ASX 200 storms to cusp of key technical level it's crashed from four times before

The S&P/ASX 200 closed 62.7 points higher, up 0.84%.

Please note that Morning and Evening Wraps will take a break from Wednesday, 20 December and return on 8 January 2024. Kerry & Carl wish you a safe and happy Christmas and New Year!

Well, I have some good news and some bad news. I suggest you're going to want to watch very closely from here...

Let's dive in.

Markets

ASX 200 Session Chart

%20Intraday%20Chart%2019%20Dec%202023.png)

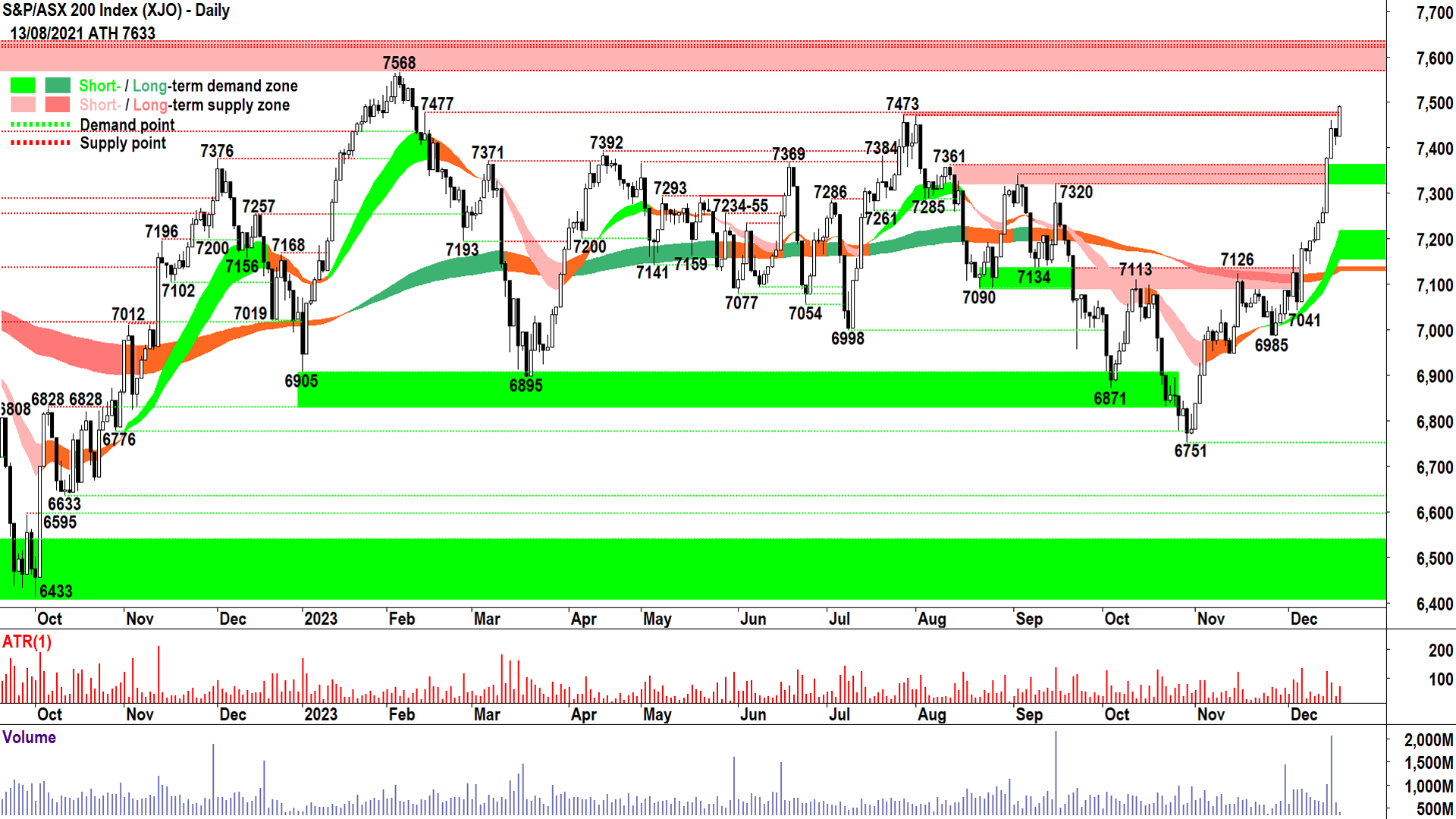

The S&P/ASX200 (XJO) finished 62.7 points higher at 7,489.1, 0.9% from its session low and just 0.1% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 218 to 67 – one of the best moves in terms of market breadth in recent memory.

%20Chart%2019%20Dec%202023.png)

