An alternative Alternative

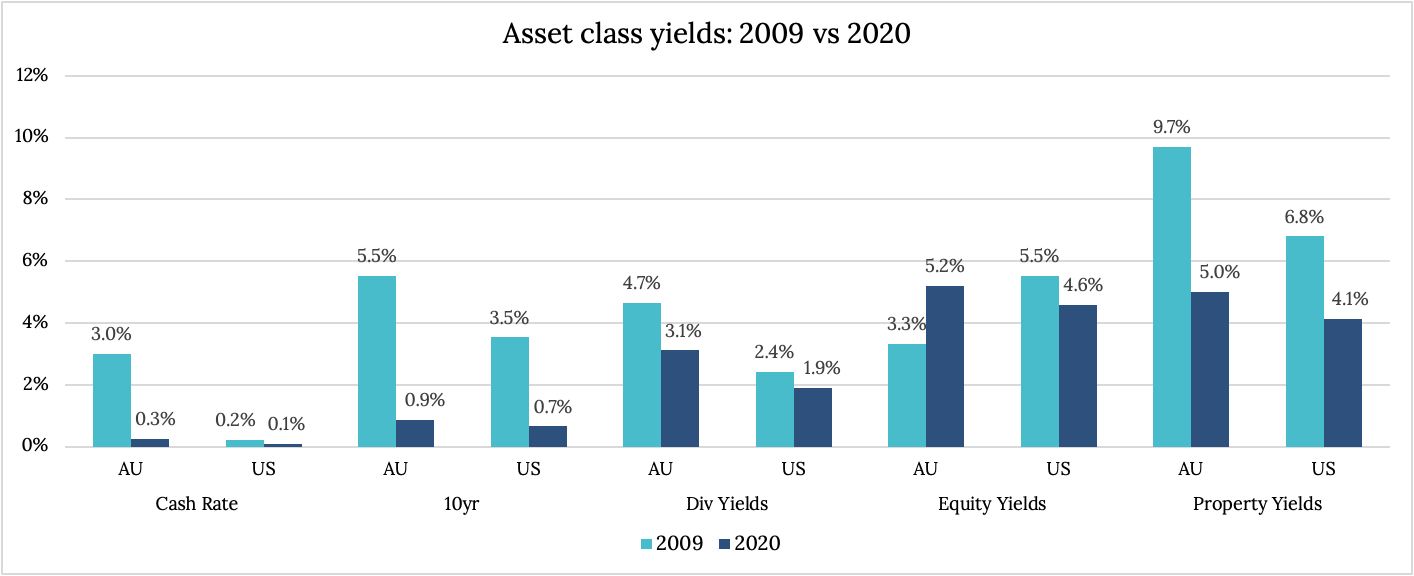

Income from all asset classes has been declining for over a decade, and accelerated this year since COVID took hold. From cash to fixed income, property to dividend yields, the decline has been gradual but significant.

Source: Bloomberg

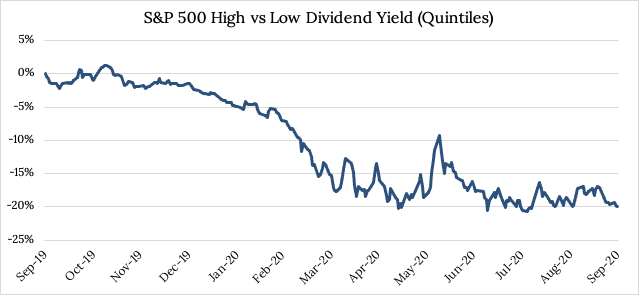

However, the demand for income has not changed, especially for retirees no longer earning a wage. When it comes to equities, typically retirees will choose stocks based on their ability to generate income, however as the below chart shows, if you’ve done that this year, it hasn’t gone well.

Source: Bloomberg

One of the reasons is that looking at absolute dividend yield doesn’t address risk. High dividend yields can reflect problems with a business. For example Tobacco stocks tend to have high yields, because investors are skeptical of their ability to maintain them in the face of structural declines in their core markets.

This then leads to the importance of fully understanding your investments to identify sustainable dividend returns. An example is Swiss Re AG (SREN.SW) - a leading wholesale provider of reinsurance, insurance and other forms of risk transfer. Swiss Re have a current dividend yield of around 8.4% and an extremely strong capital position, with twice the amount of capital required by the regulator. While no analyst is foolish enough to say a company will never cut its dividend, our research suggests distributions to shareholders are far more secure than the share price indicates.

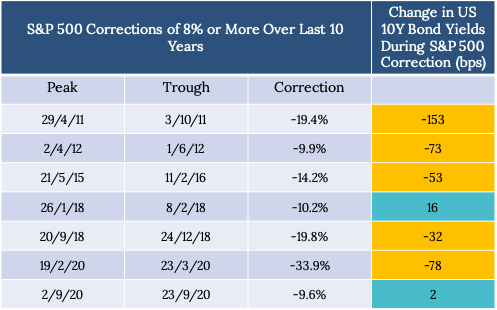

It’s also worth noting that as previously discussed, the traditional investment portfolio construction of 60% equities and 40% bonds (fixed income) is not delivering as it historically has.

A recent example below shows all the S&P 500 corrections of 8% or more over the last 10 years. From peak to trough in the S&P, bond yields have typically fallen. However, the recent correction last month was a rare exception – the market went down but bonds didn’t go up. Bonds didn’t play their role in the 60/40 as an alternative to balance out equity loss.

Source: Bloomberg

A third concern for retirees in particular is market volatility. While volatility has declined from its March peak this year, the focus is perhaps now shifting to the ‘safe haven’ stocks of technology. For example, during the sell-off in the first two weeks of September, the tech heavy Nasdaq underperformed the S&P 500 by some 5% and, since April, its volatility has been rising versus that of the broader index – index mavens will want to compare Nasdaq volatility (VXN) with S&P volatility (VIX).

So now there is uncertainty in supposed safety, structural cracks to portfolios and low income across the board.

It’s not hard to see how this could create serious problems for retirees.

Luckily there are alternatives. One solution lies not in the stocks themselves, but in the process of buying them. Selling put options to enter stock positions generates a premium (income) for the potential buyer, regardless of whether the stock is ultimately bought or not. It creates:

- a downside buffer to first loss

- more consistent income,

- reduces portfolio volatility, and

- diversifies the sources of return.

This means that in periods such as now, investors have an alternative alternative to the multiple factors impacting their investments.

2 topics