ASX 200 futures flat, S&P 500 gives back early strength, Treasury yields tumble

ASX 200 futures are trading 5 points higher, up 0.07% as of 8:20 am AEST.

S&P 500 SESSION CHART

MARKETS

- S&P 500 finished slightly lower, down from session highs of 0.72%

- US bond yields sold off for a third-straight session, 2-year yield down 31 bps in the last three sessions to lowest level since 14 July

- Market now expects the first Fed cut to take place in May 2024 with nearly 100 bps in easing seen for the full year (two months ago, it only expected 50 bps of easing)

- Investors Intelligence bulls jumped to 55.7% in latest survey, marks the highest level since late July’s 57.1% and enters the ‘caution zone’ (major indices tumbled more than 10% in September)

- Insiders snap up company shares, signals rally has room to run (Bloomberg)

- Bill Ackman bets Fed will begin cutting rates as soon as the first quarter of 2024, sooner than markets are expecting (Bloomberg)

- Derivatives markets positioning for aggressive Fed easing in 2024 (Bloomberg)

- OPEC+ continuing to hold talks on 2024 policy, with no delay to a meeting scheduled for Friday (Reuters)

STOCKS

- Apple to end credit card partnership with Goldman Sachs (Bloomberg)

- 3M and DuPont win forever chemicals class action lawsuit (Reuters)

- Micron raises guidance but below analyst expectations (Bloomberg)

- CrowdStrike sees strong Q4 on resilient cybersecurity demand (Reuters)

- GM sees US$9.3bn hit from labour deals, outlines US$10bn buyback (Reuters)

- Hewlett Packard beats quarterly profit estimates but forecast falters (Reuters)

- Lineage Logistics eyes US$30bn valuation in IPO next year (Bloomberg)

CENTRAL BANKS

- Fed officials signal December pause (Bloomberg)

- RBNZ on hold, warns of further rate hikes if inflation surprises (Bloomberg)

- Rising JGB yields drive BOJ's unrealized losses to 10.5 trillion yen (Nikkei)

- China-style quantitative easing emerges as property fix option (Bloomberg)

- Bank of Korea expected to leave rates unchanged Thursday (Bloomberg)

GEOPOLITICS

- Hamas releases more hostages as CIA and Mossad meet (Reuters)

- Finland will close entire border with Russia until 13-Dec (CNBC)

- US Congressional leaders to drop China investment curbs from Defence Bill (Bloomberg)

ECONOMY

- US economy grows 5.2% in the third quarter (Reuters)

- German inflation eases to 3.2% in November (Reuters)

- Spanish inflation falls to 12-month low of 3.2% in November (Reuters)

