ASX 200 flat ahead of RBA and BoJ decisions, S&P 500 snaps three-day losing streak

ASX 200 futures are trading 3 points higher, up 0.03% as of 8:30 am AEDT.

S&P 500 SESSION CHART

ASX TODAY

- ASX 200 set for a flattish open ahead of several high-profile macro events

- ANZ CEO looks for India, China growth as focus shifts (Bloomberg)

- Perseus among potential bidders for Newmont’s Akyem gold mine (The Australian)

- Latin Resources puts Maverick Minerals spinout on hold due to challenging market conditions (Announcement)

- Seven Group increases Boral stake from 71.65% to 72.65% (Announcement)

- Webjet reaffirms full-year underlying EBITDA to be above midpoint of $180-190 million vs. $185 million consensus (Announcement)

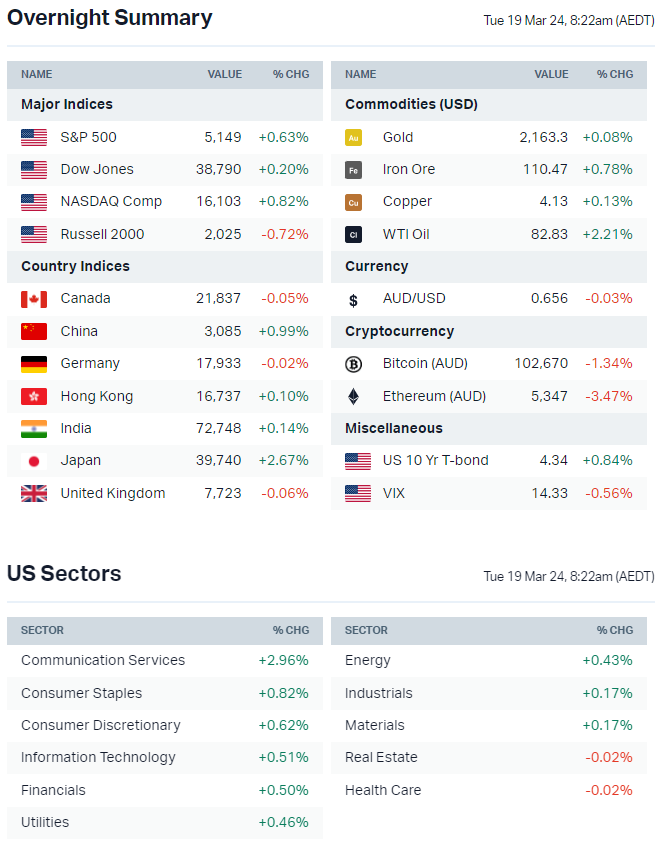

MARKETS

- S&P 500 higher but finished near worst levels

- Small caps struggled, the Russell 2000 underperformed the S&P 500 by 130 bps

- Bond yields continued to trend higher, with the US 10-year yield up for a sixth straight session and close to 3 month highs

- Near-term overhangs include corporate blackout window (runs through to 26 April), US$25bn of equities for sale by pensions as part of quarter-end rebalancing, unfavourable seasonality trends for late-March and stretched sentiment

- Breadth improvement with over three quarters of the S&P 500 trading above their 200-day moving averages, the highest since late 2021, according to Bespoke

- Industrials exhibit the strongest breadth profile, according to Morgan Stanley

- Energy, Materials, Real Estate and Utilities have shown the most improvement in the past month

- Massive week for high-profile macro events including Nvidia’s GPU Technology Conference as well as interest rate decisions from the Bank of Japan, Fed and RBA

- Fed swaps now pricing less than 50% chance of rate cut in June (Bloomberg)

- Strategist monitoring 4.35% level for 10-year Treasury yield, highlighting risk for US equity rally (Bloomberg)

- Bond traders surrendering to a higher for longer regime from Fed and a murky path forward for markets (Bloomberg)

INTERNATIONAL STOCKS

- Apple in talks to build Google's Gemini AI engine into the iPhone (Bloomberg)

- TSMC bulls ignore Buffett's warning by betting on company's AI-driven growth prospects (Bloomberg)

- Pfizer plans to sell ~$2.5bn of shares in UK consumer health company Haleon (Bloomberg)

- Exxon CEO says company not trying to buy Hess, only seeking to secure Guyana assets (Reuters)

CENTRAL BANKS

- BoJ set to end YCC, purchases of risk assets this week (Nikkei)

- BOJ may pivot but analysts say unlikely to materially shift ~$3tn of yen that Japanese investors have parked abroad (Reuters)

- Fed's new economic projections this week may be a wild card, potentially flagging less rate cuts for this year (Reuters)

- BoE to cut rates in June, earlier than previous expectations (FT)

- RBA expected to leave the cash rate at 4.35% at its Tuesday policy meeting as economy shows signs of slowing (Bloomberg).

