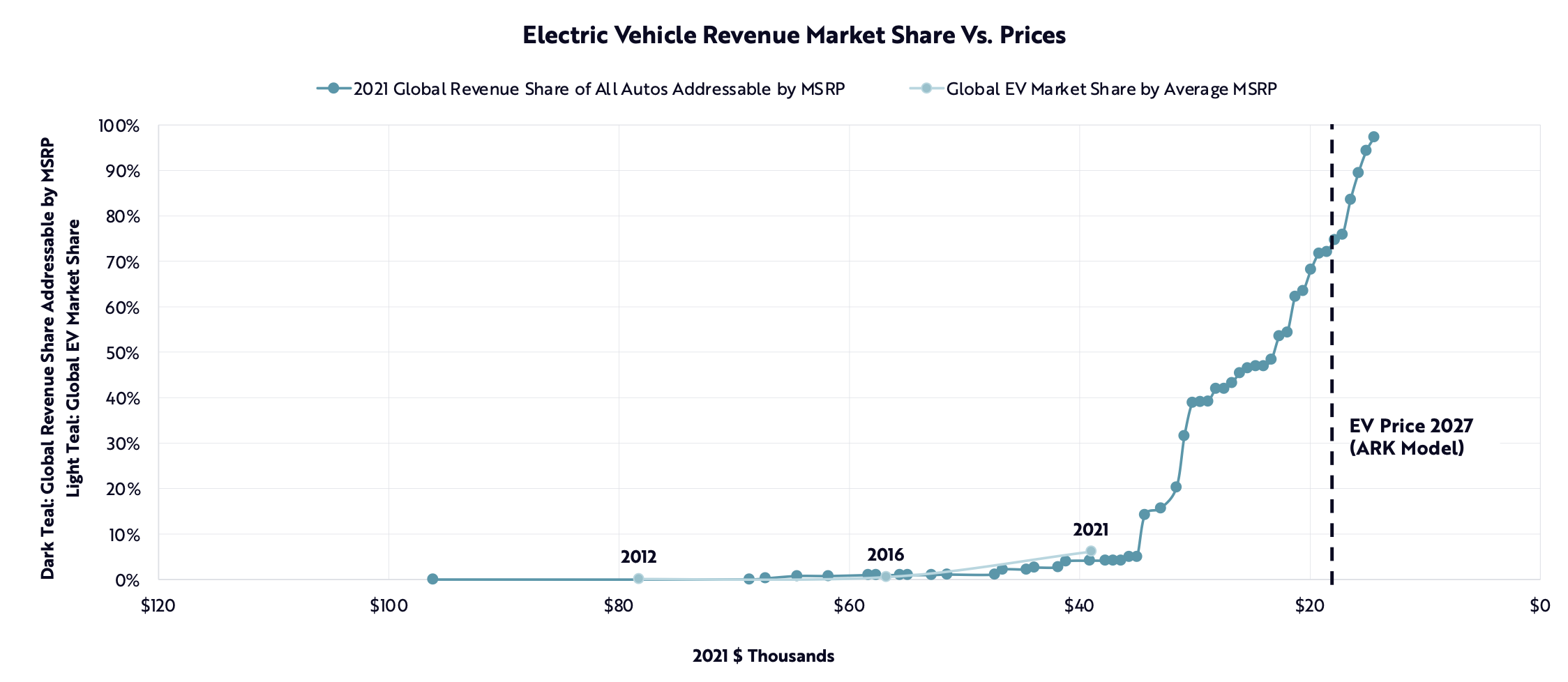

But as is with everything related to electric vehicles, it comes down to the batteries. The largest cost component of an EV is its battery, the declining cost of which will be critical to reaching sticker-price parity with gas-powered vehicles. The next two charts show ARK's forecast with regards to battery costs and, just as importantly, how that will affect EV sales growth.

