ASX 200 sinks on global markets, recession fears, mining & energy hardest hit

Today in Review

Markets

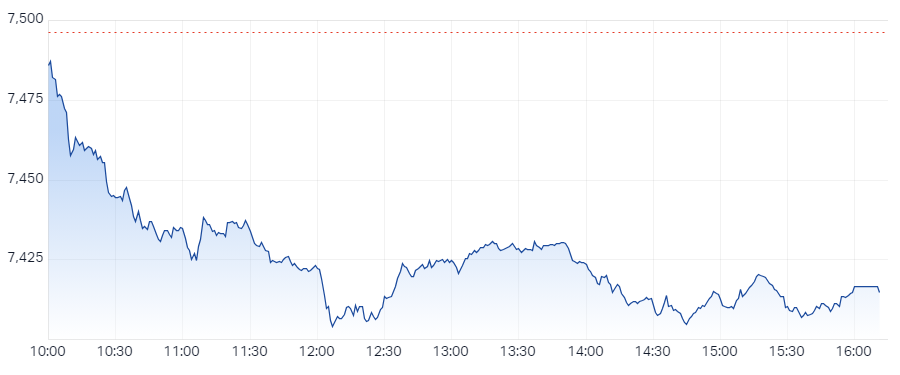

ASX 200 Session Chart

%20Intraday%20Chart%2016%20Jan%202024.png)

The S&P/ASX200 (XJO) finished 81.5 points lower at 7,414.8, 1.1% from its session high and just 0.2% from its high/low. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by a truly dismal 55 to 219. Ouch!

Each platitude feels like wishful thinking after today's sell off in which pretty much nothing was spared. All 11 of the major ASX sectors were down, with mining and energy names bearing the brunt of the selling.