GEOPOLITICS

- Putin wins landslide Russian presidential election with no real competition (Reuters)

- Israeli military target Gaza hospital Al-Shifa, citing Hamas activity (Bloomberg)

- Israel sends delegation to Qatar to offer a six-week Gaza truce under which the Palestinian militants would free 40 hostages (Reuters)

ECONOMY

- China's strong factory output, investment growth may raise doubts over how soon Beijing officials provide more stimulus (Bloomberg)

- China economy improving but weakness in the property sector remains major overhang on growth prospects (Reuters)

Oil's Comeback

The ASX 200 Energy Index has been the second best performing sector in the past week (not that there was much competition since everything else was flat or red), with oil prices up around 5% in the last four sessions to near five month highs.

Morgan Stanley revised its Brent forecast higher overnight to US$90 a barrel by the September quarter. Here are its key takeaways:

- Oil demand on track to grow ~1.5 million barrels a day this year, slightly above historical trend growth, driven by jet fuel, and regionally by China and India

- Supply forecast for OPEC and Russia revised down in Q2-3 after OPEC+ agreement extension and recent drone attacks on Russian refineries

- Non-OPEC non-Russia supply outlook broadly unchanged

- 1Q24 forecast of US$85 (up from US$82.5), 2Q24 forecast of US$87.5 (up from US$82.5) and 3Q24 of US$90 (up from US$80)

Sectors to Watch

It's a bit of a waiting game for markets ahead of new monetary policy guidance from the RBA and Fed as well as the Bank of Japan's widely expected plans to end negative interest rates.

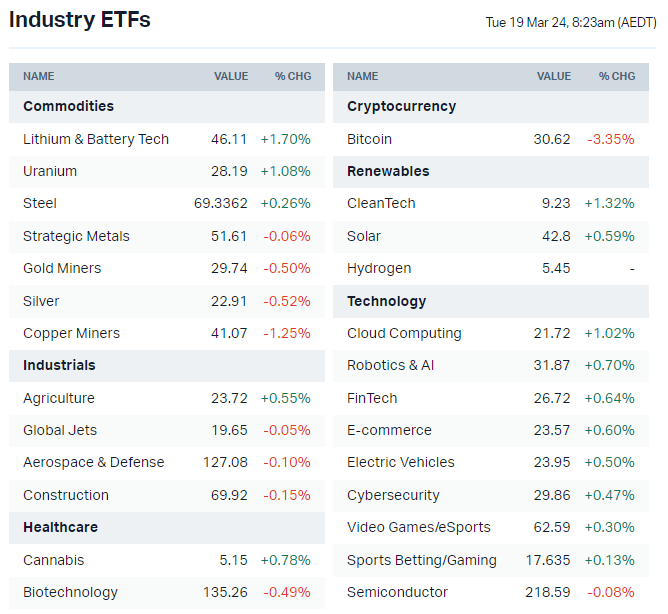

Overnight winners – Uranium ETF (URA) up for a third straight session (up only 1.08% so nothing wild but still a positive for uranium equities)

Choppy sectors – Rare Earths/Strategic Metals ETF (REMX) finished around breakeven following a choppy session for Chinese lithium carbonate futures (finished Monday session up 3.0%, down from session highs of 4.6% and unchanged over the last five sessions).

Overnight losers – Several ETFs from the above watchlist eased overnight including Biotech, Homebuilders, Gold Miners (despite slightly higher gold prices) and Copper Miners (despite relatively unchanged copper prices).

KEY EVENTS

- Trading ex-div: Auckland International Airport (AIA) – $0.06, LGI (LGI) – $0.012, Briscoe Group (BGP) – $0.154, Seek (SEK) – $0.19, Credit Corp (CCP) – $0.15, Adrad (AHL) – $0.013

- Dividends paid: Amcor (AMC) – $0.189, Challenger (CGF) – $0.13, Resimac (RMC) – $0.035, HiTech (HIT) – $0.05, REA (REA) – $0.87, Baby Bunting (BBN) – $0.018, Johns Lyng (JLG) – $0.047, Dalrymple Bay (DBI) – $0.05

- Listing: None

- 2:00 pm: Bank of Japan Interest Rate Decision

- 2:30 pm: RBA Interest Rate Decision

- 9:00 pm: Germany ZEW Economic Sentiment Index (Mar)

- 11:30 pm: Canada Inflation (Feb)

- 11:30 pm: US Building Permits (Feb)

This Morning Wrap was written by Kerry Sun.

1 contributor mentioned