Battery Cost Declines Should Continue To Drive Exponential Growth in EV Sales (Source: ARK Invest)

Automation

One other thing that the pandemic highlighted is the supply chain challenge. Resource security is one big challenge all on its own but now, nations and economies must find a way to strengthen their supply chains. Some countries are doing this through protectionism, and others are like Amazon, which has introduced even more robots in their warehouses.

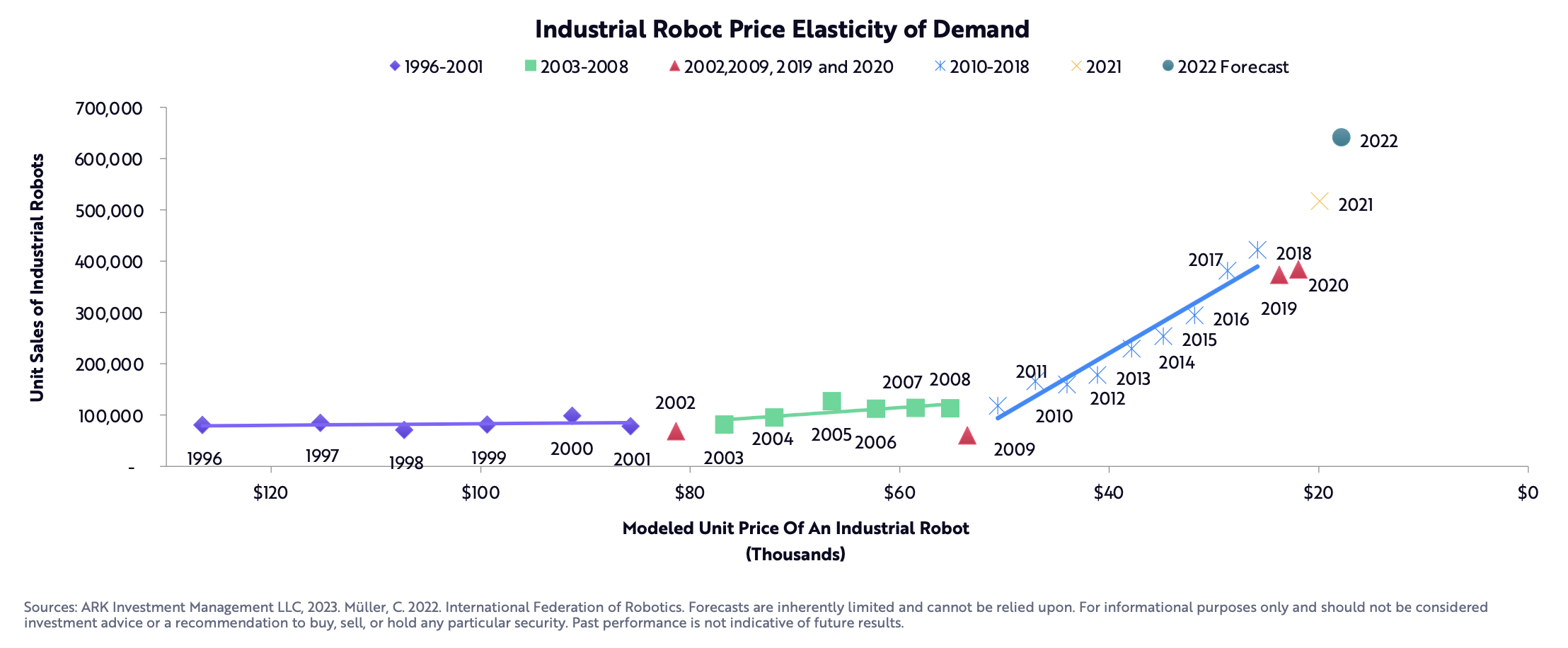

The adoption of industrial robots accelerated after the 2002 dot-com bust and again after the 2008-2009 crisis, as this next chart shows. The responses to the China/US trade conflict in 2019 and supply chain bottlenecks from 2020 through 2022 have been the same.

