Are CSL's best days behind it?

There is a lot to unpack in CSL Limited's (ASX: CSL) results, but the context in which they are being received is equally important. Earlier this month, on an episode of Buy Hold Sell, both David Wilson (First Sentier) and Matt Williams (Airlie) talked about how critical these results were for the biotech.

"I would say it's one of the most important results of this reporting season", said Wilson, whilst Williams added, "This is a crucial result. Management needs to restore some credibility, and this is a chance for them to do so".

Against that backdrop, CSL delivered the following versus UBS estimates;

- Revenue up 5% to $15.6bn vs. $15.8bn est (1.0% miss)

- NPAT up 17% to $3.0bn vs. $2.96bn est (1.0% beat)

- NPATA EPS up 10% to $6.65 vs. $6.55 est (2.0% beat)

- Final dividend up 12% to $1.62, total dividend up 11% to $2.92 vs. $2.96 est (1% miss)

Other key information and guidance

- Multi-year buyback program starting with $750m in FY26

- Intention to demerge Seqirus as a separate ASX-listed entity in FY26 and cut almost 3000 jobs (15% of workforce)

- FY26 guidance included Group revenue growth of 4-5% and NPATA up 7-10% to $3.45-3.55bn vs. Citi est of 7.3% and 15.5% respectively.

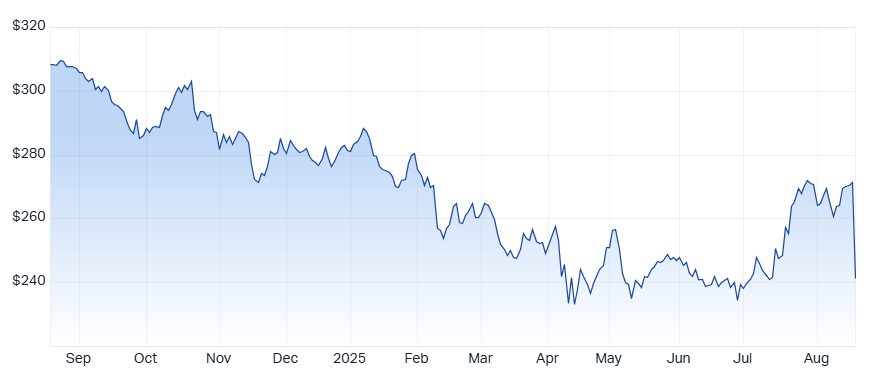

So, how did the market react to all this? It punished the stock - brutally. At the time of writing, CSL shares are down 13%.

Chief Executive, Paul McKenzie, spoke to a changed operating environment, hence the need to cut costs and simplify the business. The changes are set to save CSL $550 million annually over three years, following one-off net restructuring costs of $560-$620 million in the 2026 fiscal year.

Whilst it remains to be seen whether these changes will have the desired impact, IML's Daniel Moore points out that the business is still growing strongly;

"Despite all the headwinds from competition and regulatory price cuts, they're still growing double digit. I think that's a pretty good business".

For the rest of Moore's take, keep reading below.

What was the key takeaway from CSL's result in one sentence?

The results were largely in line, maybe a touch soft, but the outlook - particularly on the revenue growth side - was softer than expected due to higher competition.

The restructuring program they announced - I think it was well anticipated - but $500 million in pre-tax savings is significant, and that really ensures they can deliver double-digit earnings growth into the future.

Were there any surprises in this result that you think investors need to be aware of?

The US funding cuts from Part D were higher than expected, which impacted the result and the outlook, and the announcement of the demerger of Seqirus was definitely new news.

Would you buy, hold or sell CSL off the back of this result?

Rating: BUY

We think the business is still a very high-quality business with a strong competitive advantage.

The demand for their products continues to grow mid to high single digit, and they can deliver double-digit earnings growth, and the stock trades on what we think is a very reasonable price, with a PE in the low 20s.

Are there any risks investors need to be aware of?

The increase in competition, that's the key bit of new information that we're keeping our eye on.

So lower volumes or lower prices are the risk for the plasma business.

From 1 to 5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX today?

Rating: 4

Relative to history, average multiples for the market are high, and also relative to bond yields.

5 topics

1 stock mentioned

1 contributor mentioned