Amazon's effect on the retail sector

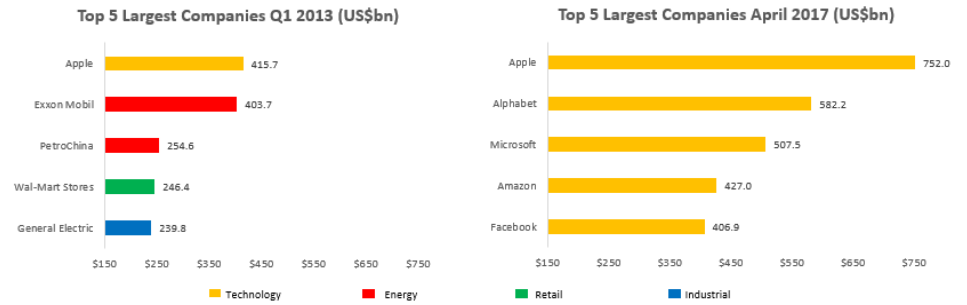

As smaller company investors, we are relatively accustomed to seeing rapid growth from new businesses that have identified a new market or way to disrupt a lazy incumbent. The rapid growth and domination of new companies and business models at the mega-cap end of the market, however, is an entirely new phenomenon and reminds us that the corporate landscape has never been so fluid. Only 1 of the top 5 largest companies in the world in 2013 still made the list in 2017. Of the top 5, all are now tech businesses. Three of these companies (Apple, Facebook and Amazon) have accounted for more than a third of the total increase in the S&P 500 this year.

The learning from this is obvious: the pace of innovation continues to increase rapidly, and businesses that win the innovation race are now tending to control enormous chunks of their end markets as a result. This isn’t a development consigned solely to the online space – perhaps in an even greater symbol of the willingness of the market to support new business models, electric car maker Tesla this month saw its market capitalisation eclipse that of the Ford Motor Company

Australian investors have been greeted with a near wall of hyperbolic commentary surrounding the pending arrival of Amazon into the Australian retail market. While predictions for the demise of traditional retailing as we know it seem exaggerated, there are rightly many reason for caution – take any metric on the growth of the business in the US and the statistics are staggering. As it stands today, it is estimated that more than ~80m Americans (more than 50% of households) now hold a paying subscription to the Amazon Prime service.

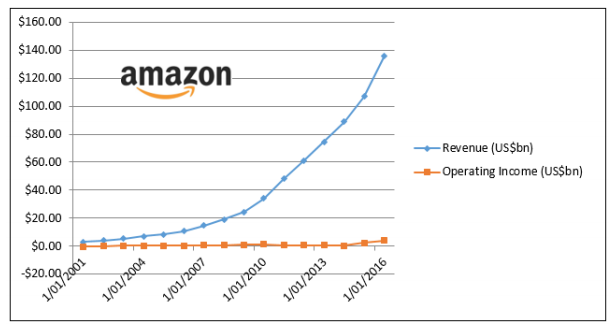

The growth and success of Amazon is a great example of the “winner-takes-most” business model that a number of large disruptive-style businesses have successfully executed over the past decade. Armed with a technology edge and an extensive marketing budget, the new entrant identifies an unfulfilled or underwhelmed market and pours an excessive amount of capital and resources into winning that market with little regard for near term profit. Amazon’s growth strategy has been no different - continually reinvesting profits to ensure rapid revenue and market share growth – the scale, however, is much larger. With a shareholder base that is supportive of the strategy, the amount of capital that management are able to recycle back into growth initiatives is extraordinary.

The graph below charts Amazon’s top line revenue since 2001 against its reported operating income – an image that will likely cause some concern to existing bricks and mortar retailers in Australia. It would be no surprise to learn that Amazon is also now the global leader in research and development spend – their recent quarterly highlights a US$4.8bn R&D expenditure line for the past quarter alone. As highlighted in a recent analysis by Barrons, at a market cap of ~US$450bn, no company has ever reached such a size with so little in cumulative profit (approximately US$5bn in total cumulative profits since listing in 1997).

The impact of Amazon’s aggressive entry into the US market has been swift, particularly for a number of the bricks and mortar businesses that were the once sought-after anchor tenants for new regional shopping malls through middle America. A combination of excess mall capacity, a weaker consumer and the disruption of new entrants has subsequently seen the growth rate in retail store closures increase significantly. The first three months of 2017 alone has seen the shuttering of some 2,880 retail store fronts in the US, a run rate higher that the last significant slowdown through the recession of 2008.

These are a significant numbers of closures, albeit not all a direct result of Amazon’s success. Indeed, there are a good number of US retailers that are currently growing their storefront numbers on the back of differentiated product offerings that can circumnavigate the Amazon platform (see Warby Parkers, Sephora etc). As investors, we need to reconcile the offshore experience with that of the current state of play in Australia and determine where the opportunities and threats will likely emerge.

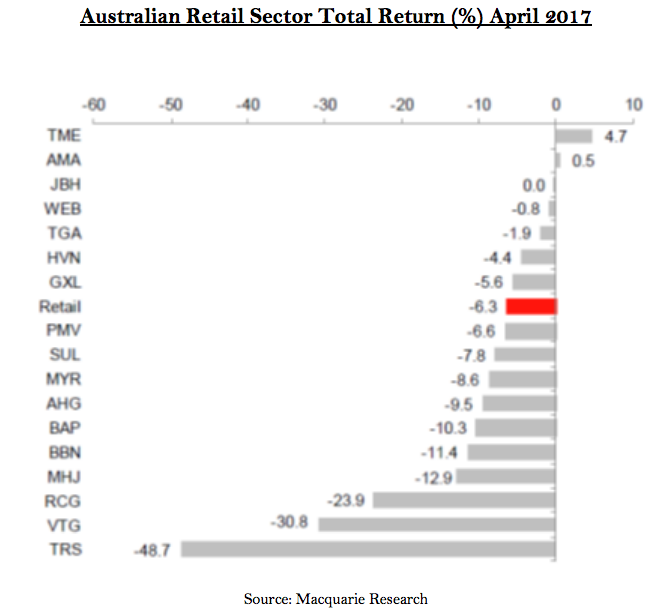

The volume of media exposure surrounding Amazon’s arrival has certainly impacted the listed space in the short term – retailing stocks in April on average fell -6.3% for the month – and the compounding effect of structural change and a broadly weaker Australian consumer continues to impact a number of the more traditional retailing businesses and their listed valuations. There is one stock that we hold in this space however, which we will discuss in our next wire.

This extract from Ophir's April Letter to Investors was contributed by Andrew Mitchell, Director and Portfolio Manager at Ophir Asset Management.

3 topics

1 stock mentioned