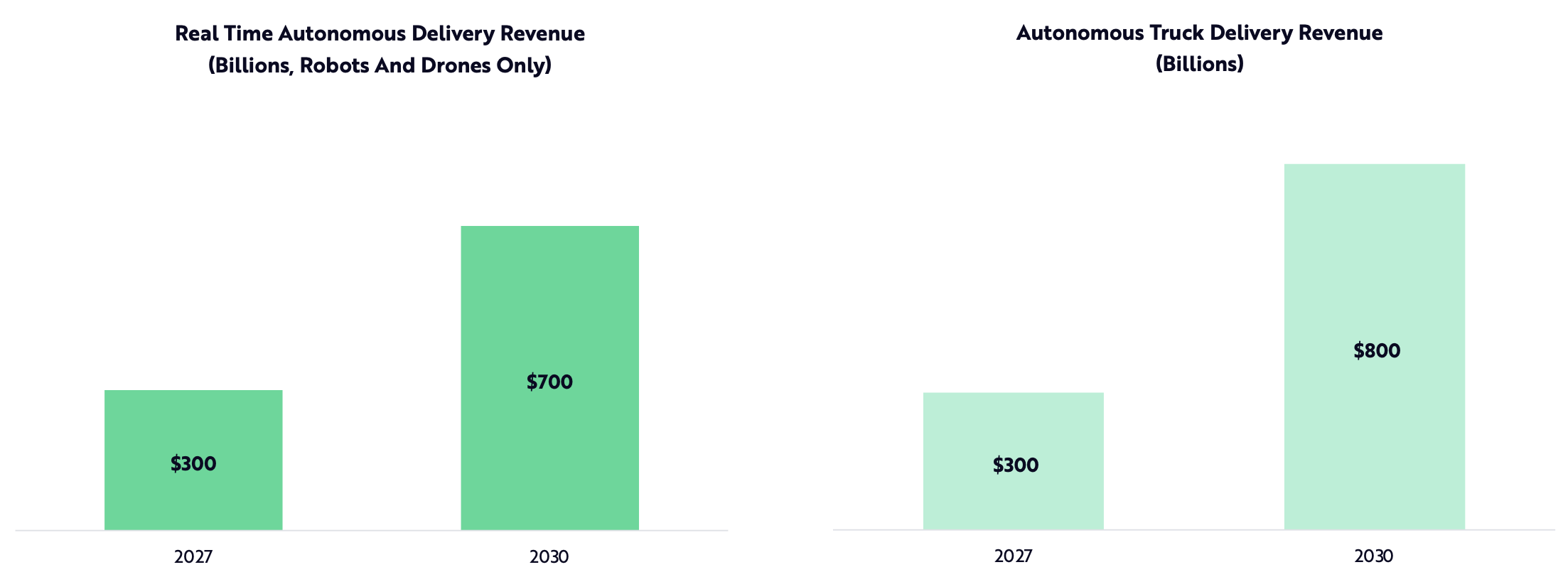

And speaking of robots, autonomous delivery has also become a thematic in the last few years in some overseas markets (think those headlines about drone-delivered pizzas). Autonomous logistics could help companies transport goods to consumers and businesses in a more cost and time-efficient way. So much so that ARK believes the autonomous delivery business could be worth at least US$1 trillion by 2030. This next chart shows why:

Global Autonomous Delivery Gross Revenues Could Total $1-2 Trillion By 2030 (Source: ARK Invest)

Million Dollar Bitcoin?

