An introduction to stop losses

OK its probably a bit late for this (maybe not) but I have been emailed asking "How do you set stop losses" (surely a sign that the bottom is close!). So here's a stop loss overview for investors - because traders already know all about them.

WHAT ARE STOP LOSSES AND WHO SHOULD USE THEM

The life of a trader is not what most of us might imagine it to be – ie. glamourous, exciting and paved with gold. More likely it is solitary, private, a bit boring and when done right, provides a living. We could all be traders. We could all be Arnold Schwarzenegger too. Go to the gym every day, lift heavy weights, eat protein shakes, avoid chocolate, and talk in a vague middle-European accent. But the reality is, who can be bothered?

And who can be bothered to be a trader because to do it properly is pretty much a full-time job, and most of us already have one of those, and those of us who don’t probably don’t want one. I have worked with professional 'big book' daytraders, most brokers have them, trading with company money and the broker's 'edge'. It's not glamourous, it's stressful, it's unhealthy, it's boring, they cannot leave the desk for a minute and when aeroplanes hit a building they can lose years of gains in seconds. I don't want that job.

But that doesn’t mean we can’t adopt some of the core principles of the job, principles that apply not just to traders but to investors as well, principles like “preserve your capital” and “cut your losses”. Clichés all, but as any trader will tell you, no trading system will succeed without them and no long-term investor will either.

The big mistake for long-term investors is that they see things as being part of a portfolio in which the winners make up for the losers. With that mindset long-term portfolio investors “excuse” the losers and do nothing about them. But if you really want performance the losers are just as important as the winners and you need to protect against them. To do that you have to pull the weeds and plant flowers in their place. And if flowers turn into weeds, cut them and plant some more. Do this relentlessly and you will end up with a garden full of blooming flowers.

How do you cut weeds? Simple. Use stop losses. How? Let’s cut to the substance.

- What are they? An order that automatically closes your trade at a predetermined price, thus limiting your loss. A stop loss is a mechanism that short circuits debate and emotion and provides certainty.

- Requirements: Forget the concept of “portfolio”. Think of every stock you hold as a separate trade. Preset a stop loss for each individual holding, preferably when you are unemotional and in possession of a clear mind. The time of purchase would be good, but any time will do.

- The mechanism: It is impossible to set a rule for everyone. There are many different types of stop-loss mechanisms but the principle of all of them is the same – Have the discipline to cuts losses and if you can't do that by feel, do it with a formula to circumvent your indecision and procrastination.

Here are some of the different methods to set stop-loss levels.

- The most obvious is a flat percentage. If it falls by five per cent, sell it. But that’s very basic and most of us struggle doing that in practice. The market is so volatile these days.

- Most (hardcore) traders use The 2% rule. The 2% rule means you are prepared to risk a maximum of 2% of their trading capital on any one trade. In other words, on $100,000 of capital (a portfolio of $100,000) they would cut a trade that makes a $2,000 loss. Notably, this is not the same as a 2% drop in share price. If they have put $10,000 of the $100,000 portfolio in the trade it could be a 20% loss on that one trade ($2000 of the $10,000).

- Another way is to set stop loss levels is by reference to a chart rather than a percentage. For instance, if you are trading price breakouts (buying stocks that break a resistance level) the stop loss can be set at the price at which it breaks out and so the resistance level that was broken serves as the stop loss level if it reverses again.

- Then there are rolling stop losses. As prices rise you raise the stop loss to eventually guarantee a profit if the price then falls from its new high to the ever-rising stop-loss level.

- Once in profit some people use partial stops, they continue to identify levels or technical sell signals and either sell all or part of the position depending on what level or signal is hit.

- Others set stop loss levels with reference to the volatility of the stock. Setting stop losses at a level that allows the trade to develop without being stopped out by a normal fluctuation. The way to avoid this is to learn about volatility and average true range (ATR). Simply put this means accounting for how volatile a stock is when setting a stop loss. Volatile stocks need more room to move. If you don’t understand volatility you are trading every stock as if it has the same risk, and clearly, there is a big difference between trading Telstra and trading Zip Money. It's easier than it sounds.

