ASX 200 dips as gold shines and lithium's rally comes to an abrupt end

Today in Review

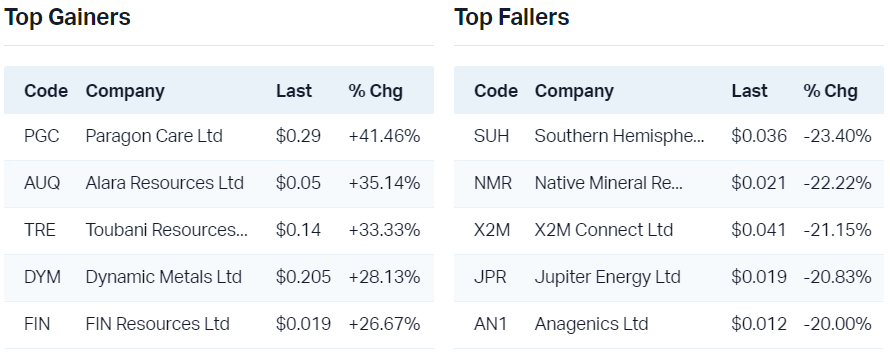

Markets

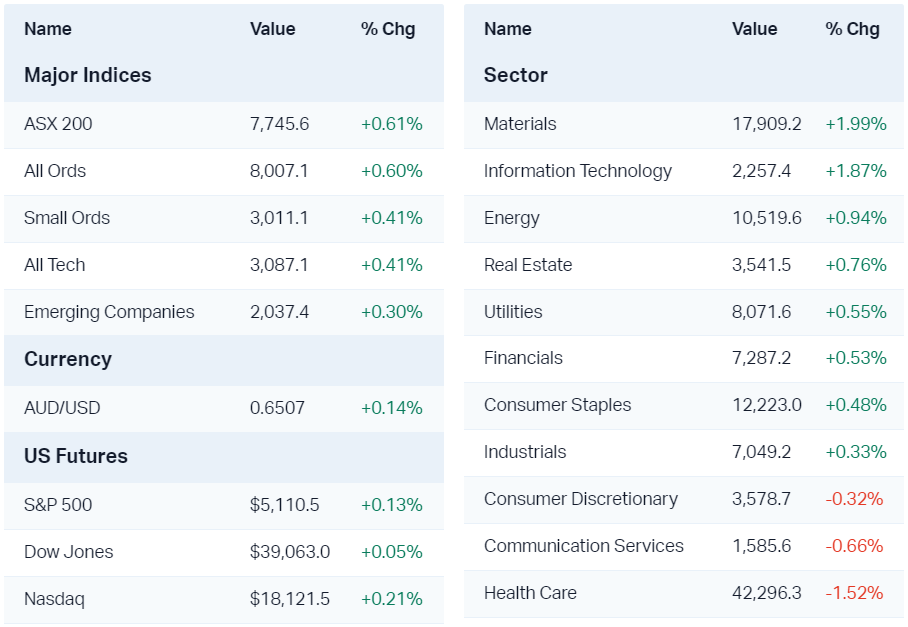

%20Intraday%20Chart%201%20Mar%202024.png)

The S&P/ASX200 (XJO) finished 11.6 points lower at 7,724.2, 0.16% from its session low and 0.36% from its high. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by 127 to 145.

Earnings season and the wall of results and broker upgrades and downgrades is behind us, which leaves Aussie investors to focus more on macro themes such as local and Chinese growth, and the usual ebb and flow of commodity prices.

News on China's economic aspirations in 2024 failed to excite, while rising gold prices and falling lithium prices sent stocks in those sectors in opposite directions.

Tomorrow, we'll get a reading on local economic growth with the release of GDP figures for the December quarter, and later in the week, important data on US employment plus two speeches by Federal Reserve Chairman Jerome Powell.

The Gold (XGD) (+4.0%) sector was easily the best performing sector today as gold futures on COMEX surged to 3-month highs and just shy of the US$2,152/oz record set on 4 December.

Here's a list of today's best performers, but check out ChartWatch below for a list of the ASX gold stocks currently in long term uptrends.