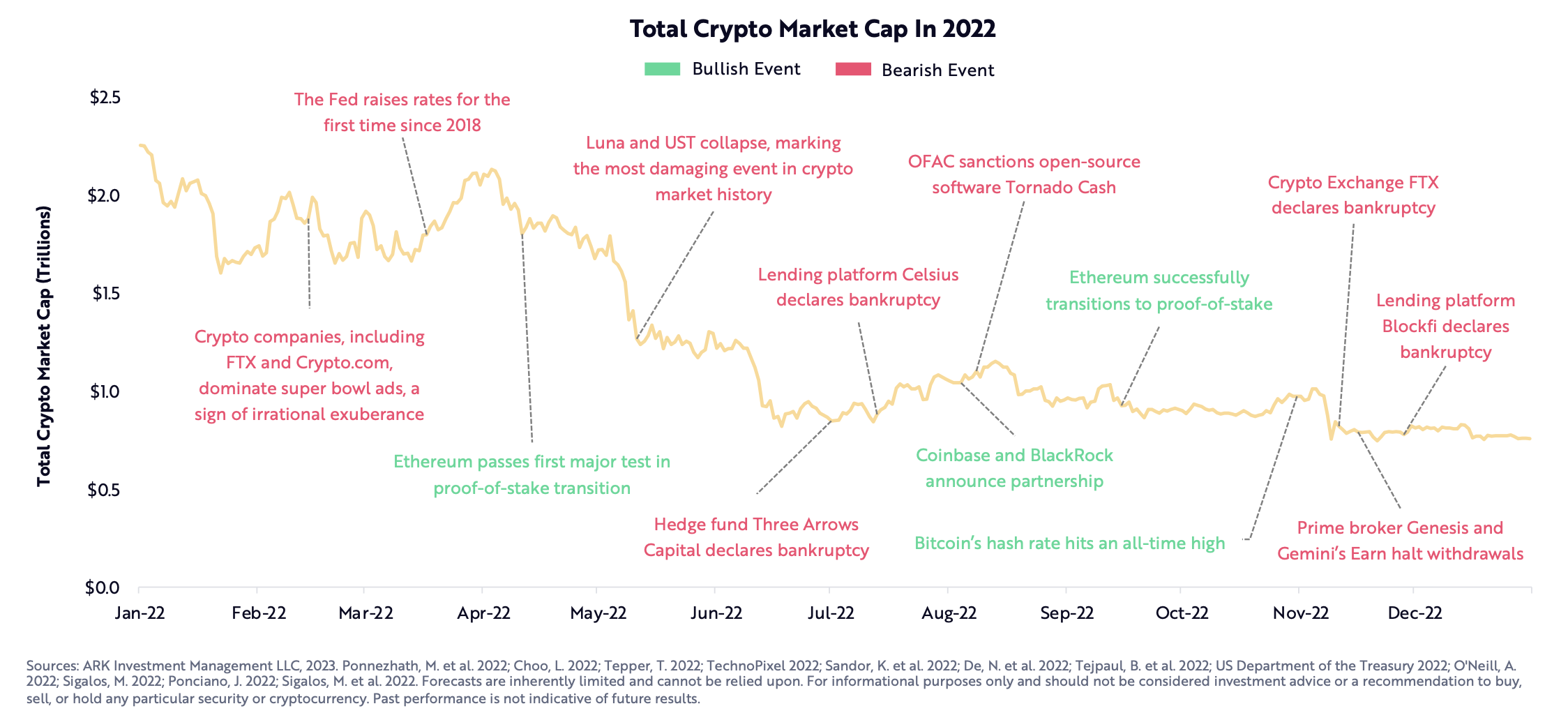

Finally, there's the digital currency trend. Livewire's most outspoken readers appear to be at total odds with Cathie Wood's belief in Bitcoin. But there's no way in avoiding the conversation around digital tokens.

Here's how the ARK Invest team are thinking about Bitcoin despite falling 65% during 2022.

"We believe Bitcoin’s long-term opportunity is strengthening. Despite a turbulent year, Bitcoin has not skipped a beat. Its network fundamentals have strengthened and its holder base has become more long-term focused. The price of one bitcoin could exceed $1 million in the next decade."