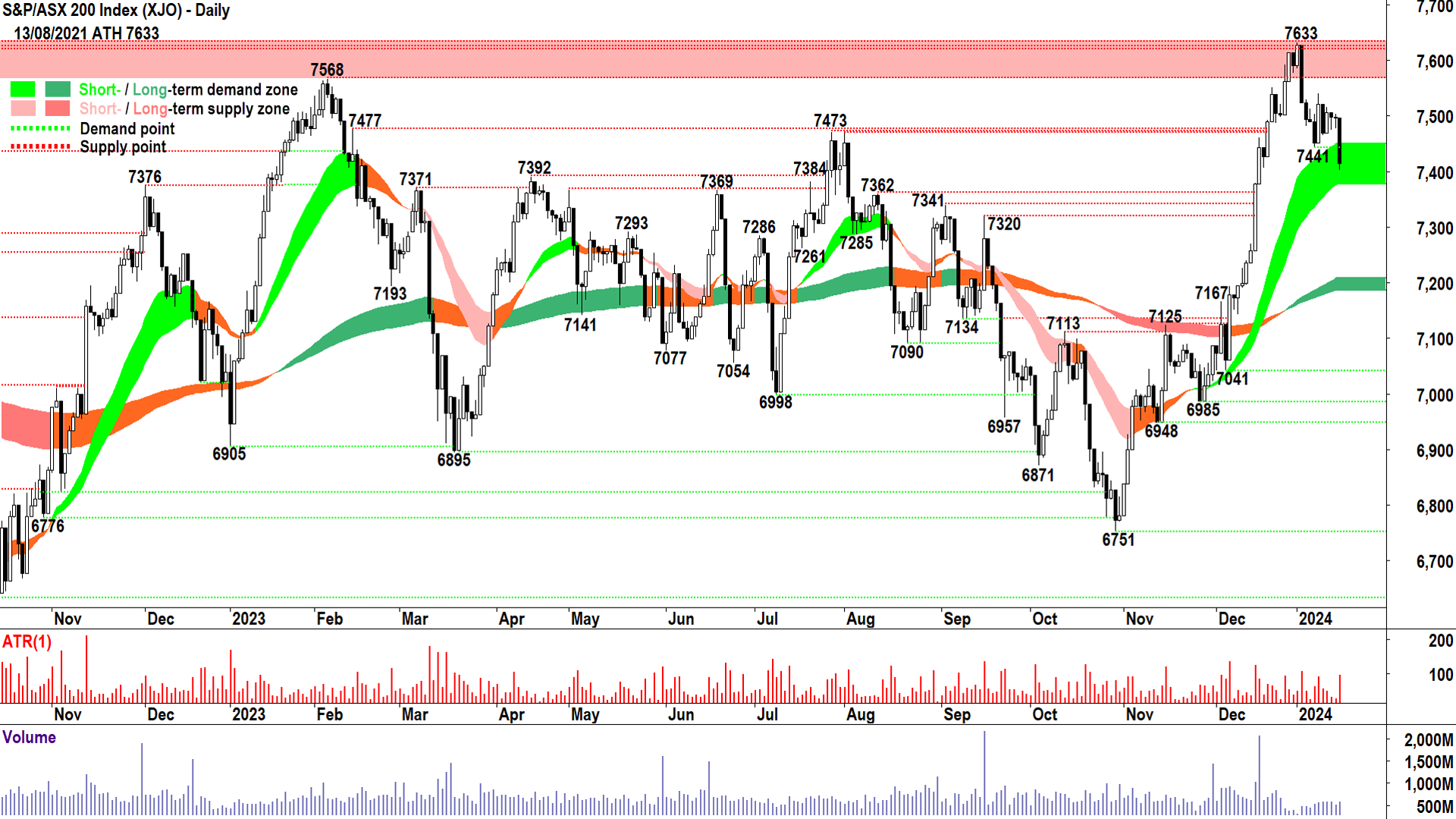

As it says in the caption, that is definitely not the candle ASX investors wanted to see out of what was building as a promising consolidation zone. We all know nothing goes up forever, there's a reason why technical analysts refer to a "healthy pullback". It's good to shake a few weak hands and Jonny-come-latelys from the tree from time to time.

The usual bull market scenario is: Big run up on big daily ranges, small pullback on small daily ranges. Basically, highly motivated demand versus unmotivated supply. That's how it was looking until today's candle. Unfortunately today's candle indicates we're not in a healthy pullback anymore, but something which is going to take longer, and likely probe deeper in terms of price, to play out.

These are the key levels I'm now looking for:

- Short term uptrend ribbon: often provides an zone of "dynamic support"

- Point of demand from historical peaks/troughs: area between 7320 - 7362

- Point of supply from historical peaks/troughs: 7542 & 7633

- Close below 7320 could see a deeper retracement to LT trend ribbon around 7200

- Close above 7542 confirms resumption of short term uptrend, likely retest of 7633 all-time highs

Economy

-

Westpac Melbourne Institute Consumer Sentiment Index-1.3% to 81 in January (vs +2.7% in December

- Negative readings indicate deterioration in consumer sentiment, bad for the economy as roughly two-thirds of GDP is derived from consumer spending

- Cost of living and higher interest rates are the main concerns

- One of the most pessimistic starts to a year

- Over half of respondents still expect rates to rise

- Big drop in "finances compared to a year ago" sub-index, -7.6%

- "Economic outlook, next 5 years" sub index -6.3%

- But! Not all doom and gloom, employment index was up 1.4%

What to watch out for...

- Weds from 1:00pm: China "Data Dump" including Industrial Production, quarterly GDP, new home prices, retail sales, fixed asset investment, NBS interest rate decision, unemployment rate

- Thurs from 12:30am: US retail sales; from 11:30am Australian employment change and unemployment rate

Latest News

Super Retail Group, JB Hi-Fi, Universal Store Holdings: Brokers vs Charts…Who wins?

The highest yielding ASX 200 stocks: Which ones will deliver in 2024?

Short Selling: Shorters continue to pile into lithium companies, uranium shorts rise

Cheap ASX 200 stocks with P/E less than 10: Which have big potential upside?

