Increasing confidence in ASX small cap outlook

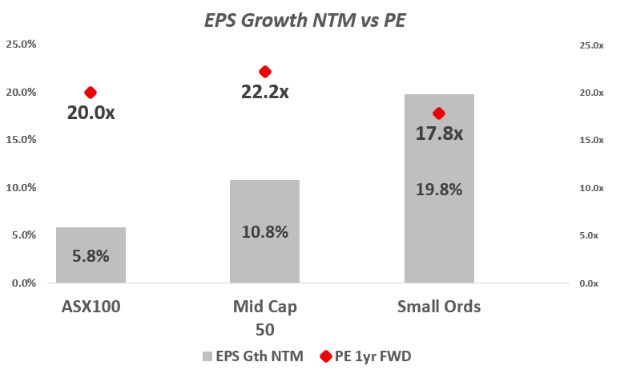

ASX Smaller companies are expecting superior growth than the ASX100 over the next 12 months. Small Caps despite this more robust growth profile trade at a discount to large and mid-cap stocks. In the short term, sentiment can dictate valuation, but over the long-term share prices track earnings which sets up well for future returns for small cap investors.

Source: Barrenjoey

Further interest rate cuts a tailwind for ASX small caps

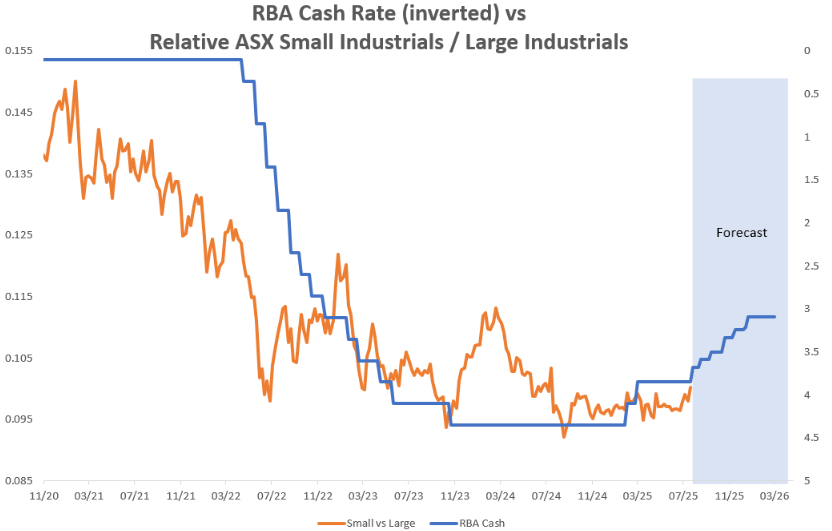

After two interest rate cuts in earlier in 2025, today the RBA delivered another 25bps cut and market expectations are for a further 50bps (2 x 25bps) over the coming 12 months. Domestically, inflation at 2.1% is now tracking towards the bottom of the RBA’s 2-3% guidance range and unemployment rate jumped to a 3-year high of 4.3%.

Small Caps have historically performed well during rate easing cycles, and we expect interest rate sensitive sectors like financials, retail and housing to do well with this supportive backdrop.

Through 2022 and 2023 ASX Small Industrials significantly underperformed ASX Large Industrials after the RBA increased the cash rate on 13 occasions to combat the high inflationary environment at the time. With the inflation problem now behind us, and with interest rates now being cut we have started to see the early stages on Small Cap outperformance after >5 years of underperformance relative to ASX Large Caps.

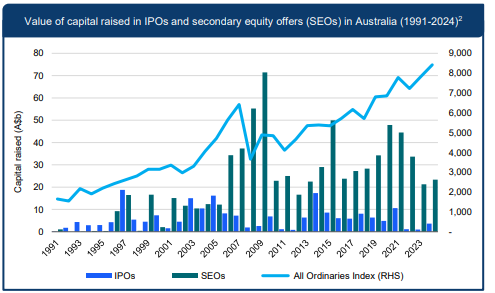

M&A cycle & IPO activity a positive lead indicator

Listed corporate balance sheets and private capital are well positioned to capitalise on current market conditions. Driven by attractive valuations in many areas, falling interest rates and the pursuit of growth, M&A activity is picking up in listed markets. Takeover bids for Johns Lyng Group (ASX: JLG), Domain Holdings (ASX: DHG), PointsBet (ASX: PBH), MAC Copper (ASX: MAC), Smartpay Holdings (ASX: SMP) and Insignia Financial (ASX: IFL), all ASX Small Caps, have laid the positive foundations for further activity in the near term.

For the first time since 2019, there have been some greenshoots and we have seen several Small Cap companies successfully launching IPOs and going on to trade above issue price. We have seen the successful IPO of medical device company Tetratherix (ASX: TTX), property business GemLife Communities Group (ASX: GLF) and also airline Virgin Australia (ASX: VGN) all trade up post IPO. After half a decade of little to no activity in the IPO market, some increased activity gives investors opportunities to look at new companies, replacing some of the ones that have exited the ASX to takeover and can also deliver an additional source of returns for selective small cap investors. In some wealth managementportfolios unlisted / private assets make up between 30-50% of the total portfolio and many investors are keen to see some of this capital recycled once fair value can be agreed.

We expect the interest rate easing cycle to provide a healthy tailwind for ASX small caps and a broadening of performance across the market driven by an improved growth outlook. ASX Small Caps are where the most valuation disconnect exists, where our research is identifying the most compelling opportunities and where the least amount of sell side research coverage exists. This is where the next generation of leading ASX Small Cap stocks will be discovered.