Or if you prefer the graphical version, enjoy the colours in this next chart:

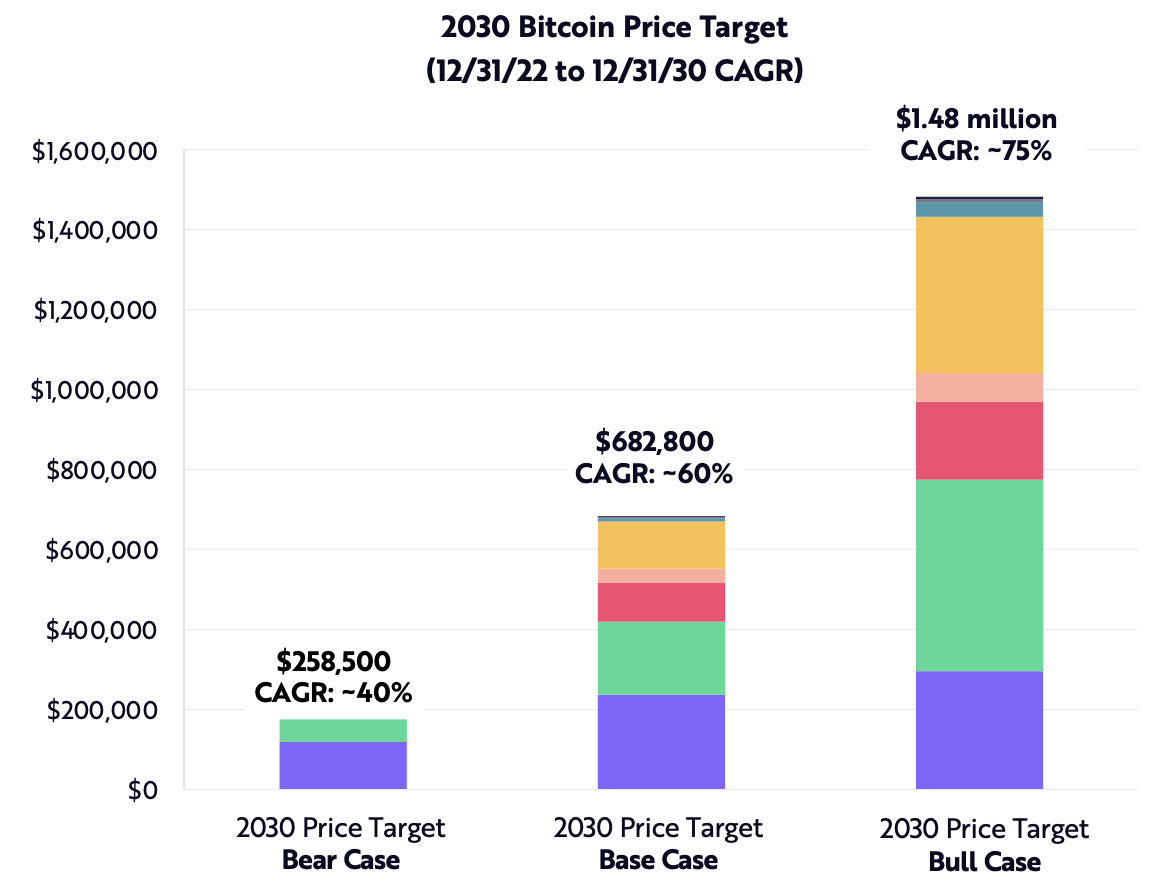

So is their forecast bullish or foolish? Here is how ARK's team divides the bull, bear, and base cases for the world's largest cryptocurrency.

Bitcoin Is Likely To Scale Into A Multi-Trillion Dollar Market. In the bull case, the growth will be driven primarily by institutional demand, growth in digital gold, and the wider acceptance of crypto in emerging markets. (Source: ARK Invest)

Do you back Cathie Wood and ARK Invest's views on innovation? What parts do you agree or disagree with? We'd love to hear from you.

5 topics

3 stocks mentioned

1 contributor mentioned