Ultimately there are a lot of ways of setting stop-loss levels. As noted, a flat percentage is very basic. But the core to it is to make the decision to use them rather than rely on guts, to set your stop-loss levels early, to set them for each individual stock and stop thinking in terms of “the greater portfolio”.

I suggest you read some trading books, it's hard-core stuff but takes you ahead of the average punter in terms of trading discipline. Most good trading books are very hard work (dull) and full of theory and are interestingly nothing to do with picking stocks but about risk management. It's not what you buy, it's all about what you do after you buy. That’s the bit that needs a plan and discipline and vigilance and where almost everyone goes wrong and doesn’t bother.

Of course, all of this stop loss stuff takes a bit of monitoring and this is where most of us fall down. But it is not as complicated as it might seem.

It's as simple as opening a basic excel spreadsheet. All you need do is get a list of your stocks, a list of current prices and next to that a column defining your stop-loss levels. Every so often update the current prices and compare to the stop-loss price. When a share price drops below the stop loss you set it a 'tap on the back of the head' that says…"Are you going to do anything about it?". And when five stocks then ten stocks tap you on the head, you might just get the message.

Stop losses being hit and constantly ignored are a sign. A sign that you are either very rich and don't need to care about how much money you have, or a sign that you are inactive, indecisive, a procrastinator, and maybe shouldn't be managing your own investments.

A sign that maybe you would be better off without an SMSF and with your money in an Industry or Retail Super fund instead.

If you are going to ignore the market's ups and downs and rely purely on the long term uptrend, why are you watching individual shares, and doing nothing?

There are better things for you to be doing. Like life..and occasionally logging into your Super Fund website and checking they aren't completely cocking it up (which is something the big funds don't do).

Stop losses can still work for long term investors – One layer down from being in an Industry or managed fund are interested long term investors that do manage their own shares. Your concern is Armageddon rather than a correction, you can still use stop losses on that spreadsheet but be a bit more relaxed. Set your stop losses nice and wide and update current prices once a month or whenever the news “vibe” suggests something could be going wrong. Dance to your own tune. If you are more concerned about short-term fluctuations check in more often. Hardcore traders use live prices. The average trader would check against daily closing prices. Other investors might check stop-losses against weekly prices. Whatever suits.

But the main thing is to pay at least some attention to what’s happening and have an understanding with yourself that you will take action when a price falls a pre-determined amount, and stick to your guns.

If you work stop losses diligently then when the market falls over you will find you have sold each stock on its own lack of merits as it turned down and have ended up in cash, where you should be, without having to make some impossibly big call on all your holdings (your portfolio) at once.

Yes, you will make mistakes. Yes, you will sell stocks that then go up again. But nine out of ten stocks that are going down are going down for a reason and are likely to keep going down. And if they don’t, don’t worry about it. The game is to learn what works and whatever you do it has to be better than setting and ignoring.

Taking losses delivers more than a financial value. It delivers a new state of mind, reduces stress, provides clarity of mind, empowers you to consider the next move unemotionally. And it lets you sleep at night whilst all around you falls apart. Cash is power, taking a loss puts you in the eye of the storm, a pause for objective thought. And you know, you can always buy back.

This is a huge subject to consider so let me leave you with a core tenet:

When it comes to controlling losses anything is better than nothing – and if your mechanism doesn’t work, you can always change it.

Interested in Marcus Today? - CLICK HERE for a no-obligation 14-day free trial.

__________________STOCKBROKERS AND STOP LOSSES

MEMBER EMAIL - Great article on stop-losses. However, what does an older, long-term investor do if he or she still uses a full-service broker? A few of us have used a broker for many years, and now have a reasonably large portfolio. My experience is that brokers refuse to set stop losses for their clients. Not sure what proportion of your subscribers can set their own stop-losses, and how many can’t. Either get a divorce from your broker and go on-line, or sit glued to the screen all day?