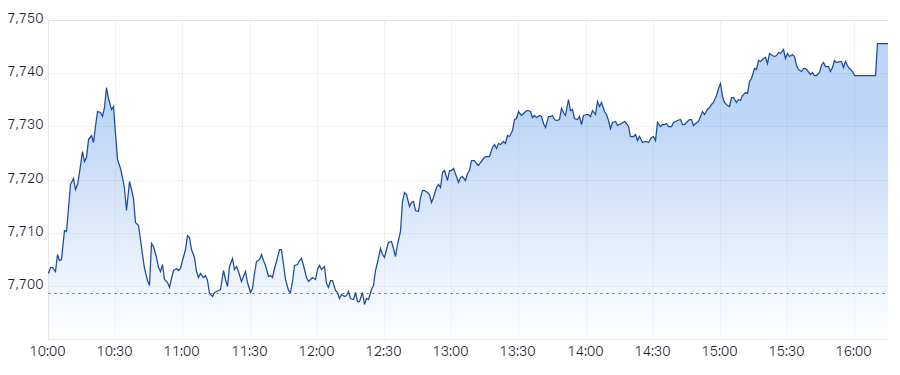

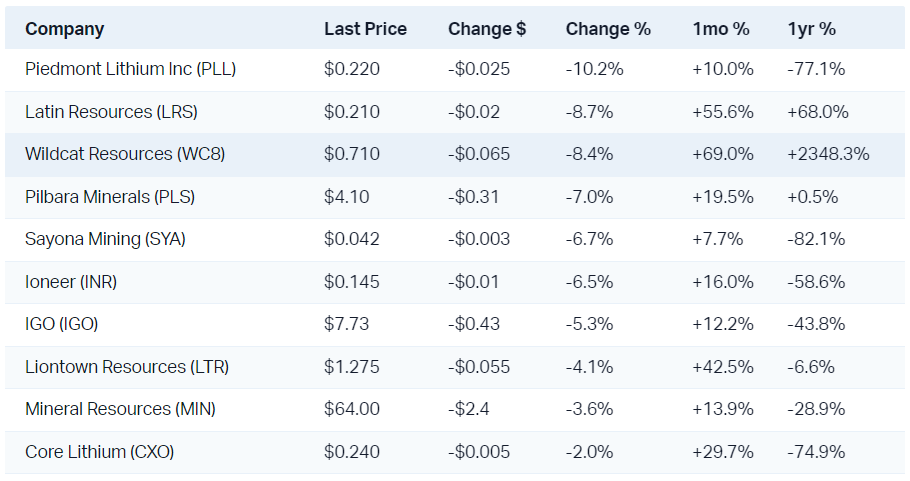

Doing it tough today was the lithium sector which sagged under the weight of a second day of lower lithium carbonate futures prices on the Guangzhou Futures Exchange (GFEX). At the time of writing, the benchmark July contract is trading down just over 5% to RMB 113,850/t.

The daily chart of GFEX lithium carbonate (not including today's incomplete candle) shows this move comes on the back of a key reversal candle logged yesterday at a band of historical supply in the zone defined by RMB 121,00/t and RMB 131450/t.

The previous zone of supply between RMB 108,150/t and RMB 113,800/t is likely to act as a zone of demand going forward. White candles and or downward pointing shadows would confirm this. If on the other hand, we see black candles or upward pointing shadows in this zone, then the supply side has regained control and the lithium carbonate price could retest the lows between RMB 92,700/t and RMB 85,400/t.

ChartWatch

Northern Star Resources Ltd (NST)

.png)

Given the strong performance of gold stocks today it is only fitting to cover the biggest Australian domiciled gold producer, Northern Star Resources.

I can see a well established and strong long term uptrend here, supported by a short term trend which has just turned higher, and some very good recent price action and candles. Today's close above 13.93 demonstrates further an environment of building demand and supply removal.

14.44 is the final near-term key point of supply. The consolidation phase between it and the present provides a broad base of potential support should NST be able to break higher and out of this range.