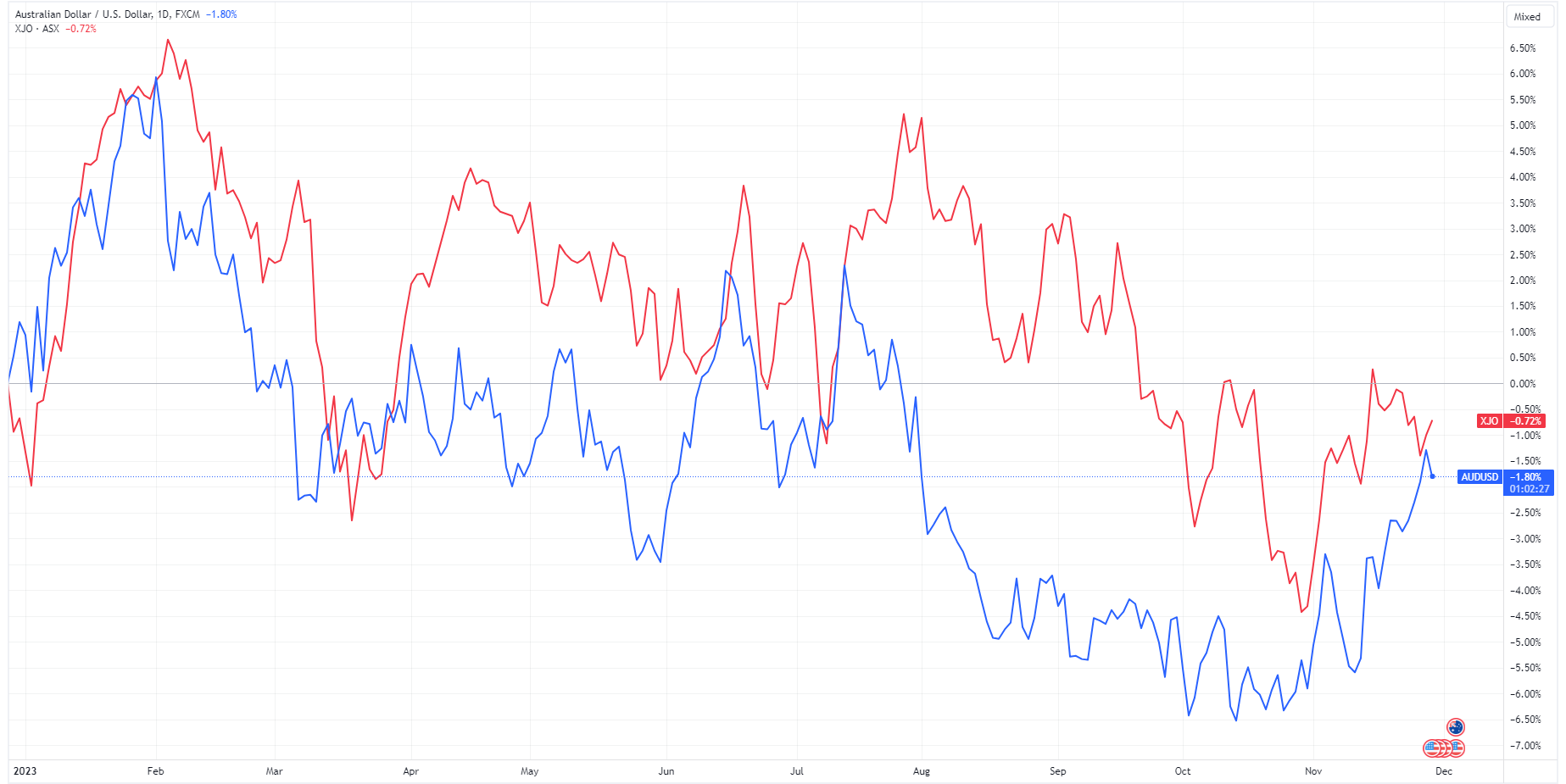

The Aussie Dollar Resurgence

After a little while in the doldrums, the Australian Dollar is back at levels we haven't seen since early August. Earlier this week, the local currency also passed its 200-day moving average for the first time in four months (I am no technical aficionado, but I've been informed this is important). There are several reasons why the Australian Dollar has been on a good run:

- The US Dollar has fallen sharply as traders bet the Fed is done with rate hikes

- The front end of the US bond curve has also acted as a big depressant on Australian Dollar strength. Now that yields are coming down, the local unit has room to move higher

- Iron ore has been on a tear, with prices are up 10% in the past month and that has flown through to the local unit given we are widely perceived as a China and risk-on proxy

- The switch to gold and bonds as a safe haven takes away from the US Dollar and this has also, without a doubt, impacted the value of the reserve currency

Some traders argue the Australian Dollar would be on an even bigger run if it were not for fears of an intervention in the Chinese and Japanese currency markets by those respective central banks.

