Are we at the start of another commodities supercycle?

Many Australian investors look back at the last great commodities supercycle with fond memories. The likes of Fortescue Metals, Papillon Resources, and Equinox Minerals made more than a few people rich in the last cycle.

But since the end of the last supercycle in 2014, the mining sector has been stuck in the doldrums. Or at least, it had been until recently. A quick Google search for “commodities supercycle” reveals that the topic is back in the press, with strong views on both sides as to whether we’re about to kick off another.

To help bring clarity to the issue, I reached out to three experts to find out whether they think we’re at the start of another supercycle spin. Responses come from:

- Mike Jenneke, Credit Suisse

- Raf Choudhury, State Street Global Advisors

- Tim Gerrard, Janus Henderson

Conditions improving, but no great boom

Mike Jenneke, Credit Suisse

Our expectation in commodities is a positive, albeit less explosive, cycle when compared to the early 2000s supercycle as future demand growth will be lower than this exceptional period in history.

The economic development of China was key to the previous supercycle and given a much higher volume base and a more mature global economic cycle, future demand growth will be lower. We also regard a sustained upward move in inflation as unlikely given structural forces placing downward pressure on inflation such as low wages growth and high debt levels. These forces remain in place removing potential fuel for the commodity cycle from generalised price pressures.

Nevertheless, commodity prices are driven more by demand levels relative to supply rather than necessarily relying on high demand growth. Positive and more predictable demand combined with supply discipline drives attractive price formation that is both financially rewarding for the industry and lower risk for investors.

In contrast, a high demand growth supercycle risks a level of exuberance that leads to strong cash flows being directed into excessive volume expansion and potential overpayment for assets, leaving investors with lower profits and returns as the volume boom inevitably matures.

We therefore expect quality commodity suppliers to be good investments over the medium-term.

One driver that could support a new supercycle

Raf Choudhury, State Street Global Advisors

Supercycles are generally periods of abnormally strong demand growth that leads to a rally in prices that can last years or decades.

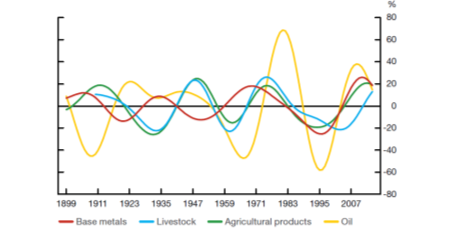

Over the last 120 years, there have been 4 commodity supercycles for Metals, Agricultural Products and Livestock and 3.5 cycles for oil. The last supercycle was driven by Chinese demand supporting its rapid urbanisation. It was historically unique in that all commodity sub-components peaked, and troughed, at roughly the same time. In previous supercycles, while there was overlap, the cycles were more differentiated.

Supercycles across major commodity groups

Source: Bank of Canada

Surging prices for copper and agricultural products, and oil back at pre-Covid-19 levels, have led some observers to label the current environment as the start of the next supercycle.

Our fundamental value equity team believe while there is an argument for a structural increase in the intensity of useage for battery materials, it is difficult to see the same structurally driven increase in demand for commodities such as oil and iron ore - which make up a significant proportion of the commodity universe.

Consequently, while we can see normal cyclical movement in prices above trend for a period of time, we don’t believe current circumstances warrant calling it a commodity supercycle.

There is one other driver that could support a supercycle trend – the increased focus on climate and carbon neutrality. This may result in constrained supply, while demand still remains for source materials used in building the infrastructure for renewable energies. However, these supply and demand dynamics are currently too fluid to call the start of a new supercycle.

A cleaner, greener planet set to drive demand

Tim Gerrard, Janus Henderson

I find the supercycle concept a pretty loaded one and perhaps something that promises more than it delivers. ‘Supercycle’ seems to suggest a tide that lifts all boats and so suggests speculation, leaving little room for quality investments. However, there seems little doubt that substantial changes are afoot that bode well for a very broad range of resource commodities, whether in mining, energy or agriculture.

There are important structural changes occurring beyond the appetites of China and India. Demand for materials to make the world a better place to live is driving change globally. Whether it is satisfying the need to decarbonise by electrification, replacing plastics with paper products that are renewable and biodegradable or developing more sustainable animal nutrition – the need for resources is very diverse and growing rapidly.

The global focus on environmental, social and governance (ESG) factors is real and it is going to cause permanent change. I prefer to call this a structural change rather than label it as a ‘supercycle’, which suggests a pullback in the future.

The structural shift toward a cleaner planet will put pressure on commodity providers to meet demand, even as obtaining environmental permits gets tougher and tougher for companies. There is increased pressure on deforestation, clean air requirements, reduction in carbon emissions and water resources. Strong demand for commodities and an inability to deliver them quickly could well result in sharp moves for commodity prices, well beyond what we currently see.

Stay tuned for more

If you enjoyed the first in this three-part series, make sure to give this wire a "LIKE". Hit the yellow "FOLLOW" button to the left if you'd like to be notified when parts two and three are published.

You can also check out the latest episode of The Rules of Investing podcast, where I speak to Charlie Jamieson about the most important question facing investors today - how high will rates go? Or if commodities is more your interest, I spoke to Ben Cleary about precious metals, lithium, nickel, and uranium in an episode of the podcast from last year.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

1 stock mentioned

2 contributors mentioned