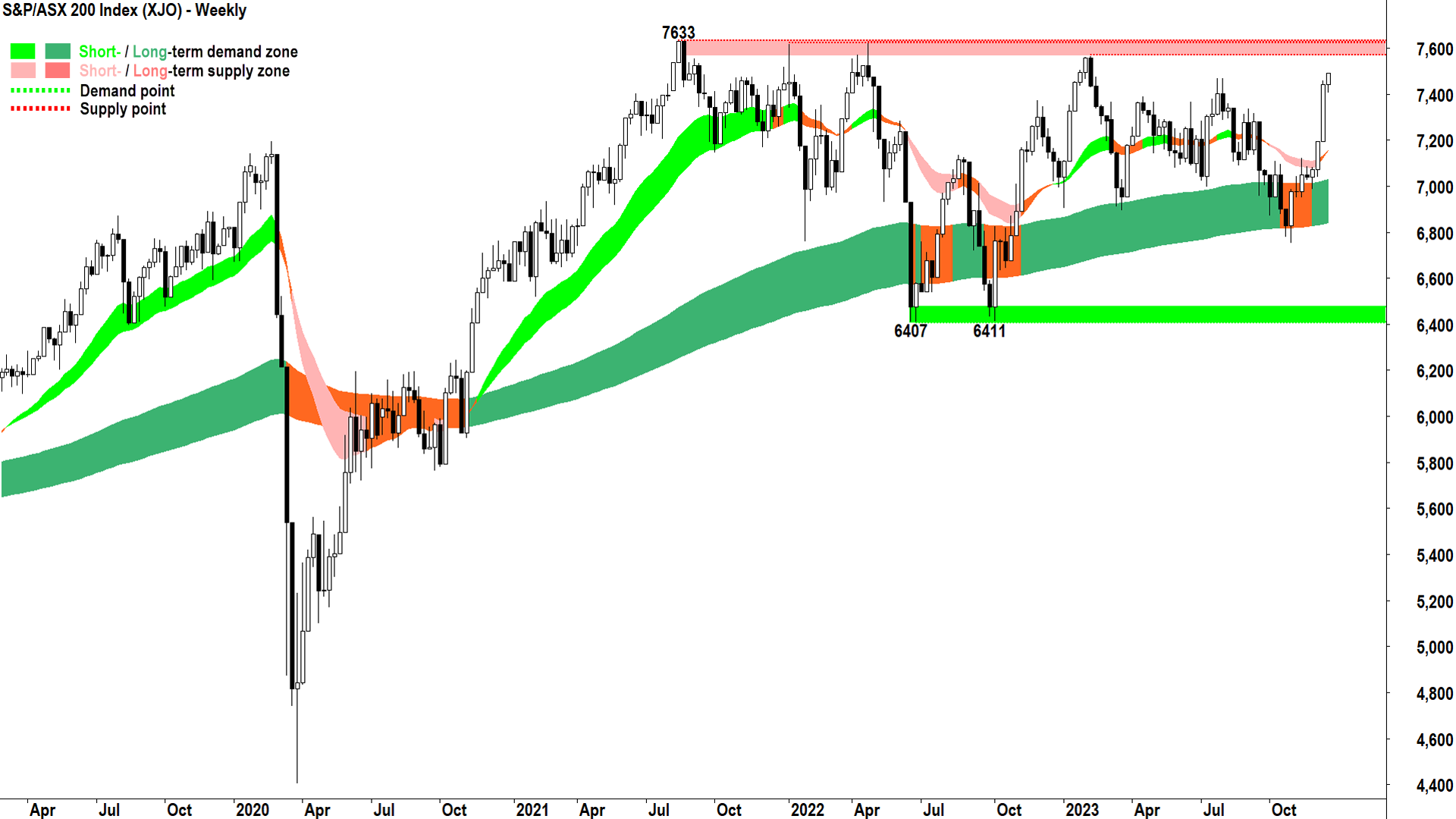

White candle, high close, broad move. Check, check, check. Even better, the close has eclipsed a historical major point of demand (“MPOD”) in 7,473. The next stop from a technical perspective is what I describe as the "big one". The summit. Well quadruple summit to be precise.

%20Weekly%20Chart%2019%20Dec%202023.png)

Here's the problem. We looked as good as we do now each time before. At least two of those times you could argue the rally to get to the highs was just as extended. But that's the thing about trend following – you're always wrong at the top and the bottom!

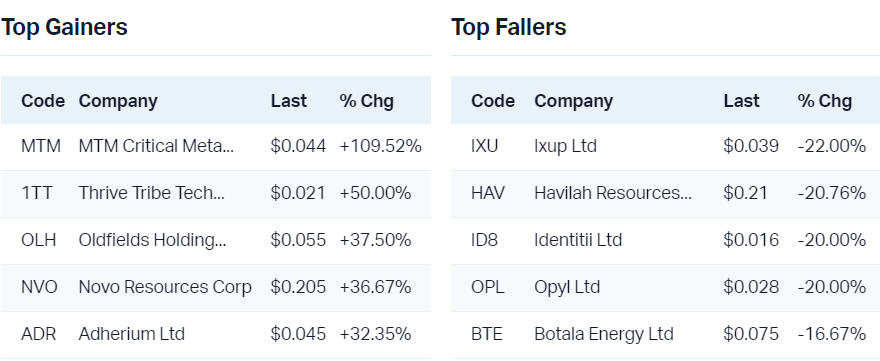

Best and worst today...

Worst? Every major sector was up today so there's no obvious theme here. I'll highlight a few stock specific moves in the Movers section below.

Economy

If you’ve made it to this paragraph (instead of seeing “Bank of Japan” and skipping to the Broker rec’s!) then you’ll get the benefit of me telling you why this is such an important detail for your portfolio! The BOJ has been holding long term Japanese rates at an artificially low level for many years. This forces the huge Japanese pension funds to chase higher yields overseas, i.e., including in Aussie stocks.

So, whilst yields in Japan remain very low, we get the benefit. If, however, long term Japanese bond yields are allowed to rise in line with a recent recovery in Japanese inflation (they actually want inflation), then it could reverse the flow of capital back towards Japanese assets. This could undermine demand for local stocks. In a sentence: Black candle today on chart above equals good for Aussie stocks.

What to watch out for...

A couple more snippets on the US housing market (I explained why the US housing market is so important yesterday). Building Permits and Housing Starts data are due at 12:30AM AEDT. Economists are expecting permits to moderate to 1.47 million in November compared to 1.49 million in October, and starts to dip to 1.36 million from 1.37 million.

Latest News

Citi on Woodside – Santos merger, one’s a buy and one’s a sell

Want to know where stocks are headed in 2024? Watch these indicators closely

Morningstar's commodity outlook and top stock picks

The ASX lithium stocks this broker thinks should be on your Christmas shopping list

The big signals every investor should watch ahead of 2024

Who has been buying what (both here and in the US)?