AUD/USD (Blue) vs. ASX 200 (Red) | Source: TradingView

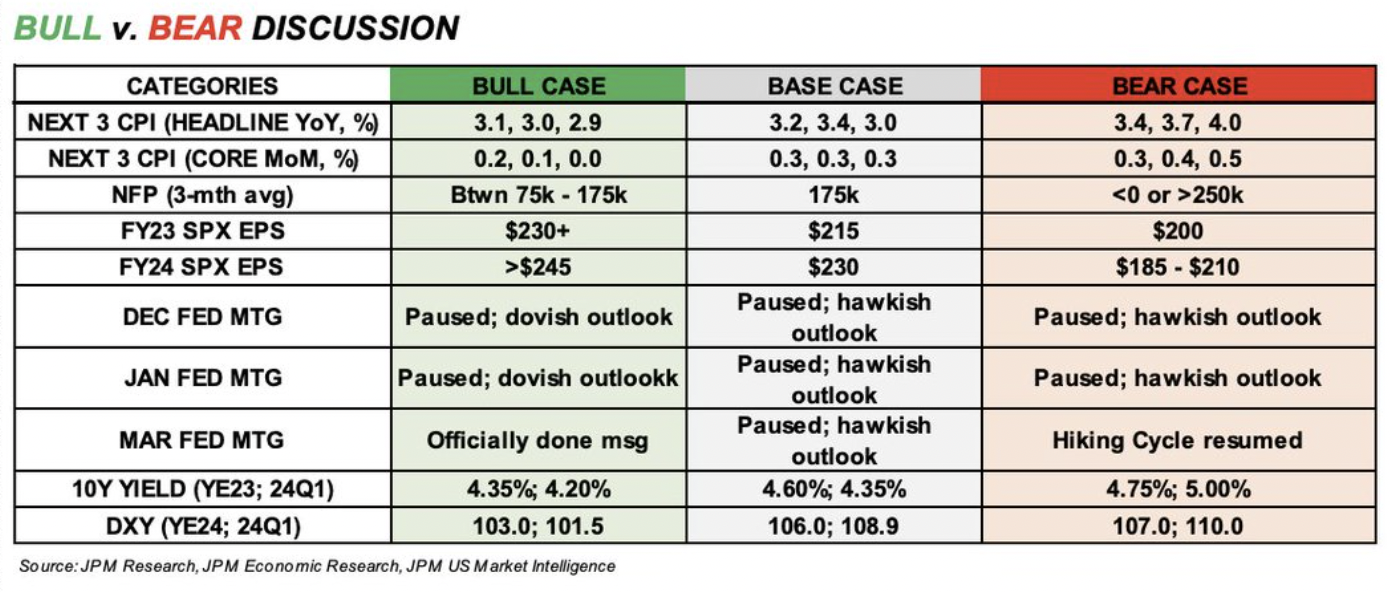

The JPMorgan Bull, Bear, and Base Case

Marko Kolanovic, who was once one of Wall Street's most outspoken bulls, has been noticeably far more bearish in recent months. His bull, bear, and base case tables reveal some incredibly interesting storylines over the next three months.

The base case at JPM is currently the bearish view, with Kolanovic's team arguing that "stocks should be an underweight in portfolios given a slowing economy, increasingly constrained consumer, margin compression, valuations, and the potential for Fed-induced economic destruction."

And before you think Kolanovic is a party pooper, you may want to award that title to BCA Research instead. The Montreal-based investment advisory firm is calling for a ~10% earnings downgrade cycle next year and an S&P 500 that could finish the year at just 3,700. If that pans out, that would be an 18% fall in the S&P 500... which also happens to be the gain for the S&P 500 this year. You can read more about the S&P 500 targets (and the wild, wild range between analysts here.)

KEY EVENTS

ASX corporate actions occurring today:

- Trading ex-div: Aristocrat Leisure (ALL) – $0.34, Technology One (TNE) – $0.14

- Dividends paid: Bisalloy Steel (BIS) – $0.10, Rand Mining (RND) – $0.10, Copper Strike (CSE) – $0.02, Acrow (ACF) – $0.02, Kelly Partners (KPG) – $0.004, Janus Henderson (JHG) – $0.61, Tribune Resources (TBR) – $0.20, BlackWall (BWF) – $0.02, US Student Housing REIT (USQ) – $0.005

- Listing: Freedom Care Group (FCG) – 11:00 am

Economic calendar (AEDT):

- 11:30 am: Australia Building Permits (Oct)

- 11:30 am: Australia Housing Credit (Oct)

- 12:30 pm: China NBS Manufacturing and Services PMI (Nov)

- 9:00 pm: Eurozone Inflation (Nev)

- 11:00 pm: India GDP (Oct)

- 12:30 am: Canada GDP (Q3)

- 12:30 am: US Personal Consumption Index (Oct)

This Morning Wrap was written by Hans Lee.

1 contributor mentioned