Analysing bitcoin drawdowns

There is a popular meme on crypto forums stating: “If you can’t handle the 20% drops, you don’t deserve the 600% gains.”

Of course, in reality the potential for gains is inherently uncertain, but, historically, the numbers suggest that a buy and hold (aka ‘HODL’) strategy has been one of the most effective when investing in bitcoin.

As an investor, it can be unhelpful to look at bitcoin with equity ‘lenses’ on. Even crypto equities that have a high level of correlation to the underlying cryptocurrency markets can’t be viewed as ‘normal’ equities, as they typically are much more volatile. A 10% drop in equities is considered a correction and a 20% drawdown is considered a ‘bear’ market. When it comes to bitcoin, a 40% drawdown is widely seen as a correction and a drawdown of 70% is considered a bear market. In fact, Bitcoin has spent more than 80% of its history in a drawdown of 20% or more.

What this means is that investing in bitcoin is not for everyone. Bitcoin should only be considered by those with a long enough time frame, and prepared to see their holding regularly fall by 20%, and potentially by more than 80%.

The largest drawdown that bitcoin has suffered to date was 93.7%, in the cryptocurrency’s early days. However, if an investor held for at least four years, their investment eventually would have recovered. In fact, holding bitcoin for any four-year period throughout its history would have meant positive returns, rewarding those who held through the bear market.

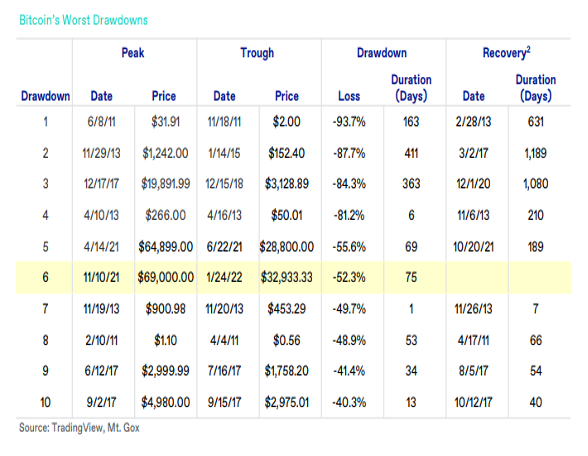

Let’s examine the ten largest drawdowns in bitcoin’s history, how long it took to recover, and the outcome if willing to hold throughout a four-year cycle.

From the table, you can see that bitcoin has dropped more than 70% four times in its 13-year history.

The 87.7% drawdown back in 2013 was slightly more than in 2018 and took an extra 109 days to recover from (a total of 1,189 days). But let’s assume you bought at the 2013 high of US$1,242 and held for four years from the date of purchase. On 19 January 2017, the BTC price was $9,863, resulting in a return of 694% - despite the 87.7% drawdown.

Consider bitcoin’s third largest drawdown, in 2018, which took 1080 days to recover from. If you bought the top of $19,891 and waited exactly four years to sell at a price of $46,326, you would have earned a return of 133%.

Investors who weren’t unlucky enough to buy at the peak of the market, and who managed to dollar cost average in or bought when the price was declining, would clearly have done even better.

It is almost impossible to time the Bitcoin market. There have been many price bubbles and busts, and extreme volatility - but over the longer term, historically the price has continued to trend higher.

As an investor in bitcoin, rather than the price being the main driver of investment, the adoption of the technology and the security of the network could be a better indication of future value. The code embedded in Bitcoin dictates a limited supply, and a decreasing issuance rate. If the network remains secure and adoption continues, while future outcomes can’t be predicted it may be that the buy and HODL strategy will continue to serve investors well.

Learn more

BetaShares offers the broadest range of technology-focused ETFs in Australia providing access to global tech giants, cybersecurity, Australian technology and more. To stay up to date with my latest insights into the digital assets market click FOLLOW below, find out more about investing in crypto with BetaShares here.

3 topics

1 stock mentioned

1 fund mentioned