The dogs and darlings of the ASX in 2023 (and what to back in 2024)

Interesting Movers

Trading higher

- +13.8% G8 Education (GEM) - Trading Update

- +11.8% Liontown Resources (LTR) - No news, but got a bid on speculation it could be a takeover target again post Azure takeover moves

- +7.6% Neuren Pharmaceuticals (NEU) - No news since 18-Dec still pumping from P2 trial shows significant improvements in Phelan-McDermid

- +5.9% Ridley Corporation (RIC) - No news since 18-Dec still pumping from Agreement to Acquire Oceania Meat Processors

- +5.2% MMA Offshore (MRM) - No news, well established short and long term uptrends

- +4.7% Infomedia (IFM) - No news

- +4.6% Audinate Group (AD8) - No news, stronger tech sector, well established short and long term uptrends

- +4.0% Elders (ELD) - No news, long term trend turning back up

- +3.9% Karoon Energy (KAR) - No news, technical bounce

- +3.8% GWA Group (GWA) - No news, long term trend turning back up

- +3.7% Alpha HPA (A4N) - No news, long term trend turning back up

- -5.9% Weebit Nano (WBT) - Pullback from recent correction, usual WBT shenanigans!

- -5.0% Tabcorp Holdings (TAH) - New Exclusive Victorian Wagering and Betting Licence

- -4.7% KMD Brands (KMD) - No news, well established short and long term downtrends

- -3.1% Calix (CXL) - Calix appoints new NED's in board renewal

- -2.6% Skycity Entertainment Group (SKC) - No news, well established short and long term downtrends

- -2.3% Pilbara Minerals (PLS) - No news, $4 is key technical resistance point, lithium carbonate rally in China losing steam amidst weaker spodumene spot price

Broker Notes

- Atlantic Lithium (A11) retained at outperform Macquarie; Price Target: $0.65 from $0.66

-

Adbri (ABC)

- Retained at equalweight Morgan Stanley; Price Target: $3.20

- Retained at neutral Citi; Price Target: $2.50

- Boss Energy (BOE) retained at buy Bell Potter; Price Target: $5.69 from $5.53

-

Carnarvon Energy (CVN)

- Upgraded to outperform from neutral at Macquarie; Price Target: $0.25

- Upgraded to buy from overweight at Jarden; Price Target: $0.25

- Domino's Pizza Enterprises (DMP) retained at buy Citi; Price Target: $61.10

- Iluka Resources (ILU) retained at outperform Macquarie; Price Target: $8.90 from $9.30

- IPH (IPH) upgraded to buy from outperform at CLSA; Price Target: $9.05 from $9.20

-

Lendlease Group (LLC)

- Retained at equalweight Morgan Stanley; Price Target: $7.95

- Retained at buy Citi; Price Target: $9.50

- Link Administration Holdings (LNK) downgraded to underperform from buy at CLSA; Price Target: $2.26 from $2.00

- Neuren Pharmaceuticals (NEU) upgraded to buy from hold at Bell Potter; Price Target: $27.00 from $17.50

- Patriot Battery Metals Inc. (PMT) retained at outperform Macquarie; Price Target: $2.10

- Ridley Corporation (RIC) retained at buy UBS; Price Target: $2.80 from $2.60

-

Stockland (SGP)

- Retained at overweight Morgan Stanley; Price Target: $4.45

- Retained at buy Citi; Price Target: $5.10

- Santos (STO) retained at buy Citi; Price Target: $8.25

-

Tabcorp Holdings (TAH)

- Retained at overweight Morgan Stanley; Price Target: $1.20

- Retained at neutral UBS; Price Target: $1.02

- Woodside Energy Group (WDS) retained at sell Citi; Price Target: $26.50

Scans

This content originally appeared on Market Index.

3 topics

5 stocks mentioned