Despite gold's heroics over the past two trading sessions, many ASX listed gold stocks remain in long term downtrends, plagued by production issues and rising input costs. For your reference and research, here is a list of major gold stocks which are currently trading in a long term uptrends:

Economy

Today

There were no major economic news releases today

Later this week

-

Wednesday

02:00 USA ISM Services PMI February (forecast 53.0 vs January 53.4)

11:30 AU GDP December Quarter (forecast +0.2% vs September +0.2%)

-

Thursday

02:00 US Speech by Federal Reserve Chairman Jerome Powell

02:00 US JOLTS Job Openings January (forecast 8.8M vs 9.03M December)

-

Friday

00:15 ECB Meeting & Monetary Policy Statement (forecast no change at 4.5%)

02:00 US Federal Reserve Chairman Jerome Powell semiannual monetary policy testimony to a House committee

-

Saturday

00:30 US Non-Farm Employment Change February (forecast +198K vs 353K January), Unemployment Rate (forecast 3.7% vs 3.7% January), & Average Hourly Earnings (forecast +0.2% vs +0.6% January)

12:30 CHN Consumer Price Index (CPI) February (forecast +0.3% vs -0.8% January)

12:30 CHN Producer Price Index (PPI) February (forecast -2.5% vs -2.5% January)

Latest News

Gold prices are soaring: Which ASX gold miner has the highest upside?

Insider Trades: Reporting season is over and these 14 ASX 200 directors bought the dip

Short Selling: A small pullback in lithium shorts + Iress, Domain and Solvar shorts in the rise

Morning Wrap: ASX 200 futures flat, S&P 500 gives back gains + Gold soars past US$2,100

Evening Wrap: ASX 200 eases from all-time highs, iron ore stocks falter + Gold stocks rip higher

Will ASX earnings and dividends beat the odds and rise this year?

Interesting Movers

Trading higher

+14.7% Healius (HLS) - HLS Strategic Review and CEO Resignation and Appointment

+12.5% Iress (IRE) - Media reports that a potential bid for Iress is being weighed by Thomas Bravo, trading was halted just before the session close

+11.3% Westgold Resources (WGX) - No news, gold sector strength on rising gold price, rise is consistent with prevailing short and long term uptrends

+9.9% Red Hill Minerals (RHI) - No news, gold sector strength on rising gold price, rise is consistent with prevailing short and long term uptrends

+8.2% Tyro Payments (TYR) - No news 🤔

+7.4% Genesis Minerals (GMD) - No news, gold sector strength on rising gold price, rise is consistent with prevailing short and long term uptrends

+7.0% Predictive Discovery (PDI) - No news, gold sector strength on rising gold price

+6.7% Austal (ASB) - Austal USA delivers future USS Kingsville (LCS36) to US Navy

+6.1% Tabcorp Holdings (TAH) - No news 🤔

+5.9% Silver Lake Resources (SLR) - No news, gold sector strength on rising gold price

+5.6% Immutep (IMM) - First Clinical Data announced from 90mg Dosing of Efti, retained at buy at Bell Potter & price target $0.65 from $0.55, rise is consistent with prevailing short and long term uptrends

+5.5% Aussie Broadband (ABB) - No news, upgraded to overweight from underweight at Morgan Stanley & price target: $5.50 from $2.40

+5.5% Newmont Corporation (NEM) - No news, gold sector strength on rising gold price

+5.5% Regis Resources (RRL) - Becoming a substantial holder notice, also gold sector strength on rising gold price

+5.4% Bravura Solutions (BVS) - No news, continued positive response to H1 FY24 Results released 20 Feb

+5.4% Emerald Resources (EMR) - No news, gold sector strength on rising gold price, rise is consistent with prevailing long term uptrend

+5.3% Imdex (IMD) - No news, continued positive response to H1 FY24 Results released 19 Feb

+4.9% Chalice Mining (CHN) - No news 🤔

+4.6% West African Resources (WAF) - No news, gold sector strength on rising gold price

+4.4% Red 5 (RED) - No news, gold sector strength on rising gold price, upgraded to buy from hold at Moelis Australia & price target: $0.40 from $0.34, rise is consistent with prevailing short and long term uptrends

+4.3% Ramelius Resources (RMS) - No news, gold sector strength on rising gold price

Trading lower

-8.7% Latin Resources (LRS) - No news, lithium sector correction as lithium minerals prices in China pull back

-7.0% Pilbara Minerals (PLS) - No news, lithium sector correction as lithium minerals prices in China pull back

-6.8% Strike Energy (STX) - No news, fall is consistent with prevailing short and long term downtrends