REPLY - Great question and a common problem and as a broker, for over 30 years, I can tell you, you are correct. Full-service brokers hate stop losses. The reason is that stop-loss orders, if a broker accepts them, open the broker up to a risk, the risk that they miss executing the stop-loss order instructions because they happened to go to the loo, miss the share price dip and then get you in their ear saying "I told you to sell at X, you didn't, so you owe me thousands of dollars". Humans, especially human stockbrokers, cannot possibly execute stop losses faultlessly using the "Watch the screen" method. Not if they want to go to the loo between 10am and 4:10pm. So no brokers will take stop-loss orders. "Nice theory, but you'll have to monitor it yourself. Just ring me when you want to execute" will be what they tell you. So there are two options:

(1) Use an online broker that allows you to put on a "Contingency order". That means you are telling a computer that "If this happens do this". Computers are much better than humans at that sort of stuff. So if the price is 100c, you can tell a computer that if the stock ever trades at 90c, sell my shares at 90c (but not until). Some online brokers charge more for contingency orders. Seriously? It is standard fare for any trading platform these days.

(2) Relax. There are some very complex technical calculations (the 2% rule or an ATR based stop loss) that determine stop-loss levels and in so doing the exactness of the calculation can stress you out that the execution must be at exactly this or that. But the exact price you sell at is not that important. It is the use of a loss controlling discipline, of any sort, that matters most. Getting fussed about the execution at the exact calculated stop loss is a bit of a joke. Stop-loss use is just a self-imposed manipulation of your own mind used to convince you to do something rather than nothing when a share price is going down. So relax. The main purpose of seeing a stop-loss being hit is not to achieve that exact price, it is to prompt you into selling (at whatever price). One way you can do it is to set stop losses on a spreadsheet (have a column for the current price and a column for the stop loss) and set a conditional format on excel that says "If the current share price is below the stop loss turn the current price cell format to a red background". So when a stock goes wrong the cell goes red, and when the market goes wrong your spreadsheet goes red. That's the sign that maybe you should do something. And if you ignore a red cell, then at least you've been tapped on the head by a stock. If the next time you open the spreadsheet and it's still red, then you've been tapped on the head again. And it will keep tapping at you as long as the cell is red. Eventually, you might get the message. Or not. In which case you might think about closing your super fund and putting it all into a managed fund because you're not adding any value.

__________________

ATR – Average True Range- a very brief explanation

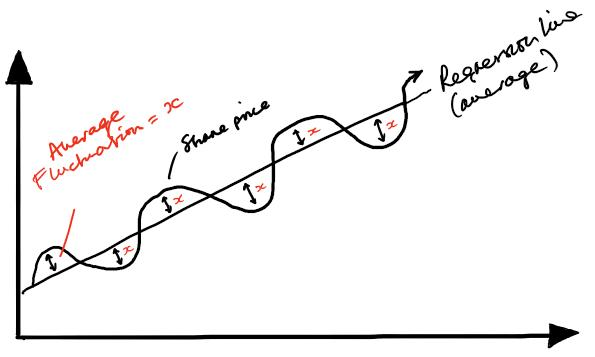

If a 300c stock moves on average 10c a day (the average range from top to bottom it has traded in each day for the last 14 days) then 10c is its average true range. You work that out by averaging the daily share price range over (say) the last 14 days or weeks. A more volatile stock will have a bigger daily or weekly range. You can then use that to set your stop loss – it is common practice to set a stop loss at a multiple of the stock's range. Most commonly at 2 times the daily range or 2x the ATR from the purchase price. So for our 300c stock with an ATR of 10c, you would set the stop loss at 2xATR below the share price, which is 280c. For a 100c stock that moves 5c a day your stop loss might be set therefore at 90c. This would be your initial stop loss. You might then roll that price up as the share price rises so the stop loss is constantly 2xATR below the highest price hit since the trade was placed. You can get ATRs for all the top 500 stocks on a daily or weekly basis from the Marcus Today ALL ORDINARIES SPREADSHEET which is updated weekly for Marcus Today Members. This is a chart showing the measurement of the average range.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics