ASX 200 futures flat, S&P 500 hovers around 5000 + Charts of the Week

ASX 200 futures are trading flat as of 8:30 am AEDT.

S&P 500 SESSION CHART

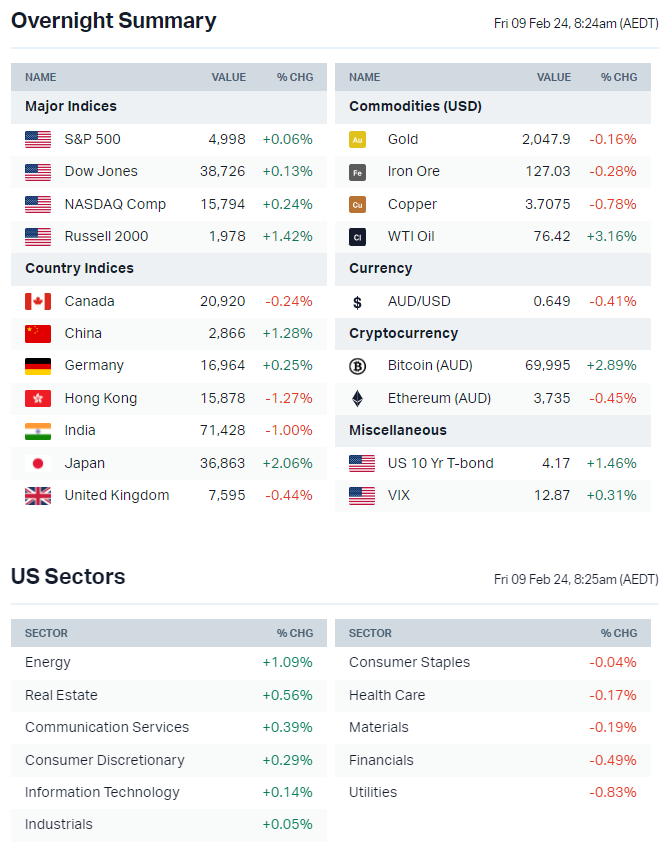

MARKETS

- ASX 200 set for a flattish open after a relatively mixed session on Wall Street

- Underperformance of US Financials and Materials as well as slightly higher yields/US dollar could place downward pressure on our market

- Boral released its 1H24 result and it smashed expectations (NPAT of $138.6m vs. $108m consensus and upgraded full-year EBIT guidance to $330-350m vs. prior $300-330m)

- S&P 500 traded largely sideways and failed to close above the 5000 level

- Russell 2000 rallied after underperforming in the prior session

- Crude settled 3.3% higher, its third consecutive daily gain

- JP Morgan predicts equities to fall 20-30% from 2024 peak (Investing.com)

- Hedge funds betting on US dollar appreciation (FT)

STOCKS

- Big oil firms return record amount to shareholders in 2023 (Reuters)

- Google rebrands Bard chatbot Gemini, offering $20/month subscriptions (Reuters)

- McKinsey & Co places 3,000 employees on review (Bloomberg)

- GM selects former Tesla executive to lead battery unit after committing billions to sourcing battery materials (Reuters)

- L'Oreal CEO predicts price increases will slow this year (FT)

EARNINGS

Arm (+47.9%) – Double beat, quarterly revenue up 14% year-on-year to US$824m, raised next quarter revenue guidance to US$850-900m vs. US$780m current estimate, also upgraded full-year view.

- License growth: "More companies choosing Arm's most advanced CPUs to run AI , where more advanced CPUs command a higher license fees."

- AI momentum: "We are also seeing strong momentum and tailwinds from all things AI. From the most complex devices on the planet for training and inference, the NVIDIA Grace Hopper 200 to edge devices such as the Gemini Nano Pixel 6 from Google or the Samsung Galaxy S23, more and more AI us running on more edge .... and that's all running on Arm."