-6.7% Sayona Mining (SYA) - Lithium sector correction as lithium minerals prices in China pull back, State Street no longer substantial shareholder (4 March), fall is consistent with prevailing short and long term downtrends

-5.7% Brainchip Holdings (BRN) - No news, pull back after recent bounce from short and long term trend ribbons

-5.3% IGO (IGO) - No news, lithium sector correction as lithium minerals prices in China pull back, fall is consistent with prevailing long term downtrend

-4.6% Super Retail Group (SUL) - No news, continued negative reponse to H1 FY24 Results on 22 Feb, goes ex-div tomorrow $0.32 fully franked

-4.6% Bluescope Steel (BSL) - No news, has logged several black candles since 26 Feb

-4.5% Lynas Rare Earths (LYC) - No news, ralied with lithium stocks, falls with lithium stocks

-4.4% Mader Group (MAD) - No news, at risk of closing below long term trend ribbon

-4.4% Chrysos Corporation (C79) - No news, has logged several black candles since 28 Feb, closed below historical support at the 22 Feb low of $6.60

-4.1% Liontown Resources (LTR) - No news, pull back after recent bounce off short and long term trend ribbons

-3.8% Iluka Resources (ILU) - No news, ralied with lithium stocks, falls with lithium stocks

-3.6% Mineral Resources (MIN) - No news, lithium sector correction as lithium minerals prices in China pull back

-3.6% Novonix (NVX) - No news, ralied with lithium stocks, falls with lithium stocks

-3.4% Endeavour Group (EDV) - No news, fall is consistent with prevailing short and long term downtrends

-3.3% Alliance Aviation Services (AQZ) - Gold Fields Contract Extension, fall is consistent with prevailing short and long term downtrends

-3.3% Lovisa Holdings (LOV) - No news, pull back after massive run following co's H1 FY24 results on 22 Feb

-3.2% Bannerman Energy (BMN) - No news, generally weaker uranium sector as spot uranium price continuees to fall

Broker Notes

-

Life360 (360)

Retained at buy at Goldman Sachs; Price Target: $14.20 from $10.50

Retained at overweight at Morgan Stanley; Price Target: $14.40 from $11.50

Aussie Broadband (ABB) upgraded to overweight from underweight at Morgan Stanley; Price Target: $5.50 from $2.40

Australian Finance Group (AFG) upgraded to neutral from sell at Citi; Price Target: $1.50

Aeris Resources (AIS) retained at neutral at Macquarie; Price Target: $0.13

Alcidion Group (ALC) retained at hold at Bell Potter; Price Target: $0.05 from $0.08

Atlas Arteria (ALX) retained at equalweight at Morgan Stanley; Price Target: $6.06

AMP (AMP) retained at buy at Citi; Price Target: $1.25

ANZ Group (ANZ) retained at hold at Citi; Price Target: $26.00

Aurizon Holdings (AZJ) retained at underweight at Morgan Stanley; Price Target: $3.77

Beforepay Group (B4P) retained at buy at Shaw and Partners; Price Target: $1.00

Bendigo and Adelaide Bank (BEN) retained at sell at Citi; Price Target: $8.60

-

Capitol Health (CAJ)

Retained at neutral at Jarden; Price Target: $0.27 from $0.36

Retained at outperform at Macquarie; Price Target: $0.32 from $0.30

Retained at buy at Ord Minnett; Price Target: $0.31 from $0.30

Retained at sector perform at RBC Capital Markets; Price Target: $0.27 from $0.25

Retained at marketweight at Wilsons; Price Target: $0.27 from $0.25

Commonwealth Bank of Australia (CBA) retained at sell at Citi; Price Target: $82.00

Cochlear (COH) retained at underperform at Macquarie; Price Target: $255.00

CSL (CSL) retained at outperform at Macquarie; Price Target: $310.00

DGL Group (DGL) retained at neutral at UBS; Price Target: $0.75 from $0.92

Droneshield (DRO) upgraded to buy from hold at Bell Potter; Price Target: $0.90

Fletcher Building (FBU) upgraded to buy from neutral at BofA; Price Target: $4.35 from $4.45

Fineos Corporation Holdings (FCL) retained at buy at Citi; Price Target: $2.25 from $2.70

Firefly Metals (FFM) retained at buy at Shaw and Partners; Price Target: $1.20

Integral Diagnostics (IDX) retained at outperform at Macquarie; Price Target: $2.65

