ASX 200 set to rise, Nasdaq powers ahead, UBS brings back former CEO Sergio Ermotti

ASX 200 futures are trading 48 points higher, up 0.67% as of 8:20 am AEDT.

The S&P 500 rallies back above the 4,000 level led by mega cap tech stocks, Lululemon posts a strong December quarter result and upgrades its full-year guidance and former UBS CEO Sergio Ermotti (who helped restructure the bank in the aftermath of the Global Financial Crisis) returns to help manage the Credit Suisse acquisition.

Let's dive in.

S&P 500 SESSION CHART

MARKETS

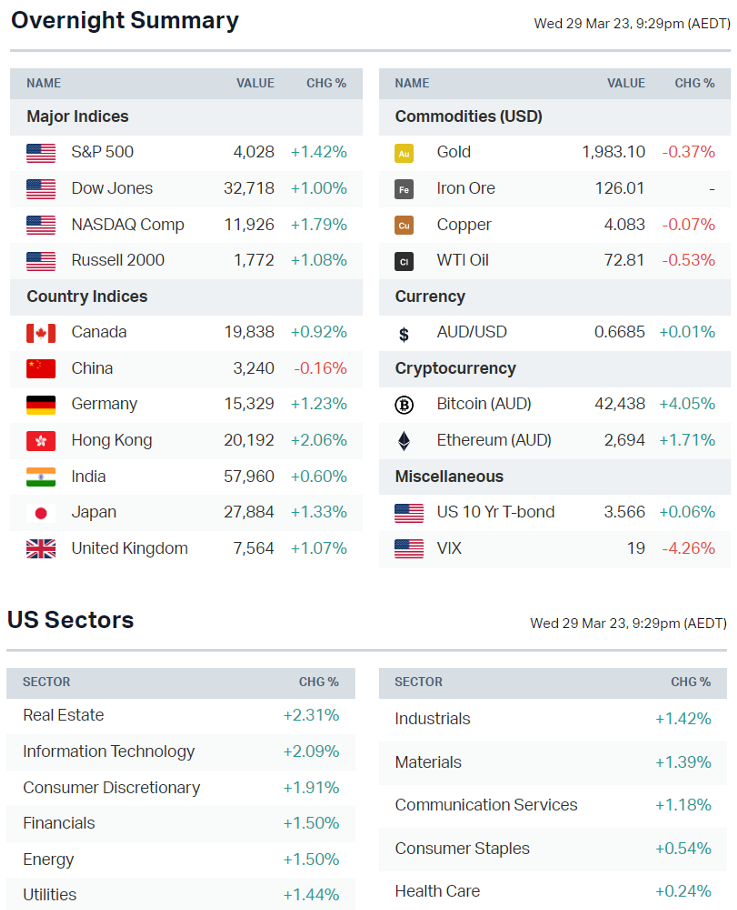

- S&P 500 opens 0.7% higher, trends higher and closes at session highs

- Institutional money continues to prop up heavily weighted mega cap tech names

- No specific factor driving the overnight strength in equity markets

- Some bullish focus points include tech strength in Asia driven by the Alibaba breakup, peak rates gathering momentum, strong results from Lululemon supporting consumer resilience theme and cooler-than-expected Australian inflation

- Traders go long treasuries after hedge funds unwind short bets (Bloomberg)

STOCKS

- Lululemon (+12.7%) shares soar on holiday quarter earnings beat, ups guidance (CNBC)

- Micron (+7.2%) plans for a big headcount reduction, misses quarterly earnings

- UBS (+4.3%) former CEO Sergio Ermotti returns to help manage Credit Suisse (Reuters)

- Apple (+2.0%) to hold annual developers conference from June 5-9 (CNBC)

BANKING CRISIS

- Credit Suisse sale 'forever impairs the ability to issue AT1s' (FT)

- Top US financial officials flag stronger capital and liquidity standard for banks (Bloomberg)

- White House expected to call on regulators to re-establish rules that were rolled back in 2018 for mid-sized backs including higher capital and cash requirements (Washington Post)

- St. Louis Fed's Bullard says banking crisis can be contained by macroprudential measures rather than interest rates (Fed)

ECONOMY

- NY Fed survey shows sharp decline in year-ahead home price expectations (NY Fed)

- US mortgage refinancing at highest since Sept as 30-yr rates hit 6-week lows (Reuters)

- German consumer confidence slows down on path to recovery (Reuters)

-

Australian monthly inflation slows further from December peak (Reuters)

Deeper Dive

Sectors to Watch

Travel, Copper and Uranium: These sectors showed solid gains overnight (as per the ETF table above) and all on four day winning streaks. Its worth noting that they're also coming off of rather sharp declines, so is this a relief rally or has a floor been finally set?

Economy: Inflation and upcoming catalysts

The Australian monthly inflation indicator came in cooler than expected yesterday. Over the year to January, inflation only (only) rose by 6.8% year-on-year, well down from the previous 7.4% figure and the cycle peak of 8.4%. You can all thank a big decrease in the cost of building materials for allowing this result to occur. New dwelling prices grew at its slowest pace since February 2022. The bad news is that rental prices are still going up, as are prices for takeaway food and breakfast ingredients (bread, cereal, dairy).

The big risk events are still coming though:

- The flash estimates for EU inflation (+7.1% and +5.7% for headline and core respectively)

- US Core PCE inflation (+0.4% m/m is the estimate)

The latter is particularly important as it's the Fed's favourite inflation gauge. Perhaps, the great wave of central bank pauses is nearer than we all thought.

What Michael Wilson is buying

Famous for his bearish forecasts on the S&P 500 over the last two years (which somehow, were also not bearish enough last year), Mike Wilson at Morgan Stanley has made a few changes to the team's US conviction list.

- BUY on Colgate (NYSE: CL) - Sales growth is not in the price, and gross margin upside is very possible for the rest of 2023 (up to 200 bps by their forecasts)

- BUY on Walmart (NYSE: WMT) - Increasing EPS visibility and stabilising margins are great news

Do you get the theme? Defensives over cyclicals. This must also explain why the team is selling Exxon Mobil (NYSE: XOM) and NYSE-listed REIT Simon Property Group (NYSE: SPG).

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Centuria Industrial (CIP) – $0.04, Charter Hall Long Wale REIT (CLW) – $0.07, Sigma Healthcare (SIG) – $0.005, Australian Unity Office Fund (AOF) – $0.025, Dexus Convenience Retail REIT (DXC) – $0.054, Dexus Industria REIT (DXI) – $0.041, Arena REIT (ARF) – $0.042, Rural Funds (RFF) – $0.029, Waypoint REIT (WPR) – $0.041, Homeco (HDN) – $0.021, Lindsay Australia (LAU) – $).01

- Dividends paid: Coles (COL) – $0.36, Ampol (ALD) – $1.05, Newcrest Mining (NCM) – $0.224, Mineral Resources (MIN) – $1.20, Commonwealth Bank (CBA) – $2.1, BHP (BHP) – $01.36, Iluka Resources (ILU) – $0.2, Ramsay Healthcare (RHC) – $0.5, Base Resources (BSE) – $0.02, Contract Energy (CEN) – $0.125

- Listing: None

Economic calendar (AEDT):

- 11:00 pm: Germany Inflation Rate

- 11:30 pm: US Initial Jobless Claims

This Morning Wrap was first published for Market Index and written by Hans Lee and Kerry Sun.

2 contributors mentioned