7 fund managers pitch why their asset class will help you most in 2024

4 ETFs that could boost your income in 2024

Interesting Movers

Trading higher

- +9.2% Zip Co (ZIP) - No news, bounced of technical support from 12 December low

- +5.3% Cobram Estate Olives (CBO) - No news, rally is consistent with prevailing short and long term uptrends

- +4.1% Immutep (IMM) - No news, rally is consistent with prevailing short and long term uptrends

- +3.3% Westgold Resources (WGX) - No news, rally from long term uptrend ribbon support

- +3.1% Alliance Aviation Services (AQZ) - No news, rally is consistent with prevailing short uptrends, long term trend showing signs of turning up

Trading lower

- -6.7% Fineos Corporation Holdings (FCL) - No news, pullback from strong 3-day rally

- -6.5% Develop Global (DVP) - No news, fall is consistent with prevailing short and long term downtrends

- -5.8% 29METALS (29M) - No news since 11-Jan Response to ASX Price Query, fall is consistent with prevailing short and long term downtrends

- -5.6% Seven West Media (SWM) - No news, fall is consistent with prevailing short and long term downtrends

- -5.2% Lovisa Holdings (LOV) - Downgraded to neutral from buy at UBS; Price Target: $24.00 from $23.00

- -5.0% Catapult Group International (CAT) - No news, price action has swung to lower peaks and lower troughs

- -4.7% Calix (CXL) - No news, fall is consistent with prevailing short and long term downtrends

- -4.7% Nuix (NXL) - No news since 12-Jan 1H24 Results Update, continued fallout

- -4.6% Mount Gibson Iron (MGX) - No news, price action has swung to lower peaks and lower troughs

- -4.5% Silex Systems (SLX) - Uranium sector pullback after strong 4-day rally

- -4.5% Ansell (ANN) - No news, short term trend rolling, has resumed long term downtrend

- -4.2% South32 (S32) - General weakness in mining sector, lower commodity prices, has resumed long term downtrend

Broker Notes

- Alkane Resources (ALK) downgraded to accumulate from buy at Ord Minnett; Price Target: $0.70 from $0.75

- BHP Group (BHP) downgraded to hold from accumulate at Morgans; Price Target: $49.00 from $50.00

- Beach Energy (BPT) retained at neutral Citi; Price Target: $1.60 from $1.55

- Charter Hall Group (CHC) upgraded to overweight from equalweight at Morgan Stanley; Price Target: $13.25 from $11.10

- Fortescue (FMG) retained at sell Citi; Price Target: $23.00 from $18.90

- Hub24 (HUB) retained at neutral Citi; Price Target: $42.20 from $35.60

-

Karoon Energy (KAR)

- Retained at buy Citi; Price Target: $3.25

- Retained at outperform Macquarie; Price Target: $2.60

- Lovisa Holdings (LOV) downgraded to neutral from buy at UBS; Price Target: $24.00 from $23.00

- Macquarie Group (MQG) retained at neutral UBS; Price Target: $185.00 from $180.00

- Netwealth Group (NWL) upgraded to neutral from sell at Citi; Price Target: $16.10 from $13.45

-

Rio Tinto (RIO)

- Downgraded to hold from accumulate at Morgan Stanley; Price Target: $127.00

- Retained at buy Citi; Price Target: $139.00

-

Super Retail Group (SUL)

- Downgraded to underweight from neutral at JPMorgan; Price Target: $15.50

- Downgraded to underperform from neutral at BofA; Price Target: $14.60

- Downgraded to hold from add at Morgans; Price Target: $17.50

- Downgraded to underperform from buy at CLSA; Price Target: $16.50

- Downgraded to underperforrm from neutral at Jarden; Price Target: $14.50

- Retained at neutral Barrenjoey; Price Target: $15.20

- Retained at buy Citi; Price Target: $19.00

- Retained at sell Ord Minnett; Price Target: $10.50

- Southern Cross Media Group (SXL) retained at buy Ord Minnett; Price Target: $1.70

Scans

This article first appeared on Market Index on 16 January 2024.

3 topics

9 stocks mentioned