IVE Group (IGL) retained at buy at Bell Potter; Price Target: $2.70 from $2.65

Imdex (IMD) retained at buy at Citi; Price Target: $2.25

Immutep (IMM) retained at buy at Bell Potter; Price Target: $0.65 from $0.55

Imricor Medical Systems (IMR) initiated speculative buy at Morgans; Price Target: $0.96

Johns Lyng Group (JLG) retained at buy at Citi; Price Target: $7.50 from $8.35

Lynas Rare Earths (LYC) retained at buy at Goldman Sachs; Price Target: $7.40

Monadelphous Group (MND) retained at buy at Citi; Price Target: $16.20

Megaport (MP1) retained at buy at Citi; Price Target: $16.80 from $12.05

Macquarie Group (MQG) retained at hold at Citi; Price Target: $161.00

Mount Ridley Mines (MRG) retained at equal-weight at Morgan Stanley; Price Target: $2.30

MMA Offshore (MRM) initiated buy at Citi; Price Target: $2.60

Monash IVF Group (MVF) retained at outperform at Macquarie; Price Target: $1.55

MyState (MYS) initiated buy at Ord Minnett; Price Target: $3.95

National Australia Bank (NAB) retained at sell at Citi; Price Target: $25.75

Nine Entertainment Co. Holdings (NEC) retained at buy at Goldman Sachs; Price Target: $2.10

National Storage REIT (NSR) retained at buy at Citi; Price Target: $2.60

NRW Holdings (NWH) retained at buy at Citi; Price Target: $3.25

News Corporation (NWS) retained at buy at Goldman Sachs; Price Target: $45.00

Pro Medicus (PME) retained at outperform at Macquarie; Price Target: $120.00

Polynovo (PNV) retained at outperform at Macquarie; Price Target: $2.75

-

Pepper Money (PPM)

Retained at neutral at Citi; Price Target: $1.55 from $1.40

Retained at overweight at Jarden; Price Target: $1.60 from $1.50

Upgraded to outperform from neutral at Macquarie; Price Target: $1.70 from $1.35

Retained at outperform at RBC Capital Markets; Price Target: $1.80 from $1.50

Perenti (PRN) retained at buy at Citi; Price Target: $1.25

-

Platinum Asset Management (PTM)

Retained at underweight at Barrenjoey; Price Target: $0.80 from $0.85

Upgraded to neutral from sell at Citi; Price Target: $1.15 from $1.00

Retained at sell at Goldman Sachs; Price Target: $1.00 from $1.12

Retained at underweight at JP Morgan; Price Target: $1.00 from $1.06

Qantas Airways (QAN) upgraded to outperform from underperform at CLSA; Price Target: $6.00 from $5.60

Qube Holdings (QUB) retained at equalweight at Morgan Stanley; Price Target: $3.48

Red 5 (RED) upgraded to buy from hold at Moelis Australia; Price Target: $0.40 from $0.34

Regis Healthcare (REG) retained at outperform at Macquarie; Price Target: $3.85

Resmed Inc (RMD) retained at outperform at Macquarie; Price Target: $33.45

South32 (S32) upgraded to outperform from neutral at Macquarie; Price Target: $3.40 from $3.10

Stockland (SGP) retained at overweight at Morgan Stanley; Price Target: $5.10

Select Harvests (SHV) upgraded to buy from neutral at UBS; Price Target: $5.10 from $4.20

Sigma Healthcare (SIG) retained at neutral at Citi; Price Target: $1.15 from $0.78

Service Stream (SSM) retained at buy at Citi; Price Target: $1.20

Seven West Media (SWM) retained at sell at Goldman Sachs; Price Target: $0.24

Transurban Group (TCL) retained at equal-weight at Morgan Stanley; Price Target: $13.68

Westpac Banking Corporation (WBC) retained at hold at Citi; Price Target: $22.25

Woolworths Group (WOW) retained at buy at Goldman Sachs; Price Target: $40.40

-

Xero (XRO)

Retained at buy at Goldman Sachs; Price Target: $152.00

Upgraded to outperform from underperform at Macquarie; Price Target: $152.60 from $87.00

Scans

This article first appeared on Market Index on 5 March 2024.

5 topics

10 stocks mentioned