- Royalties: "We're getting paid royalties on roughly 8 billion chips a quarter ..."

Disney (+11.5%) – Earnings beat but revenue miss, EPS up 23.2% year-on-year, boosted dividends by 50%, targets US$3bn in FY24 share repurchases and invested US$1.5bn in Epic Games, the owner of Fortnite. pa

PayPal (-11.2%) – Double beat but forecasts full-year EPS of $5.10 vs. $5.50 consensus.

Maersk (-14.7%) – Double miss, management expect earnings this year to be below last year due to oversupply of container vessels and uncertainty around Red Sea disruptions, CEO says they are more negative on overcapacity than analysts and investors, Red Sea disruption does not resemble what happened to shipping during the pandemic, suspended share buyback.

CENTRAL BANKS

- Mexican central bank keep rates unchanged for seventh straight meeting (Bloomberg)

- Fed officials say they see no urgency cut rates (Bloomberg)

- Strategists see Fed stopping QT with balance sheet still at least $7tn (Reuters)

- BOJ Governor Uchida downplays prospects for successive rate hikes (Bloomberg)

- ECB economic bulletin notes near-term weakness in economy (ECB)

- RBI keeps rates steady, maintains hawkish stance (Bloomberg)

GEOPOLITICS

- US drone strike kills top commander of Iran-backed militia group blamed for attacks on US forces in Iraq and Syria (Washington Post)

- EU countries have started discussions on how to respond to punitive measures if Trump is elected (Bloomberg)

CHINA

- China’s consumer prices suffer biggest fall since 2009 (Reuters)

- China CPI logs biggest drop since 2009, PPI deflation extends to 16th month (FT)

- China stock trading surges after Beijing unveils more state-led buying (FT)

Charts of the Week

This segment of the morning wrap brings you weekly technical commentary on the ASX 200 and some of the more interesting charts in the market. These charts are for illustrative and educational purposes. Always do your own research.

Setting the scene: The ASX 200 was pretty choppy this week, so far down 0.78%. Major benchmarks are in a tricky spot – The momentum should be respected but increasingly oversold and fatigued.

Charts from last week (you can check of last week's charts here):

- Alligator Energy (ASX: AGE) started to push out, in-line with the broader strength we're seeing across the uranium sector.

- Gentrack (ASX: GTK) broke out around 7% since last Thursday close to near 4-year highs

- Insurance Australia (ASX: IAG) also broke out of its recent trading range. It's on a 7-day winning streak and trading at levels not seen since May 2020

- Iress (ASX: IRE) is also slowly breaking out of its recent trading range to August 2023 levels

- West African Resources (ASX: WAF) was a disaster. WAF initially rallied 4.1% last Friday to a 10-month high but sold off 17% over Mon-Tue after a dip in gold prices and poor quarterly update. A reminder that charts aren't everything and why its important to manage risk

Interesting charts for this/next week:

Accent Group (ASX: AX1) is a pretty textbook setup. Price action has been rather tight the past few weeks and its trying to break out after six months of consolidation. Also note tailwinds from peers such as Nick Scali's 1H24 earnings beat and Myer's solid trading update.

Botanix Pharmaceuticals (ASX: BOT) a less constructive version of the above chart. But still trying to break out after six or so months of consolidation. The company completed a $13.5m placement in December 2023, so the stock might have a bit more supply to get through.

Suncorp (ASX: SUN) is another strong name from the insurance sector that's trying to break out into multi-year highs. Like I said last week, insurance stocks are not exciting. They love to grind sideways like no tomorrow. IAG has already moved out of its recent trading range. Let's see if SUN can do the same.

KEY EVENTS

ASX corporate actions occurring today:

- Trading ex-div: None

- Dividends paid: Newmark Property REIT (NPR) – $0.019

- Listing: None

Economic calendar (AEDT):

No major economic announcements.

This Morning Wrap was written by Kerry Sun.

7 stocks mentioned

1 contributor mentioned